AUDUSD falls on Turnbull/Huawei headlines

Summary

-

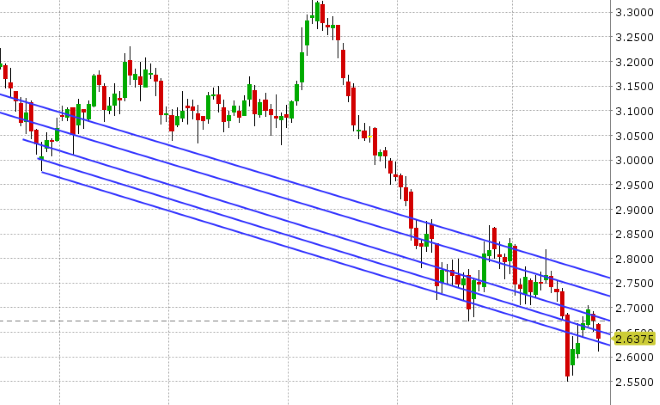

USDCAD: Dollar/CAD traders couldn’t muster the bounce that was looking likely yesterday as crude oil rallied impressively after the EIA inventory report. The October contract shot up the $68 handle, triggering USDCAD to break below support in the 1.3010s. The FOMC Minutes had something in it for both hawks and doves https://www.reuters.com/article/us-usa-fed-instant/fomc-minutes-more-hikes-coming-soon-trade-a-worry-idUSKCN1L71Z1, but the report did mark a turning point for the broader USD late yesterday. Asia then came in bought USD across the board, with AUDUSD selling appearing to lead the way following some very negative political developments for Australian PM Malcolm Turnbull: https://www.theguardian.com/australia-news/2018/aug/23/australia-in-crisis-as-prime-minister-faces-down-coup-attempt-by-bullies. We also saw China lash out at Australia following a decision by Australia to ban Huawei from its 5G network: https://www.smh.com.au/business/companies/china-lashes-australia-saying-it-s-gravely-concerned-about-huawei-decision-20180823-p4zzf2.html. Other than that, there hasn’t been much in the way of headlines overnight. We’ve seen the broader USD pull off its session highs here following some comments from Trump on Fox & Friends (TRUMP SAYS MARKET WOULD CRASH IF HE GOT IMPEACHED: FOX). USDCAD now sits back above upward sloping trend-line support, which today checks in at the 1.3020s. Today’s calendar is relatively quiet, with the main event coming tomorrow in Jerome Powell’s expected comments at Jackson Hole. We think USDCAD chops around current levels for the time being, and possibly drifts higher.

-

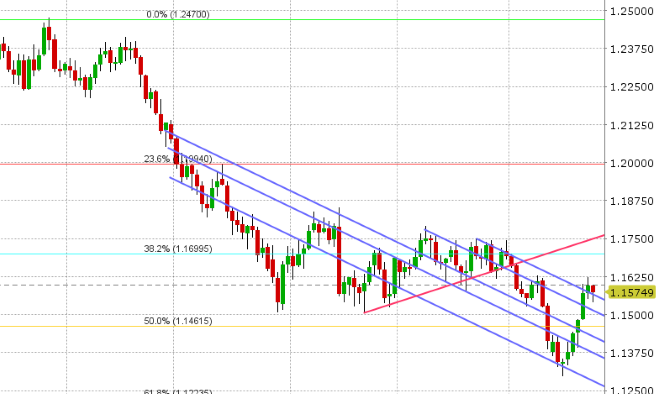

EURUSD: Euro/dollar has fell victim to the broad wave of USD buying that has swept through in overnight trade; losing support in the 1.1570s in the process. The Eurozone PMIs (which came in mixed) were nonevents in our opinion. We’ve seen some buying though over the last hour following Trump’s “market crash” headline on Fox, and we now sit back above the 1.1570s; which renews the upward momentum for bulls. Today’s calendar features some huge option expiries above here, would could have a magnetizing effect on price (4blnEUR+ between 1.1600-1.1625). We also have another 2blnEUR going off the board tomorrow at the 1.1625 strike.

