Australia reimposes 6-week lockdown on Melbourne

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- News derails positive China open, causes AUDUSD buyer failure above 0.6980s.

- Australian dollar losses lead USD broadly higher into European AM.

- Sterling breaks above 1.2520s as Brexit talks set to resume tonight/tomorrow.

- GBPUSD gains now leading EURUSD and AUDUSD higher into NY trade.

- Large option expiries in play for EURUSD and USDJPY over next 48 hrs.

- Reserve Bank of Australia keeps outlook/monetary policy on hold last night.

ANALYSIS

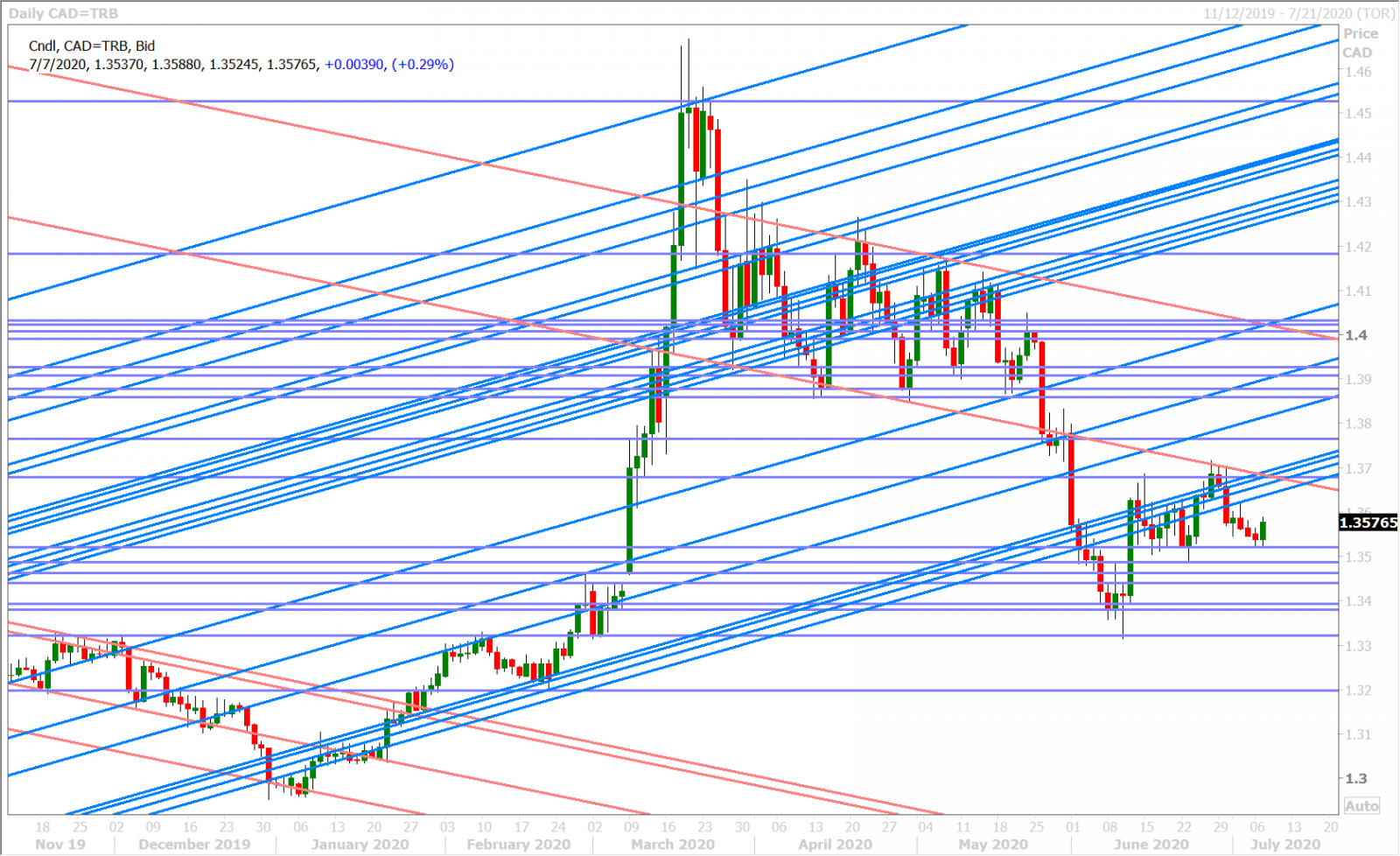

USDCAD

It looked like it was going to be another “risk-on” session in Asia last night after Chinese stocks opened almost 2% higher and after the dollar/yuan collapsed below the psychological 7.00 level, but all this got upended after Australia announced a new 6-week lockdown for all (not just parts) of Melbourne. More here from the Financial Times. Australian dollar buyers, who had just bought a breakout above the 0.6980 level on the China open, then immediately reversed AUDUSD lower and this downward momentum drove the USD broadly higher for most of the European morning session. Some relative calm (USD selling) has now returned towards the NY open, but it seems to be coming from GBPUSD buying as traders break the market above 1.2520s chart resistance ahead of tonight/tomorrow’s new round of Brexit talks.

