Bank of Canada shocks market with dovish turn in tone

Summary

-

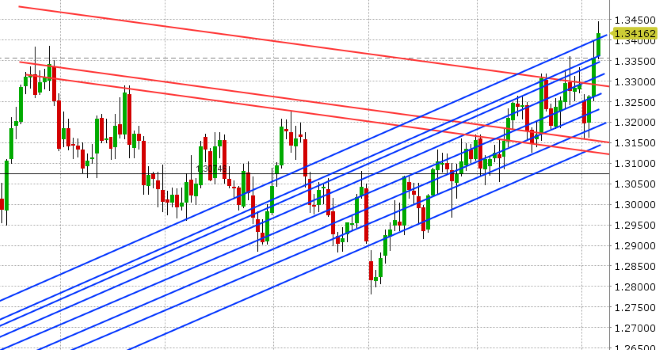

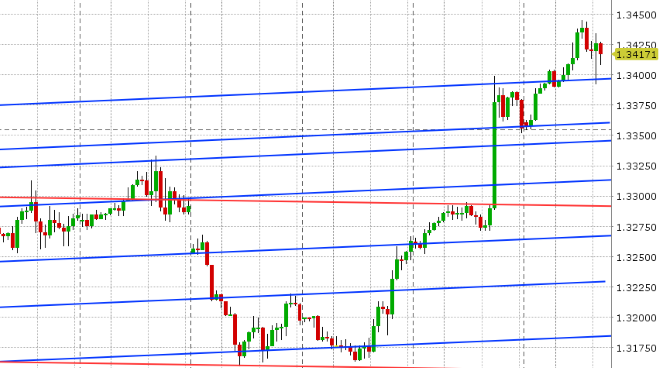

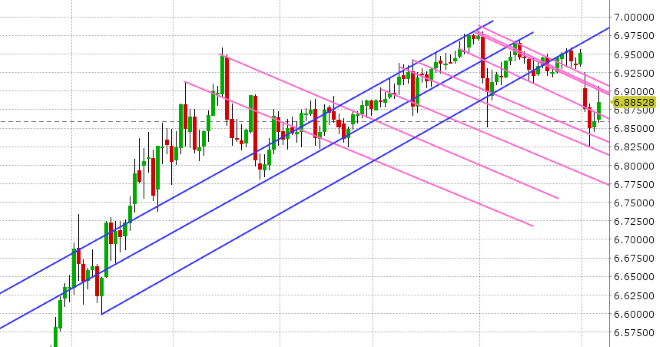

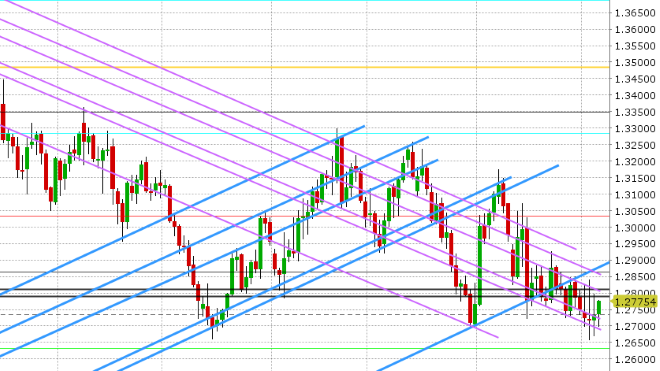

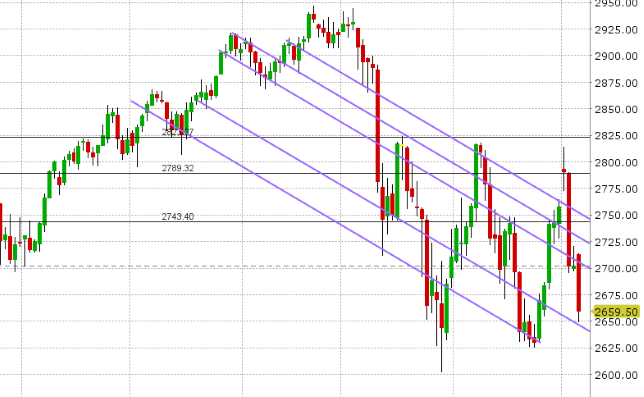

USDCAD: The Bank of Canada shocked markets yesterday with a more dovish than expected hold to interest rates. The Canadian central bank now sees the economy loosing momentum into the 4th quarter. It’s now concerned about the Canadian energy sector, global trade spats and softer than expected inflation. What is more, the Bank of Canada signaled “more room for non-inflationary growth”…a weird way of saying there’s now less pressure to raise interest rates. Full text here. With that, USDCAD immediately shot higher to the 1.3400 mark. The January overnight interest swaps market dropped to just a 40% chance of a rate 25bp hike, compared to almost 70% prior to the BoC announcement, and an April hike has now been priced out completely. We’ve seen some risk off flows emerge in overnight trading, after the announcement of the arrest of Huawei’s CFO Wanzhou Meng by Canadian authorities for extradition to the US. China’s Huawei has been the focus of the US intelligence community for some time now and there is suspicion that Meng violated US sanctions against Iran. It’s being reported that the arrest occurred on Dec 1st (and so Chinese authorities already knew about this before they issued positive comments on trade relations yesterday). Rightfully or wrongfully, stock traders did not take the headlines well in overnight trading, and crashed the S&Ps lower by over 50pts on the re-open after yesterday’s closure. The broad USD reaction to the arrest was understandably higher, with USDCNH strength (Chinese yuan weakness) leading the way. This allowed USDCAD to retest the 1.3400 level after pulling back in late NY trade. OPEC headlines then started to dominate the news flow as European traders walked in, and there’s talk now from the Saudis now that a 1mln barrel per day cut “would be enough” for markets. Oil traders are not liking this, because that would