Barrage of negative trade related headlines leads to "risk-off" tone into month end

Summary

-

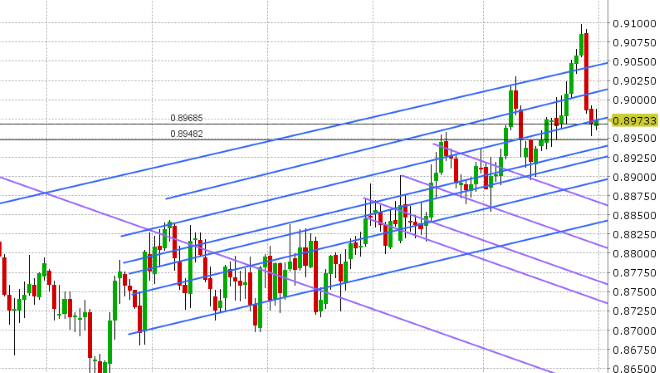

USDCAD: We’re seeing a broad “risk off” tone to markets this morning as we round off the month of August. Negative trade related headlines from Trump appear to be the culprit, with reports that his administration will back tariffs on an additional $200bln of Chinese goods as early as next week (when the period for public comments ends). Bloomberg also interviewed Trump and it was revealed that the President rejected the EUs proposal to remove auto tariffs, threatened once again to pull out of the WTO, and said the EU is almost as bad as China on trade. More here: https://www.bloomberg.com/news/articles/2018-08-30/trump-says-he-will-pull-u-s-out-of-wto-if-they-don-t-shape-up. Global equities, yields, crude oil and copper are all trading lower. We’re seeing broad demand for USD and JPY (the traditional safe havens). EM FX is trading mixed today, with the TRY recovering slightly after another stop gap measure was announced. https://uk.reuters.com/article/us-turkey-currency/turkish-lira-gains-against-dollar-after-move-on-lira-deposits-idUKKCN1LG0FC. The Argentine peso is steady after yesterday’s emergency rate hike halted a 15% plunge to 40 against the dollar. USD/CAD is benefiting from all this, building upon gains from yesterday’s Canadian GDP disappointment, and has inched above trend-line resistance in the 1.2990s to test the next level in the 1.3010s. The Globe and Mail is just reporting that Canadian officials doubt a NAFTA deal will be accomplished by today’s Trump-imposed deadline, and with that USDCAD has broken above the 1.3010s. Next resistance is 1.3050-60. Canadian and US markets will be closed on Monday for the Labor Day holiday.

-

EURUSD: Euro/dollar took a knock lower yesterday after the BTP/Bund spread blew out 10bp to +285. It was hard to tell what exactly was driving this, but we would note that this occurred right as the Argentine peso was blowing up. Buyers stepped in after the London close and there was an attempt to regain upward sloping support in the 1.1670-80 twice since then, but both attempts failed. Sellers then found it easier to step in and the broad “risk off” tone to the overnight news flow helped with that. We now sit slightly above yesterday NY lows, with a negative tone. Over 2blnEUR in options expire today at the 1.1600 strike. Next support is 1.1610-20s. German Retail Sales for July disappointed today, coming at -0.4% MoM vs flat expected. USDCNH looks directionless ahead of the weekend, with the 6.87s resisting and the 6.84s supporting.

-

GBPUSD: Sterling continues to struggle with chart resistance in the 1.3030s, and is now trading back below the 1.30 figure amid the broad demand for USD today. Today features at 970mlnGBP option expiry at the 1.3000 strike. EURGBP is marking time. We think GBPUSD follows EURUSD going into the weekend.

