USD takes another leg lower after China denies US purchase halt

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- China’s foreign ministry says it has no information on directed halt to US soybean purchases.

- China’s Global Times says “firms continue to purchase US soybeans in line with market rules.”

- USD selling continues in early Europe as dollar loses more technical support levels across the board.

- Reserve Bank of Australia keeps policy on hold. PBOC sets another weaker than expected USDCNY fix.

- UK PM JOHNSON SPOKESMAN SAYS WISHFUL THINKING' FROM EU OVER BREXIT TALKS.

- USDJPY busts through 108.07 resistance level; stretched, losing fund short position adding fuel.

- Broad USD bid in early NY trade otherwise mild, USDCNH support and GBPUSD resistance helping.

ANALYSIS

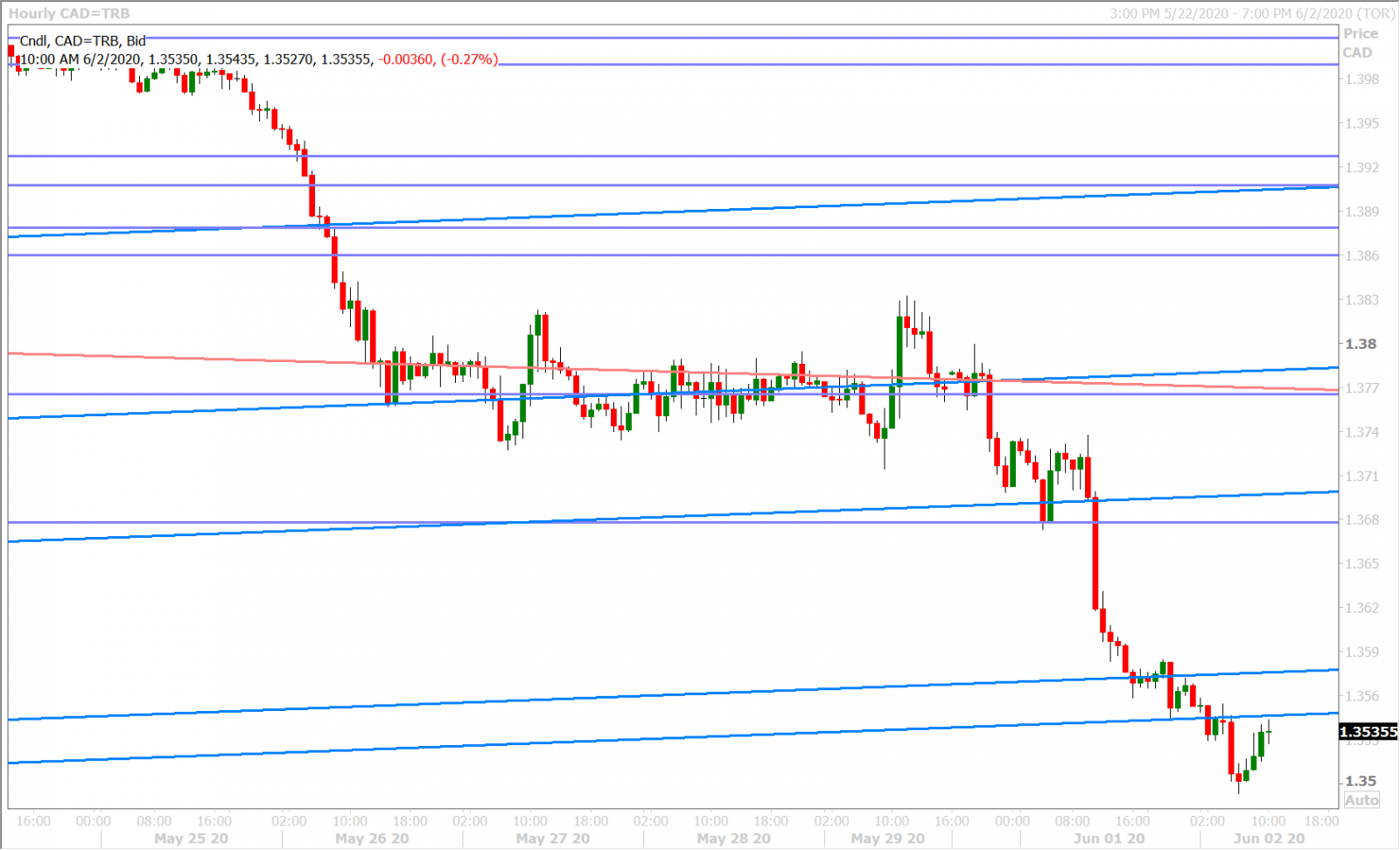

USDCAD

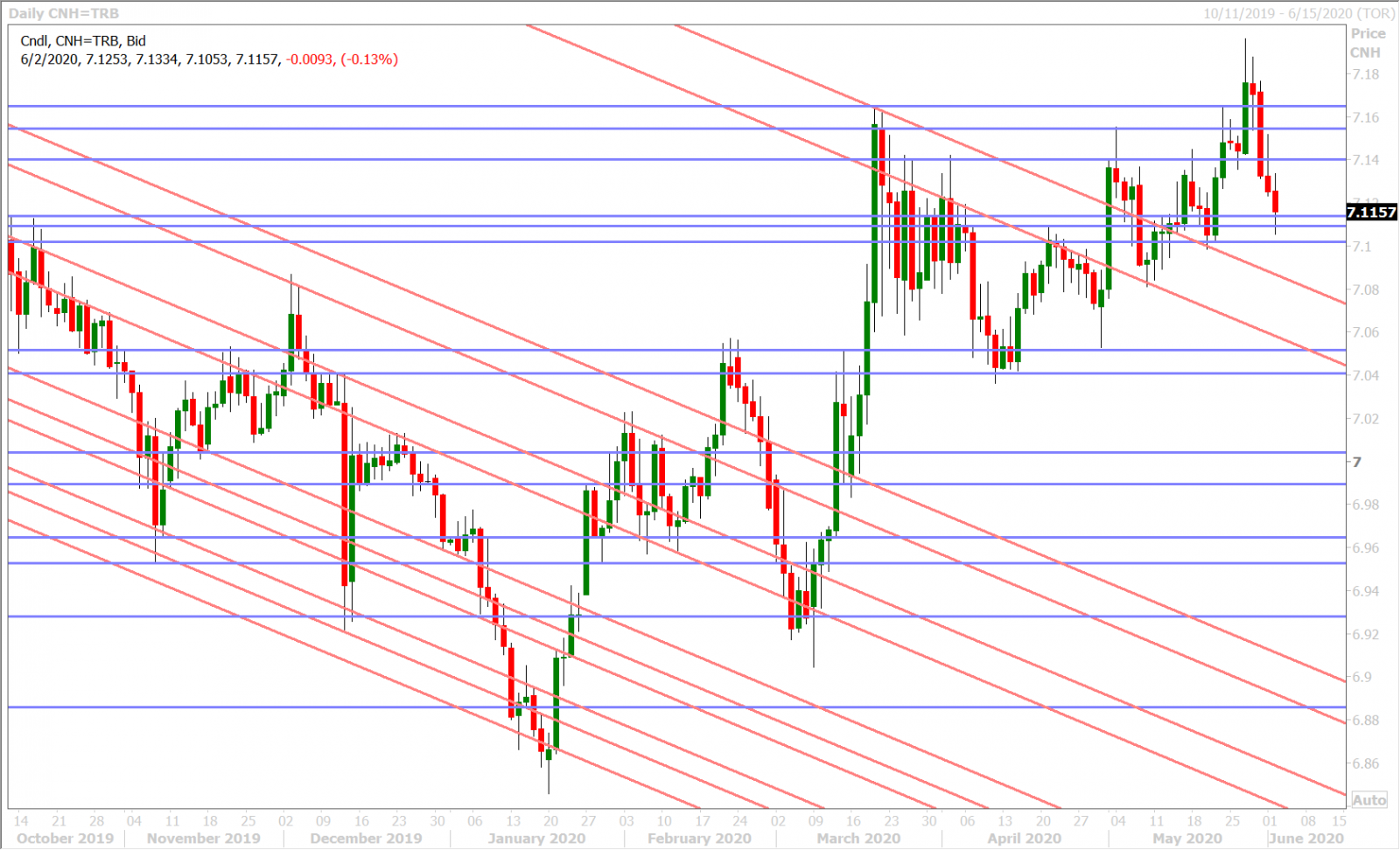

The US dollar fell apart yesterday after the ISM Manufacturing PMI showed its first month-over-month gain since January. While the headline number of 43.1 just missed the consensus estimate of 43.6, we think traders were also relieved that it wasn’t worse than expected considering the very poor PMI figures released out of Chicago last week. This news saw key USD support levels break on the charts against CAD (1.3680-1.3700), against AUD (0.6770), and against GBP (1.2410), which in turn made matters worse for the buck. Reports that state-owned Chinese firms actually bought three cargoes of US soybeans