Big GBP option expiry in play this morning. Busy US calender kicks off tomorrow with Powell testimony. USDCAD recoving Friday's losses

Summary

-

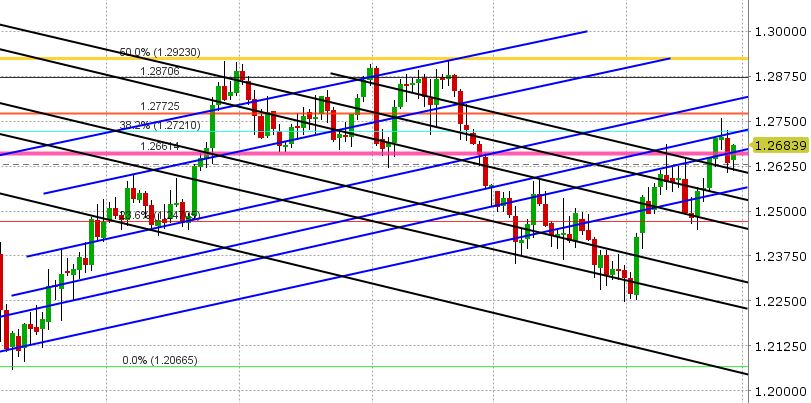

USDCAD: Dollar/CAD is starting the week with a mixed to positive tone after Friday’s selloff, which was driven by a higher than expected Canadian CPI print. The market closed back below support at 1.2650-1.2660 in the final minutes of NY trade on Friday, which allowed prices to retreat further at the Sunday open last night. We’ve bounced off the next trend-line support level of 1.2610-1.2620 in European trade however, and we’re now right back into the 1.2650s as the broader USD sees some buying here. There’s not much on the calendar today, aside from a couple of Fed speeches (Bullard at 8am and Quarles at 3pm). The calendar really gets going tomorrow with Jerome Powell’s first speech as Fed chair, before the House Financial Services Committee. A hawkish tilt to Powell’s testimony will get markets speculating about a fourth rate hike from the Fed this year (USD bullish), whereas a “Yellen 2.0 approach” of not rocking the boat will likely see the markets range-trade. We think the latter is the most likely scenario considering Powell is new to the helm. Tomorrow also sees the US January Trade Balance, Durable Goods and Consumer Confidence numbers, as well as Bill Morneau’s Federal Budget for Canada. On Wednesday, traders will be eyeing the 2nd read on US Q4 GDP, and the Chicago PMI. Thursday sees the US PCE inflation index and US ISM, and on Friday we get Canadian GDP for December. All this makes for a potentially eventful week. Another thing we would note are two huge votes this weekend in Europe (Italian elections and German SDP vote), which could affect EURUSD and the broader USD tone. For now, USDCAD is content to follow the broader USD trend, which is higher at this hour. The market has just moved through 1.2670 as we write, and this now opens the door to some technical retracing of Friday’s sell-off. Resistance is 1.2715-1.2725.

-

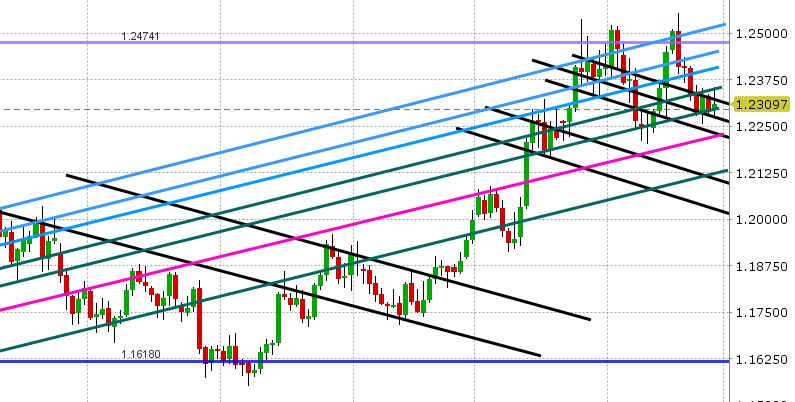

AUDUSD: The Aussie started the week last night with a strong bid tone, smashing through 0.7840-0.7850 as it followed EURUSD and GBPUSD higher. However, all that is unravelling now as the broader USD sees a wave of buying in the last two hours. AUDUSD is now attacking 0.7840-0.7850 with downward momentum and the next support level is 0.7830. The Australian calendar is super light this week (2nd/3rd tier data) and so AUD traders will continue to trade off the broader USD trend, copper prices and all the US calendar items we mentioned above. AUDUSD’s chart failure at the 0.7880s earlier today is not a great technical setup going into NY trading.

