Vaccine optimism boots risk. Bank of Canada up next.

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Moderna / Astrazeneca headlines lift risk sentiment in overnight trade.

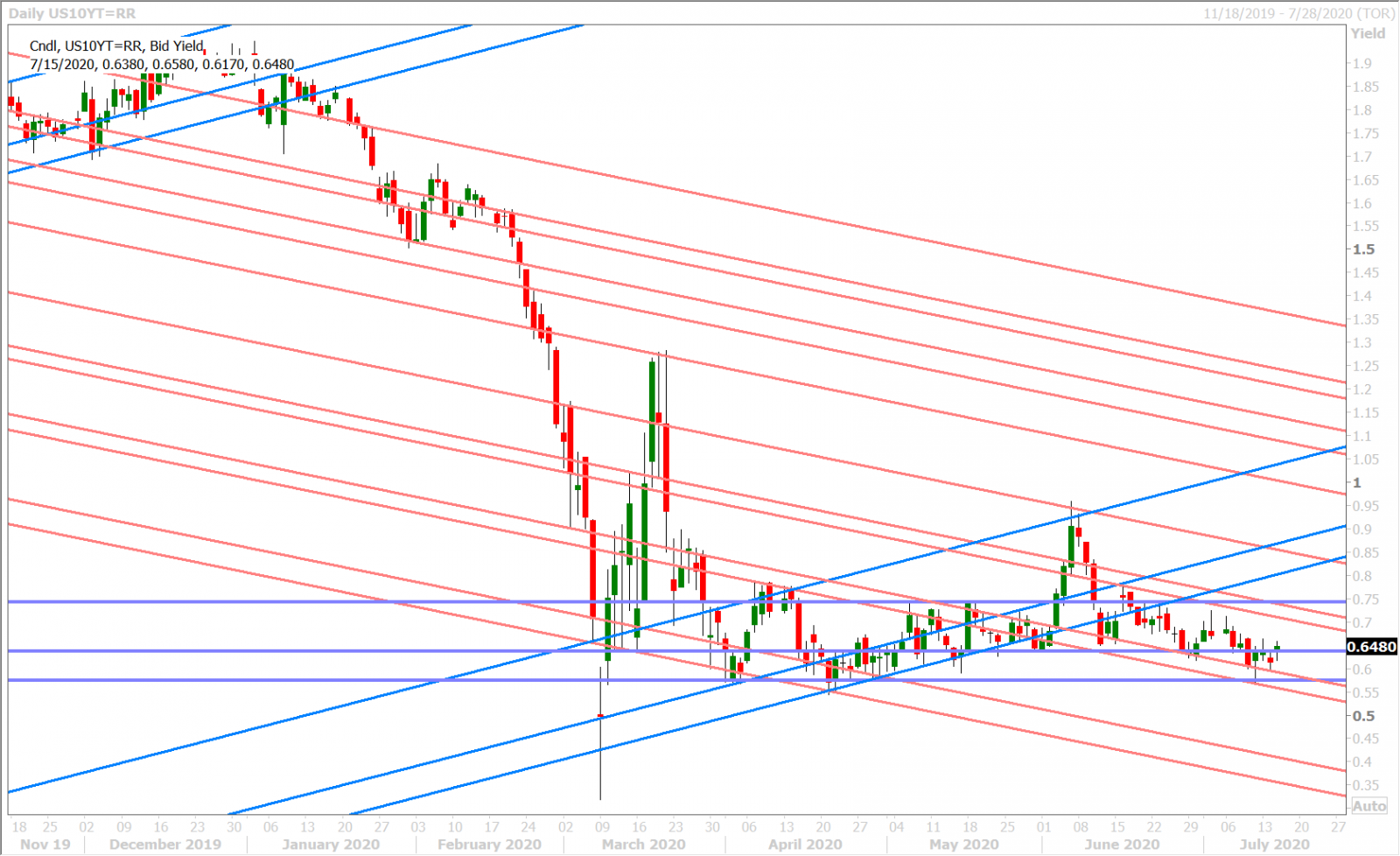

- Global equities and bond yields trading higher, USD continues lower.

- More large EURUSD option expiries in play today between 1.1400-1.1450.

- Same for USDJPY 107.00-30, may explain drop despite BOJ hold last night.

- US NYFed Empire survey and US Industrial Production beat estimates.

- Bank of Canada decision/MPR up next at 10amET. Press conference at 11amET.

