All eyes on Fed chairman Powell today

Summary

-

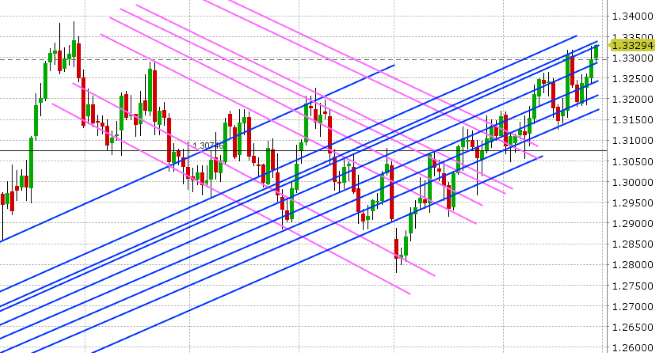

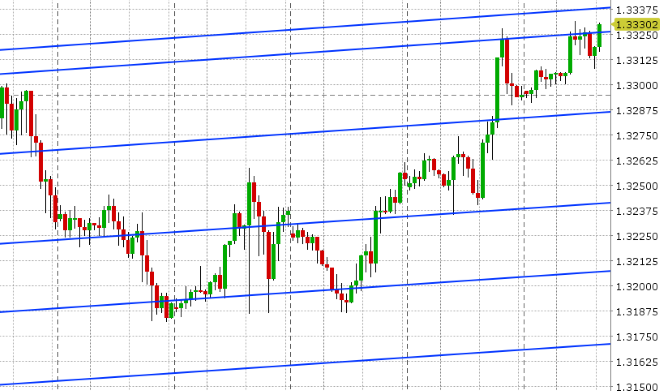

USDCAD: Dollar/CAD rallied strongly yesterday after reports circulated about Trump imposing auto tariffs on German cars as early as next week. This put immediate pressure on EURUSD heading into the London close, which then spurred USDCAD to break above chart resistance in the 1.3280s. Some swift selling in crude oil around the noon hour kept the upward momentum in place and, before we knew it, the market was testing the next resistance level in the 1.3320s. We have since pulled back twice from this level (once yesterday afternoon and once again in overnight trade). The broader USD is trading mixed at this hour and crude oil prices are trading flat after last night’s expected build in API oil inventories. The second reading on US GDP for Q3 just came in at 3.5%, matching expectations and the initial reading. Next up is the weekly EIA oil inventory report at 10:30amET, and then the much anticipated speech from Fed chairman Powell before the Economic Club of New York at 12pmET, titled “The Federal Reserve’s Framework for Monitoring Financial Stability”. We feel market participants are expecting his tone to remain hawkish, especially in light of vice-chair Clarida’s comments yesterday. Fed fund futures are currently pricing in a 79% chance that the Fed hikes rates for a 4th time this year on Dec 19th. We think USDCAD coasts here ahead of the speech, but we think traders have to be mindful of chart resistance in the 1.3320-40 region potentially giving way. There is not much resistance on the daily chart after this, which means we could very easily gallop into the 1.34s should another wave of broad USD buying come in.

-

EURUSD: Euro/dollar is struggling today after a combination of hawkish comments from the Fed’s Clarida, negative headlines regarding German auto tariffs, and talk of the European Commission launching EDP measures on Italy before Christmas all combine to sour the mood ahead of today’s speech from Powell. The market fell below trend-line support in the 1.1280s overnight, held the next trend-line level in the 1.1260s, and is trying to regain the 1.1280s again now. The BTP/Bund spread continues to trade steady around the +290 mark. There are no major option expiries on deck for today, although 1.6blnEUR goes off at the 1.1350 strike tomorrow. We think EURUSD may bounce a little bit here ahead of Powell at 12pmET.