-

EURUSD: The Euro tested the upper end of its recent range to start the week, led by the decline today in USDCNH we feel, but EURUSD traders have a lot to think about this week and so it’s not surprising to see the market settle back again now. Tomorrow, traders will be watching the German CPI figures at 8amET, the release of the text for Powell’s testimony at 8:30amET along with some US data, and then of course Powell’s live testimony which commences at 10amET. On Wednesday, we’ll get the German employment report and Eurozone CPI data. Thursday sees the release of the manufacturing PMIs across Europe, and finally on Friday we get German Retail Sales data. EURUSD traders also have this weekend’s Italian elections to think about along with a crucial vote for Germany’s SDP regarding the coalition with Merkel. While most market participants are expecting more gridlock in Italy after these elections, more grid-lock is not what Germany needs right now as so we feel a negative outcome with the SDP vote is a greater risk to EUR (would probably force another German election). All this makes for a potentially nerve racking week for EURUSD traders, but we think markets are going to take things one step (one headline) at a time and we think volatility might be lower than many are expecting. For now, EURUSD seems content in its 1.2280-1.2350 range.

-

GBPUSD: Sterling started the week with a strong rally (breaking back above 1.4000) in Asian and early European trade but, like EURUSD and AUDUSD, it’s now backing off and retreating into NY trading. Trend-line resistance at 1.4050-70 capped the rally earlier. A huge option expiry is the next focus for GBPUSD traders, as 2.3bln GBP rolls off at 1.4000 at 10am. Some traders are attributing GBP strength today with hawkish comments from the BOE’s Dave Ramsden over the weekend: (“I see the case for rates rising somewhat sooner rather than somewhat later”). He voted against a rate hike in November, so this is a turn-around in view, but it echoes what Governor Carney has said. We feel, however, today’s move in GBPUSD is more option driven. It looks like it’s going to be a good battle going into 10am as GBPUSD plunges lower as we write. The 1.4000 level is also trend-line support. It’s going to be a quiet week for UK data, so traders will be focused on Powell’s testimony tomorrow, the US data items this week and the broader USD trend.

-

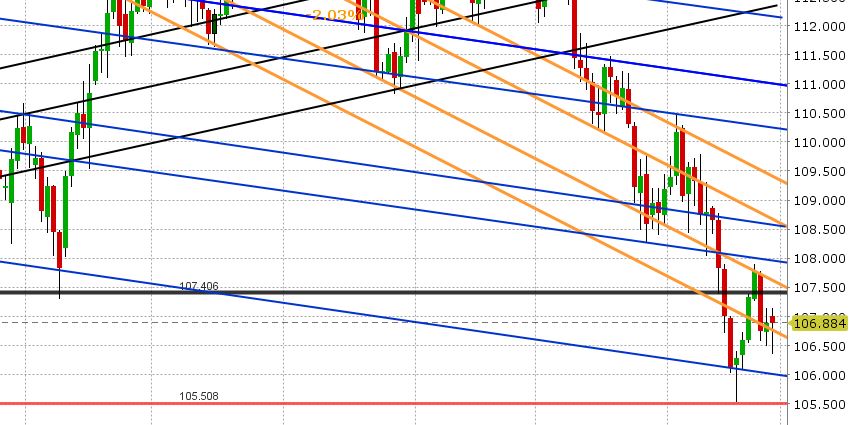

USDJPY: Dollar/yen started the week with an offered tone as the BOJ’s Kuroda spoke in Japanese parliament. While he sounded dovish as usual, he also said there were no plans for a comprehensive assessment of BOJ policy at this point (markets deemed this to mean the BOJ has no plans in intervene in USDJPY at these levels) and so we saw USDJPY continue lower its trend from Thursday last week. The 106.40-50 level supported price action in European trade however, and with that markets have been able to regain the 106.70 level once again (which bodes well for a higher USDJPY today in our opinion). The Nikkei finished strong today and the S&Ps are up 9, which is helping USDJPY. Next resistance for USDJPY is 107.15, then 107.40-50.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.