Bank of England rate cut odds shoot up to 66% after more weak UK data

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- UK Retail Sales fall 0.6% MoM in December versus expectations for a 0.5% gain.

- OIS market now sees 66% chance of 25bp rate cut from the BOE on Jan 30th.

- GBPUSD rejects last week’s 1.3080s chart support (turned resistance) with a vengeance.

- EURUSD weighed down by weak NY close, GBP selling and huge downside option expiries.

- Bearish “head & shoulders” pattern developing in EURUSD. Taking shape in AUDUSD too.

- USDJPY needs to break out further fast, or else reversal risks increase.

- USDCAD still range-bound, now 1.3110-1.3170, with mildly positive underpinnings.

ANALYSIS

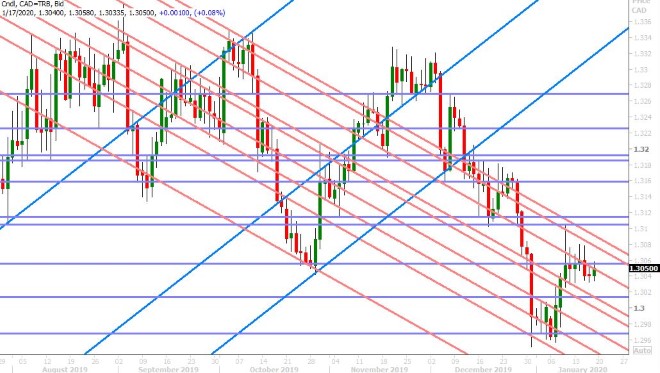

USDCAD

Dollar/CAD is tracking the broader USD moderately higher this morning. Weakness in sterling appeared to lead the way in the early goings, after the UK reported a much weaker than expected Retail Sales number for December, and massive downside option expiries in EURUSD appear to be driving USD strength now as we head into NY trade. The US just reported some mixed housing data for the month of December...1.416M vs 1.468M expected (-3.9% MoM) on Housing Starts but 1.608M vs 1.375M (+16.9% MoM) on Building Permits. US Industrial Production for December (-0.2% exp) and the Michigan Sentiment Survey for January (99.3 exp) are up next at 9:15amET and 10amET respectively.

We think USDCAD could end up inching higher towards the top end of its most recent range if broad USD buying persists and February crude oil prices struggle at the $59 handle. The chart technicals still point to a range trade for USDCAD right now unfortunately and, given the downward sloping nature of the trend-lines we’re currently plotting, we see this range as being between the 1.3110s to the 1.3170s.

USDCAD DAILY

USDCAD HOURLY

FEB CRUDE OIL DAILY

EURUSD

Euro/dollar is not looking in good shape this morning. Yesterday’s poor NY close back below the 1.1150s, on the back of good US economic data, set us up for negative price momentum heading into the overnight session. A swift 50pt fall in GBPUSD following some weak UK data then unleashed some broad USD buying, which in turn saw EURUSD lose chart support in the 1.1130s. Finally, we have the weight of hedging flows on over 4.6blnEUR of options expiring between the 1.1090 and 1.1125 strikes this morning at 10amET. We pointed out the potential development of a bearish “head & shoulders” pattern on the daily AUDUSD chart yesterday, and we can now see one on the daily EURUSD chart as well!

EURUSD DAILY

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

Sterling indeed went on the hunt for more sellers by rallying off chart support in the 1.2960-80s over the last 72hrs, and it has found them again this morning following the release of some more bad UK data. Retail Sales for the month of December were reported a whopping -0.6% MoM vs expectations for +0.5%, and just +0.9% YoY vs +2.6% expected. This is now the worst 5-month stretch for UK retail sales growth since record keeping began in the 1970s!

To add insult to injury for the market, last week’s defining chart support level in the 1.3080s (the break below which gave way to this week’s early GBPUSD weakness) has now acted as fierce resistance on the charts. If we combine all this with Jan 30th Bank of England rate cut odds increasing again to 66% this morning and bearish chart patterns developing for EURUSD and AUDUSD, we think we have a GBPUSD market that is looking increasingly vulnerable to further weakness.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

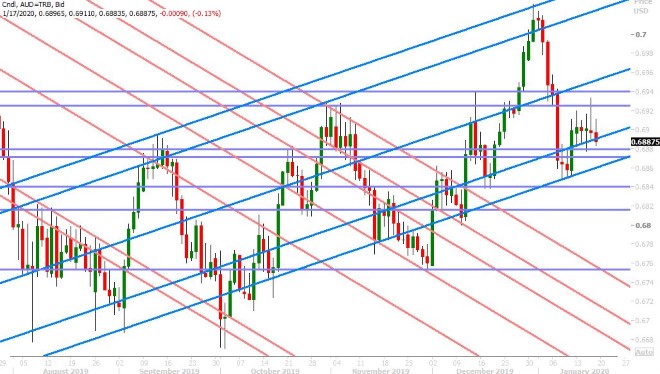

AUDUSD

The bearish “head & shoulders” pattern we pointed out yesterday, as potentially developing on the daily chart, appears to be taking a step in the right direction this morning. The broad USD buying we’ve seen today in Europe is now putting pressure back on familiar chart support in the 0.6880s and we would see a confirmation of this negative price pattern with a NY close below the 0.6860s. We think the market’s inability to benefit from last night’s better than expected December Industrial Production and Retail Sales data out of China is rather telling of how traders feel about the Aussie here.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen continues to hold the bulk of its gains from last week’s US/Iran de-escalation and this week’s US/China “phase one” trade deal optimism, but we’d make the argument that the market should be demonstrably higher than this by now, given Monday’s break above key weekly chart resistance in the 109.60s. We think the longer the market meanders just above the 110 figure without another push higher will make it vulnerable to reversing lower. Over 1.5blnUSD in options will be expiring between the 110.00 and 110.15 strikes this morning, which should keep the market steady for the moment, but it will be interesting to see what happens after that.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.