All eyes on Mario Draghi press conference

Summary

-

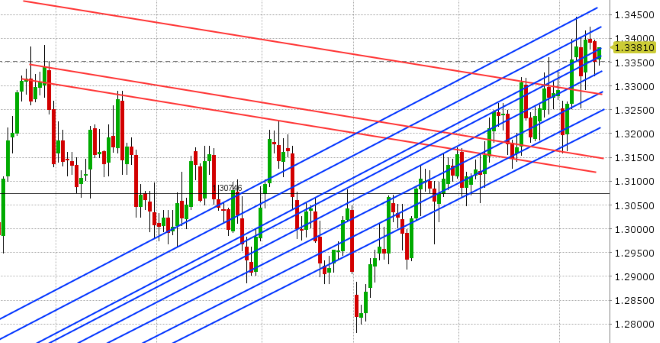

USDCAD: Dollar/CAD is trading with a bid tone this morning after yesterday’s bounce off the 1.3320s helped to stall this week’s pullback in prices. The slip for January crude oil back below the $51 mark in overnight trade is also helping the tone this morning. The 1.3370s (yesterday’s first support level, now turned resistance) are capping prices though however, and so we could very well range trade here for the time being. The broader USD is trading with a mixed to offered tone as this hour as the ECB meeting takes center stage for markets. The rest of today’s calendar is fairly quiet with regard to expected economic announcements. While we respect the technical strength the market has shown since recovering quickly on Monday, we remain a little wary of the December seasonals which suggest the two month rally will stall at some point this month.

-

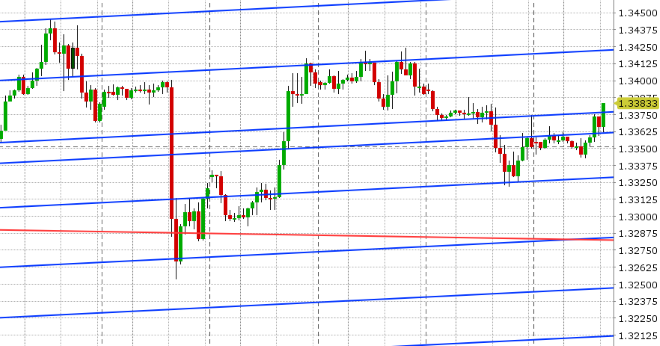

EURUSD: Euro/dollar is tripping stop orders on both ends of the market at this hour after the ECB just confirmed the conclusion of its bond buying program and left its forward guidance unchanged (both as expected by market participants). Next up is Mario Draghi’s press conference at 8:30amET, where the European central bank president is expected to take a dovish tone by lowering growth and inflation forecasts. A decently sized option expiry (1.1blnEUR at 1.1350) may very likely be in play today. With the Italian budget drama now essentially out of the way following yesterday’s 2.04% budget deficit revision, we think EURUSD has the potential to commence a rally, but we would need to see some firm closes above the 1.1400 level, and above the 1.1450 mark most especially.

