All eyes on the Fed today. Markets expecting 25bp hike.

Summary

-

CME OPEN INTEREST CHANGES 12/12: AUD +1012, GBP +3708, CAD -2253, EUR +10149, JPY +2241

-

ECONOMIC DATA UPDATE: US PPI comes in at +3.1% YoY, slightly higher than expected. Australian Consumer Confidence jumps 3.6% in December to 103.3. Japanese Machine orders jump 2.3% YoY in October, much better than expected, and finally the UK employment figures came in mixed (slightly weaker than expected on the headline job loss and the unemployment rate, but the 3-month YoY rise in weekly earnings came in slightly higher than expected). Neither the RBA’s Lowe nor the BOJ’s Kuroda said anything noteworthy in their respective speeches overnight. Today we get US CPI at 8:30amET (+2.2% YoY expected) and then of course the Fed’s FOMC meeting at 2pm followed by Yellen’s final press conference at 2:30pm. (markets expecting a 25bp rate hike and at least two more rate hikes for 2018)

-

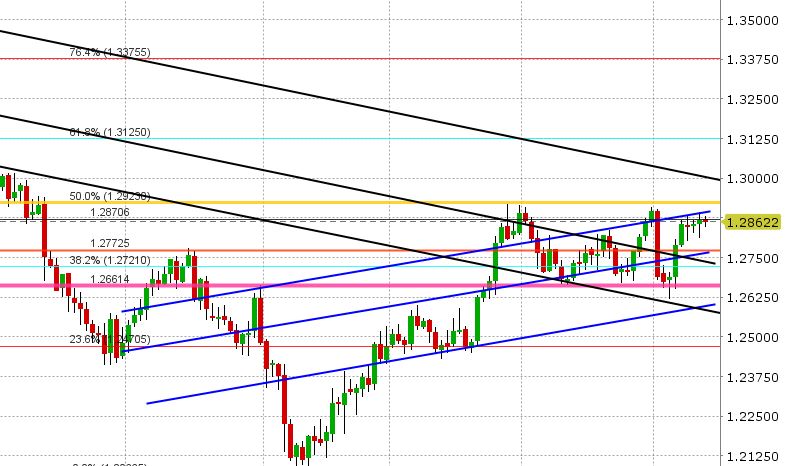

USDCAD: Dollar/CAD continues its range-bound to higher trade as markets await the Fed’s decision on interest rates and monetary policy later today. Yesterday’s range was a little wider than Monday’s, with traders pushing spot towards support in the 1.2810-1.2820 area earlier on, but the market snapped back higher after the release of the higher than expected US PPI. Chart resistance in the 1.2880-1.2890 area proved formidable for USDCAD yesterday with traders trying to punch through the level multiple times to no avail. We now sit slightly off those resistance levels at the start of NY trading, which is still a positive trading pattern. The US/CAD 2yr yield spread remains firm at +31bp. EURCAD and GBPCAD are a little bit directionless this morning. Technical support today lies at 1.2810-1.2820 again, then the 1.2770s. Resistance today is 1.2890-1.2900, and then the 1.2920s (the 50% Fibo retrace of the May-Sep down move). There is very little resistance above this level should the market break higher.

-

AUDUSD: The Aussie continues to hold its M&A related gains yesterday as traders await the FOMC today. The jump in Australian Consumer confidence is a nice positive backdrop. The AU/US 2yr yield spread is steady at +1bp. Copper is higher again today (up three days in a row), but it’s running into a little bit of resistance now at 3.05. AUDUSD continues to consolidate in yesterday’s NY range with the 0.7550s supporting and the 0.7570-0.7580 region resisting. A break above this resistance level would usher a move higher to 0.7600-0.7620. A firm close below 0.7550 renews the downtrend and would put 0.7500-0.7515 back in focus. It will be a big overnight session for Aussie tonight, with Australian inflation, employment data and Chinese Retail Sales/Industrial Production data.

-

EURUSD: Euro/dollar broke down a little bit in yesterday’s trade. Monday’s technical failure at 1.18 (option expiry level and trend-line resistance area) was compounded after the higher than expected read on US PPI, and we trading back down to the November lows in the 1.1720s. We’re a touch higher now going into NY trading but below the 1.1750-1.1760 support level (that acted as support last week). So it’s a bit of negative setup, according to the charts, going into the FOMC meeting today. The US/GE 10yr yield spread continues to be a drag for EURUSD, and now sits close to +210bp. There is a 1.5bln+ EUR option expiry at 1.1700 today, which could have a magnetic effect going into 10am. Option traders are still not pricing in much excitement over the next 24hrs, with breakevens trading in the low 70pt range. Support today lies at the 1.1710-20 level, then 1.1660-80. Resistance is 1.1750-60, then 1.1810-1.1825, 1.1860.

-

GBPUSD: It’s been a mixed overnight session for sterling, but the market had a nice little run up before the UK employment report and the gains continue to hold despite the mixed result. GBPUSD traders will be watching the FOMC decision today as well. Support today is 1.3310-1.3320, then 1.3270-1.3280. Resistance is 1.3370-1.3380, then 1.3400-1.3420, then 1.3450. A reminder that we get UK Retail Sales early tomorrow and the Bank of England announces its monetary policy update at 7amET. The markets are not expecting another rate hike tomorrow, but traders will be watching for any hints of a hawkish tone in light of the higher than expected UK CPI read earlier this week. Traders will also have the EU summit and potentially more Brexit headlines to deal with come Thursday and Friday.

-

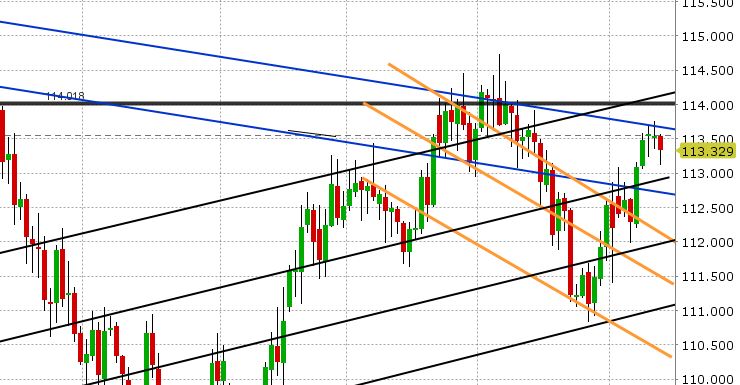

USDJPY: Dollar/yen is a bit on the back-foot today as traders here await the FOMC as well. US stock futures dipped lower after the Republicans took a hit in the Alabama Senate race last nice (creates some angst regarding passage of US tax reform), and USDJPY followed suit, but the futures are close to breakeven again as we enter NY trading and there’s a firm bid to US yields as well. USDJPY seemed to have a lot of trouble at chart resistance in 113.60-70s yesterday. It is definitely now the level to watch post FOMC meeting. A firm close above there would invite an upward test the 114s again (renewing the weekly uptrend). Support today lies at 113.00-113.10, then 112.70.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.