-

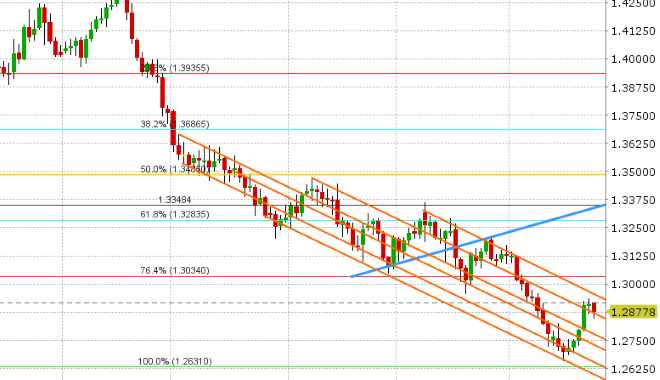

GBPUSD: Sterling, like EURUSD and everything else, reversed course after the FOMC Minutes yesterday. Asia came in and sold the market below the familiar downward sloping trend-line level we mentioned yesterday (today in the 1.2880s), tried to regain it once and failed, but finally surpassed over the last hour on the Trump comments. EURGBP is bid but lacking momentum. We think GBPUSD remains in good shape here technically so long as the 1.2870-80s hold. UK Brexit secretary Raab was out earlier today with some “no-deal” ramifications for everybody to think about: https://www.theguardian.com/politics/2018/aug/23/britons-in-eu-could-lose-access-to-uk-bank-accounts-under-no-deal-brexit.

-

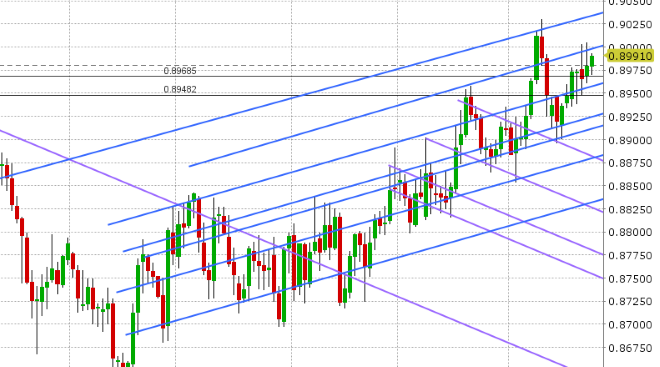

AUDUSD: The Aussie is taking a beating today following the surprise Turnbull/Huawei headlines. The selling made quick work of support in the 0.7320s, and has now ruined the upward momentum for bulls since the Aug 15th bottom. All eyes will now be on a governing Liberal party vote, expected to come at noon Australia time tomorrow. More here from Bloomberg: https://www.bloomberg.com/news/articles/2018-08-22/turnbull-looks-to-survive-next-24-hours-of-australia-power-plays. With politics all of sudden front and center here for AUD, we think AUDUSD remains on the defensive, possibly inching lower into the mid 0.72s. Copper is off 1.6% today, in lockstep with a higher USD. Tomorrow features a large option expiry at 0.7305 (1.2blnAUD), which may attract if the market bounces in the next 24hrs.

