USDCAD slammed lower from Cdn jobs/GDP data. USDJPY and US stocks recover from Michael Flynn headlines. GBPUSD traders pumped up about Brexit talks today in Brussels. RBA rate decision on deck for Aussie traders

Summary

-

CME OPEN INTEREST CHANGES 12/1: AUD +2173, GBP +4277, CAD +763, EUR -3517, JPY +836

-

CFTC COMMITMENTS OF TRADERS REPORT (NET SPECULATIVE POSITIONS AS OF NOV 28): The net GBPUSD position flips to net long again after spending most of November short to flat. This comes as the market traded back up to the 1.33s and despite the significant volatility of the Nov 28 session. The net USD short (CAD long) position was largely unchanged week over week at the close of trading on Nov 28, remaining near 7-week lows. Open interest in EURUSD surged higher in the 200pt run up from the 1.1750s to the 1.1950s and in the subsequent 100pt pull back, but the number of new shorts actually outnumbered the number of new longs, leaving the net long EURUSD lower week over week. Position liquidation continued for the 4th week in a row in USDJPY going into Nov 28, leaving the net long USD (short JPY) position 20% lighter than it was two weeks ago.

-

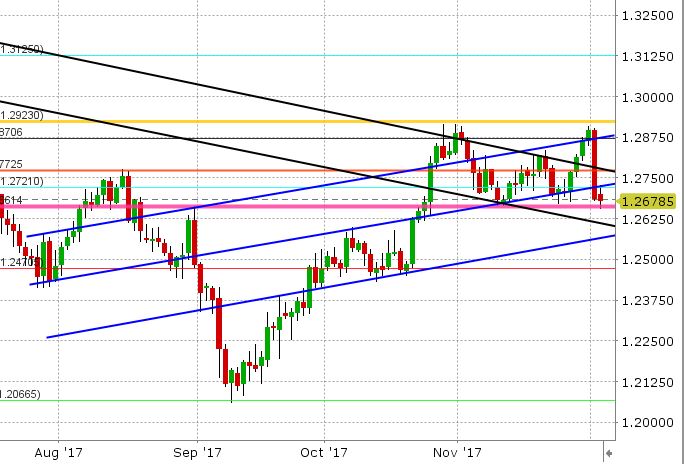

USDCAD: Dollar/CAD starts the week battered and bruised after Friday’s ferocious sell-off. The primary catalyst was the Canadian employment report, which came out at a surprise +79.5k, almost 8x expectations for November job growth! The month over month change in Canadian GDP for Sep came in at +0.2%, slightly higher than expected. Combine that the shocking Michael Flynn headlines out later Friday morning and traders threw in the towel on the near-term bull thesis for USDCAD. Over the weekend, we got some positive US news in the Senate’s passage of their version of tax reform and revelations that ABC’s initial report on Michael Flynn was an erroneous error, but it is doing little to help USDCAD. There’s been much technical damage to the charts, with multiple support levels giving way easily, and we now enter NY trading testing key support in the 1.2660s. The level is holding so far, but a break below there would invite a move lower into the low 1.26s or even high 1.25s. Resistance today comes in at 1.2720-30. The CAD crosses got destroyed on Friday too, with EURCAD down 250pts and GBPCAD down over 350pts. EURCAD saw continued selling in Europe today but looks to be finding some support now at 1.5000. GBPCAD has found support too around 1.7040-50, with optimism about today’s meeting between Theresa May and the EU helping. The US/CAD 2yr yield spread got hammered on Friday too, and now sits at 27bp. All of this makes this week’s Bank of Canada meeting on Wednesday all the more interesting. While no rate hikes are expected, traders will be watching the BOC’s tone and their response to recent job growth. We’re calling USDCAD range-bound to lower today, with the potential for a small bounce led by CAD crosses.

