USD pressured on lockdown easing hopes

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.gvf

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Traders focus on continued talk of plans to slowly reopen economies around the world.

- Australia leading efforts with new COVID-19 tracking app. Italy to slowly re-open on May 4th.

- Spain, France, UK and Canada expected to announce plans this week to slowly get back to normal.

- USD trading broadly lower; AUD gains helped by move above 0.6370s. CAD lagging with June WTI -25%.

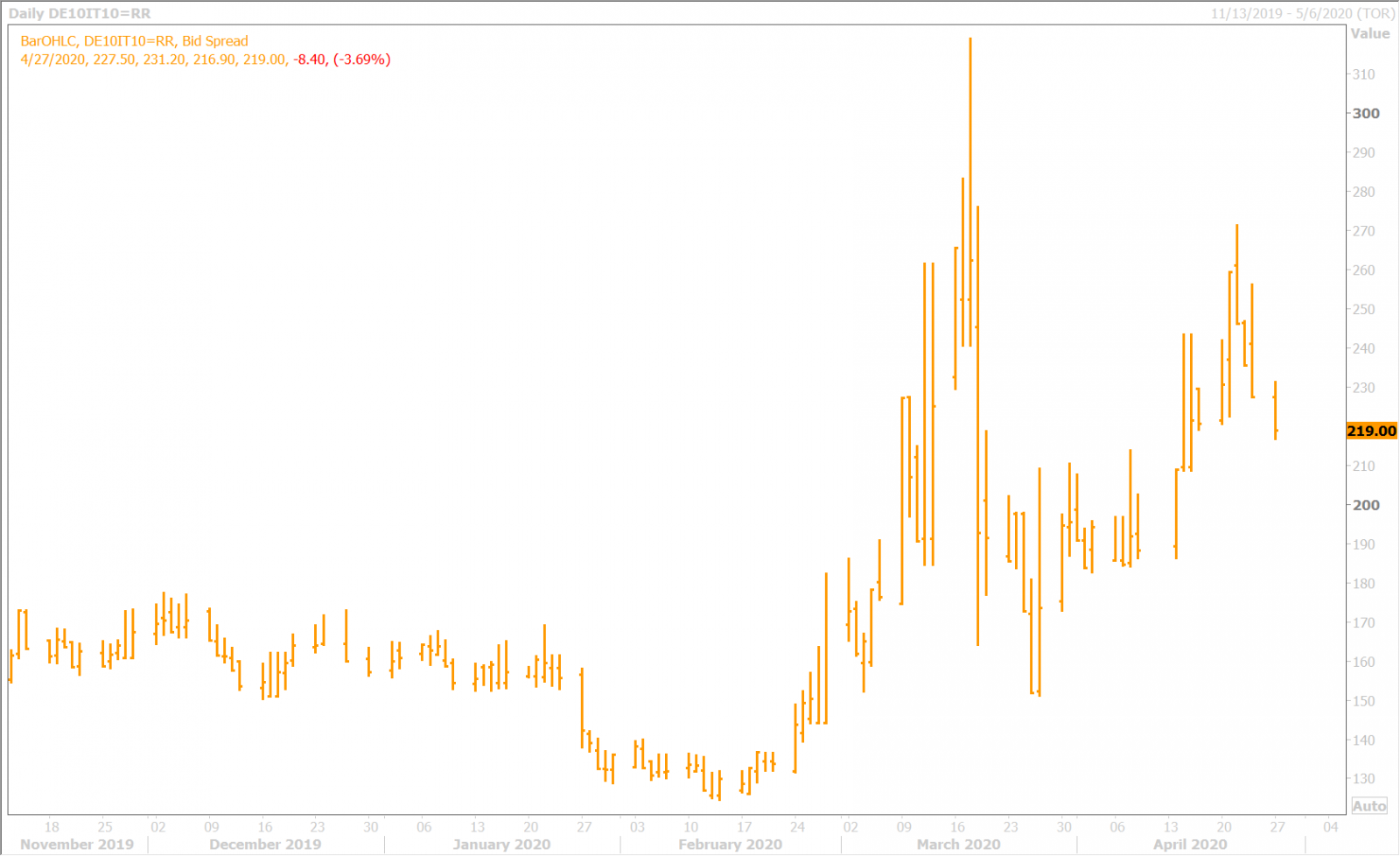

- EURUSD fund longs likely breathing sigh of relief after disappointing EU Summit. BTP/Bunds +218bp.

- US Q1 Advance GDP, Fed/ECB meetings, final US & European April manufacturing reads in focus this week.