-

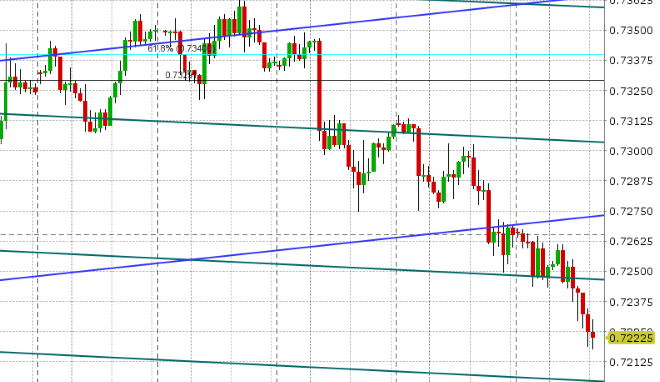

AUDUSD: The Aussie continues to show its increased sensitivity to trade-related headlines; trading lower again today amid the barrage of Trump headlines overnight. The break of chart support in the 0.7260s yesterday did not help. Today’s large option expiry at the 0.7250 strike (1.2blnAUD), which some argued contributed to weakness yesterday, might support price a little bit here considering the market currently trades below it.

-

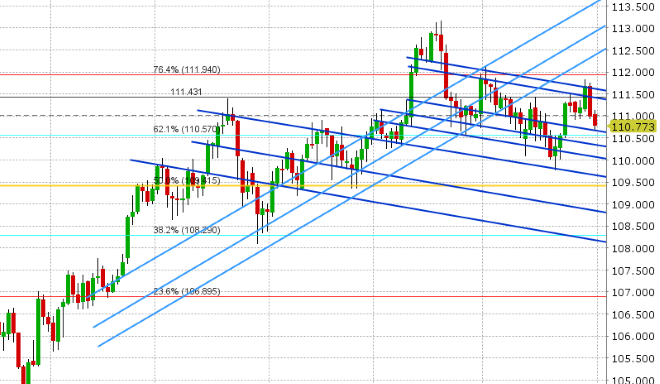

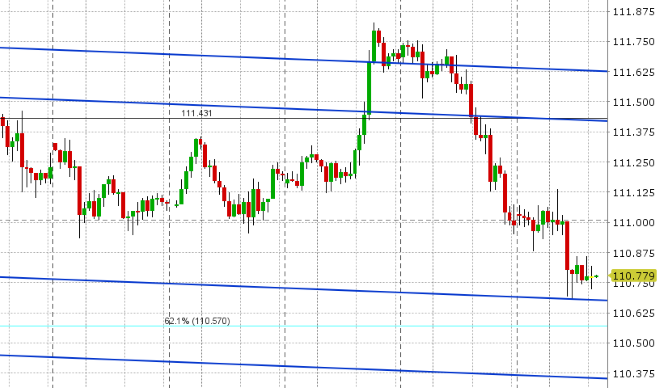

USDJPY: Dollar/yen completely gave up Wednesday’s gains yesterday, after the 111.60s could not be regained (something we warned about). Yesterday’s EM FX turmoil then exacerbated the safe have demand for JPY broadly, and this trend continues today with the negative tone to the overnight news flow. There was a barrage of Japanese data overnight (July Industrial Production missed, August Tokyo CPI beat, Japanese employment report missed), but none of this had much of an effect on the market. What was more meaningful in our opinion was the slight tweak to the BOJ’s September JGB buying schedule, announced earlier today. While the reduced frequency and increased amounts may seem cosmetic on the surface, it draws traders attention back on the topic of “stealth tapering”, which led to rate hike speculation and JPY demand earlier this year. More here: https://uk.reuters.com/article/uk-japan-boj-bonds/bank-of-japan-tweaks-jgb-purchase-plan-futures-fall-on-speculation-of-less-buying-idUKKCN1LG10P. We think USDJPY could probe lower still during NY trade today (perhaps 110.50-60), but we would expect some buyers to appear at that point.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