on Monday, even as Bloomberg sources in China said the government had told them to pause such purchases, then added insult to injury by pushing USDCNH back to session lows. Yesterday’s NY session very much felt like traders scrambling to get out of safe-haven USD bets…but it was interesting to see how bond and gold markets remained defiantly bid.

The purging of USD long positions took a break last night in Asia, despite another lower than expected daily USDCNY fix from the PBOC and another 1% rally in the Nikkei, but it recommenced quickly in Europe this morning following reports from China’s foreign ministry that it had no information about a directive to halt US soybean purchases. The Global Times more or less confirmed this by then tweeting “Chinese firms continue to purchase US soybeans in line with market rules, unaffected by external factors. This is proven by Chinese firms' buying of newly-harvested US soybeans on Mon, Zhang Xiaoping, country director for China at the US Soybean Export Council, told GT"…and before we knew it the USD was extending its losses against CAD, AUD and GBP. Even the EUR joined the “risk-on” rally when it finally surpassed the 1.1140s resistance level.

The dollar is now seeing a mild bid at the start of NY trade as GBPUSD fades chart resistance in the 1.1170s, and this just so happens to be coinciding with some tough Brexit talk out of Boris Johnson’s spokesman, but we’d say this broad dollar bounce is looking very tepid at the moment.

