USDJPY plunge leads USD weakness in Asia. Europe buys dollars. US CPI & Retail Sales on deck.

Summary

-

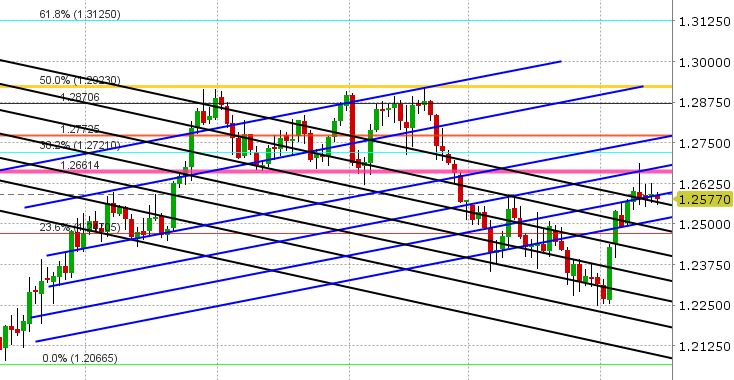

USDCAD: It was another dull session for USDCAD yesterday, with EURCAD and GBPCAD flows leading the way. We saw a broad USD sell-off in Asia, led by USDJPY plunging under 107, and that hurt USDCAD a bit. Then Europe came in and bought dollars broadly and that helped USDCAD regain key support at 1.2565-1.2570. USDCAD is seeing a bit of pressure again now as EURCAD and GBPCAD attack yesterday’s NY lows, but it’s minimal. FX traders are focused elsewhere right now. The key US data points for the week are up next: January US CPI and Retail Sales. Markets are expecting +1.9% YoY on the CPI headline, +1.7% YoY on core. The expectation for Retail Sales is +0.2% MoM and +0.5% MoM ex-auto. As always, the market reaction is more important than the print itself. We would note that net market positioning is more short USDCAD at these levels compared to 2 week ago (according to CFTC data), and there’s been steady liquidation in CAD futures open interest since last Thursday, which tells us the “pain trade” for this market would be a move higher. Support today remains at 1.2565-1.2570. Next support is 1.2510. Resistance today is 1.2625, then 1.2660-1.2670.

-

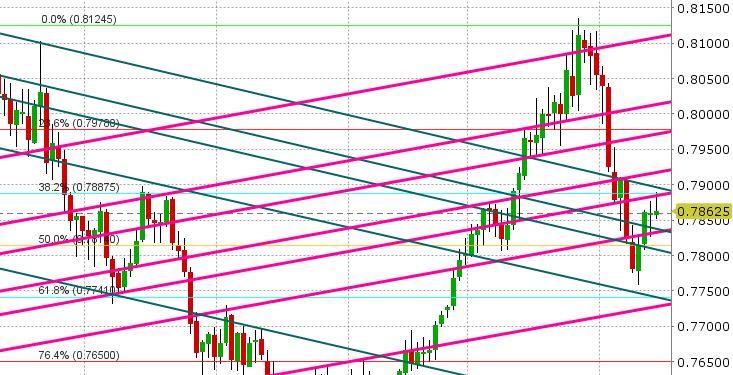

AUDUSD: The Aussie wandered higher after yesterday’s mediocre NY close. We saw resistance at 0.7880-0.7890 tested overnight as the USD sold off broadly in Asia, but AUDUSD has since backed off as Europe bought dollars. Up next are the US CPI and Retail Sales at 8:30amET, then the main event for Aussie traders this week: the Australian employment report at 7:30pm tonight. Markets are expecting a gain of 15k jobs in January. Support today is once again 0.7830-0.7840 (where buyers stepped in yesterday), then 0.7810-0.7815. Friday’s massive option expiry at 0.7850 also still looms large, and could act as a magnet for the rest of the week.

