All eyes on Brexit headlines and Theresa May's cabinet meeting at 9amET.

Summary

-

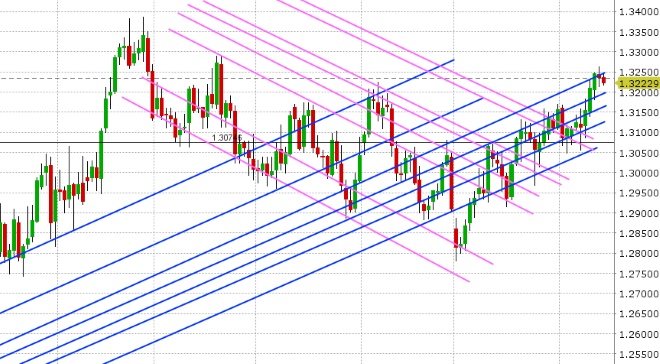

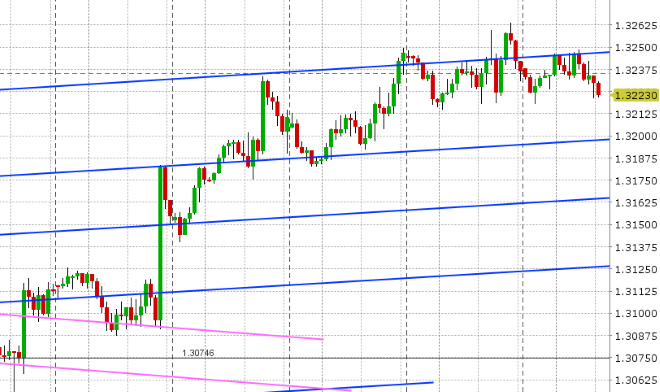

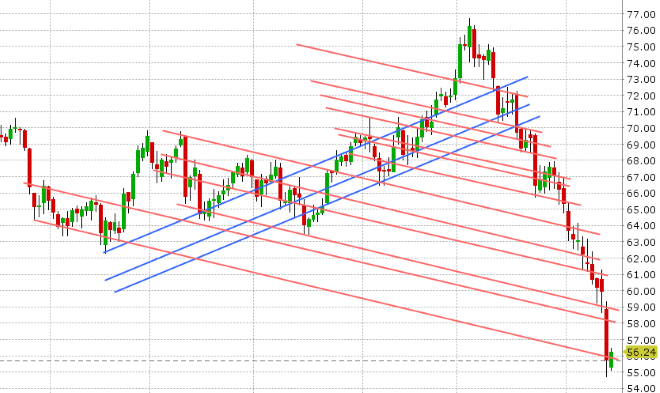

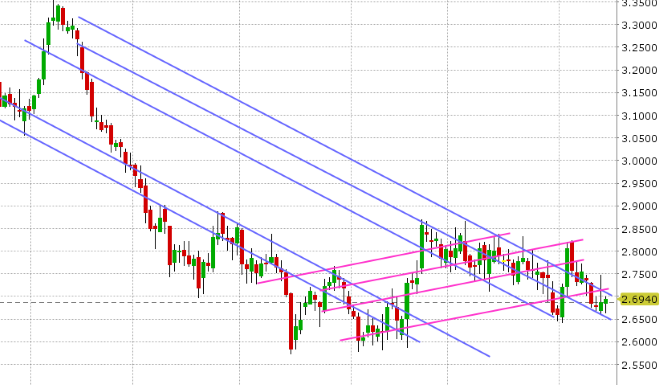

USDCAD: Dollar/CAD is trading on the defensive this morning as crude oil prices are finally staging a bounce after plunging 8% yesterday. Reuters is citing three sources that say OPEC is now discussing a proposal to cut production by up to 1.4 million barrels per day in 2019, and this is seeing prices rebound back above $60 ahead of today’s December option expiry. Next up is the US CPI report at 8:30amET, where traders are expecting +2.5% YoY and +0.3% MoM on the headline, and +2.2% YoY and +0.2% MoM on core CPI. We would not be surprised to see USDCAD pull back to 1.3200 today, especially if we get some positive news out of the UK on Brexit.

