Bank of Canada rate decision looms large. Long fund positions praying for bounce after 6-day rout in USDCAD.

Summary

-

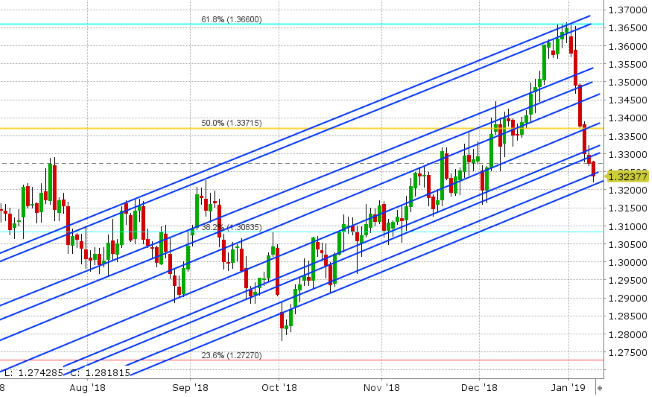

USDCAD: Dollar/CAD continues to teeter precariously in the mid to low 1.32s this morning after buyers failed to bounce the market back above the 1.3300 level into the NY close yesterday. This technical setup allowed for further selling down to trend-line support in the 1.3230s during Asian trade overnight, and we suspect we now have a market where long positions are hoping and praying the Bank of Canada delivers something dovish today. The OIS market is not pricing in any change to Canadian overnight interest rates today but option traders are anticipating an 80pt intra-day range. We think there’s a risk USDCAD probes further lower right after the 10amET announcement as we don’t think the market is positioned for any sort of slightly less dovish or slightly more hawkish commentary, but we think Stephen Poloz’s press conference at 10:15amET could ultimately provide the inflection point for a bounce. Canadian Housing Starts for December were just released 213.4k vs 205k expected, and so here’s another reason to keep the pressure on USDCAD for the moment. February crude oil is trading another 2.3% higher this morning after last night’s API inventory report showed a 6.27M barrel draw from inventories. The weekly EIA numbers get released at 10:30amET today as usual, with the consensus now looking for a 3.8M barrel draw. We think the improving chart technicals for oil continue to play a part in recent USDCAD weakness, and we think this negative drag will persist so long as crude prices still above the $50 mark. Canadian dollar futures traders continued to liquidate positions yesterday to the tune of 2583 contracts.

-

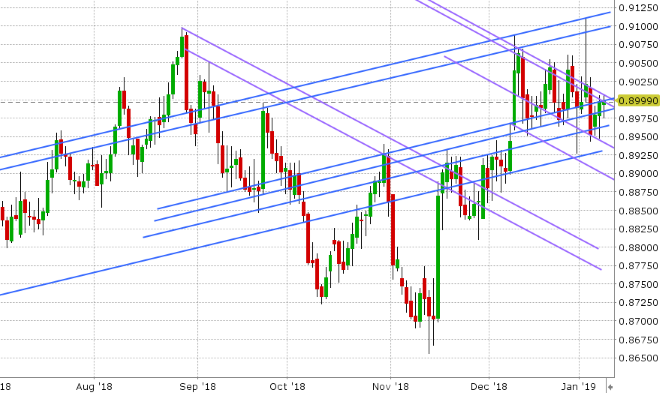

EURUSD: Euro/dollar is wandering within the 1.1430-1.1480 range this morning as markets continue to await the official communiques from the US and China after the latest round of trade talks concluded today. Reports suggest we’ll hear something positive Thursday morning local time in China, and so traders continue to sit on their palms for the moment. Today features a slew of Fed speak, with Bostic (known dove) taking the mic at 8:20amET, Evans at 9amET, and Rosengren (known hawk) at 11:30amET. We’ll also get the FOMC Minutes from the Dec 19th Fed meeting at 2pmET to top it all off. With the Fed now turning more dovish and the Italian budget deficit situation now behind us, we continue to think EURUSD has a chance to rally here, but we’d need to see a firm close above the 1.1480s and a pause in the recent stint of weak European data points. The Chinese yuan is re-approaching a 1 month high here (USDCNH falls below 6.8450), and we think this helps EUR here. Euro futures traders liquidated almost 4k contracts yesterday.

