USDJPY collapses. GBP bid on UK CPI print. EUR oddly bid, especially against commodity currencies

Summary

-

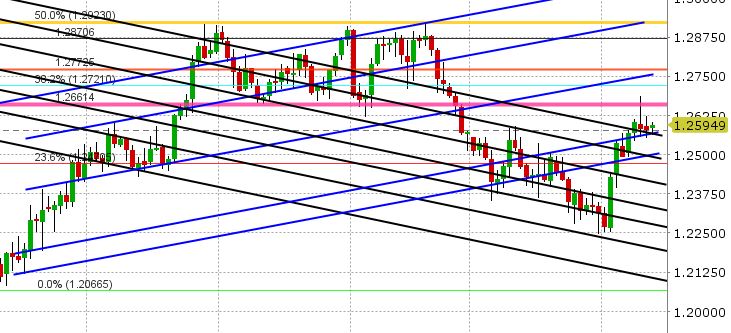

USDCAD: It’s been a quiet overnight session for USDCAD. Yesterday’s NY close was “ok” technically speaking, seeing as the market regained the 1.2585-1.2595 support level, but we had been as high as 1.2622 and pulled back, so there’s wasn’t much positive momentum going into the overnight session. The USD is broadly weaker this morning on a collapse in USDJPY and a CPI-driven rally in GBPUSD, and the commodity currencies (CAD,AUD,MXN) are lagging. That has allowed the CAD crosses (EURCAD and GBPCAD) to shoot higher and erase the negative momentum from Friday’s Canadian jobs report. It has also allowed USDCAD to stay relatively stable amidst all the action elsewhere. Given yesterday’s trading range and the sloped nature of our trend-line support levels, support for USDCAD today is 1.2565-1.2570. We expect a range-bound session today for USDCAD today as there’s nothing on the North American calendar until tomorrow.

-

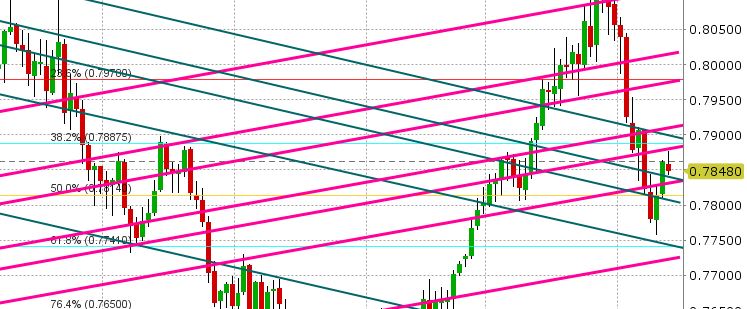

AUDUSD: The Aussie chopped around yesterday in the range-bound to higher pattern we expected, and then it quickly extended beyond trend-line resistance at 0.7840 just before the NY close. This small technical break higher has given AUDUSD enough momentum to track marginally higher overnight, but like CAD, it too is getting sold on the crosses (against EUR and GBP). The Australian NAB survey for January came in at 19 (stronger than the previous read of 13), but the news wasn’t market moving. Copper has extended 1.6% higher overnight, but that is not helping AUDUSD either. We think AUDUSD trades range-bound today, with trend-line resistance at 0.7880-0.7890 likely capping. It also appears Friday’s large option expiry at 0.7850 might have more of a magnetic effect than originally thought as it captures Australia’s employment report on Thursday.

-

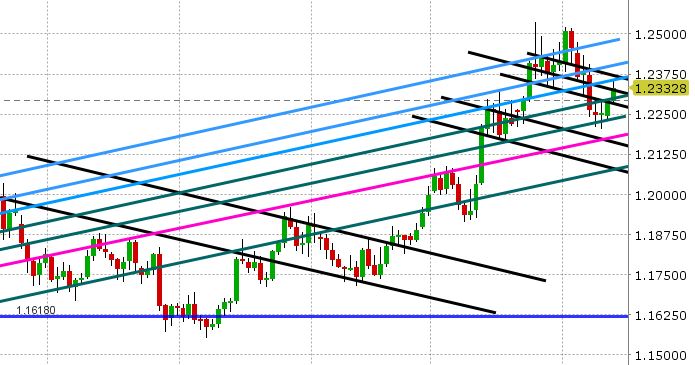

EURUSD: The factors influencing the Euro has been interesting to observe over the last 24hrs. EURJPY reasserted its influence again yesterday as we thought, helping EURUSD rally off NY lows all the way back to the 1.23 handle. However, the EURJPY’s sell off today is having no effect whatsoever. EURUSD traders today appear to be focused on USD selling against the JPY (led by the fall in the Nikkei) and USD selling against the GBP (led by a better than expected UK CPI report). A break above 1.2300 in the Asian session also allowed EURUSD to extend, technically, to 1.2325 and 1.2350 (two trend-line resistance levels). EURUSD now sits just below sessions highs, tracking GBPUSD and USDJPY, which we don’t say very often. It’s a weird move today to say the least. We think EURUSD range trades today and potentially sees profit taking against commodity currencies (EURCAD, EURAUD) ahead of US CPI and Retail Sales tomorrow. EURGBP has struggled on two attempts higher towards 0.8900 in the last 24hrs, but buyers have stepped back in at the 0.8860s. USDCNH is very quiet as the Chinese Lunar New Year holidays commence on Thursday.