UK PM JOHNSON SPOKESMAN SAYS WISHFUL THINKING' FROM EU OVER BREXIT TALKS

UK PM JOHNSON SPOKESMAN WE AREN'T COMPROMISING WITH EU ON FISH AND LEVEL PLAYING FIELD BECAUSE OUR POSITION ON THESE IS FUNDAMENTAL

USDCAD DAILY

USDCAD HOURLY

JULY CRUDE OIL DAILY

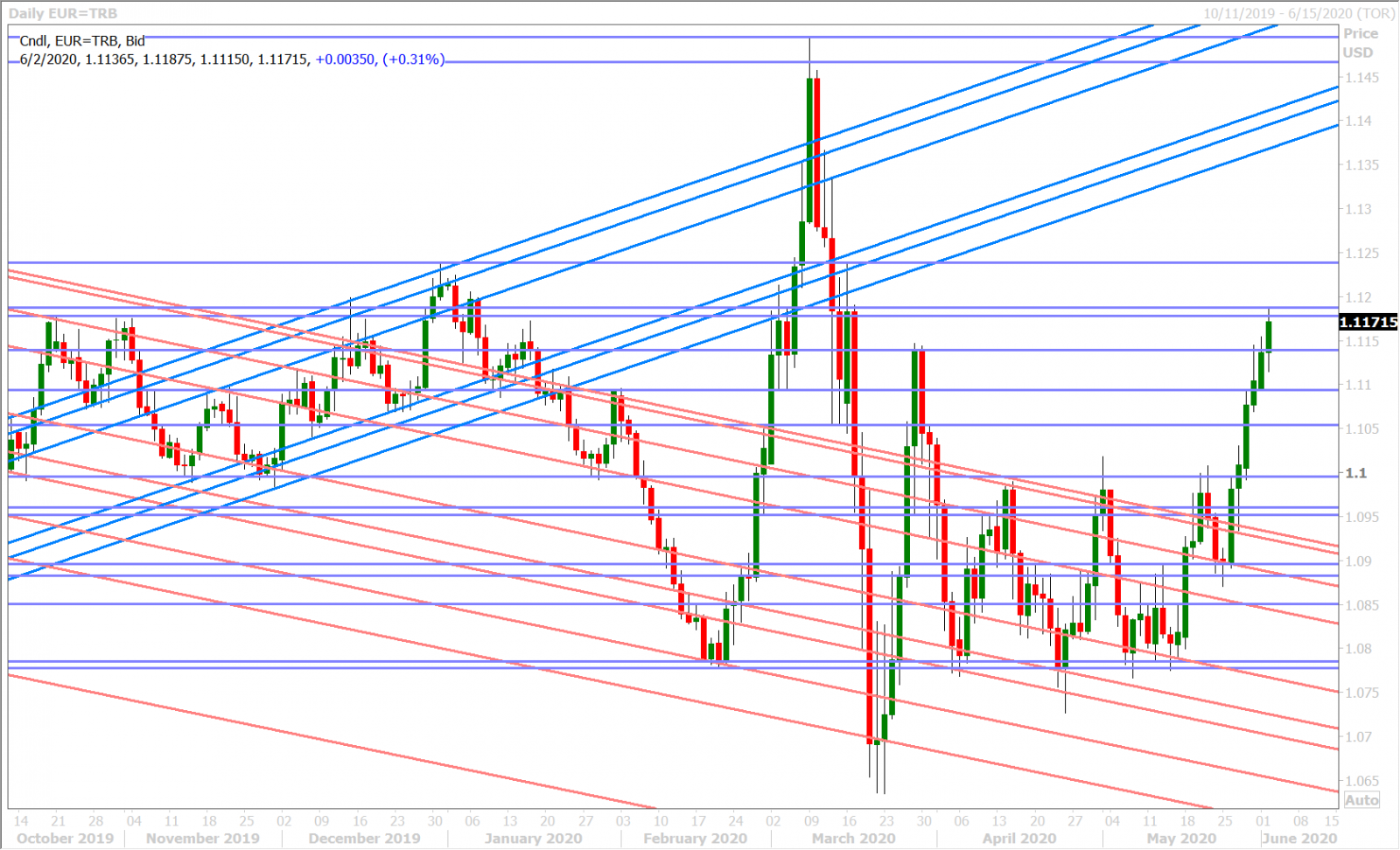

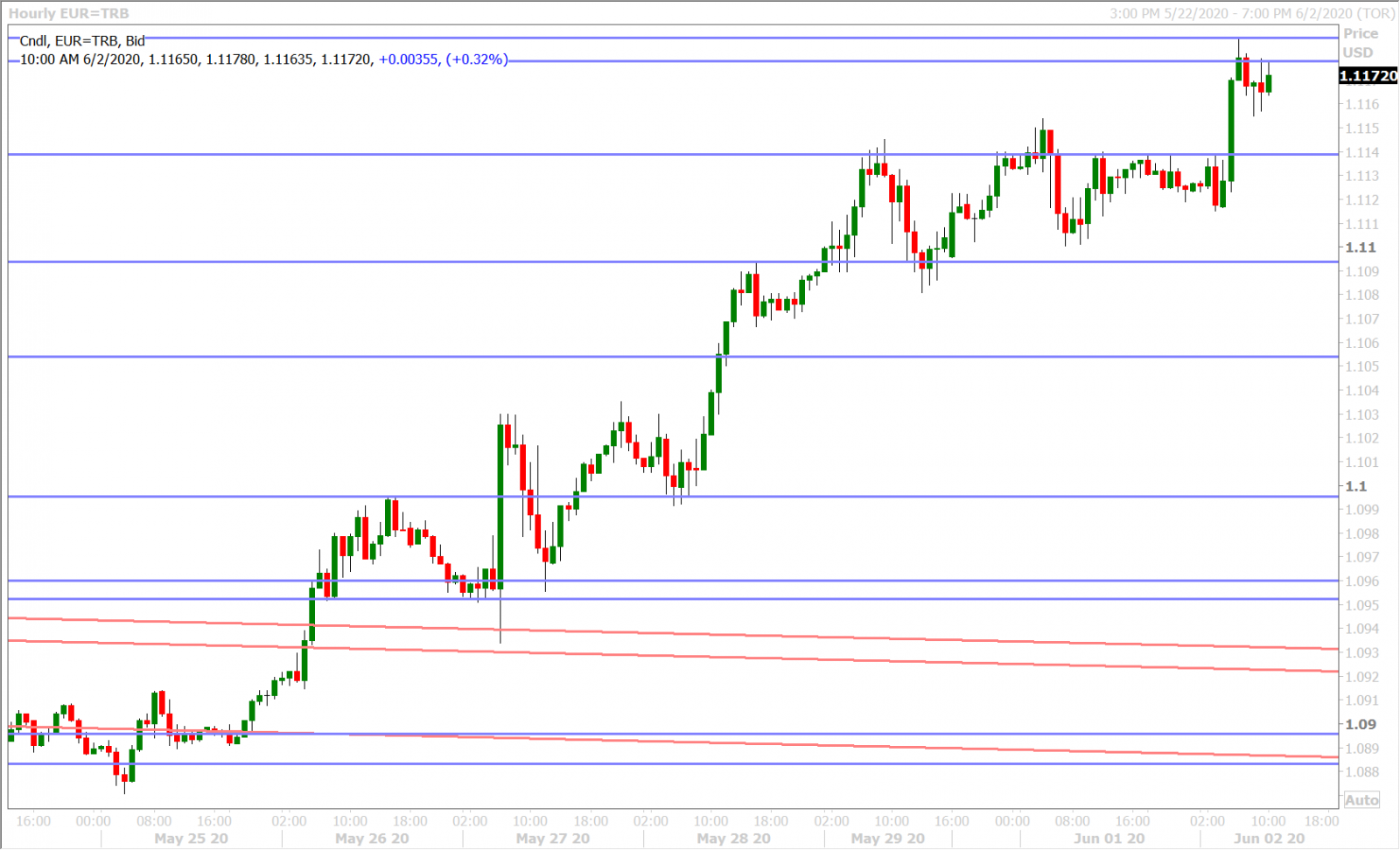

EURUSD

Euro/dollar traders finally joined that “China is actually not halting US purchases” rally this morning, but it seems as though they needed the confirmation from China’s foreign ministry and some more broad USD selling before they jumped onboard. We think today’s 1.1blnEUR option expiry at 1.1100 could have also played a part in holding EURUSD back in Asia last night. The market’s next resistance level, around the 1.1170-80s, is proving to be a challenge for EUR buyers now and we think the GBPUSD sales we’re seeing around the NY open aren’t helping.