be towards the lower end of the 1-1.3mln bpd market expectation for today’s landmark decision, and so we’re seen January crude trade almost 4% lower at this hour, and USDCAD finally break above chart resistance at 1.3400. An extremely busy NY session now awaits traders today. The December read on US ADP employment growth just came in at +179k vs +195k expected. The Canadian and US Trade Balances for October both missed expectations. The OPEC closed door meeting is currently underway and traders will be glued on the press conference that follows. The Bank of Canada’s Stephen Poloz will commence speaking at 8:50amET this morning at the CFA Society in Toronto, and it’s expected he will clarify yesterday’s dovish change in sentiment from the central bank. The November US Non-Manufacturing ISM figures come out at 10amET, and the weekly EIA oil inventory report comes at 10:30amET. We think the 1.34 mark will be the pivot for price action today, with gains still likely should we continue to trade above it. A recovery in equities/oil prices and or a shift from Poloz here today however, would probably see the 1.34 level given up and then we pull back.

-

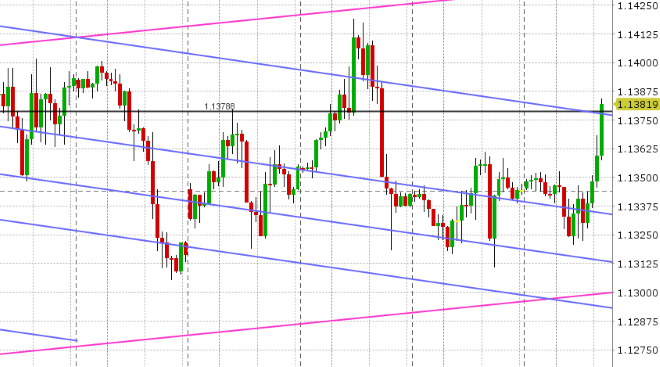

EURUSD: Euro/dollar is catching a bid as we head into NY trading today, as the weaker than expected US ADP employment report sets the tone. This is getting USD longs a little nervous ahead of tomorrow’s November Non-Farm Payrolls report. With EURUSD now once again trading back above the 1.1330s, we think the market has room to extend higher into the 1.1370-80s (the next chart resistance level). The BTP/Bund spread has ticked back up to +288bp this morning as Italy’s ruling coalition parties said they still want to be closer to a 2.1-2.2% deficit target as opposed to the 2.0% that PM Conte is now proposing.

-

GBPUSD: Sterling is bouncing higher with EURUSD this morning, as the range trade continues ahead of next week’s historic Brexit vote. Theresa May said she will push ahead with the vote, despite cabinet ministers urging her to call it off. More here. Chart support remains 1.2690-1.2720. Resistance remains 1.2790-1.2815.