ANALYSIS

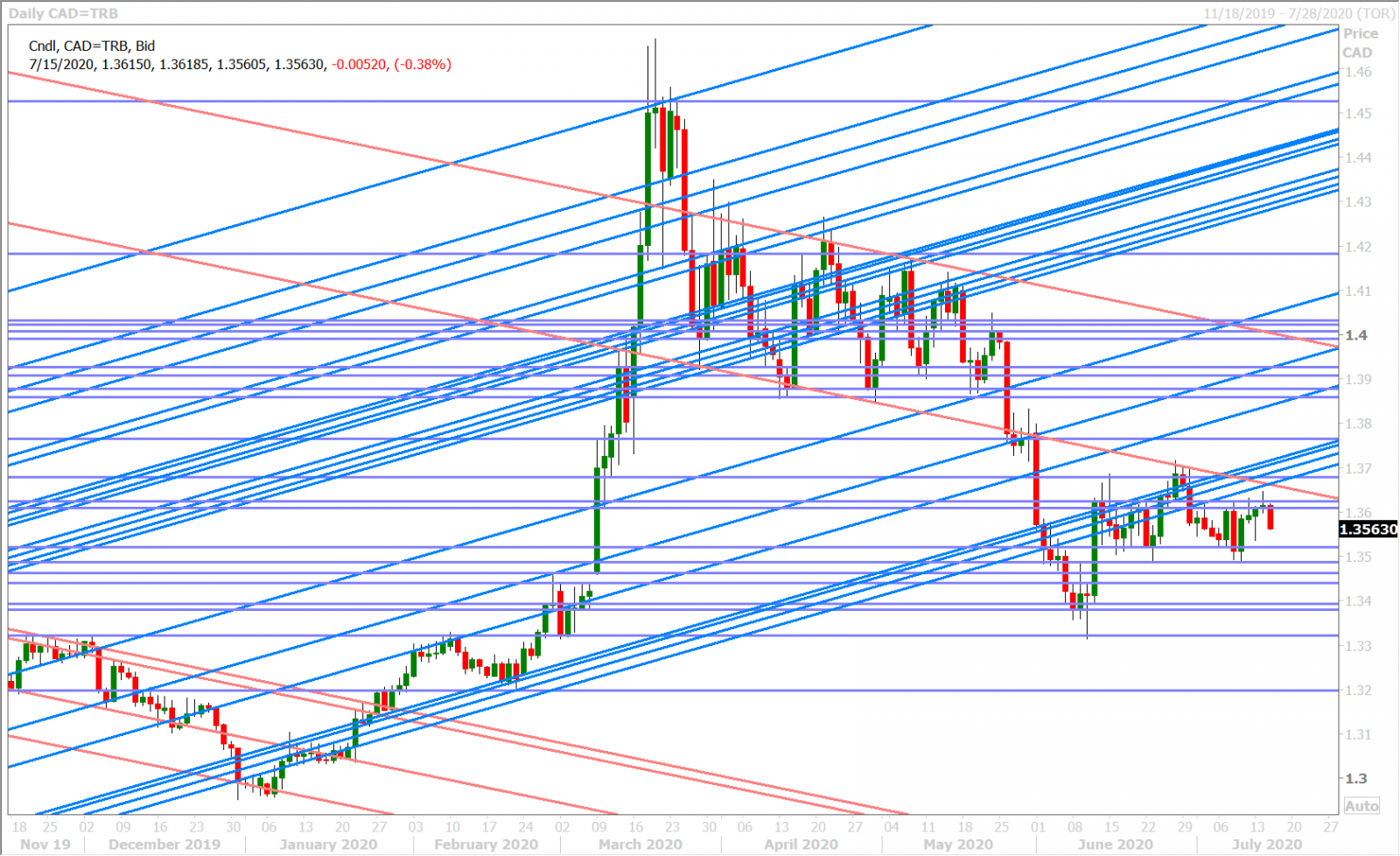

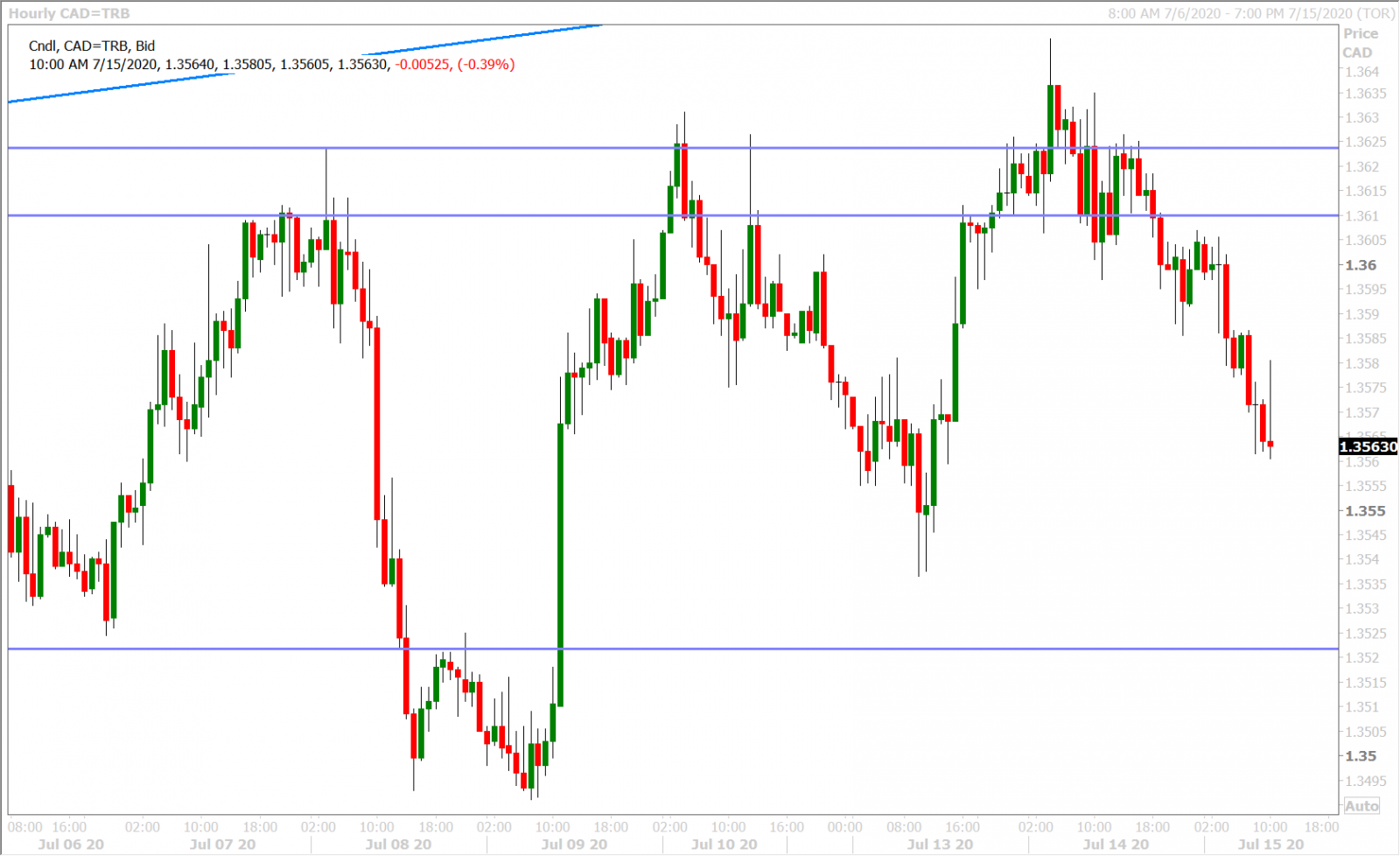

USDCAD

A double dosage of vaccine headlines boosted risk sentiment and hurt the safe haven USD in overnight trade. Moderna’s Phase 1 results showed that their vaccine was safe and produced an immune response and the ITV’s Robert Peston said “I am hearing there will be positive news soon (perhaps tomorrow) on initial trials of the Oxford Covid-19 vaccine that is backed by AstraZeneca”. Dollar/CAD now trades well below the 1.3620s, which it gave up and struggled to regain for most of yesterday’s trading session. Today’s calendar (see below) has already been and should continue to be headline heavy, with particular focus on the Bank of Canada’s latest