Bank of England rate cut odds for Jan 30th gallop to 49%

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- BOE out with yet more dovish comments over the weekend, this time from member Gertjan Vlieghe.

- UK GDP for November surprisingly contracts 0.3% MoM vs expectations of no growth.

- GBPUSD slumps down to 1.2980s. EURGBP rallies above 0.8550.

- USDJPY at new swing high and USDCNH at new swing low, ahead of US/China “phase one” deal signing.

- Weak US NFPs help EURUSD bounce off 1.1090s. NY close above 1.1115 also helpful.

- Lots of option expiries in and around 0.6900 could force AUDUSD range-trade this week.

- This week’s calendar also features US CPI, Retail Sales, Philly Fed and plenty of Fed-speak.

ANALYSIS

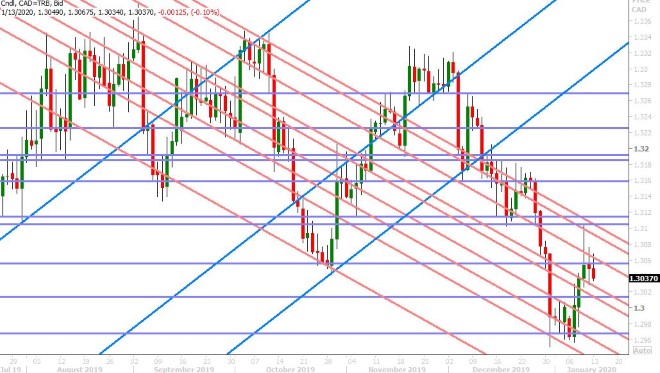

USDCAD

Dollar/CAD is starting the week with the rangy 1.3110-30 to 1.3190s pattern we talked about late on Friday. US/China trade optimism is alive and well this morning ahead of this week’s expected phase one deal signing (which ought to be a little more USDCAD negative) but it’s also hard to ignore February crude’s massive bearish reversal from last week (which is somewhat USDCAD positive). The leveraged funds at CME rebuilt their net short USDCAD position to a new 7-week higher during the week ending January 7th, if we look at the latest COT report released from the CFTC late Friday, but the market is now putting these new shorts through the wringer with last week’s 150pt bounce off the lows + a more mixed technical tone.

This week’s calendar features a slew of US data items, a bunch more Fed-speak, and of course the much anticipated US/China phase one deal signing on Wednesday:

Monday: Fed’s Rosengren 10amET, Fed’s Bostic 12:40pmET, Fed’s Kashkari 2pmET

Tuesday: US CPI (Dec), Fed’s Williams & George

Wednesday: US PPI (Dec), Fed’s Harker & Kaplan, Fed’s Beige Book, US/China “phase one” deal signing

Thursday: US Philly Fed (Jan), US Retail Sales (Dec), Fed’s Bowman

Friday: US Housing Starts (Dec), Industrial Production (Dec), Michigan Sentiment Survey (Jan)

We think USDCAD may try to re-test the bottom end of the range we talked about above going into Wednesday; the 1.3110-30s. This was the market’s new downtrend momentum line coming into the new year. It acted as chart resistance for USDCAD early last week, but now serves as support after Wednesday’s price action saw prices surge above it.

USDCAD DAILY

USDCAD HOURLY

FEB CRUDE OIL DAILY

EURUSD

A weaker than expected US Non-Farm Payrolls report was enough to help EURUSD bounce on Friday. It took a few attempts, but the market ultimately rallied off chart support in the 1.1090s after the numbers were released. The NY close was also half-decent (back above trend-line support at 1.1115), which we think is now encouraging some dip buyers to come in. Today’s 1.6blnEUR option expiry at the 1.1120-30 strikes could be helping as well. Friday’s COT report showed the funds reducing their net short EURUSD position during the week ending January 7th, which was not too surprising given that these positions haven’t really been working since late November. This week’s European calendar is rather light, with just the Eurozone Industrial Production (Nov) figures on Wednesday, the German CPI (Dec) figures on Thursday, and the final Eurozone HICP (inflation) figures on Friday.