-

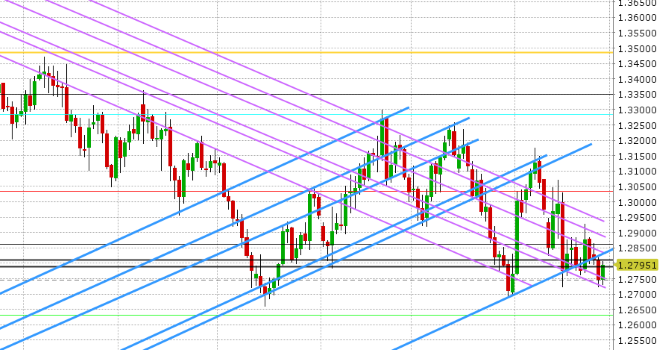

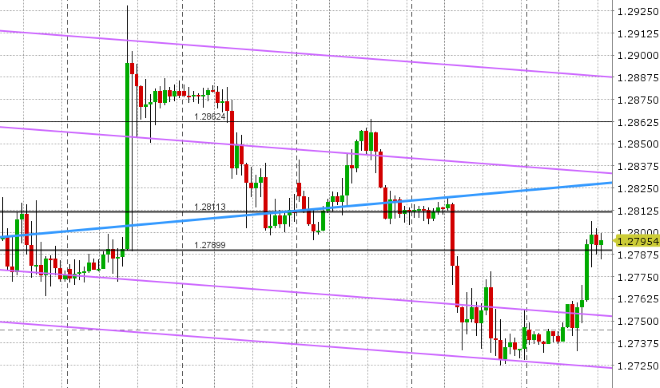

GBPUSD: Sterling is leading the G7 FX space higher after chart resistance in the 1.2750s (yesterday’s support) was regained in early European trade this morning. We’re reading reports this morning about Theresa May apparently backing down on efforts to stop Parliament lawmakers from trying to re-write her draft Brexit agreement. One could argue this is somewhat positive news, as it reduces the odds of a huge clash with Parliament going into the Dec 11th vote. UK’s Finance minister Hammond came out in support of Theresa May’s Brexit plan today, but the Northern Irish are still not happy according to the latest reports. GBPUSD has now moved back up into the 1.2790-1.2810 support channel that it lost yesterday. EURGBP has broken below trend-line support in the 0.8840s, which is GBP supportive. While we think GBPUSD will remain extremely sensitive to Brexit headlines here, we think chairman Powell’s speech today will likely dominate the news flow and broader USD tone going into week’s end.

-

AUDUSD: The Aussie is trading quietly today after a volatile 48hrs of trade sees an indecision doji candle form on the daily chart at the end of yesterday’s trade. Chart support in the 0.7220s was regained in late NY trade, and the S&Ps closed on their highs of the session. All this doesn’t necessarily point to further gains, but it stalls some of the negative momentum we’ve seen this week. Copper prices are trying to claw back losses today, after falling below chart support in the 2.75 area yesterday. The funds remain net short AUD (long USD) to the tune of 59k contracts at CME, but this net position has been declining ever to slightly over the last month as longs liquidate at a faster pace than shorts. A firm close above the 0.7250s would be a positive technical development.

-

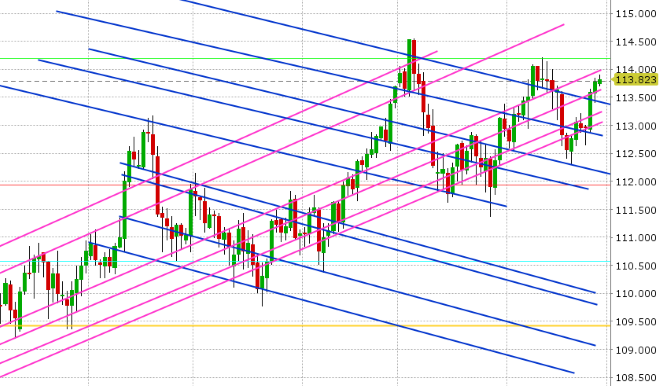

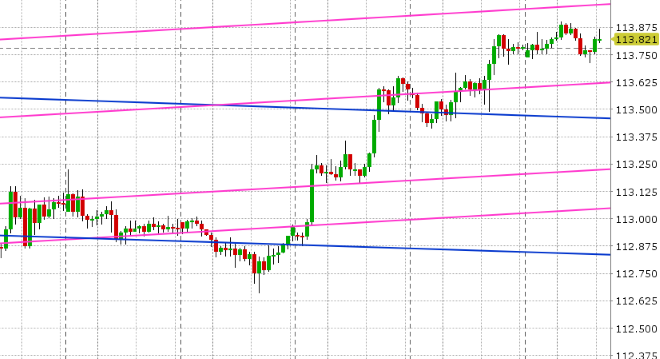

USDJPY: Dollar/yen is trading flat this morning as traders await the next signal on US monetary policy from the Fed’s Powell today. Around 1.5blnUSD in options expire at the 113.50 strike this morning, which might act to weigh prices down this morning, but we think the technical outlook is still positive for USDJPY here so long as the 113.40s hold. The BOJ’s Masai will be speaking tonight at 8:30pmET. Tomorrow night brings the October employment and CPI reports for Japan.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

January Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

December S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.