monetary policy decision at 10amET, however overnight option volatility pricing (50pt ATM straddle) suggests a rather muted market response following this event.

NY FED'S EMPIRE STATE CURRENT BUSINESS CONDITIONS INDEX +17.2 IN JULY (CONSENSUS 10.0) VS -0.2 IN JUNE

CANADA MAY MANUFACTURING SALES +10.7% (CONSENSUS 9.5%) VS APRIL -27.9% (REVISED FROM -28.5%)

U.S. JUNE INDUSTRIAL OUTPUT +5.4 PCT (CONSENSUS +4.3 PCT) VS MAY +1.4 PCT (PREVIOUS +1.4 PCT)

10:00amET – Bank of Canada press release + Monetary Policy Report (no changes expected to rates or QE)

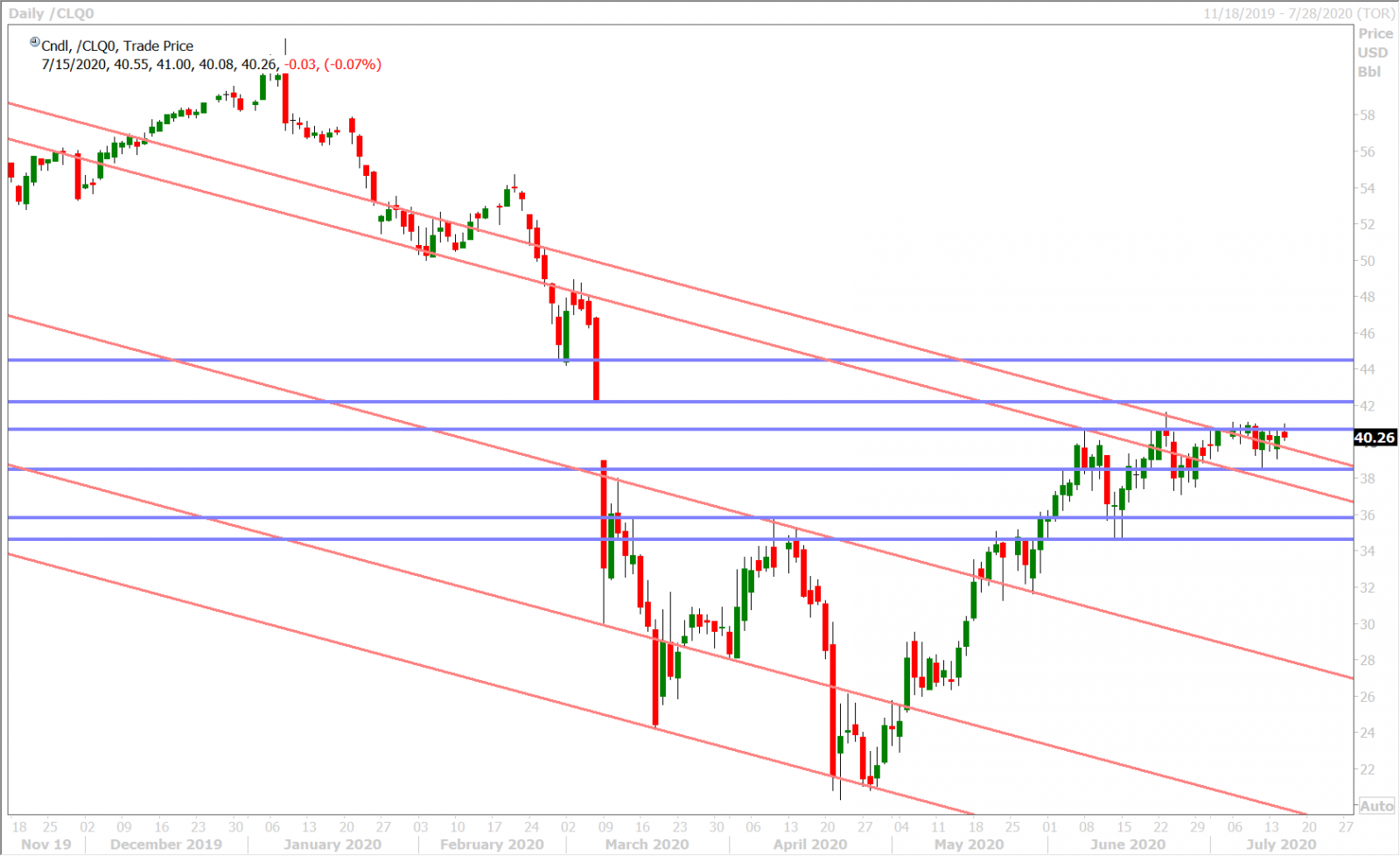

10:30amET – Weekly EIA oil inventory report (-2.098M barrels expected)

11:00amET – Bank of Canada’s Tiff Macklem and Carolyn Wilkins hold a press conference