Dollar/CAD is trading higher vis a vis yesterday’s NY close because of Aussie weakness, is off session highs now because of sterling strength, but on the whole is not doing much. Yesterday’s Q2 Business Outlook Survey from the Bank of Canada was a non-event as the negative sentiment was anticipated by market participants. The latest Commitment of Traders Report (COT) released by the CFTC showed the leveraged funds adding to both longs and shorts during the week ending June 30; which had the effect of keeping their net long USDCAD position largely unchanged week over week.

USDCAD DAILY

USDCAD HOURLY

AUGUST CRUDE OIL DAILY

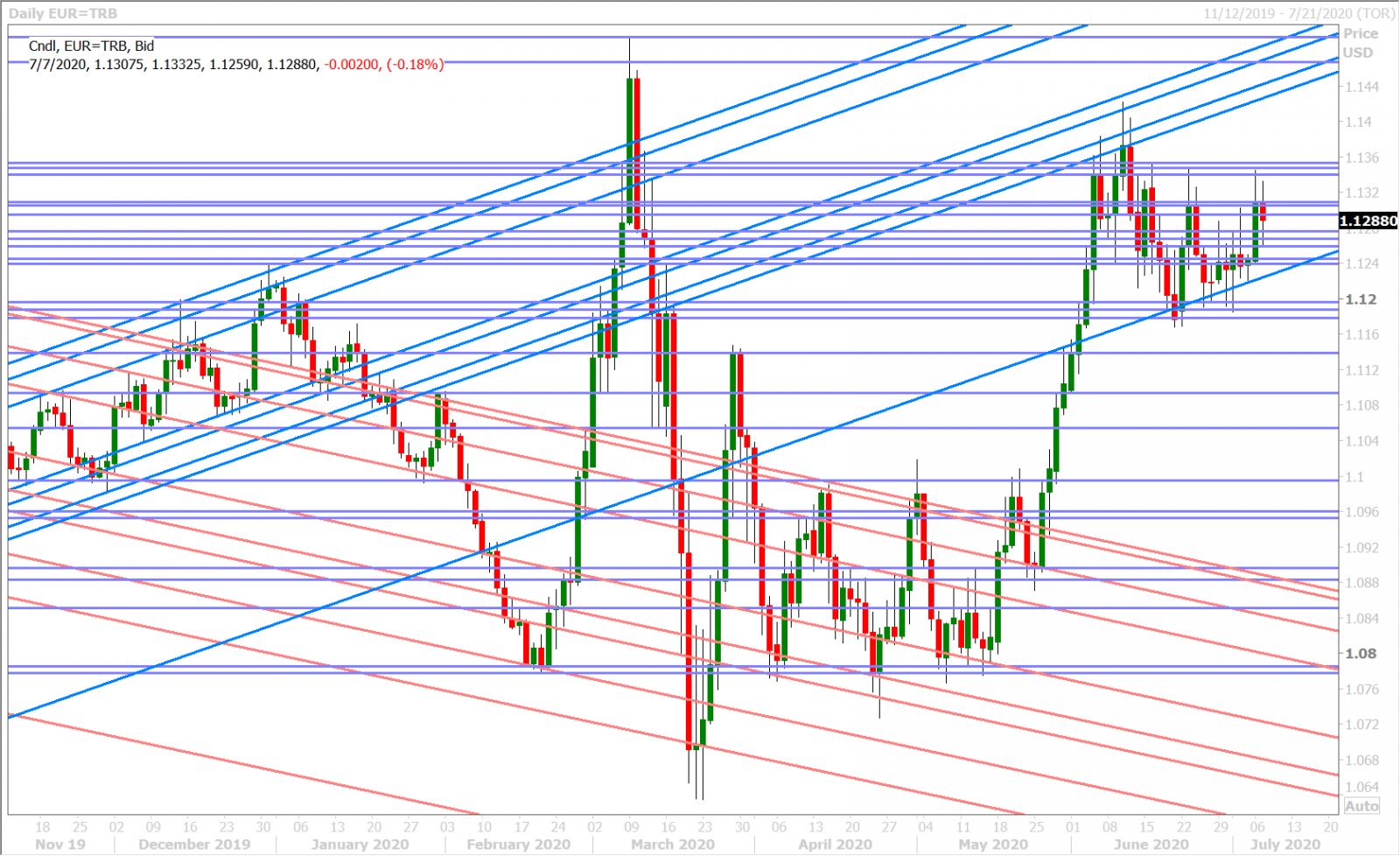