-

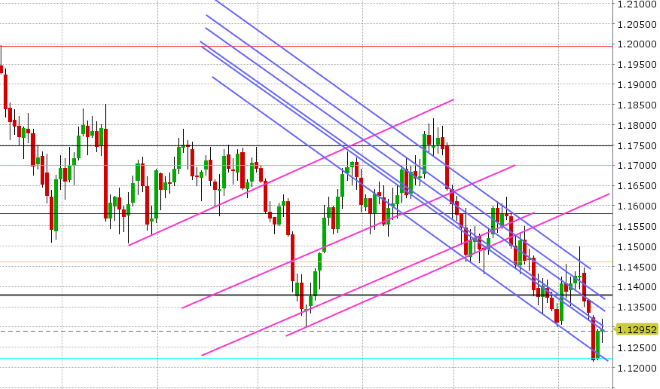

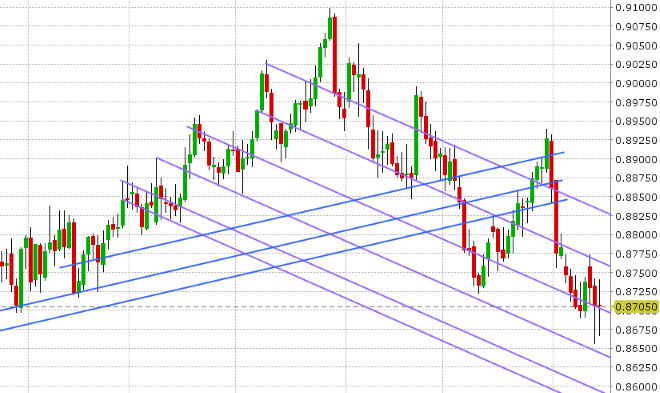

EURUSD: Euro/dollar is leaking lower this morning after trend-line resistance at 1.1300-1.1320 capped the trade in late NY/early Asian trade last night. The German GDP figures for Q3 missed estimates overnight (-0.2% vs -0.1% QoQ) and this is not helping the mood this morning. The pullback in sterling and the bounce in USDCNH is not assisting either we feel. The deadline for Italy to revise its controversial budget with the EU has passed without any changes from Italian lawmakers. This could make for an interesting rest of the week as the ball in now back in the EU’s court to react. BTPs over Bunds are trading steady though, around the +310 mark.

-

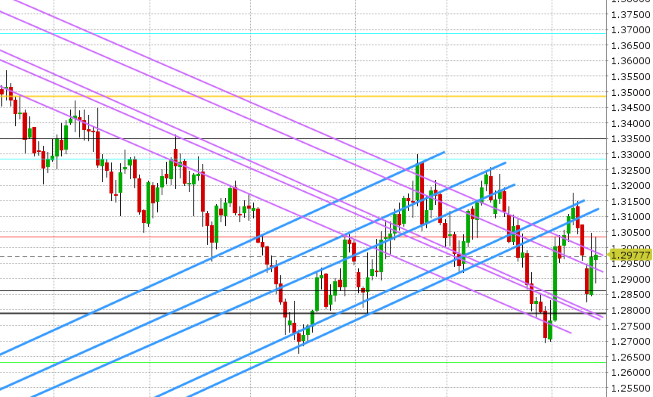

GBPUSD: All eyes are on Theresa May’s emergency cabinet meeting this morning at 9amET to discuss the UK’s new draft of the Brexit agreement. Skepticism appears to running rampant though in today’s UK media because a lot of details of this draft are still unknown and, even if Theresa May wins over her cabinet, she’ll still have a tough time convincing Parliament to vote for it considering how EU-friendly the document is at this stage. Option traders are saying something happens today, as overnight at-the-money straddles trade at 150pts (implied daily range for GBPUSD). Sterling now sits well off yesterday’s highs, but above chart support at 1.2950 for the moment. We feel a move above the 1.3030s will invite further buying into the 1.31s, whereas a move below the 1.2860s will see the sellers pounce once again. This could be one of the most important days yet for Theresa May and Brexit negotiations. The UK reported October CPI today slightly below expectations (+2.4% YoY vs +2.5%), but traders have understandably been focused elsewhere.

