USD recovers ahead of key speech from Fed Chairman Powell today. GBP dragged lower again by Brexit headlines. USDJPY back above 112.50.

Summary

-

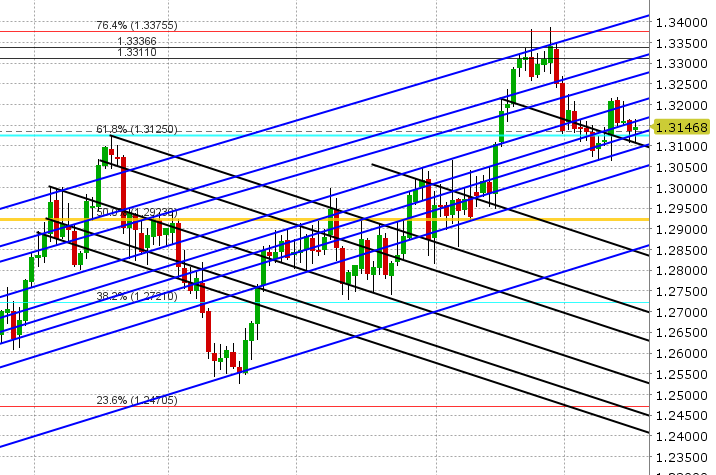

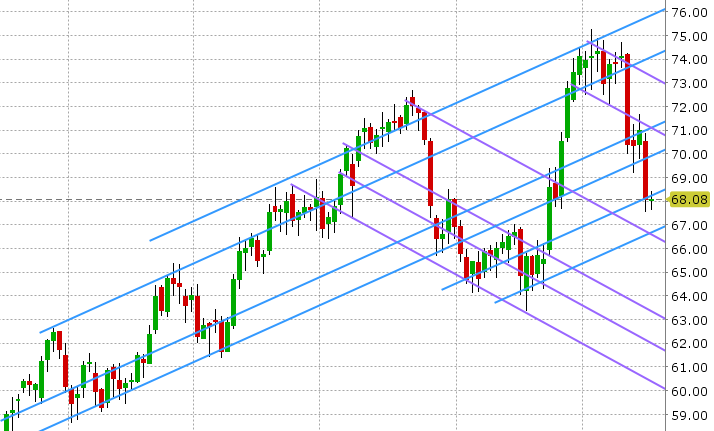

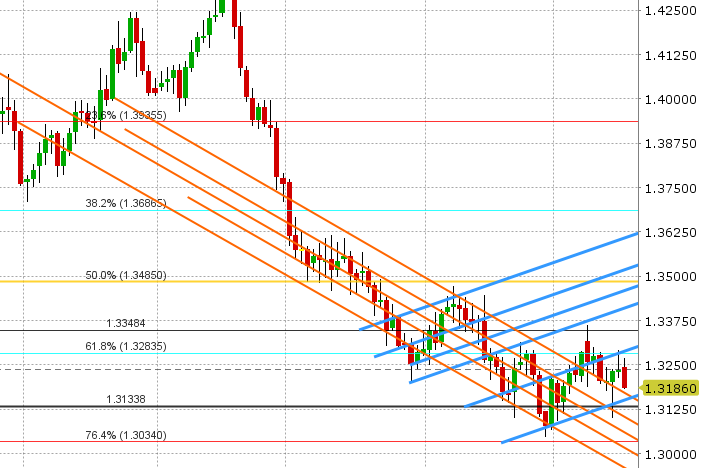

USDCAD: Dollar/CAD is up marginally this morning as the USD broadly recovers from losses in early European trade today. Yesterday’s NY low in the 1.3110 area held, and the 1.3125 Fibo support level has been regained as well, which bodes well for some upward momentum going into Fed Chairman Powell’s semi-annual testimony before the US Senate Banking Committee (10amET). Yesterday’s inability for the market to rally despite another 4% plunge in oil prices is a bit disconcerting. This may be more evidence that the market is already quite long USD (short CAD), something that the CFTC’s COT reiterated on Friday. Canada just released better than expected manufacturing sales for May (+1.4% vs. +0.5% expected), and this is seeing USDCAD back off trend-line resistance in the 1.3160s.