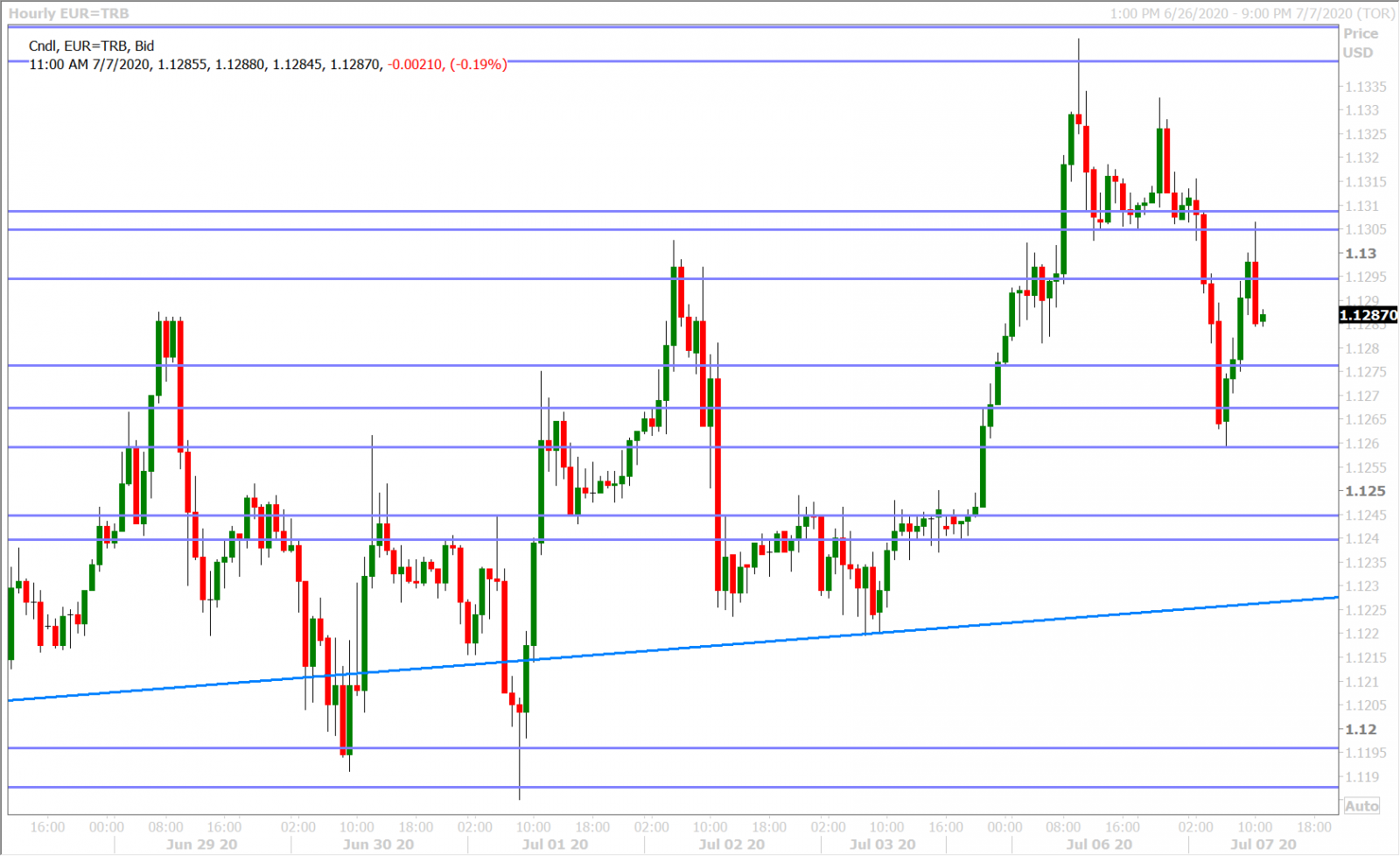

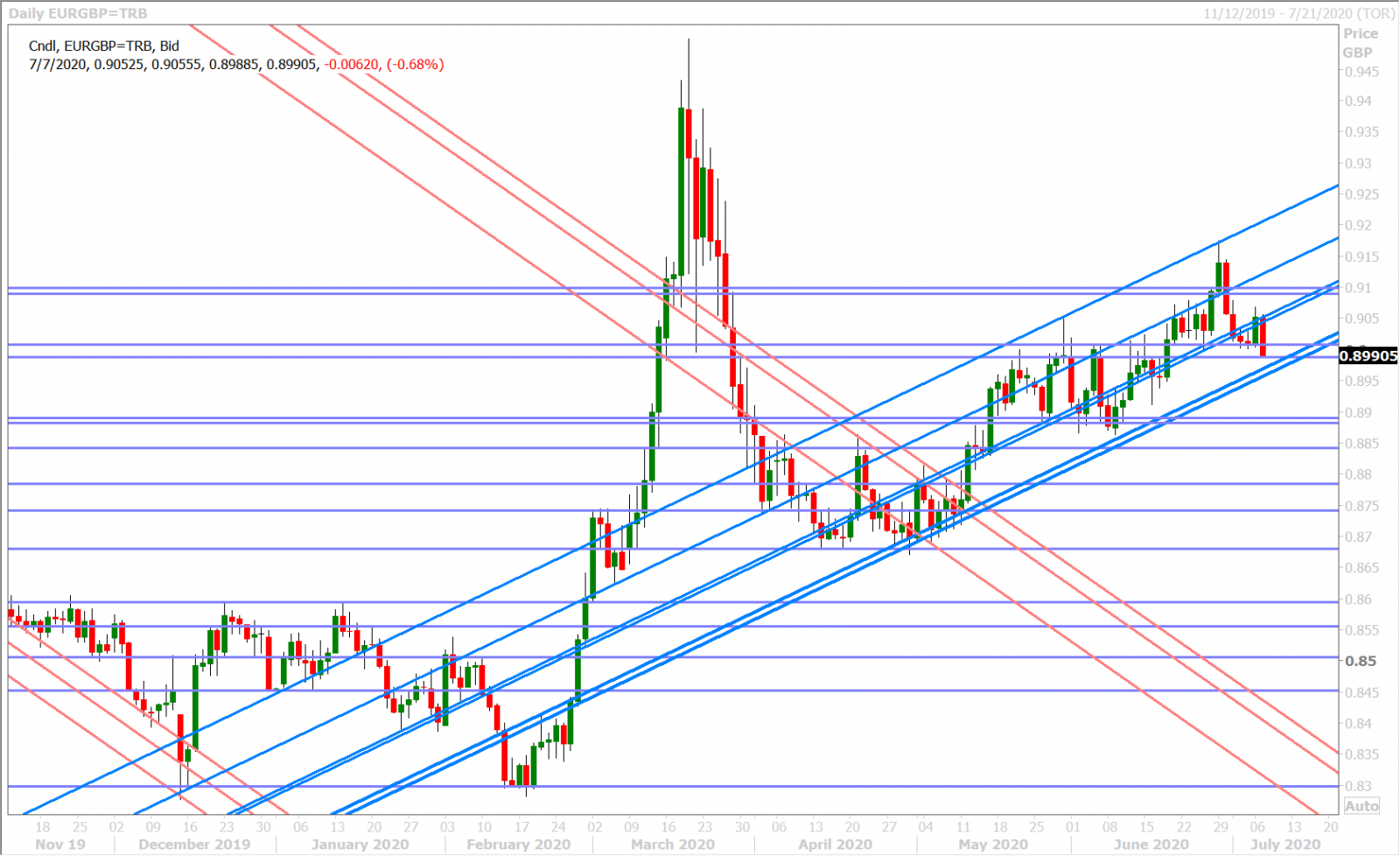

EURUSD

You could say that euro/dollar has followed broad risk sentiment over the last 24hrs, but you could also say that the market has made of point of testing two large option expiry levels for today’s calendar. Yesterday’s rally topped out almost exactly at the 1.4blnEUR of expiries going off at the 1.1335-45 strikes today, and today’s AUDUSD-driven selloff was halted at this morning’s 1.5blnEUR worth of options expiring at 1.1265-75.

This morning’s weaker than expected Industrial Output numbers out of Germany, for the month of May, were ignored by traders (+7.8% vs +10%). The latest COT Report showed the leveraged funds trimming their net long EURUSD position back down to early June levels during the week ending June 30. They did this by liquidating longs and adding to shorts; which made sense given the numerous buyer failures in the high 1.12s/low 1.13s during that week…but we think the brief upside forays for EURUSD will continue so long as large topside option expiries feature on the calendar. Over 2blnEUR worth of options will be expiring at the 1.1300 strike tomorrow and over 2.5blnEUR will be rolling off between 1.1350-75 on Thursday…which would coincide nicely with some positive vibes coming out of Angela Merkel this week heading into next week’s EU Summit.