-

AUDUSD: The Aussie is trading with positive tone this morning, as it claws back EUR and GBP driven losses from earlier today. Support in the 0.7210s on the AUDUSD chart gave way, and traders are attempting to regain it now. A bounce in EURUSD and GBPUSD appears to be helping with that. Copper is trading marginally higher as well. Over 2.5blnAUD of options roll off between 0.7200 and 0.7225 on Friday, which may likely help to keep the market bid here baring any negative shocks out of the UK today. Last night's in-line Q3 Wage Price Index data out of Australia (+0.6% QoQ) was largely brushed off by traders.

-

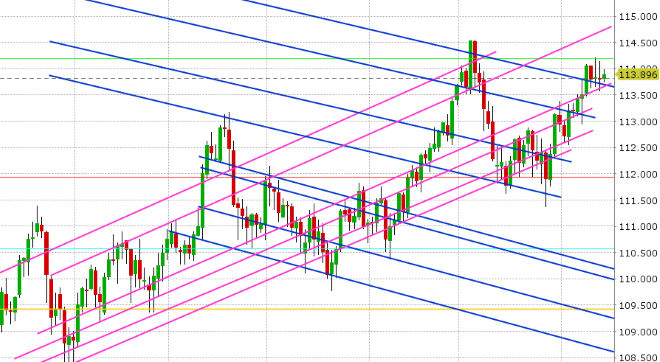

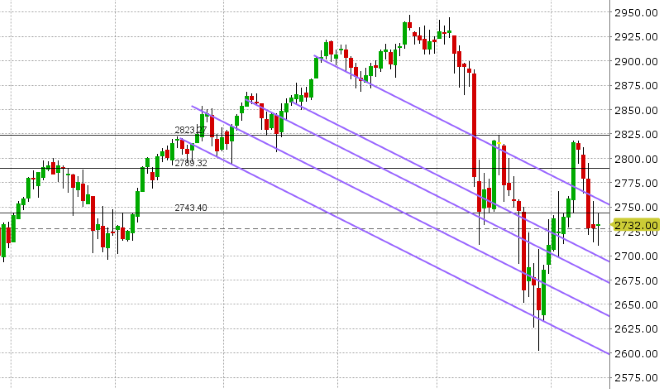

USDJPY: Dollar/yen is doing a whole lot of nothing this morning as US equity futures are trading flat at this hour and traders remain more focused on what’s going in Europe. Chart support in the 113.60-70s continues to hold and we have 1.4blnUSD in option expiries between 113.90 and 114.00 this morning that may likely keep us near current levels. Over 1.6blnUSD rolls off at the 115.00 strike on Friday, which is interesting. We think USDJPY could resume some upward momentum should the S&Ps clear the 2740s to the upside.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

December Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

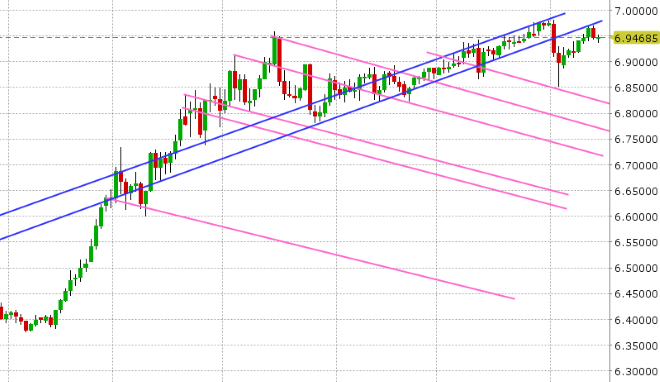

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

December S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.