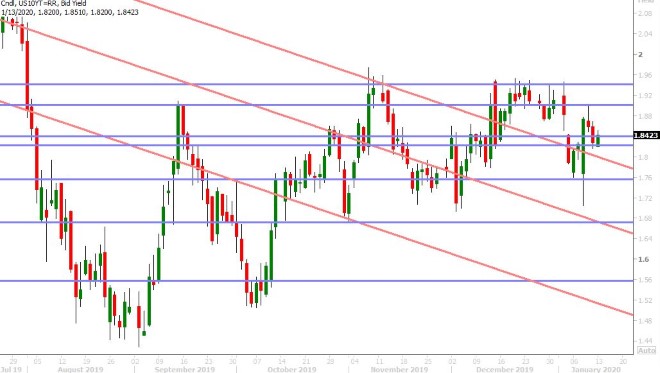

While we think EURUSD could creep higher to the mid-1.11s this week, we think the market will ultimately find more sellers if US 10yr yields manage to carry forward some of their positive momentum from last Wednesday’s bullish outside day pattern. Another move higher in US rates would also likely knock gold prices back below $1550 support on a closing basis, which would be bearish EURUSD.

EURUSD DAILY

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

The predictive power of chart technicals is on display again in sterling this morning. Late Friday we talked about EURGBP strength and how it kept GBPUSD below the 1.3080s heading into the NY close, and sure enough this morning we’re seeing follow-though GBP selling. Some more dovish comments out of the Bank of England today (this time from MPC member Vlieghe) and some poor UK economic data are now providing the fundamental catalysts for the selling.

Over the weekend, Gertjan Vlieghe said he would vote for a cut in interest rates later this month if key data do not show a bounce in the economy. More here from the Financial Times. The UK then reported some dismal GDP, Industrial Output and Manufacturing Output numbers for November this morning:

GDP: -0.3% MoM vs flat expected

Industrial Output: -1.2% MoM vs -0.1% expected

Manufacturing Output: -1.7% MoM vs -0.3% expected

All this has now seen BOE rate cut odds in the OIS market gallop to 49% for the January 30th meeting! We think some chart support in the mid-high 1.29s may stall the selling in GBPUSD for now, but we’d be on the lookout for a break below these levels. The EURGBP chart technicals are looking increasingly bullish too, should the market close NY above the 0.8550s. The leveraged funds at CME continued to liquidate short positions during the week ending January 7th, which had the effect of increasing the market’s new net long GBPUSD position for the 3rd week in a row. We think the funds have it all wrong here.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

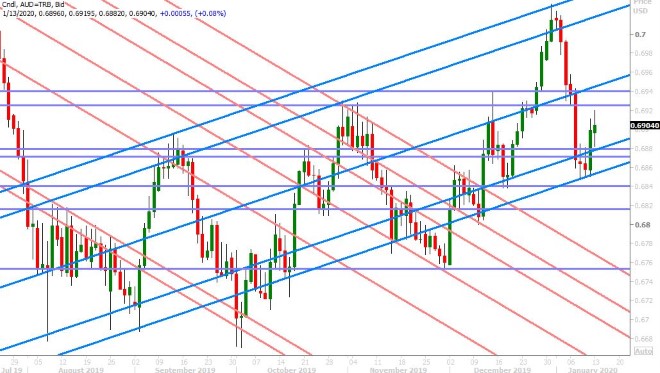

AUDUSD

The Australian dollar was one the biggest beneficiaries from the broad USD sales that followed Friday’s weak NFP print. The move above the 0.6870s now opens up a re-test of the 0.6920-40s in our opinion, at which point we could find more sellers. This week’s Australian calendar doesn’t feature any notable economic releases, and so we think traders will focus on US/China trade sentiment, US economic data, and the over 10blnAUD in option expiries that will be occurring in and around the 0.6900 strike this week. This could ultimately have the effect of keeping AUDUSD range-bound for the next little while. The OIS market is still pricing in a 93% chance that the Reserve Bank of Australia cuts interest rates 25bp when they meet next on February 4th.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

A quick look at USDJPY and USDCNH this morning would suggest that traders are expecting the week’s US/China “phase one” deal signing to pass without a hitch. We’re naturally a bit more cautious on this event, given our recent analysis of the headlines, and so we think traders still need to be on guard for a possible fade of all this “risk-on” trade optimism. The leveraged funds at CME continued to trim their net USDJPY long position during the week ending January 7th, which we’d argue made sense given the repeated buyer failures in the 109.60s during the month of December, but this position trimming now looks ill-timed given last week’s huge bullish reversal off the US/Iran de-escalation. With the market now 5X less long USDJPY than it was the last time it was near 110.00 (May 2019), we think the bulls may use this “un-stretched” positioning as justification to pille in here and chase the market higher. This week’s pre and post reaction to the US/China “phase one” deal signing could be hugely pivotal for USDJPY.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.