EURUSD DAILY

EURUSD HOURLY

SPOT GOLD DAILY

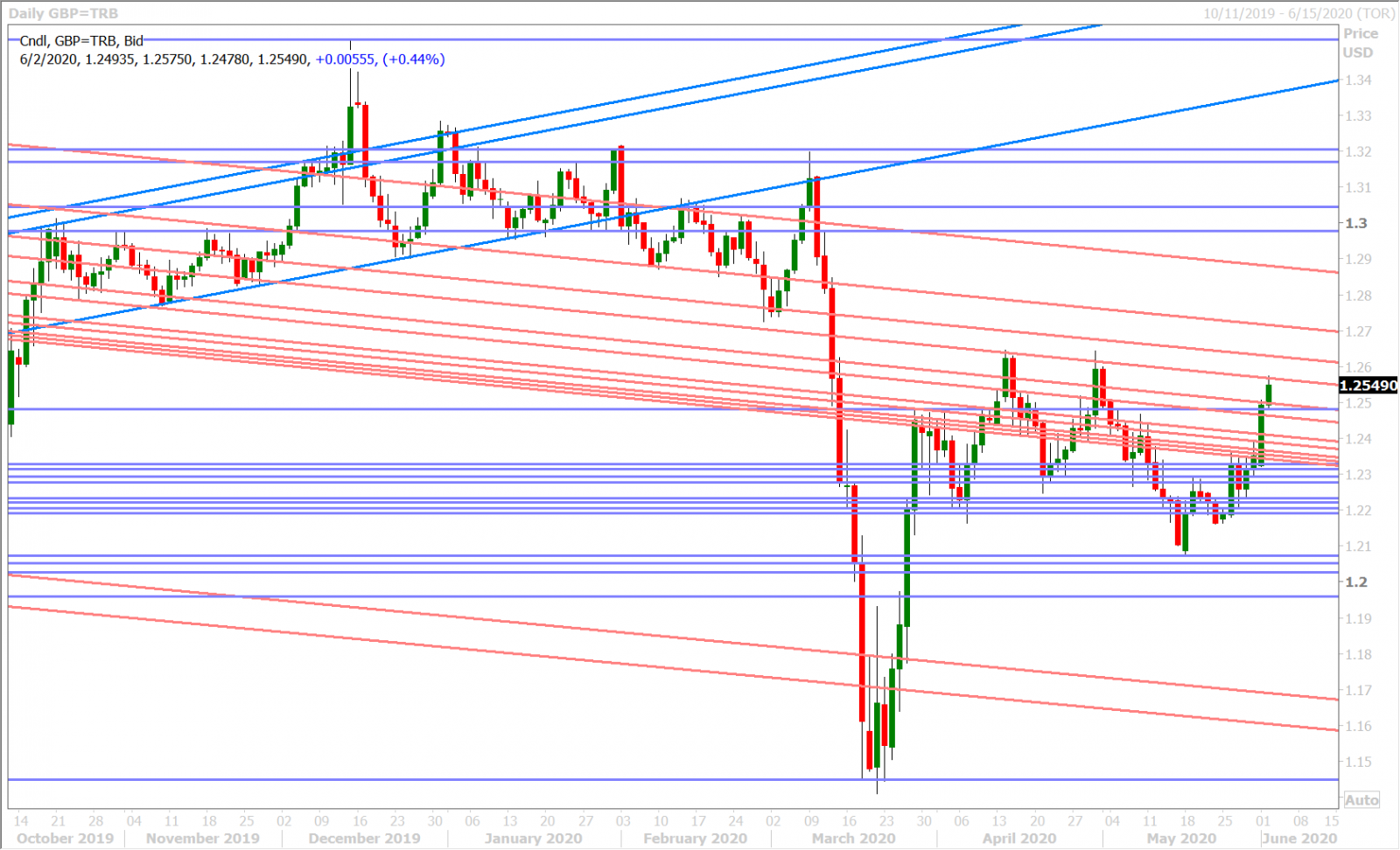

GBPUSD

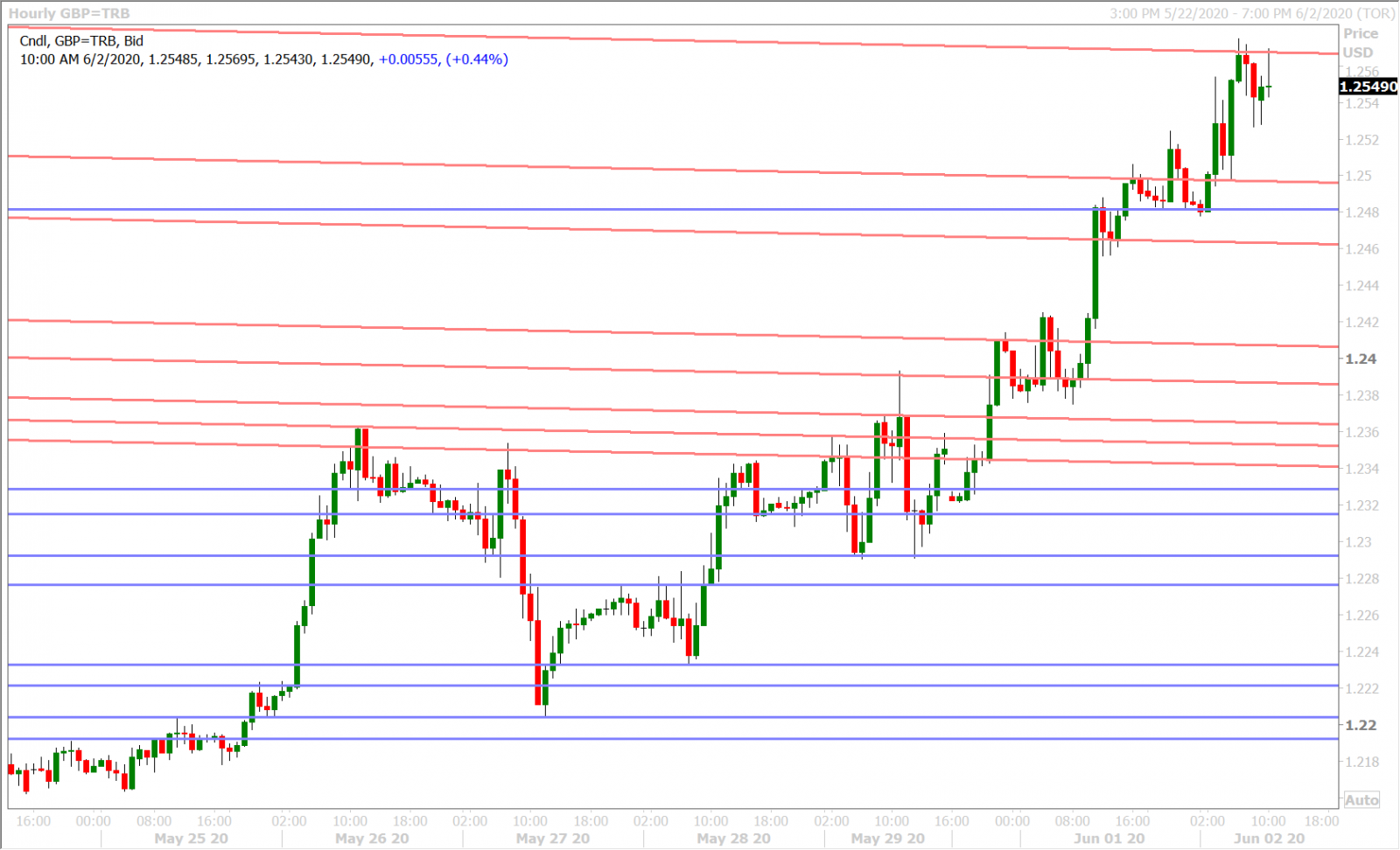

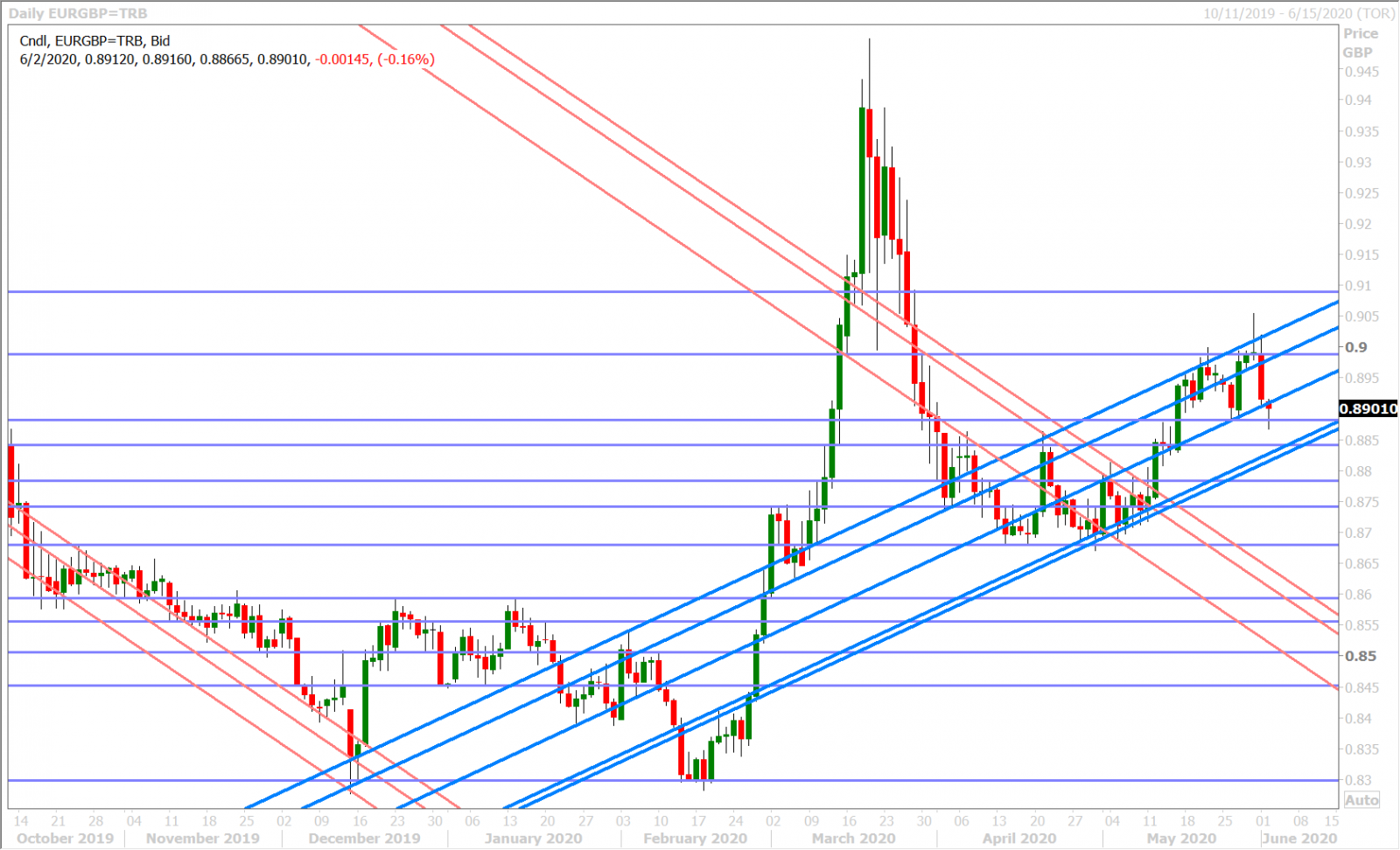

Sterling threw our new trading range idea out the window rather quickly yesterday morning when the US ISM report saw GBPUSD surge past chart resistance in the 1.2400-1.2410 area. The fund shorts, who we thought on May 25th would get squeezed on any move back above the 1.2190-1.2230s, looked like they capitulated even further and this really has us wondering now if we might get some surprisingly positive headlines out of EU/UK trade talks this week. We think that EURGBP’s plunge back down below the 0.8900 handle over the last 24hrs is a testament to the fact that perhaps traders were positioned a little too bearishly on the current UK-specific narratives heading into this week. If we look at it another way, the marketplace could be also be getting rid of some weak GBP shorts so that it can make room for more bad Brexit news.