-

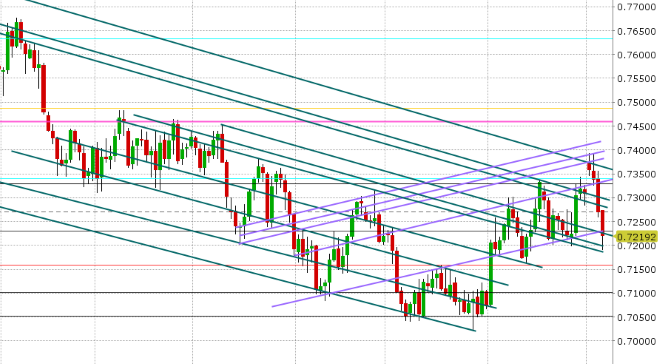

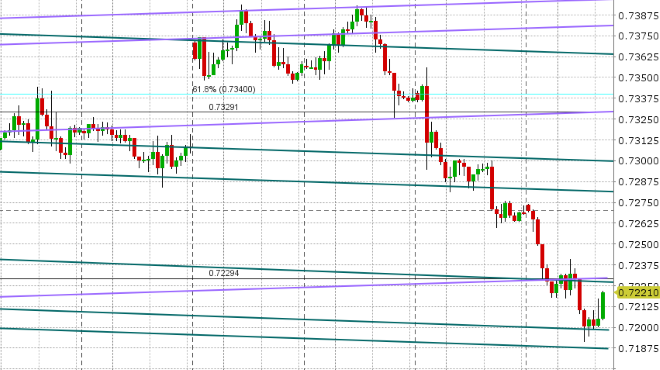

AUDUSD: The Aussie is collapsing this morning as the trade-sensitive currency succumbs to worries that US/China negotiations are really not going well, despite some positive assurances from China over the last 24hrs. The arrest of Huawei’s CFO is adding to this worry, as AUDUSD tracks the S&P futures lower in overnight price action. Last night’s softer than expected Retail Sales and Trade Balance figures out of Australia is also a dampening the mood we feel, and it adds to yesterday’s disappointing GDP figures. Some buyers have stepped in at 0.7200 chart support as EURUSD trades higher, but the momentum is still lower at this hour.

-

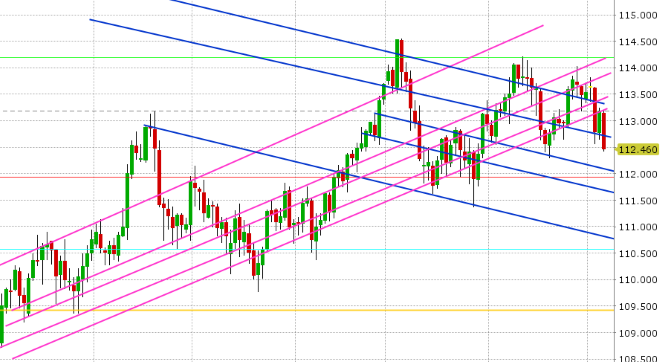

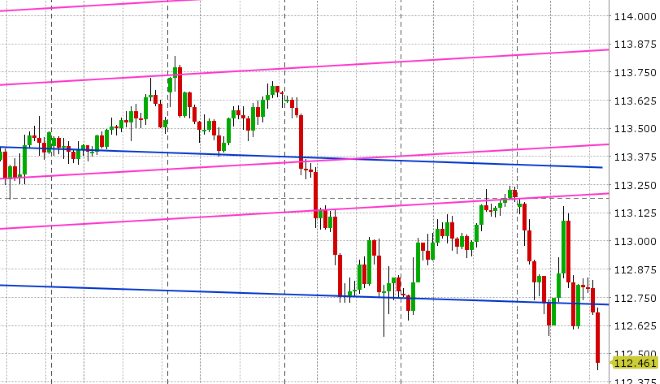

USDJPY: Dollar/yen traders found sellers overnight in the 113.20-30 area we mentioned yesterday, and it didn’t take long for them to be rewarded after the S&Ps plunged lower at the 6pmET open. The plunge in the S&P futures was so swift that the CME intervene with a series of 10-second trading halts. USDJPY naturally fell lower as a safe-haven bid for JPY returned. We saw a swift bounce around the European open after China made some upbeat comments about on committing to trade agreements with the US, but this move has unraveled quickly and we’re now threatening chart support in the 112.70s once again. We think the fund long position is at risk for further losses should this level give way.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

January Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

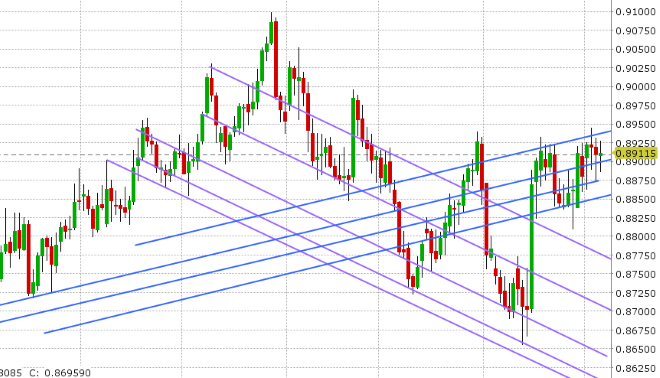

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

DEC S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.