EURUSD DAILY

EURUSD HOURLY

SPOT GOLD DAILY

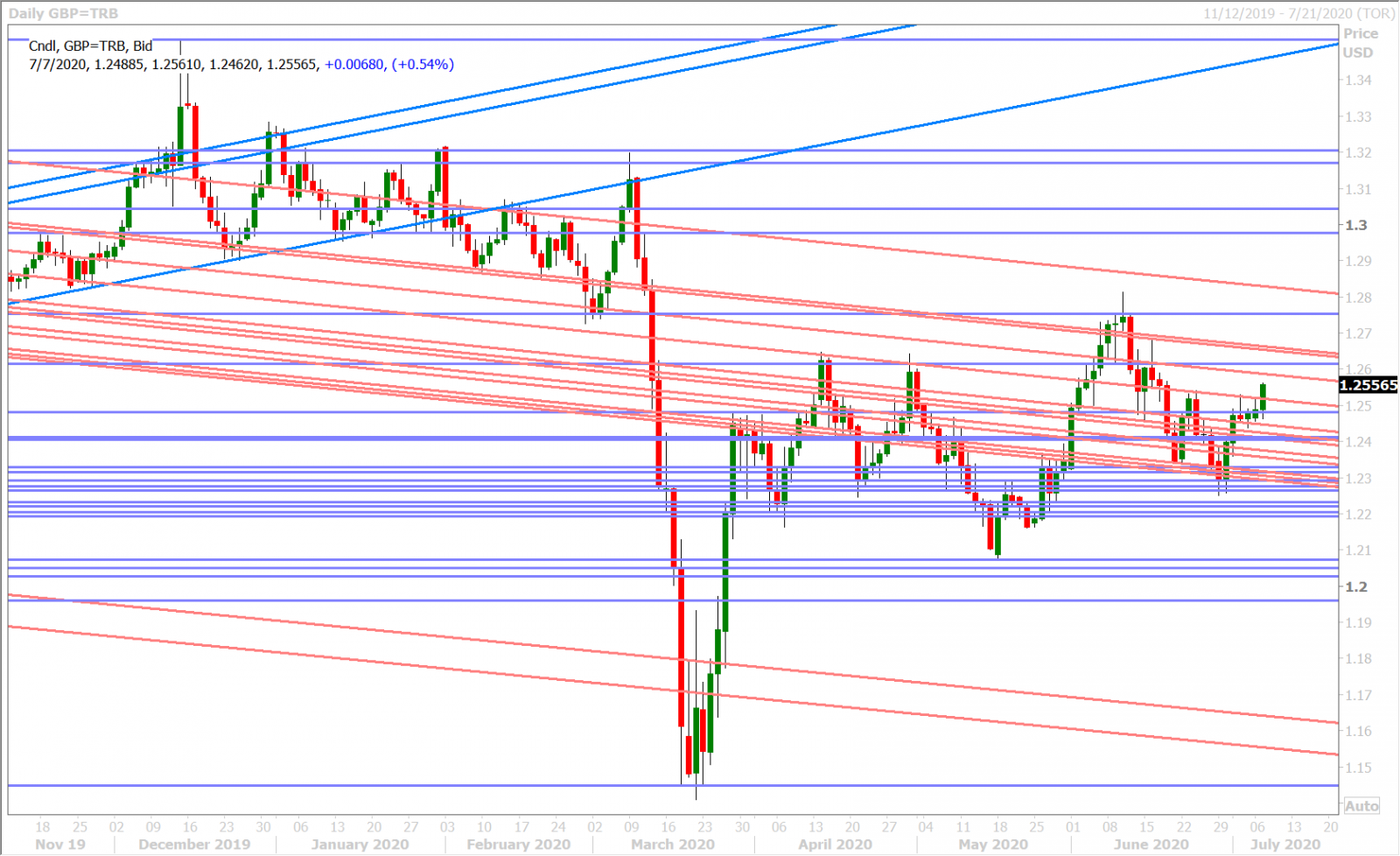

GBPUSD

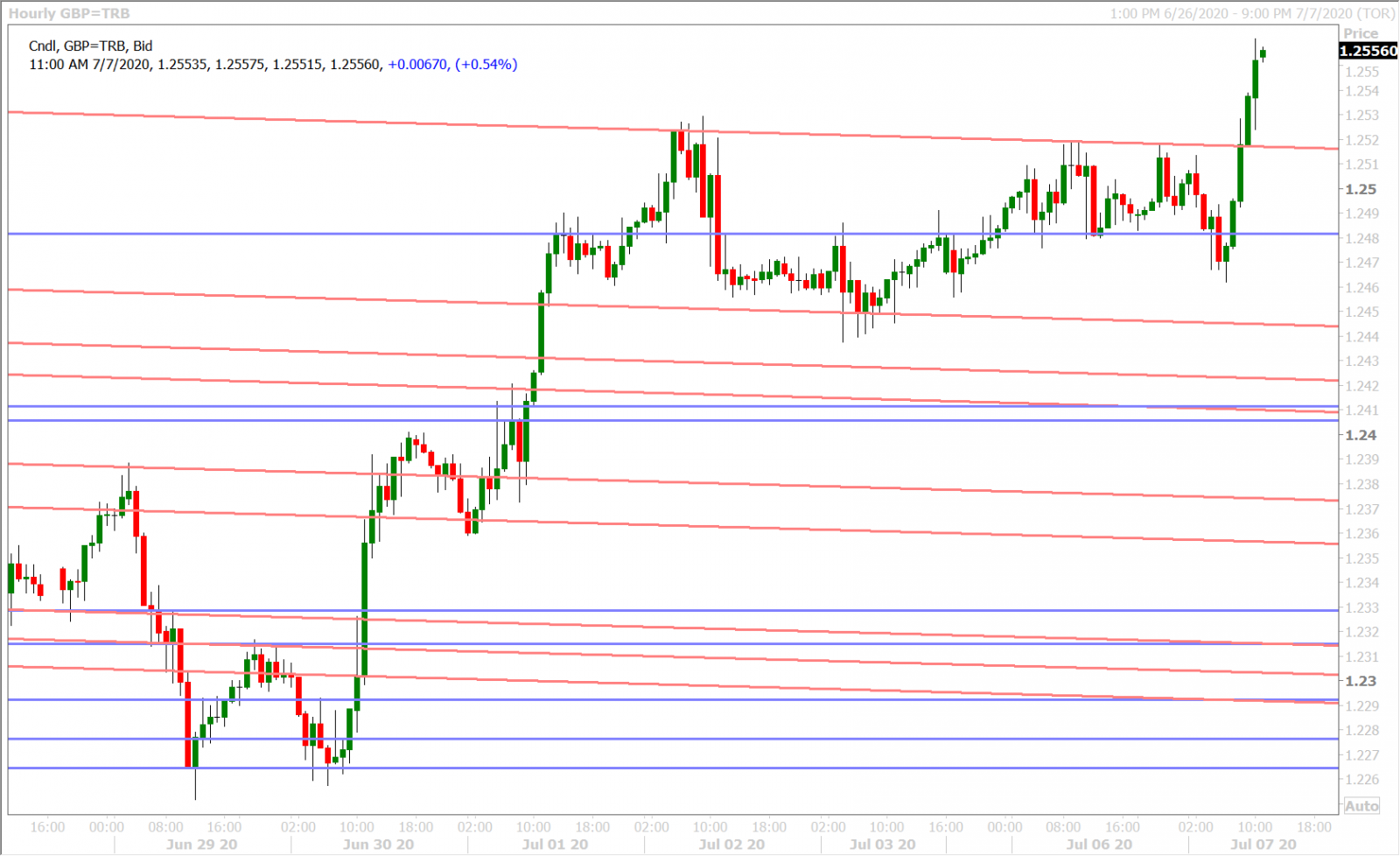

Sterling gains are leading the USD lower into NY trade this morning as traders lighten up negative bets ahead of this week’s Brexit talks. The UK’s David Frost and the EU Michel Barnier will dine tonight at Number 10 Downing Street and their respective teams will sit down again tomorrow to continue discussions. The latest COT Report showed the leveraged funds mildly increasing their net short GBPUSD position for the third week in a row during the week ending June 30. While this positioning looked good heading into month end, two waves of broad USD weakness (and perhaps a little too much Brexit pessimism) is likely forcing some of these short hands to cover.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