-

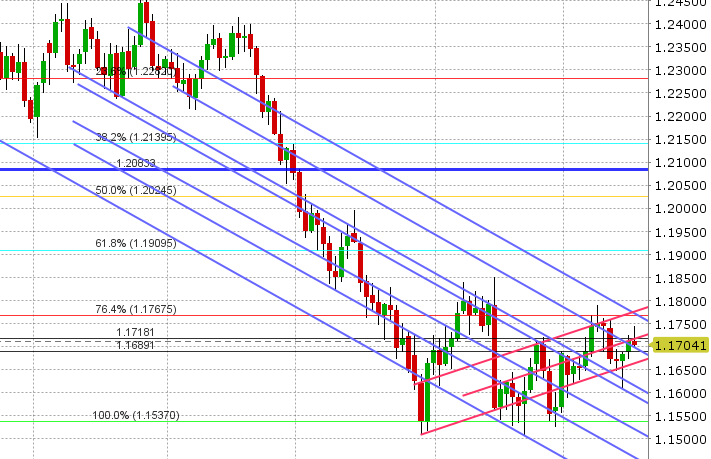

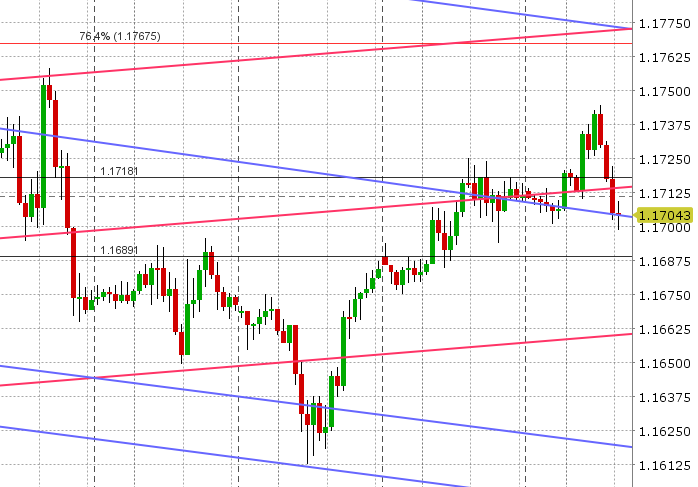

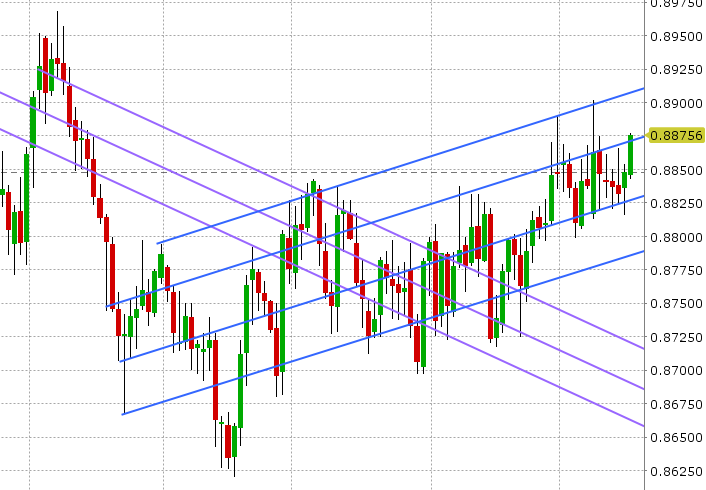

EURUSD: Euro/dollar is retreating at this hour, giving back all the gains scored when the market broke above the 1.1720s earlier today. There hasn’t been much in the way of headlines driving this move and so we think this is likely position unwinding ahead of today’s main event on capitol hill. USDCNH continues to find support in the 6.69s (now back above 6.70), and this is not helping. Nor is GBPUSD, which just took a leg lower following some disappointing news for Theresa May in parliament. More below. Technical support today is 1.1705, 1.1690, then 1.1660. Resistance is 1.1765-75. We get US Industrial Production today at 9:15amET, but the main driver of today’s action should be Powell’s speech.