12:00pmET – Fed’s Harker speaks

2:00pmET – Fed’s Beige Book report

2:15pmET – Fed’s Bostic speaks

USDCAD DAILY

USDCAD HOURLY

AUGUST CRUDE OIL DAILY

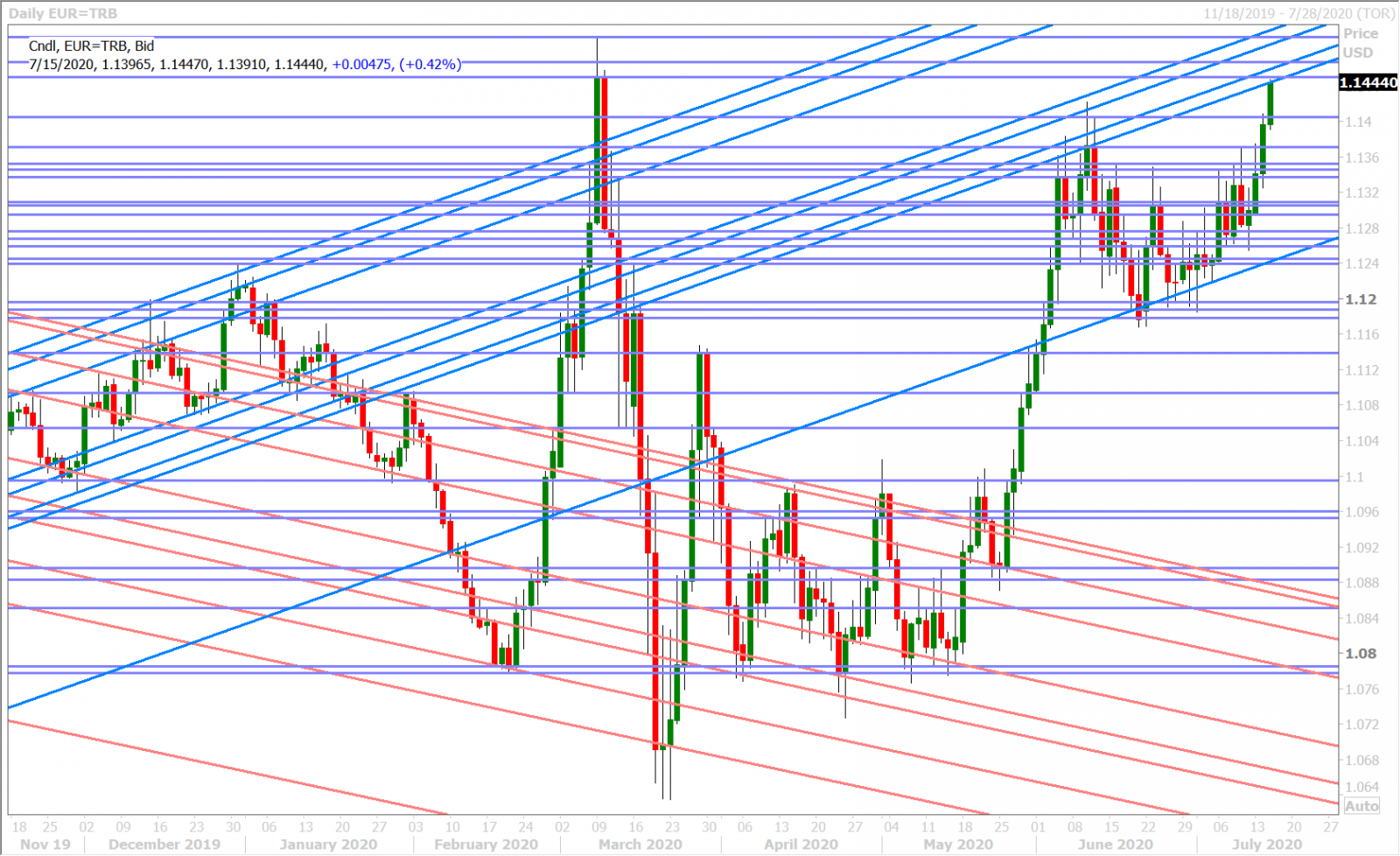

EURUSD

The euro/dollar market seems dead-set on testing every large option expiry level in play this week. Today’s rise into the 1.14s is therefore understandable given the 2.7blnEUR worth of options expiring between the 1.1400 and 1.1450 strikes at 10amET. Some analysts are chalking up this week’s EURUSD strength to pre-EU Summit optimism and recent dovish comments from the Fed’s Kaplan, Brainard and Harker, but we continue to believe it has more to do with option hedging flows and the broader market’s resilient risk tone. No changes are expected from the European Central Bank when it announces its latest monetary policy decision tomorrow at 7:45amET.