-

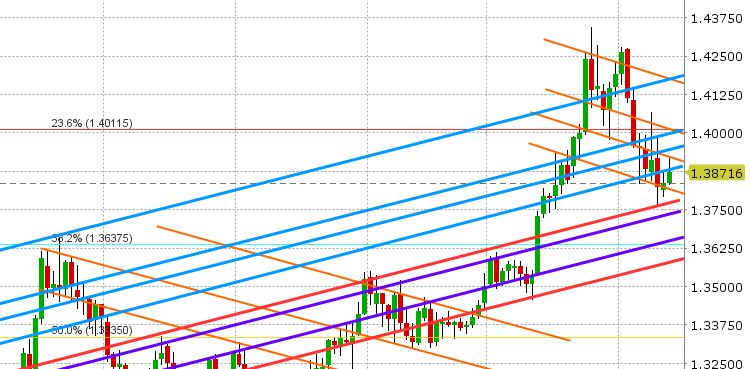

GBPUSD: Sterling had a miserable NY session yesterday, but it closed above 1.3825, which was above trend-line support, and therefore technically positive. The 1.3870s (yesterday’s highs) capped in early European trade, and then a stronger than expected UK CPI print saw us vault higher to 1.3925 (the next resistance level). Jan UK CPI came in +3.0% YoY (vs.+2.9% expected) and the MoM read came in -0.5% vs. -0.6% expected (also better than expected). All this is stoking speculation of a 25bp rate hike from the BOE in May. GBPUSD is backing off quickly as we write however. A close back below the 1.3875s would likely see the market range trade again ahead of the US data tomorrow. A move back above 1.3925 would invite a test of 1.3950 and possibly higher.

-

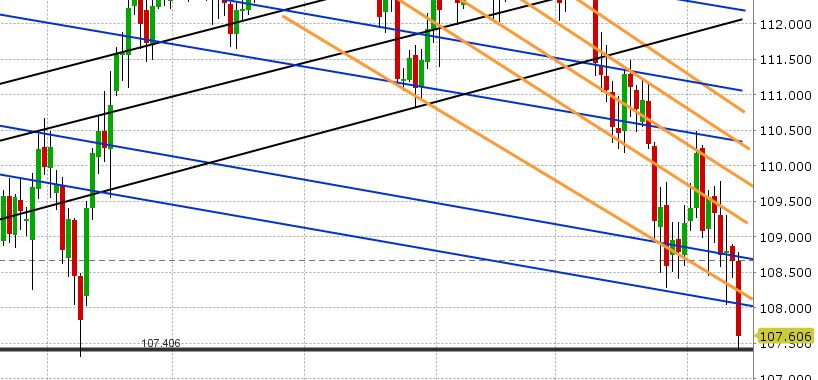

USDJPY: Dollar/yen has been the focus for FX traders overnight as it has plunged lower through every support level on the charts. Some are saying the catalyst was a “risk off” 3% drop in the Nikkei, but we would argue the S&Ps and US bonds didn’t really respond in kind. We think this move might have more to do with overextended USD long (JPY short) positioning, which continues to take heat as USDJPY declines. Perhaps this was the proverbial straw the breaks the camel’s back. Could the move overnight finally be the result of some of these positions bailing and cutting losses? We’ll know more in the days ahead, but for the time being, this USDJPY move is running some weird ripples through the FX markets. The 107.40s have held twice this morning, and the market is bouncing a little bit now, but this is the absolute last line of defense until the 104-105s. A move back above the 108 is needed to arrest the downward momentum. Be on the lookout for any comments from the BOJ as they really don’t want to see a collapse in USDJPY (JPY strength).

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

USD/CNH Chart

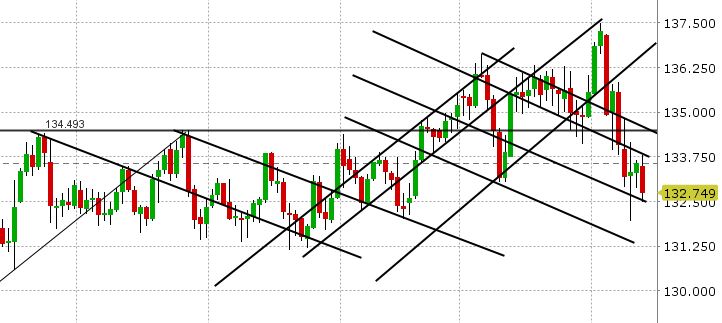

EUR/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.