Beats on US ADP/Services ISM sees US yields explode higher

Summary

-

USDCAD: Dollar/CAD is trading range bound so far today, but this comes after some hawkish comments from Powell which propelled the USD broadly higher in the final minutes of trade yesterday. Speaking at the Atlantic Festival in Washington D.C., Powell said that rates are still accommodative, long way away from neutral and that “we may go past neutral”. This drove USDCAD past chart resistance in the 1.2850s, which finally opens the door for a test of the Sunday opening gap we’ve been talking about (1.2885-1.2905). Overnight price action also featured some “risk-off” sentiment, as the Hang Seng fell another 1.5%, the S&Ps traded lower and the US 10yr yield breached 3.20% to the upside. Some positive Brexit headlines out of the UK this morning is leading to a strong bounce for GBPUSD, and this is helping “risk” recover broadly here (USD selling). November crude oil surged higher yesterday after traders shrugged off a massive 7.975M weekly build in oil inventories, but USDCAD traders largely ignored this (which we think is worthy of note). Saudi Arabia’s energy minister Al-Falih said today he sees the oil market well supplied and he reiterated that the kingdom has 1.3M bpd of spare capacity that could be brought to market “if needed”. None of this seems to be calming Iran supply fears though. Today’s NY session will be quite uneventful for data releases, with just the US Factory Order figures for August at 10amET. Tomorrow features the main events of the week, which are the job reports out of the US and Canada. We think USDCAD coasts here into tomorrow morning.

-

EURUSD: Euro/dollar is trading moderately higher this morning on the heels of the GBPUSD bounce, but we’re just making up ground from the Powell-driven losses from late yesterday. The trend-line support level broken yesterday (1.1505-1.1510 area) now serves as resistance. Any move back above will be technically positive. Italian assets are being sold again today but the losses have been trimmed since EURUSD bounced. USDCNH shot higher into the 6.91s amidst the broad USD buying, with the lack of liquidity from the Chinese Golden Week holidays helping, but it has strongly reversed back to breakeven (which helps EURUSD here). The ECB’s Coeure speaks at 1pmET today.

-

GBPUSD: Sterling is shooting higher this morning; recovering yesterday’s late day losses from Powell and then some, after a Reuters report circulated about a “new” UK proposal on the Irish border which, according to an unnamed EU source, is a step in the right direction. That’s all we have for now, but GBP traders are covering shorts and asking questions later. GBPUSD now trades back above trend-line chart support in the 1.2950s, with positive momentum. Resistance is still the 1.3030s. The EURGBP cross has broken below support in the 0.8860s, which should help GBP here as well.

-

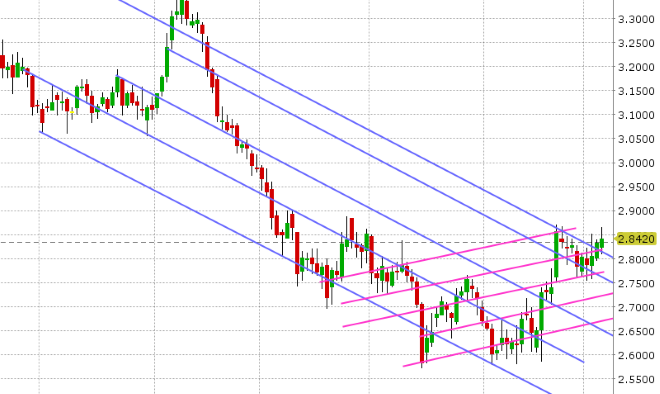

AUDUSD: The entrenched short fund position is singing this morning as AUDUSD continues its descent lower today. Yesterday’s break of chart support in the 0.7150s, and then the 0.7120-30s got the ball rolling to the downside, and Powell’s hawkish comments at the end of the day added to the bearish tones going into overnight trade. The Aussie traded down to a new 52 week low in London trade, and has since bounced a little with EURUSD and GBPUSD. Copper has vaulted above 2.85 over the last hour, but it appears AUD traders are continuing to ignore metal market supply dynamics here.

-

USDJPY: Dollar/yen rallied strongly yesterday as the US 10yr yield broke out to the upside in a monstrous move. Yesterday’s beats on the ADP employment on non-manufacturing ISM surveys appeared to be the catalysts. While this is music to the ears for the fund long position in USDJPY, fears are starting to emerge once again that global equities (especially emerging markets) are not prepared for a sustained rise in long term rates. So we’re seeing a bit of “risk off” in markets this morning, which is JPY supportive, and helps to explain why USDJPY has pulled back here to support in the 114.10-20 area. JGBs yields have ticked to 0.16% today as yields rise globally and Reuters is out with a headline saying the BOJ is tolerating this. We’d pay very close attention to broad risk sentiment today as any further fears (equity selling) could derail the USDJPY rally completely here. Next chart support is 113.50-60.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

November Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.