EURUSD DAILY

EURUSD HOURLY

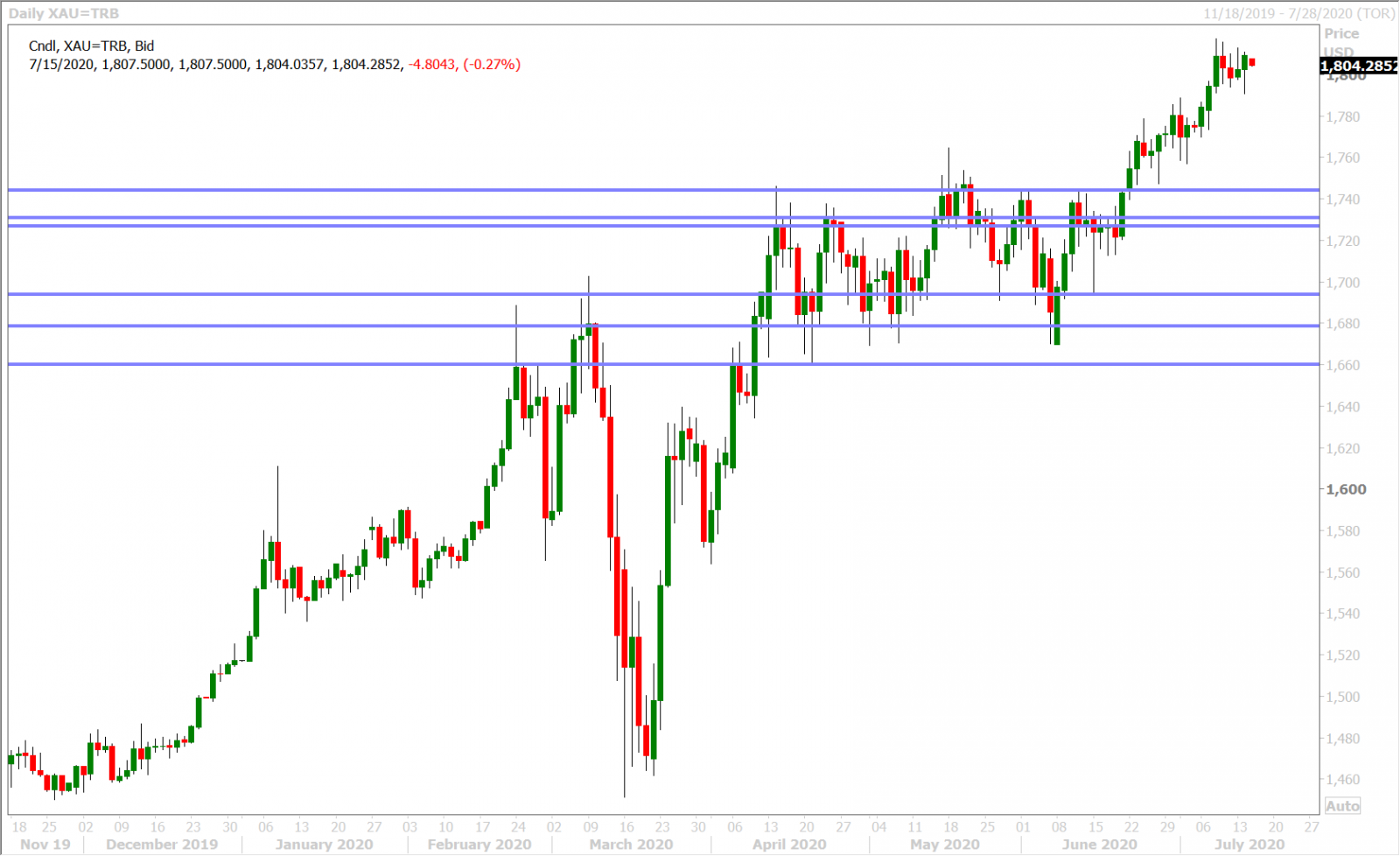

SPOT GOLD DAILY

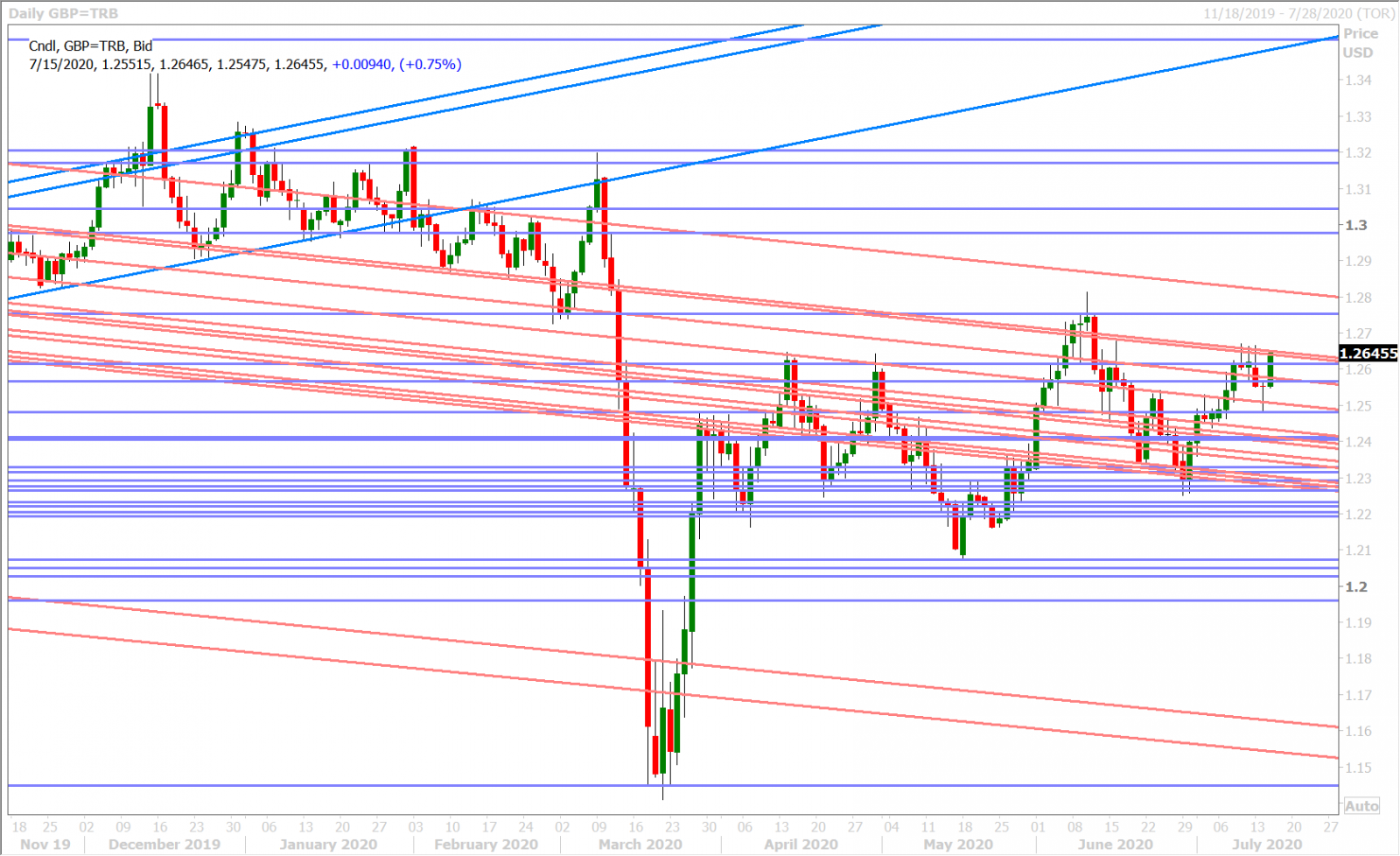

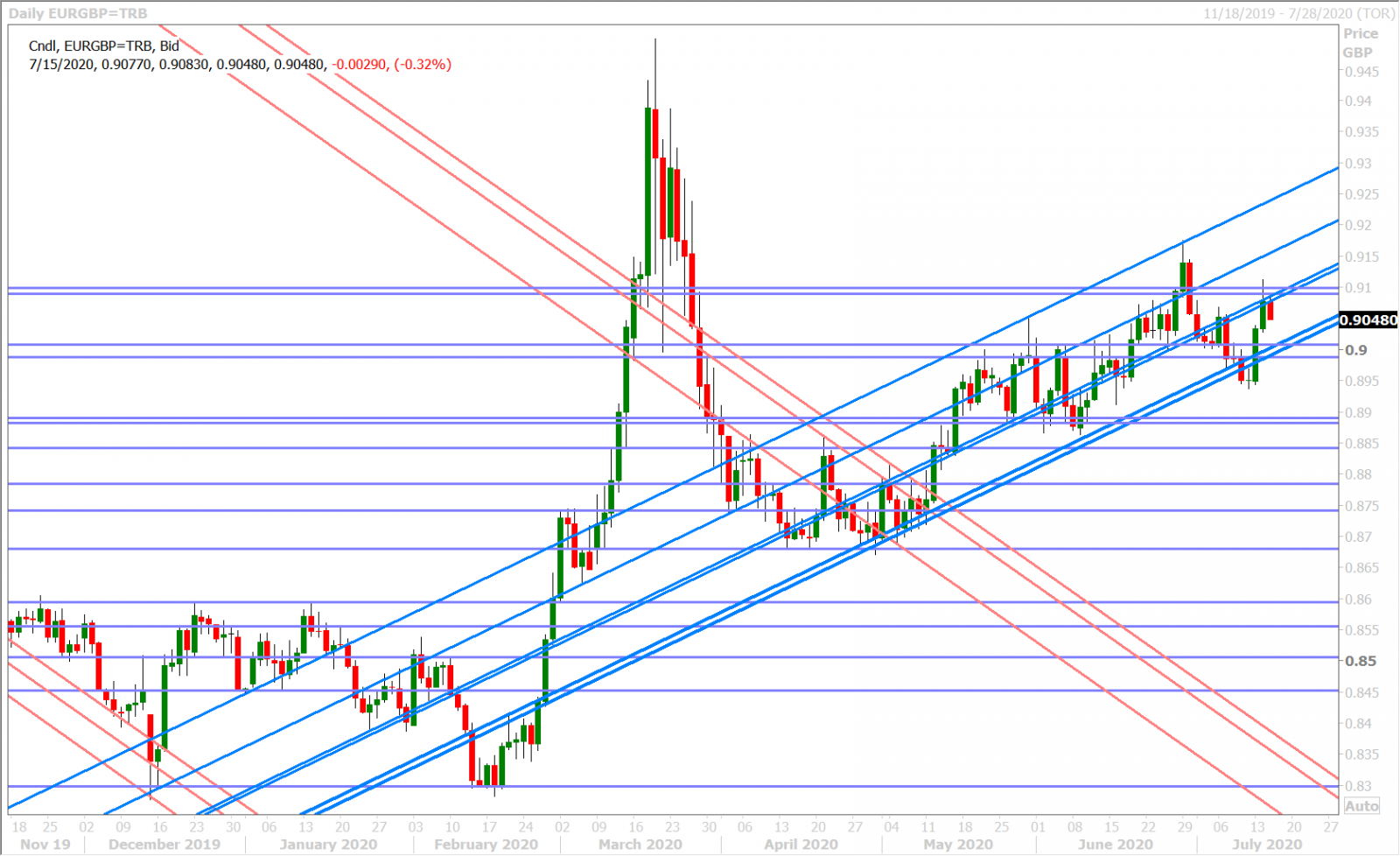

GBPUSD

Sterling bottomed at chart support in the 1.2480s yesterday and has rallied an impressive 150pts since then as the broader markets become infatuated with COVID vaccine headlines once again. Today’s UK CPI data for June came in a tad higher than expected (+0.1% MoM vs flat) while the BOE’s Tenreyro said “my central case forecast is for GDP to follow an interrupted or incomplete 'V-shaped' trajectory” and “I remain ready to vote for further action as necessary to support the economy.”…both non-events for the market. GBPUSD is now quickly retesting last week’s chart resistance in the 1.2640-50s while EURGBP struggles once again with the 0.91 handle.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