It’s impossible to predict how EU/UK negotiations will on-fold this week, but what has definitely changed is the market’s momentum. While plenty of chart resistance abounds around the 1.2570s and the 1.2630s, there is also now meaningful support in the 1.2400-1.2500 zone (yesterday’s resistance levels which gave way) which could encourage a "buy the dip" mentality.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

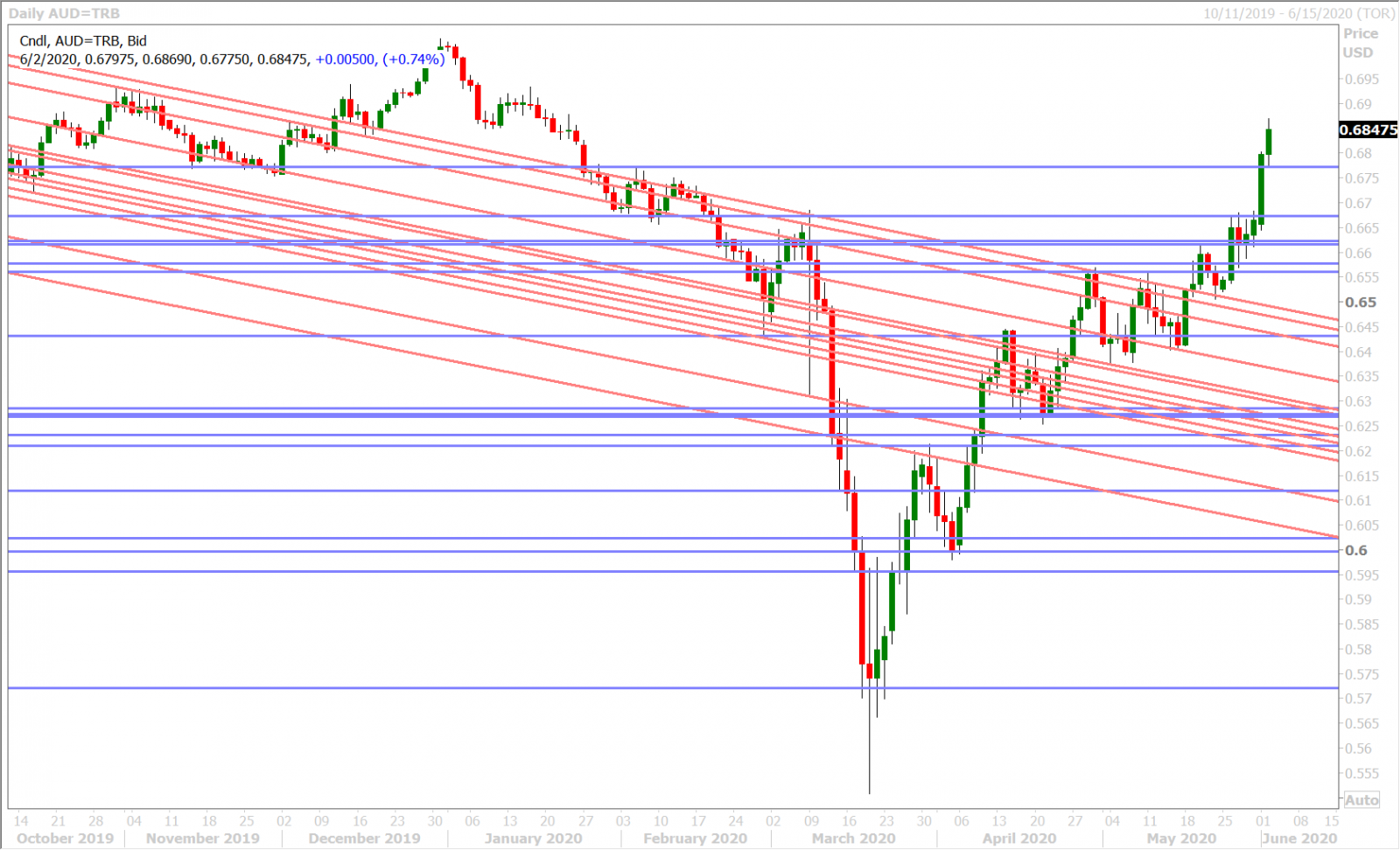

The Reserve Bank of Australia left it targets for the overnight cash rate and the 3-year government bond yield on hold last night, and they also met market expectations when it came to their more optimistic tone for the economic outlook. Full press release here. Governor Philip Lowe did not have any speeches scheduled for today, but assistant RBA governor Michele Bullock is expected speak tonight at 9:15pmET and could perhaps add some color to the central bank's latest thinking.

The Australian dollar very much broke out again yesterday and, while we said the breakout looked shaky initially, the ISM Manufacturing PMI report removed all doubt. The market not only held its breakout gains above the 0.6670s from earlier in the day, but it managed to surpass chart resistance in the 0.6770s as well. These technical achievements made for a convincingly bullish NY close, which in turn has now led to further buying in AUDUSD during the overnight session today.