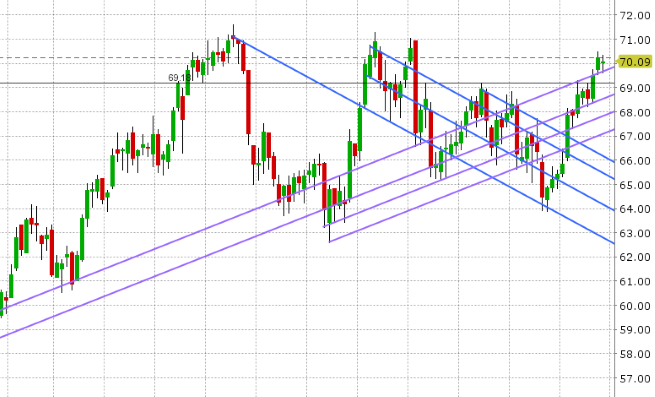

October Crude Oil Daily Chart

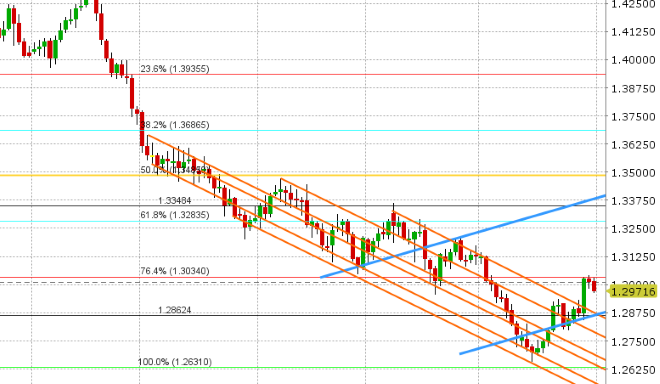

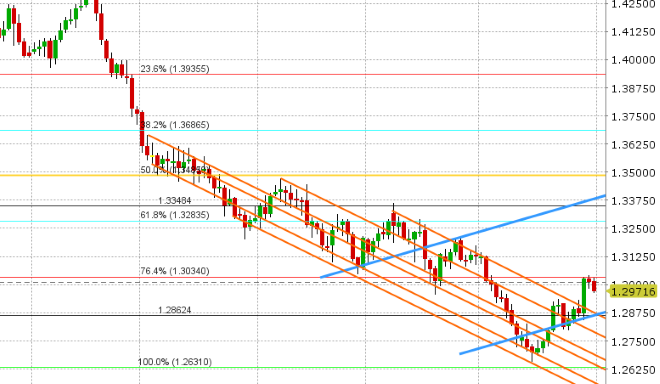

EUR/USD Daily Chart

EUR/USD Hourly Chart

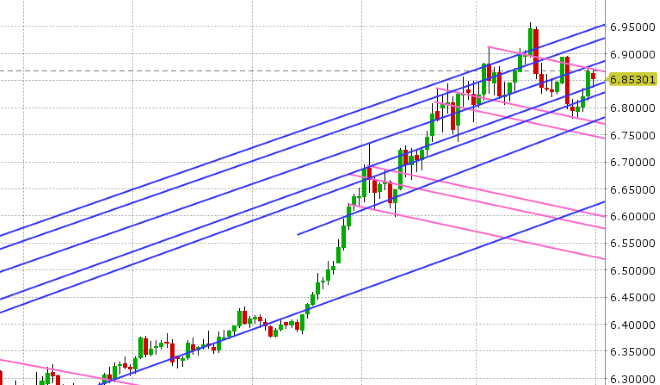

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily Chart

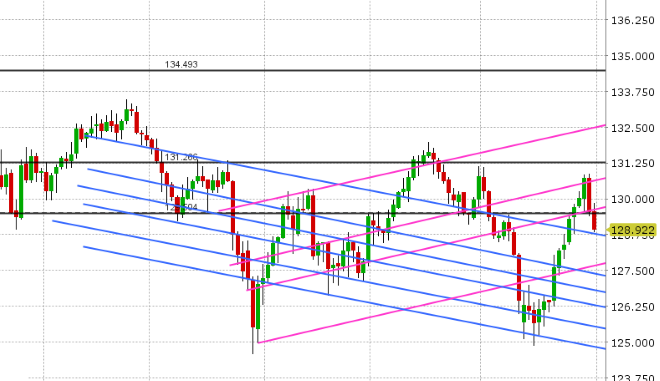

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.