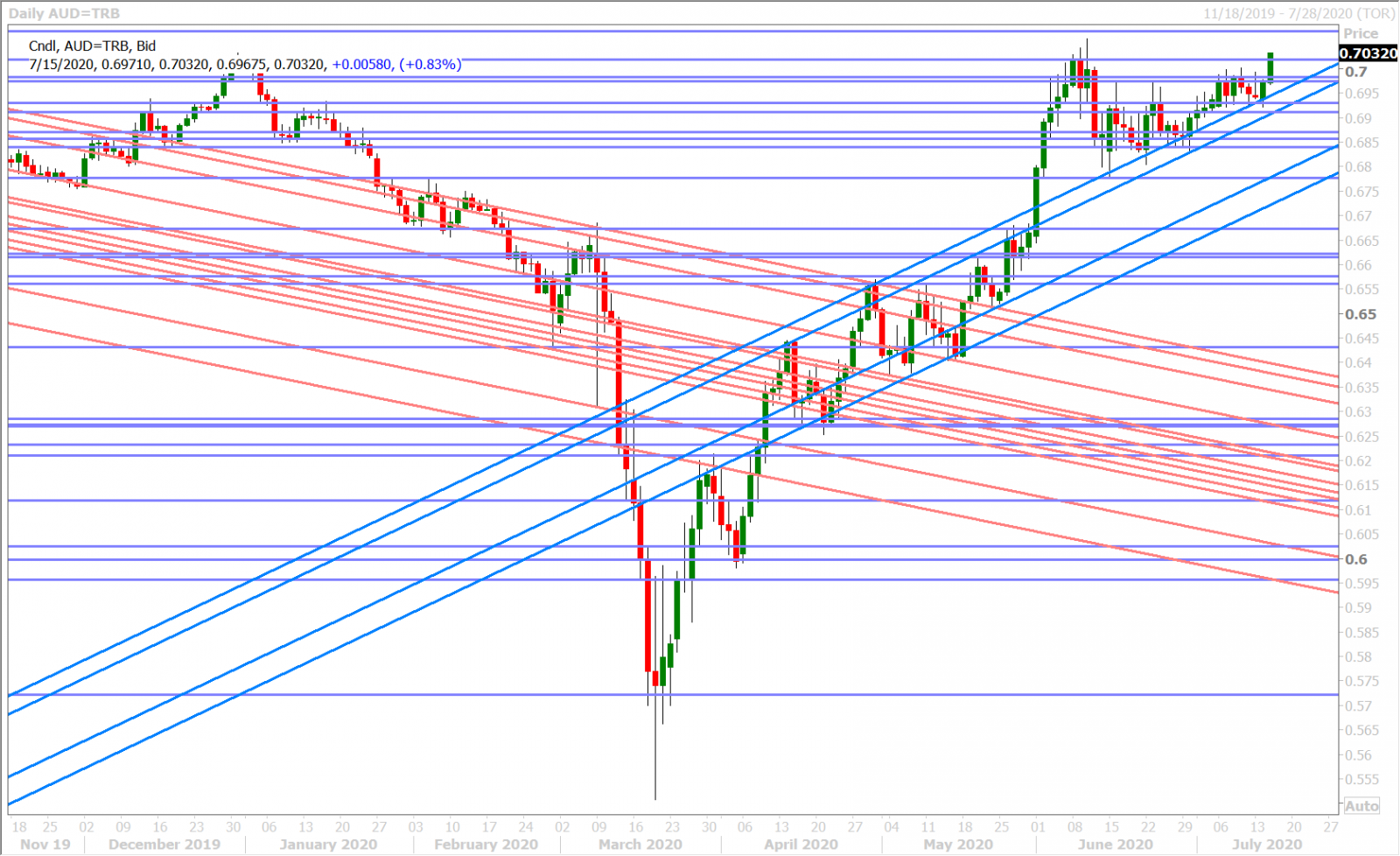

AUDUSD

The Australian dollar is hitting fresh 1-month highs this morning as broad market risk sentiment continues to climb. We felt that yesterday’s continued strength in EURUSD, after the passage of the NY options cut, was truly impressive and was a big factor in explaining AUDUSD’s ability to rally into the NY close. The Moderna headlines then saw the pivotal 0.6970-80 resistance level give way and we feel like vaccine optimism is sucking up all the oxygen in the room at this hour. Is this justified in light of last night’s executive order from President Trump to formally end Hong Kong’s special status under US law and China’s vow to retaliate? Perhaps, but the AUDUSD market has been ignoring alleged “US/China tension” since May, and yesterday’s record breaking 1.76mln ton US corn sale to China was a headline that flew right in the face of that negativity.

Australia will report its June Employment Report tonight at 9:30pmET, with traders expecting +112,500 jobs created and 7.4% for the unemployment rate. China will report June Retail Sales and Industrial Production data, plus its Q2 GDP figure, all at 10pmET.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