The continued slump in off-shore dollar/yuan, on the back of China’s denial about halts to US agricultural purchases, added validity to the Aussie move this morning, but we’d note that USDCNH is now find some support at the 7.1100-7.1150 (something to think about for AUDUSD longs). Australia will report its Q1 GDP figures tonight at 9:30pmET, with traders expecting -0.3% QoQ and +1.4% YoY.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

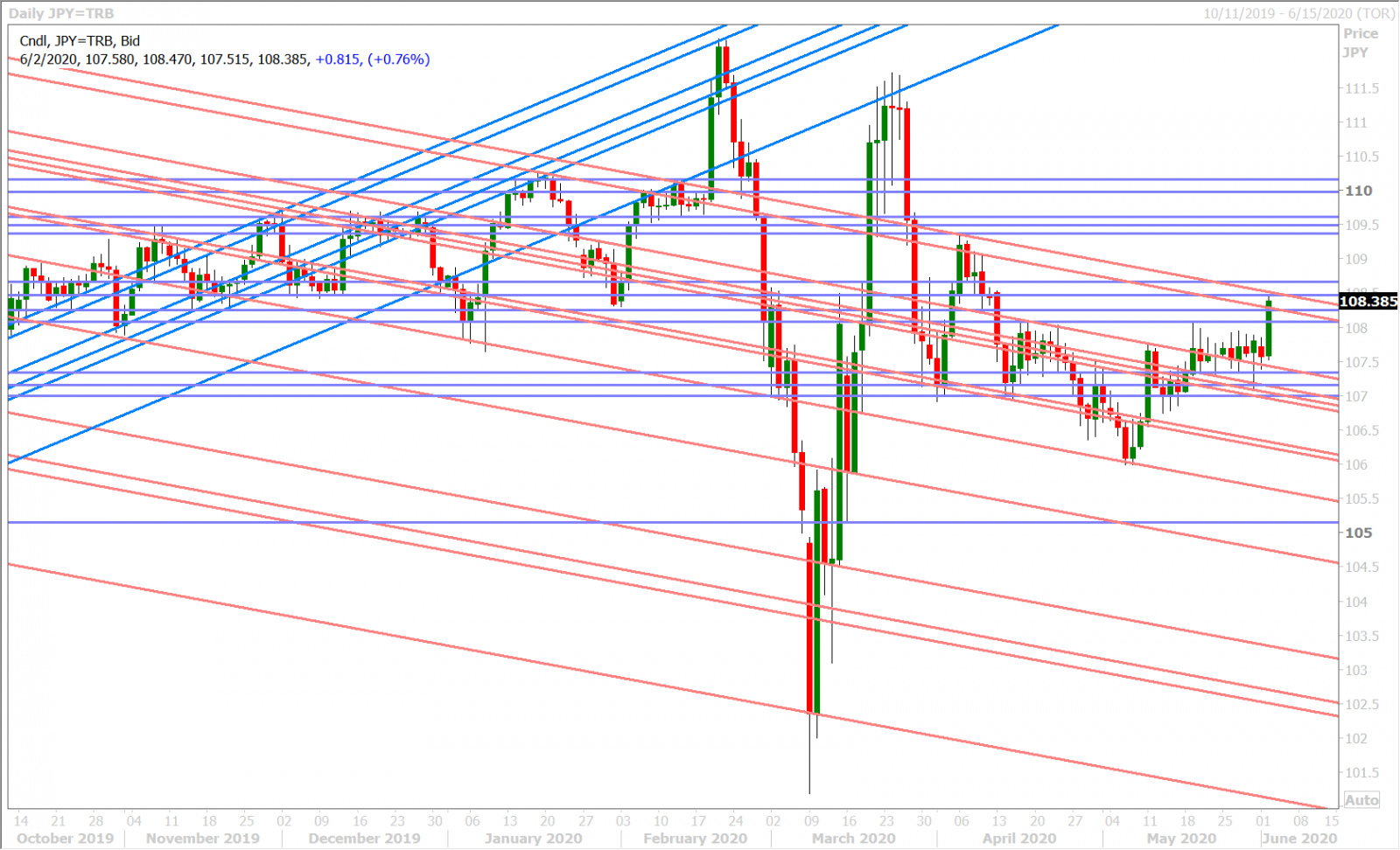

Dollar/yen has shot above the 108.07 resistance level this morning and, while we can’t point to a specific headline that is driving the move, we’d note broad USD buying at the start of NY trade, along with market chatter of some buy stops getting tripped. One could argue that the entrenched USDJPY net short position held by the leveraged fund community might be getting frustrated here as well. They extended their position to its largest since last September during the week ending May 26 (according to the latest COT report from the CFTC), but they continue not to get paid for the risk of doing so.

We also wonder too if today’s spike in Japanese coronavirus cases is sparking fears of a “second wave”. Dollar/yen’s chart technicals are starting to look more positive today, but we think the market will need to clear the 108.60s resistance level, and survive some consolidation thereafter, before we start talking about a new uptrend for prices.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.