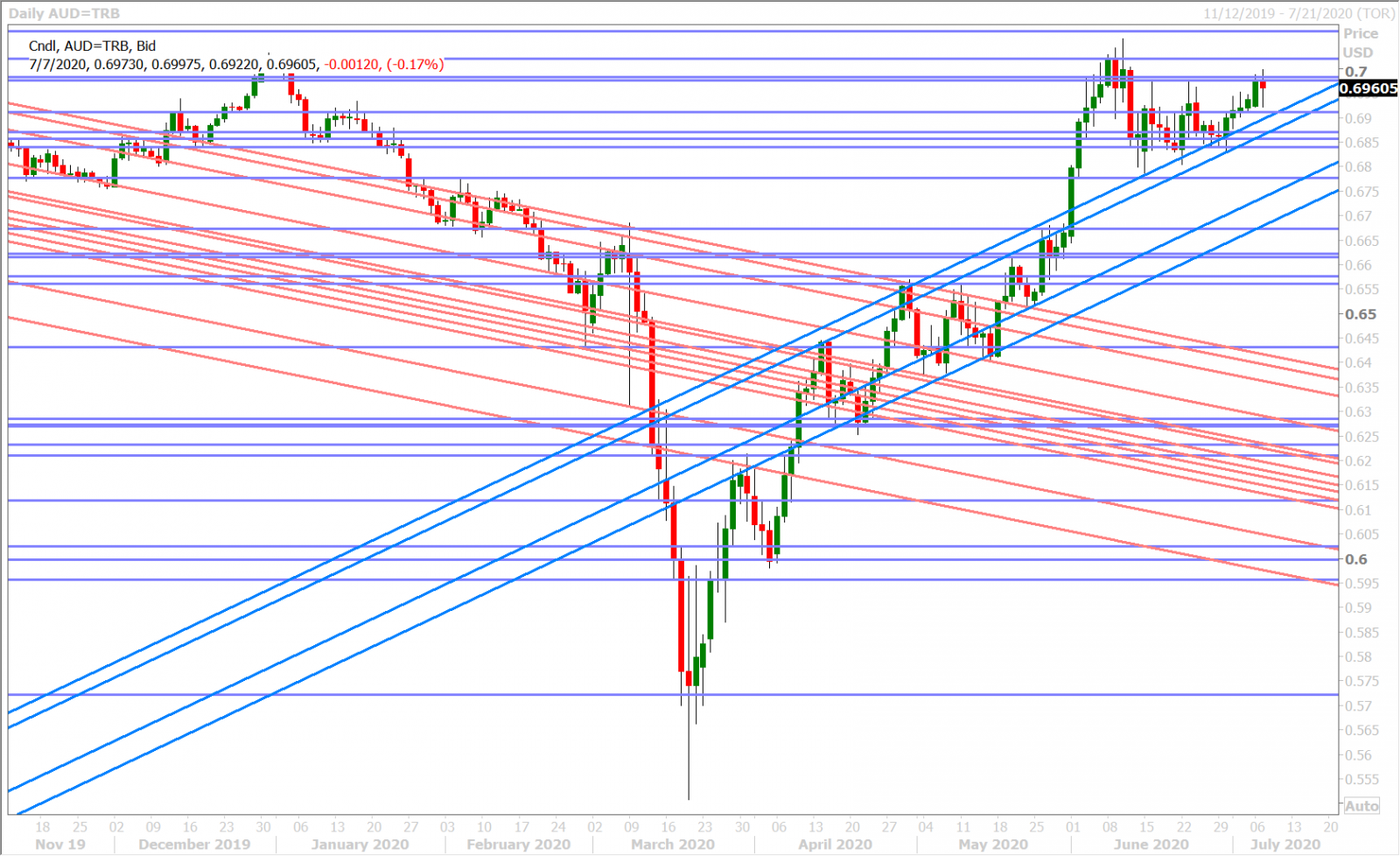

AUDUSD

The Australian dollar got knocked lower in Asia last night after news broke of 199 new COVID-19 infections in Australia over the past 24hrs; 191 of which came from the state of Victoria. This prompted Victoria’s Premier Daniel Andrew to formally reimpose lockdown measures on the entire 4.9mln population of Melbourne, Australia’s second largest city. More here from Sky News. The AUDUSD traders who bought the Chinese stock market open then had to immediately bail, and we believe that it was this “buyer failure” above the 0.6980s (plus to some degree the upside reject of the 0.70 handle) which ultimately caused the market to spiral lower into European trade today.

The market has since recovered half its overnight losses though since the NY open , as FX traders focus on GBPUSD breaking above chart resistance in the 1.2520s. Recall too that the marketplace continues not to dwell on negative COVID-19 headlines of late and so it’s not truly surprising to see another “fade” again this morning.

The Reserve Bank of Australia kept everything on hold at its latest monetary policy meeting last night; the 0.25% cash rate, the 0.25% yield target for the 3yr Aussie government bond, their less dire but still uncertain economic outlook, and their commitment to be accommodative “as long as it is required”. There was no mention of the recent strength in the Australian dollar or the recent spike in Australian COVID infections…by and large this meeting was a non-event for the markets. Full statement here.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