-

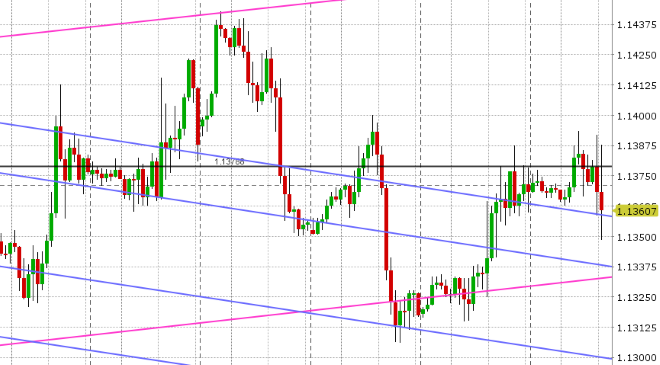

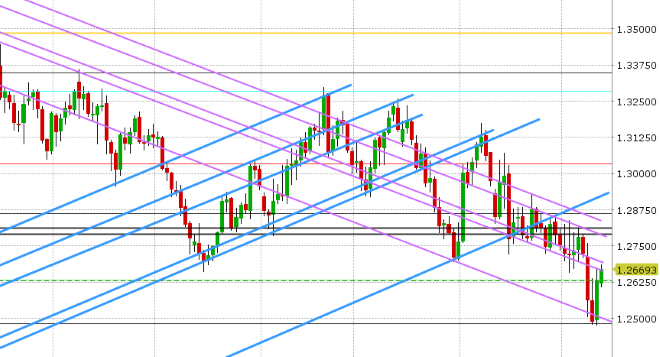

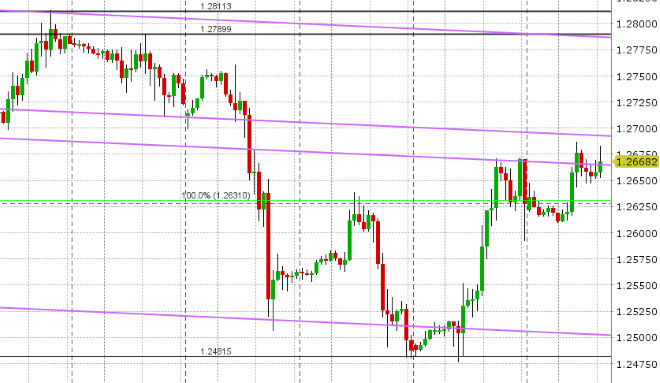

GBPUSD: Theresa May indeed survived yesterday’s no-confidence motion against her, and that vote tally was 200 to 117. This led to some GBPUSD volatility in the 4pmET hour yesterday as some members of the press felt the margin of victory wasn’t high enough. The market still managed to close above Fibo chart support in the 1.2620s however, which helped the technicals going into overnight trade. The Brexit news flow today has been focused on Theresa May’s return to Brussels yet again for the EU summit and some hopes of her winning concessions from EU leaders on the Irish backstop. GBPUSD trades just shy of the trend-line resistance zone in the 1.2670s-1.2690s. A headline has just crossed from the EC Council president Kurz saying “READY TO MAKE CONCESSIONS IN TALKS WITH MAY”. This may now put chart resistance to the test. A close above the 1.2700 mark would be bullish in our opinion.

-

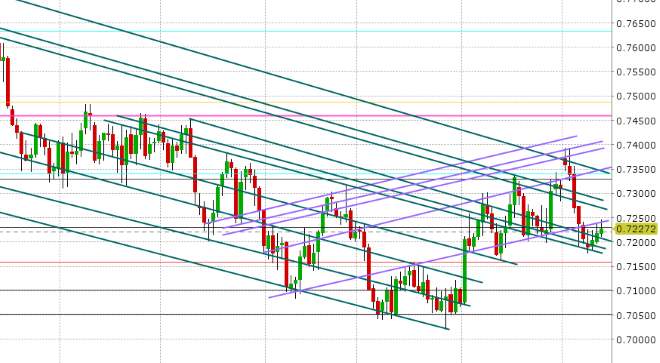

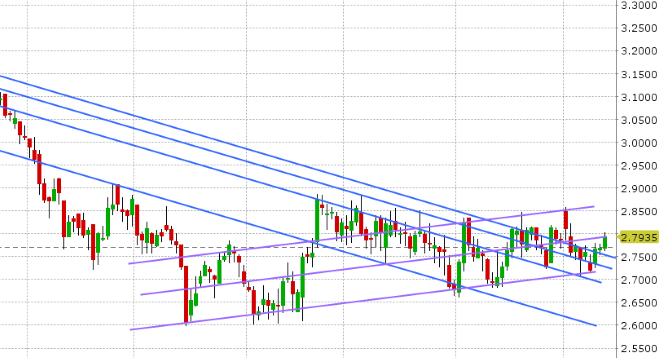

AUDUSD: The Aussie is inching higher this morning, but it continues to struggle with overhead chart resistance, which suggests sellers are still in charge. Copper prices are breaking out a little today; trading 1% higher, and so we’ll continue to monitor this to see if AUDUSD can clear the 0.7240s to the upside. We still expect sellers on rallies into 0.7270-80s after last week’s bearish outside reversal.