-

EURUSD: The Euro extended higher overnight during the USDJPY sell off, after a strong NY close. Chart resistance at 1.2355-1.2370 gave way (which was bullish), but European traders have smacked the market right back down below this resistance level, which is not a great set up going into the US data at 8:30amET. There are some massive option expiries today that will likely come into play (2.6bln EUR between 1.2335-1.2350 and 2bln EUR at 1.2400-1.2405). The European data points released overnight were non-events (German GDP, Eurozone GDP, Eurozone Industrial Production) despite pretty good numbers. EURJPY is reasserting its influence on EURUSD again today, and its currently probing below the 132.50 support level as we write. The EUR is also seeing selling against the commodity currencies this morning (AUD,CAD), which is a reversal of yesterday’s move.

-

GBPUSD: Sterling pushed higher too in Asian trade overnight as its NY close was half decent, however it struggled miserable at 1.3925 (the next chart resistance level we pointed out a couple times yesterday). GBPUSD is currently back below the 1.3870s, which doesn’t bode well for bulls at this hour. Next up is the US data at 8:30amET. Support today checks in at 1.3800-1.3815.

-

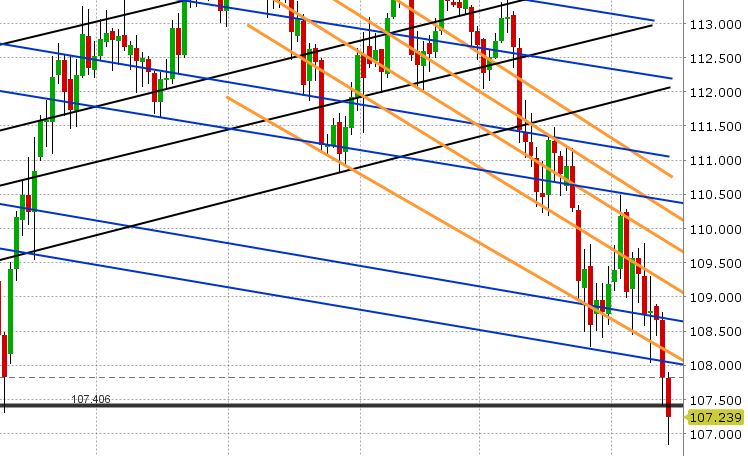

USDJPY: Dollar/yen continues to be the focus of FX markets this week as the plunge lower continued overnight. A resumption of selling in the Nikkei got the ball rolling, and then USDJPY took out stops on a swift move below 107.40 and the psychological 107 level as well. The S&Ps barely moved overnight and while the Nikkei saw selling, it didn’t break Tuesday’s lows. This is clearly a market that is long dollars and needs to get out. Surprisingly, the CME daily bulletin showing open interest changes for Feb 13 shows a market that actually added to positioning yesterday as the market plunged below 108. This was either new USDJPY short positions or USDJPY longs adding to loosing positions. Given last night’s move lower again, we feel the scenario is the latter. Every loosing trader has a “puke point”, and we think we’re witnessing this now en masse in USDJPY.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

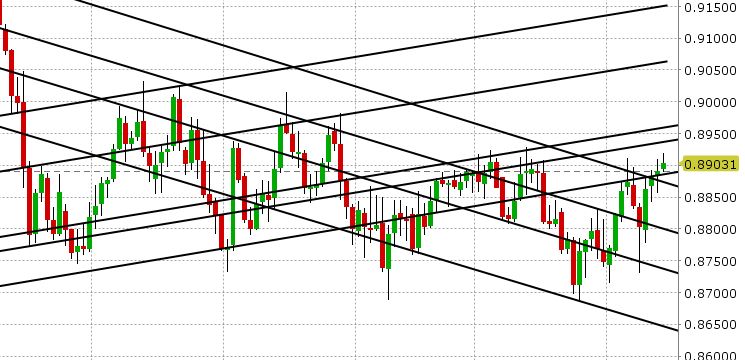

EUR/JPY Chart

EUR/GBP Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.