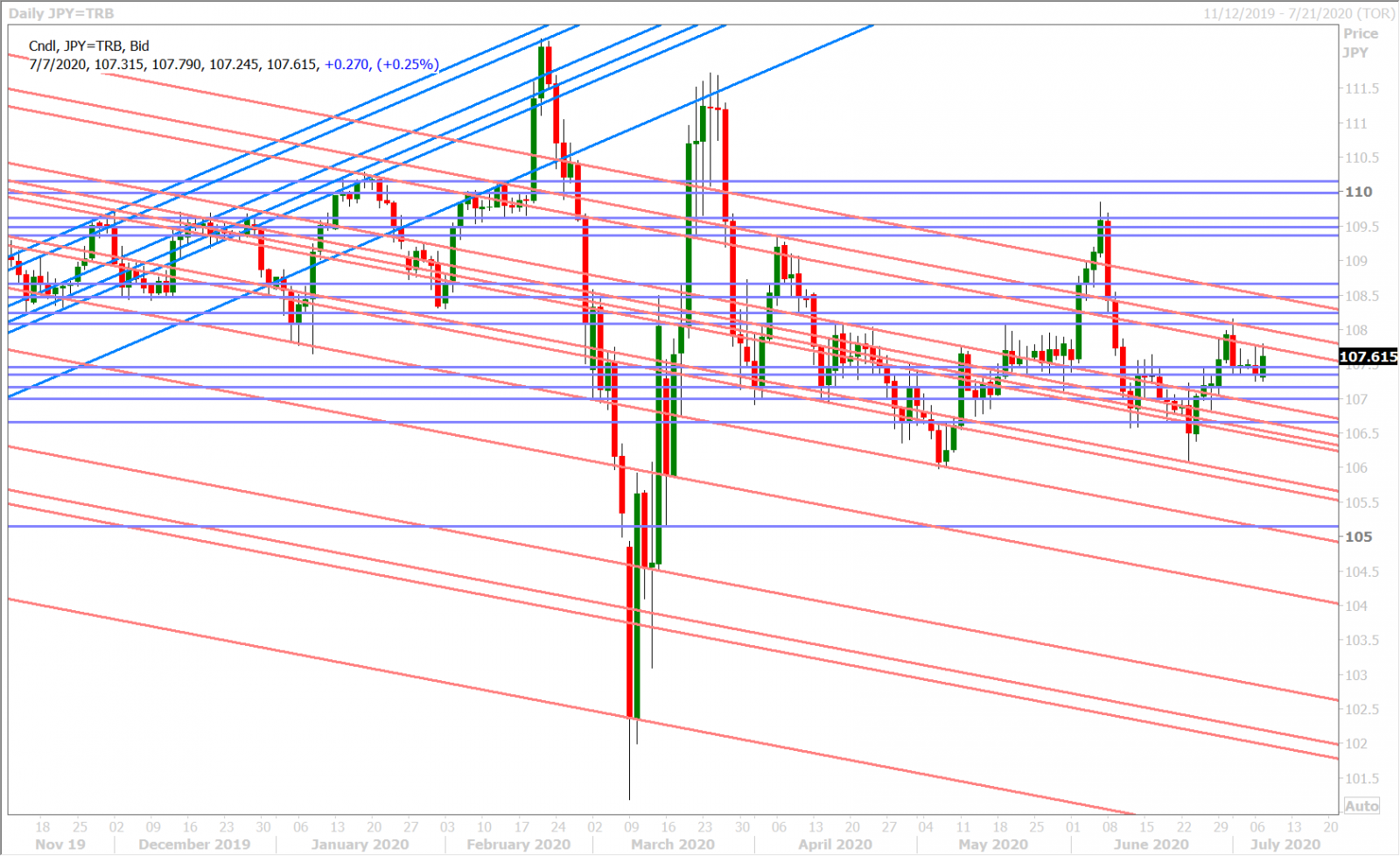

USDJPY

Dollar/yen rallied with broad USD strength overnight, which broke tradition with the market’s recent correlation to US yields…but we wouldn’t read too much into this just yet. While Tokyo reported its 6th day in row of 100+ new COVID infections today (a valid JPY negative), we don’t think the market will be able to venture higher given the $3.2bln worth of options expiring at 107.50 strike over the next 48hrs.

USDJPY DAILY

USDJPY HOURLY

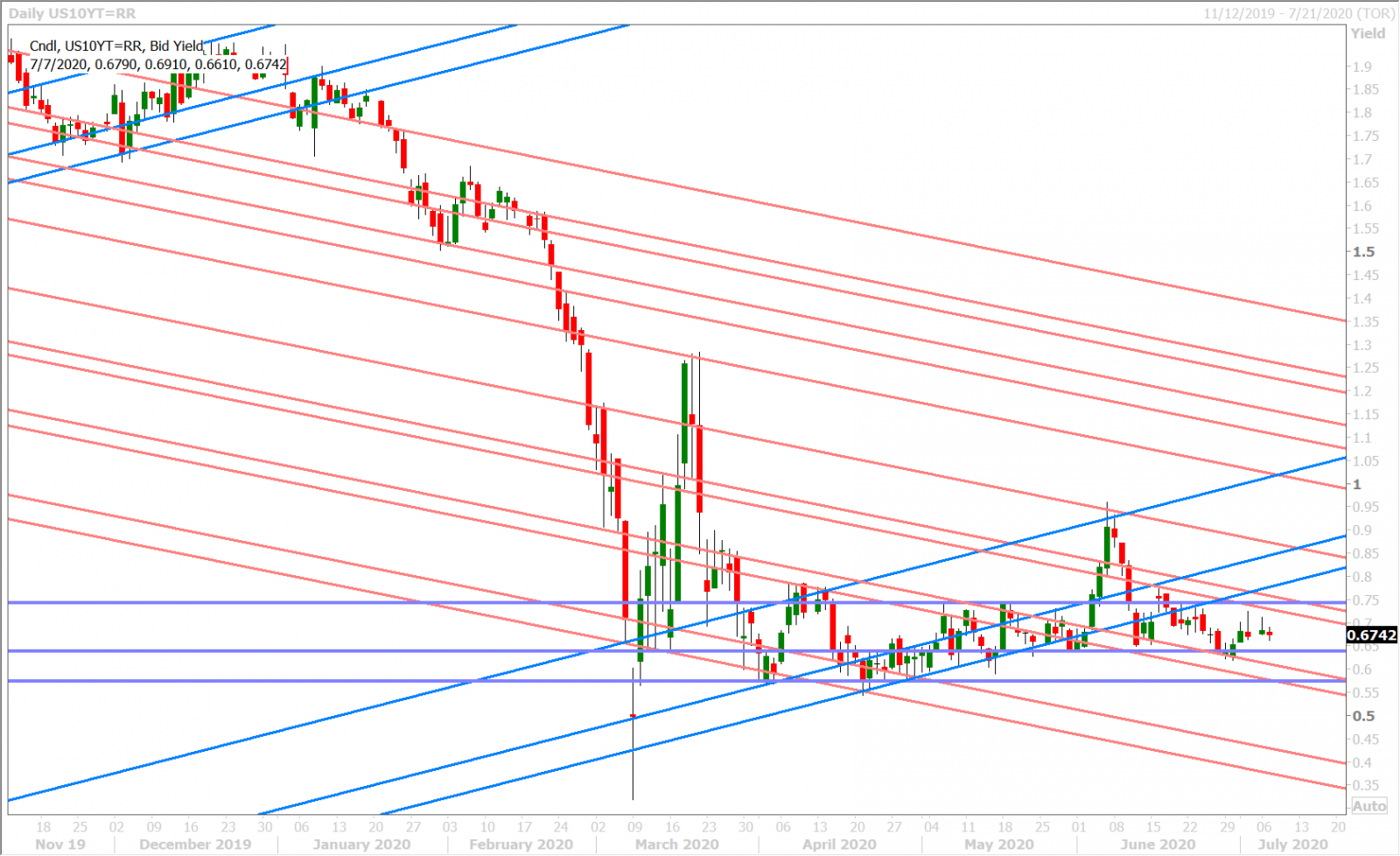

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.