-

AUDUSD: The Aussie benefited from the USDCAD selloff and the broader USD selling the ensued as the Michael Flynn headlines crossed on Friday. The market has pulled back a bit to start the week, with the positive weekend news out of the US, but AUDUSD continues to hold half the gains it made on Friday. Technically speaking, the market carved out a bullish outside day on Friday, which is positive. It has broken back above the 0.7580-90s, which has proven to be good support to start the week. Resistance is still 0.7600-0.7620. Reuters is reporting a large option barrier at 0.7645 for tomorrow’s NY session (600mln+ AUD). The big event of the week for Australian dollar traders is tonight, with the RBA rate decision at 10:30pmET (no changes expected). We continue to call AUDUSD range-bound here until 0.7550 breaks to the downside or 0.7625 breaks to the upside.

-

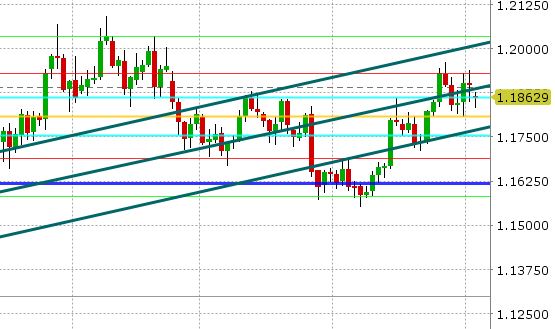

EURUSD: The Euro starts the week on a softer tone after the positive weekend developments out of the US. The market is trading slightly below the support levels we mentioned Friday (1.1860-80). There is also now a Sunday opening gap on the charts (call it 1.1880-1.1900) that has yet to be filled. The big event this week for EURUSD traders will be US payrolls on Friday. The ECB and Fed meetings are next week. The Fed’s pre-meeting black period for Fed speak commenced Friday. We expect more range bound action this week as traders position for these key event risks. The influence from cross flows continues to be mixed, with EURGBP weighing and EURJPY supporting. A break back above 1.19 would be technically positive, while a move back below 1.1810 would be negative.

-

GBPUSD: It’s a big day today for sterling traders as the market should get a major update on Brexit negotiations in Brussels. The UK’s Theresa May is meeting with her EU counterparts and rumor has it the news is going to be positive. We saw some positive headlines earlier in Europe regarding the Ireland border issue, which got GBP traders excited. Watch out for more headlines at 8:30amET and 10amET today. Technically speaking, GBPUSD has erased Friday’s weak close and the weakness in Asia overnight. It now sits firmly back above 1.35 with cross flows supporting. From a net positioning standpoint, it appears the market is getting longer (which is not surprising). We note an 24k increase in futures open interest since the CFTC’s last tally on Nov 28 and short-dated risk reversals are starting to favor GBP calls once again. It could be a volatile day for GBPUSD, so tread carefully.

-

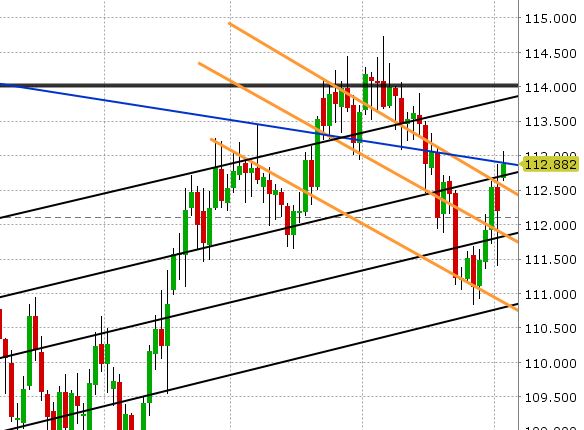

USDJPY: Dollar/yen was the biggest victim of the Michael Flynn hysteria on Friday, given its tight correlation to US stocks and US yields (which plunged intra-day). So naturally, as US stocks and US yields recovered at the Asian open, so too did USDJPY. The market gapped open to start the week and it now testing resistance at 112.90-113. Support today lies at 112.60-70. While we welcome the correction higher from Friday’s crazy session, we must note the opening gap (112.30-112.60) as markets have a tendency to fill them. This would mean potentially some weakness here over the course of the next 48hrs if USDJPY can’t push above 113.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.