AUD bid on M&A. Broader USD range bound to weaker ahead of US FOMC tomorrow.

Summary

-

CME OPEN INTEREST CHANGES 12/11: AUD +5588, GBP +11104, CAD +4233, EUR +2764, JPY +11819

-

ECONOMIC DATA UPDATE: The Australian NAB survey comes in light at just +12. UK CPI comes in at +3.1% YoY vs. +3.0% expected. The German ZEW “current situation” index beat expectations, but the forward looking “expectations” index came in a little light. On deck today: US PPI at 8:30amET (+3.0% YoY expected), RBA’s Lowe speaks in Sydney at the close of NY trading.

-

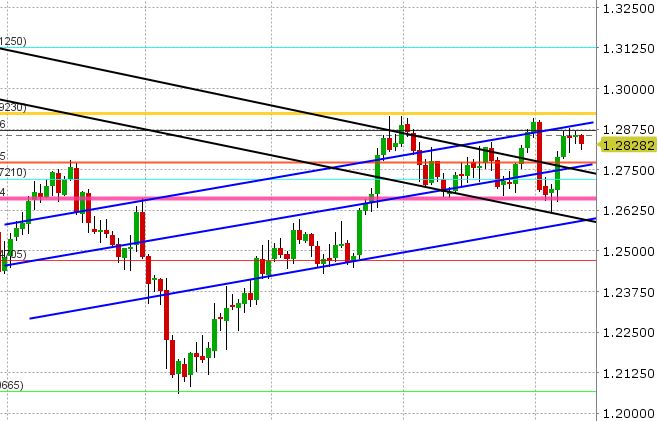

USDCAD: It was a very tight range bound session for USDCAD yesterday as traders await the key event risks of the week, starting with the US FOMC meeting tomorrow. There’s not much going on as we speak. Some traders are watching oil as Brent trades to a new high amidst the Forties pipeline outage, but the oil/CAD correlation has been poor again lately. The broader USD is weaker so far today, led by AUD and NZD, and this is adding a little weight to USDCAD. We’re also seeing some selling EURCAD and GBPCAD. The US/CA 2yr yield spread has firmed once again, and is currently trading at +31bp. The chart technicals are pretty much the same as they were yesterday: range-bound to higher with the 1.2810-20s supporting and the 1.2870-80s resisting.

-

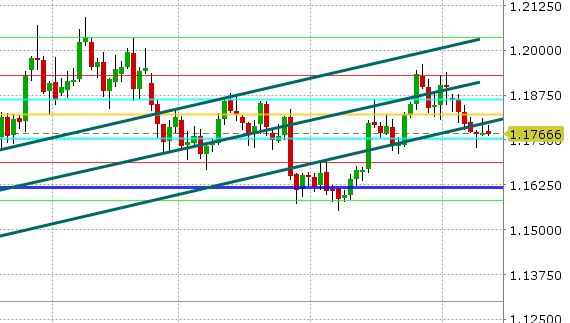

AUDUSD: The Aussie is the best performer overnight as traders punch through resistance in the 0.7530s during Asian trade. After a little bit of back and filling, this move continued higher throughout the start of European trading, leaving AUDUSD in better shape technically. Some traders are talking about the uptick in copper prices; others are talking about the $25bln AUD takeover bid for Australia’s Westfield from European shopping giant Unibail-Rodamco. NZDUSD also continues to enjoy its second day of gains after the RBNZ chose Adrian Orr to be the next governor. The latest read from the NAB survey is not supportive, nor is the AU/US 2yr yield spread, which has trading back down to flat. So, it’s a bit of mixed bag fundamentally today with the Westfield takeover getting the most press at this hour. Technically speaking, AUDUSD sits above near term resistance in the 0.7550s, but it has trend-line resistance to deal with now (0.7570s). If this level breaks to the upside, we expect an upside test of the low 0.76s.

-

EURUSD: There’s not much going on in EURUSD, as traders here also await the key event risks of the week, starting with the US FOMC meeting tomorrow and then a very heavy Thursday schedule which includes the ECB meeting. Yesterday’s failure to make any headway around 1.18 is a bit negative for EURUSD. The market held a bid going into the option expiry and then gave up. It also couldn’t break above trend-line resistance. Today’s session will see the release of US PPI, which will give traders clues for tomorrow’s US CPI. The US/GE 10yr yield spread continues to tick higher, now at +208bp, and this is a negative drag on EURUSD. Option traders are not expecting much fireworks at all from the Fed and the ECB this week as Thursday ATM straddles trade at just 75 pts. We continue to call EURUSD range-bound, and slightly weaker now given yesterday’s negative trading pattern, but we would continue to note the potential for an upside surprise (at least tomorrow) given how priced in the 25bp Fed hike is. Cross flows have been a mixed to slightly negative influence on EURUSD so far today.

-

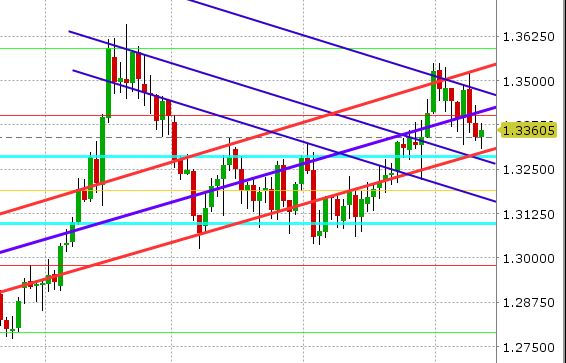

GBPUSD: Traders experienced a little volatility overnight with the slightly higher than expected read on UK CPI, but we are still trading within the 1.3330-1.3400 range we outlined yesterday. The fact that we have spiked lower (as low as 1.3311) but are now trading close to the European highs is technically positive intra-day. There’s still a lot more event risk coming though, with UK jobs tomorrow, the US FOMC tomorrow and then a very heavy Thursday session (UK Retail sales, BOE meeting, EU summit). We continue to call GBPUSD range bound until we get more clarity on chart techincals. After two days of being a negative influence, EURGBP and GBPJPY flows have been GBP supportive today.

-

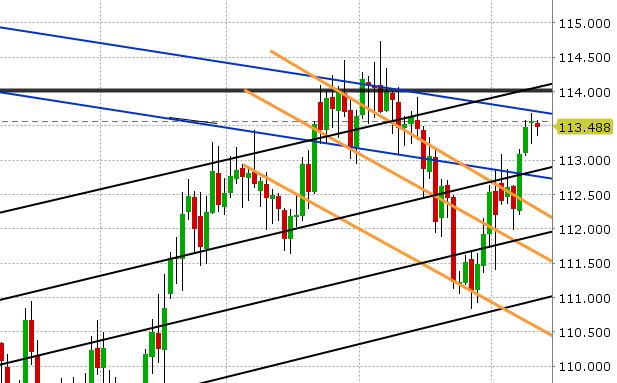

USDJPY: Dollar/yen has had a quiet 24hrs, but the market continues to remain firm going into the US FOMC tomorrow. A lot of this is attributed to the comfortable “risk-on” mood that persists in global equities and US yields. Option traders are not expecting much this week in USDJPY either with Thursday breakevens (ATM straddles) trading in the 70pt range as well. The BOJ’s Kuroda speaks early tomorrow morning. We’re calling USDJPY range-bound to higher given much improved technicals. Support today 113.10. Resistance 113.70s.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.