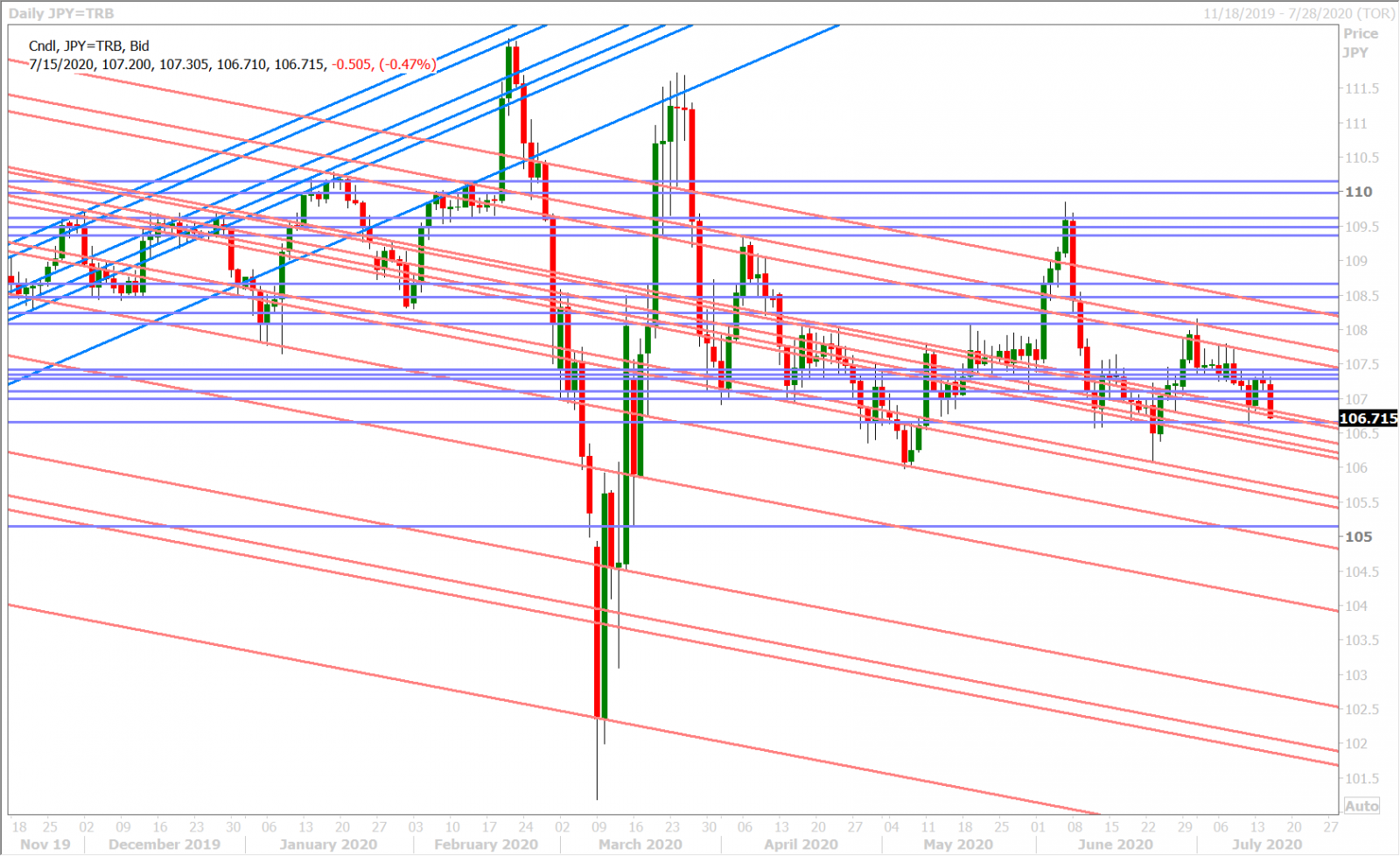

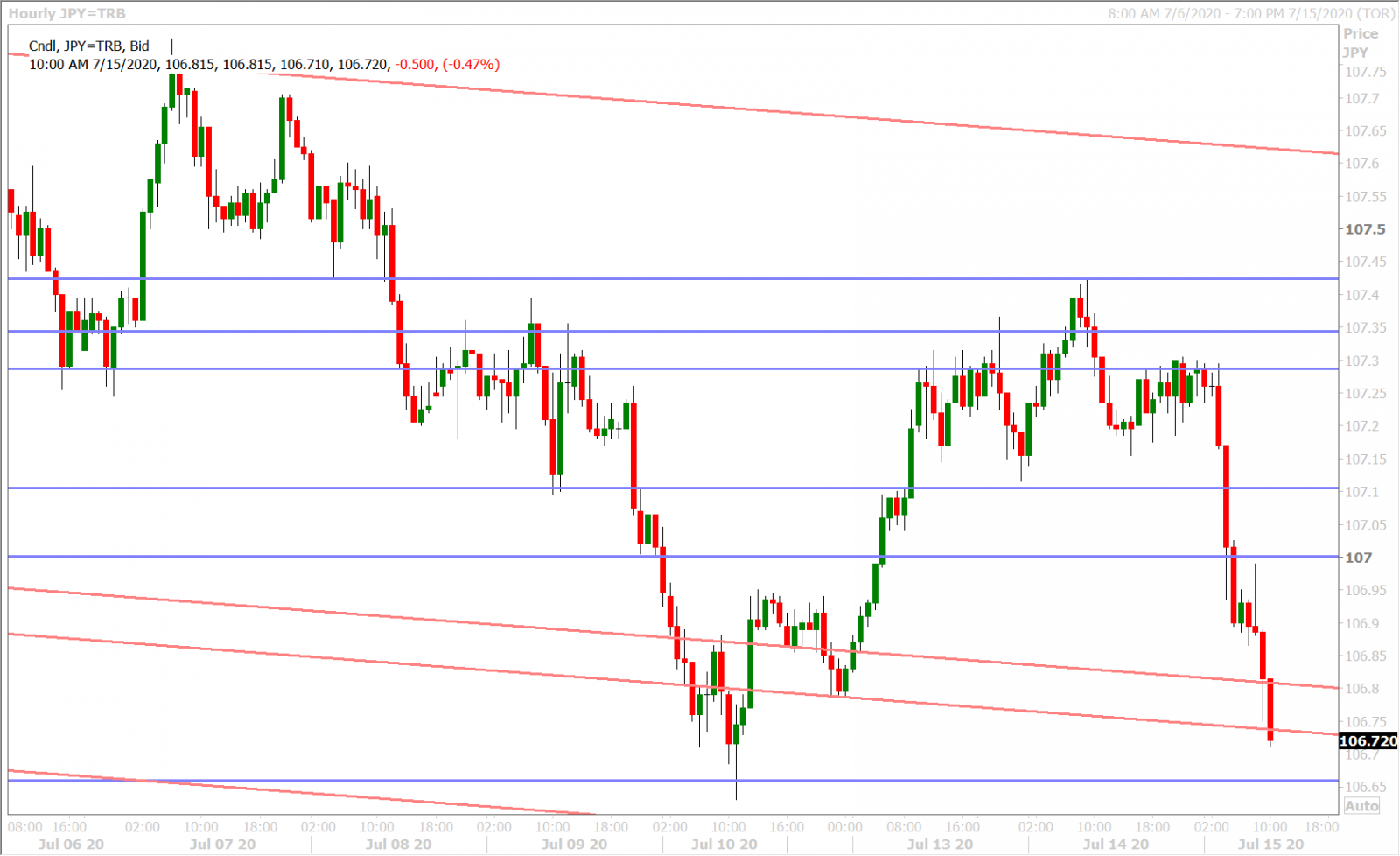

The Bank of Japan kept everything on hold last night as expected, but dollar/yen is falling apart this morning despite the upbeat tone to global stock markets and bond yields. We know that some large option expiries are in play this morning ($2.3bln between 107.00 and 107.30). Perhaps this is all option flow-driven, similar to what we believe is happening in EURUSD today?

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.