-

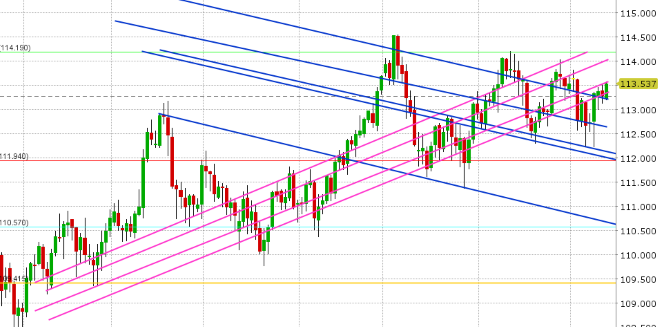

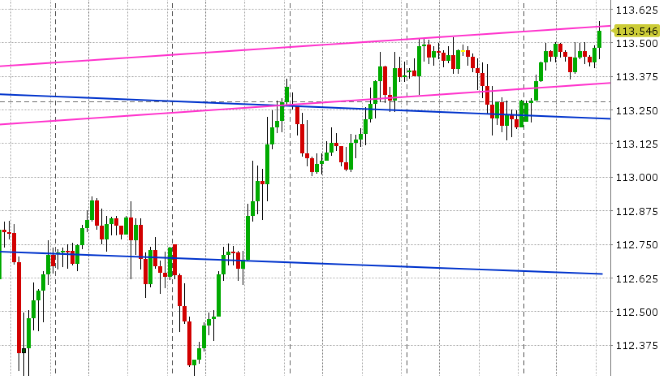

USDJPY: Dollar/yen took its breather in NY trade yesterday, and indeed found buyers in the low 113s. This also coincided with a key trend-line level, which held up prices on Tuesday. Today’s action has been relatively lackluster, with USDJPY once again trading within an upward sloping trend-line resistance channel (113.30s-113.50s). We think the fund longs will celebrate and perhaps add to positions should we close above this channel. Japan reports its Q4 Tankan manufacturing survey tonight at 6:50pmET.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

January Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

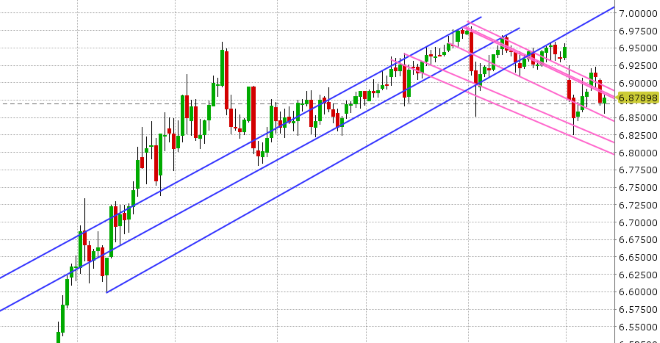

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

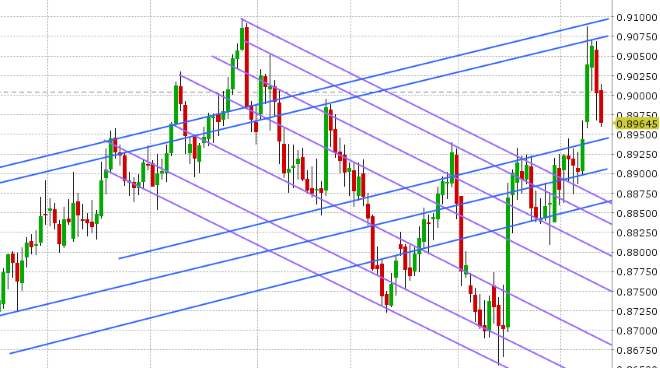

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

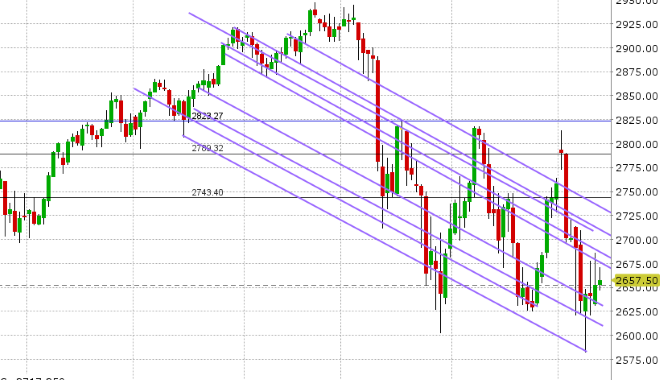

DEC S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.