-

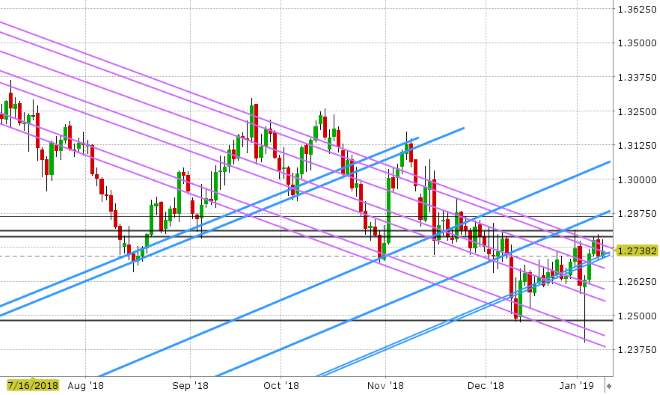

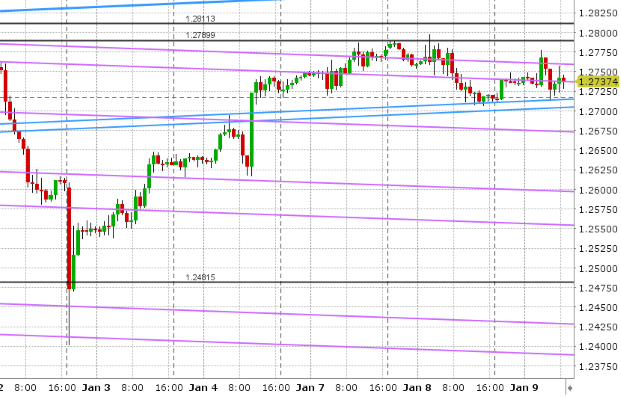

GBPUSD: Sterling has had a choppy overnight session as traders digest the latest headlines surrounding what should happen in the House of Commons if Theresa May’s Brexit vote is defeated in Parliament next Tuesday. See here for more. Chart support is now 1.2700-1.2710. Resistance is 1.2790. EURGBP has slipped back below the 0.9000 level, which is helping GBPUSD find buyers on the dip. The Bank of England’s Carney will be participating in an online Q&A session about the future of money at the BOE’s Future Forum at 10:30amET today. Futures traders liquidated over 2,500 GBP contracts in yesterday’s trade.

-

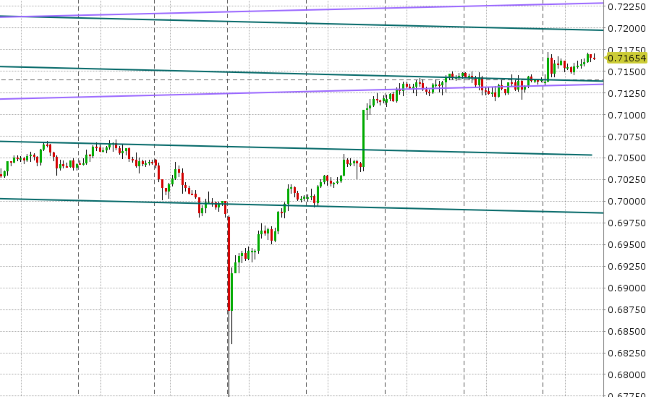

AUDUSD: The Australian dollar has pressed higher above chart resistance in the 0.7140s today. This comes surprisingly after much weaker than expected Building Permit data from Australia last night, which tells us the market is more excited about potentially positive developments on the US/China trade front. The next resistance level comes in at 0.7200. Australian dollar futures traders added over 1k contracts in new positions yesterday and we suspect this is further long accumulation after last week’s bullish technical reversal.

-

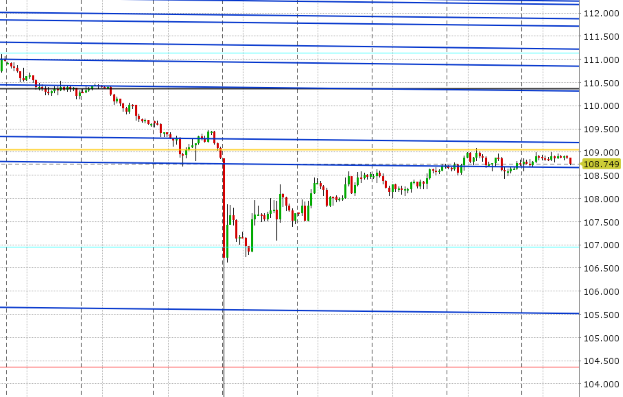

USDJPY: Dollar/yen continues to crawl here as the S&Ps inch higher today. Last night’s address to the nation from President Trump turned out to be a whole lot of nothing for markets, and traders will now have to wait until later this evening to hear how the latest round of trade talks with China went. Yen futures traders added 2k contracts in new positions yesterday. From a technical perspective, the market remains stuck in the 108.70-109.20 chart resistance zone. The S&P futures are bid to the tune of 11pts this morning and look poised to test the 2600 level in today’s session.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

February Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.