-

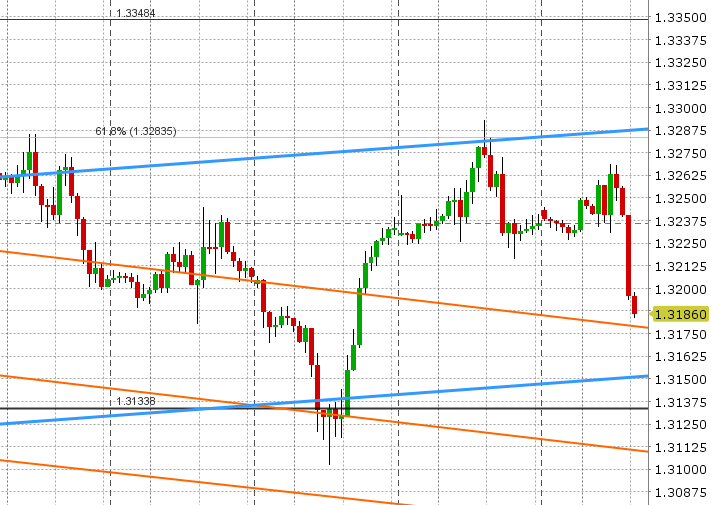

GBPUSD: Sterling just took a leg lower amid reports that the UK’s Labour Party will back the Tory rebel’s customs agreement in an upcoming vote, which if true would be huge blow for Theresa May and would spur more rumors of a leadership challenge. More here: https://www.theguardian.com/politics/2018/jul/17/may-faces-brexit-defeat-as-labour-backs-customs-union-amendment. This news is overshadowing rather decent UK employment figures for June, reported earlier today. Average hourly earnings was reported in-line with expectations, coming in at +2.5% 3M/Y. The market is now trading back to trend-line support in the 1.1380 area, because of these Brexit headlines, and now traders await Powell’s testimony. Next support is 1.3150. Interest rate traders are still pricing in 75% odds of an August rate hike from the Bank of England when it meets again next month. Tomorrow we get UK CPI for June.

-

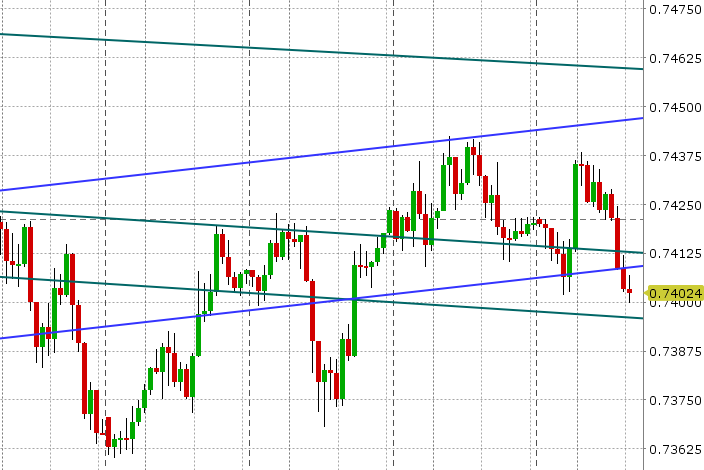

AUDUSD: The Aussie is giving back its overnight gains at this hour as well. We saw an interesting move higher in AUDUSD last night after New Zealand Q2 core CPI beat expectations and NZDUSD shot higher, but this move quickly faded as European traders rolled in. The RBA Minutes were a non-event as usual. Broad USD strength is now the theme going into Powell’s speech at 10amET. There’s a large option expiry today at the 0.7400 strike (~800mlnAUD) which may also keep prices heavy before then. Support today is 0.7390-95.

-

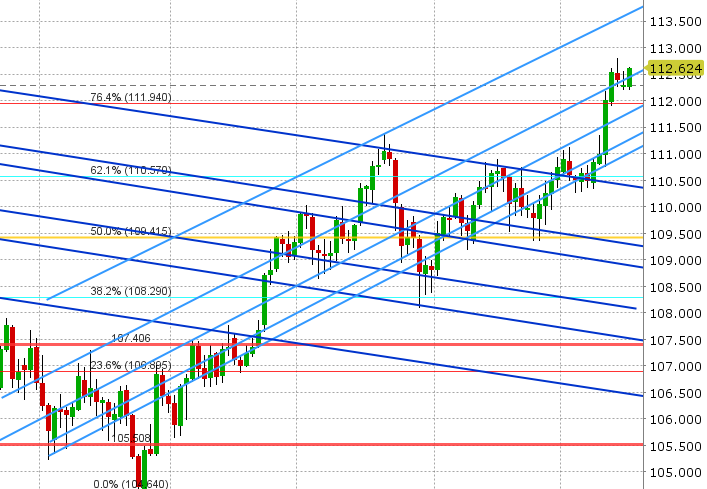

USDJPY:Japan was back from holiday today and traders took USDJPY back above the 112.50s amid some broad USD strength; a level we said is important to maintain the market’s upward momentum at this time. The JPY crosses continue to exhibit technical strength as well. US equity futures and yields are trading flat at this hour however as markets brace for Powell’s speech.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

August Crude Oil Daily

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.