-

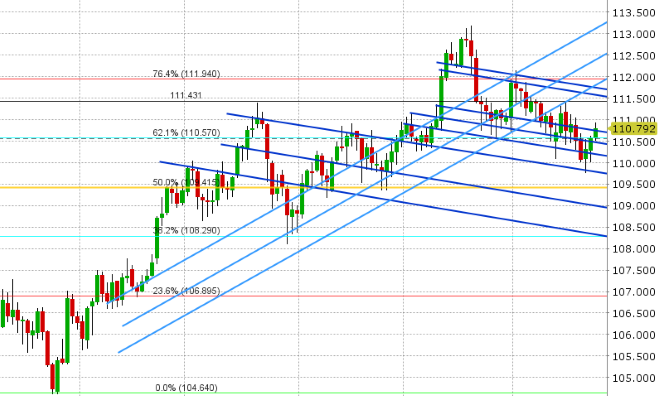

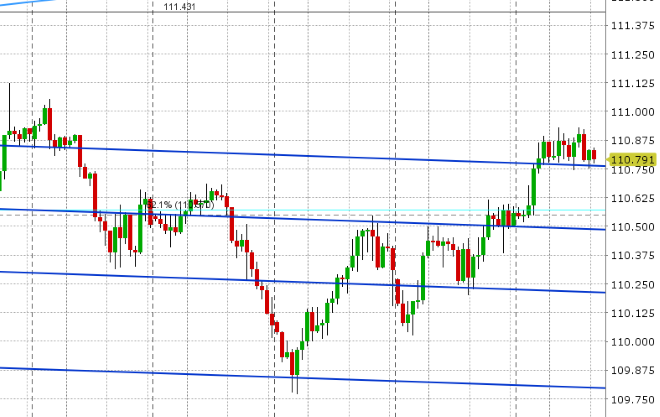

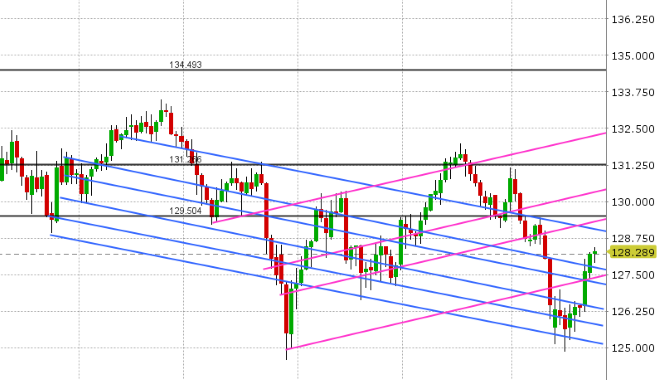

USDJPY: Dollar/yen muscled higher yesterday as US equities rallied surprisingly in the face of the Cohen/Manafort news. Resistance in the 110.60 was staunchly defended, but finally gave way overnight following the broad USD buying wave we saw in Asia. With this important technical development taking shape, we see USDJPY regaining some upward momentum here. A close above the 110.70s would invite a rally back to the 111.50s in our opinion.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

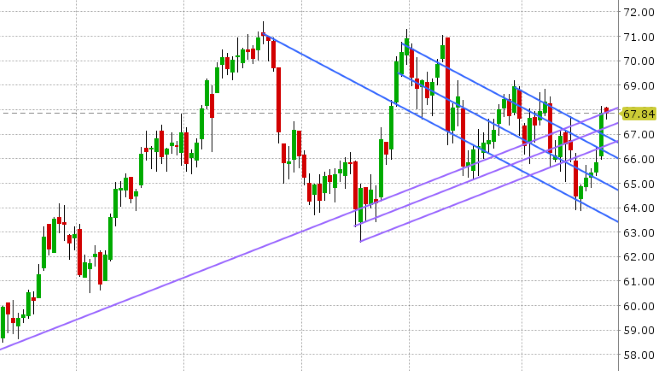

October Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

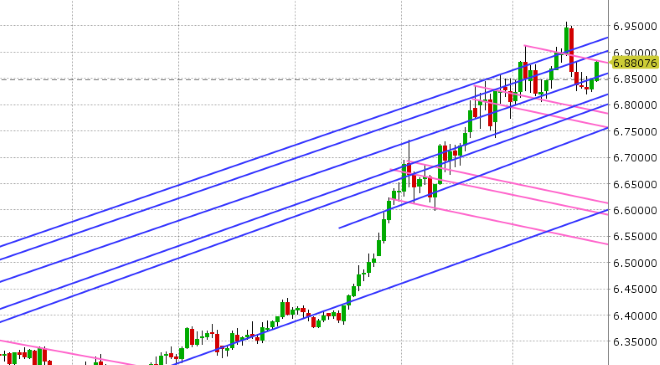

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.