ANALYSIS

USDCAD

Global risk sentiment is getting a boost to start the week as traders focus on continued talk of plans to slowly reopen economies around the world. Italian officials said they will reopen parks, sports training, museums and retail activities starting next week. The Spanish, UK and Canadian prime ministers have said they will announce proposals this week with regard to easing lockdown measures. What is more, PM Scott Morrison is now pushing for an ever faster reopening of the economy after Australia steps up its impressive COVID-19 containment efforts with a new tracking app. We think traders are taking some solace from the fact that Italy narrowly dodged a credit rating downgrade from S&P late on Friday. We also think the new stimulus measures announced by the Bank of Japan last night are also helping to underpin broad risk sentiment so far today.

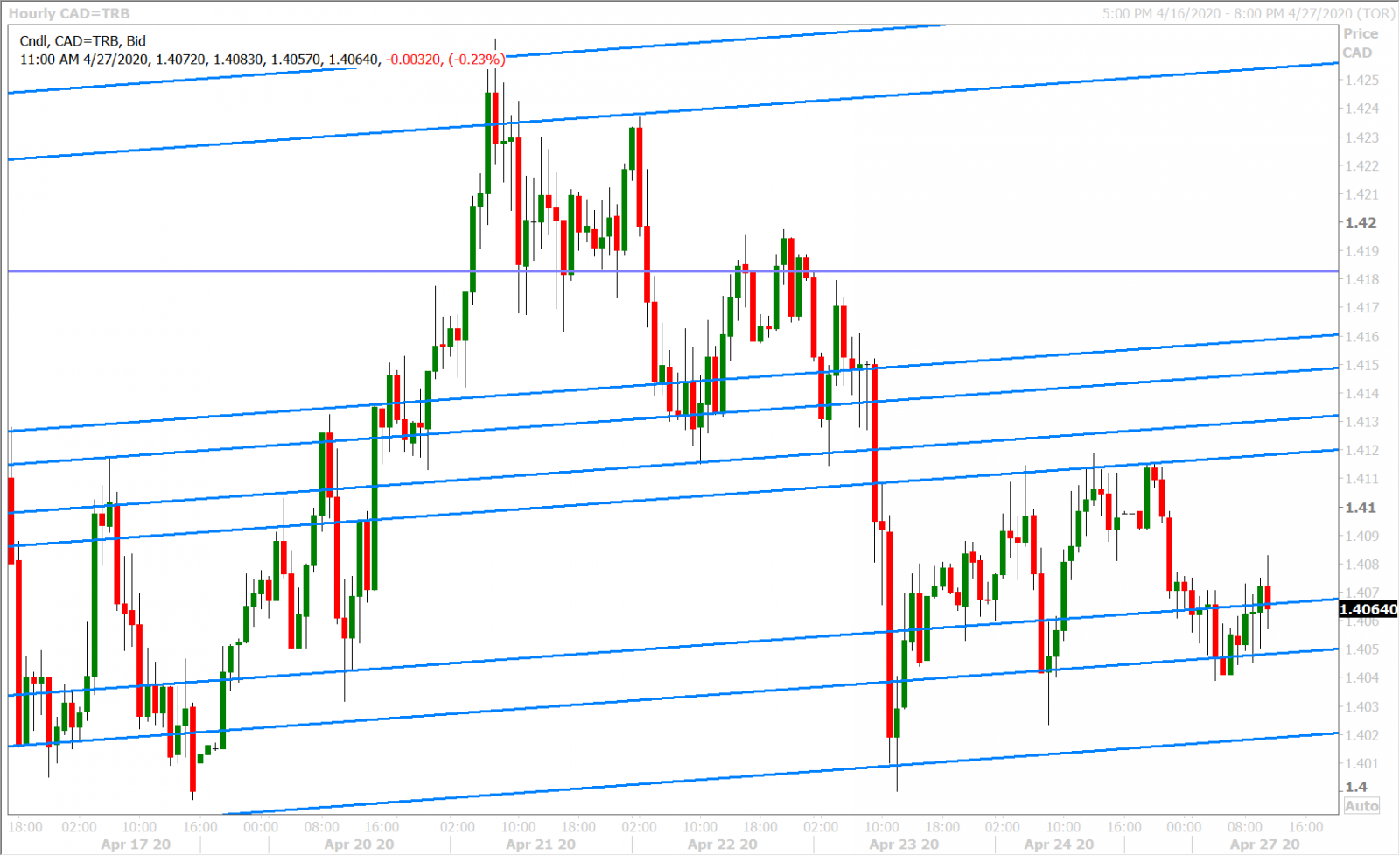

Dollar/CAD has slipped back to familiar chart support in the 1.4040-60s as the USD gets sold across the board, but a further 25% decline in June WTI prices this morning (on global oil storage fears) appears to be limiting its decline to some extent. The latest Commitment of Traders report released by CFTC on Friday showed little change to the fund net long USDCAD position during the week ending April 21; which is quite fitting given the range trade we’ve been hammering home since late March.

This week’s calendar will feature the US Q1 Advance GDP release, the FOMC meeting and China’s April Manufacturing PMI on Wednesday. We’ll also get an updated look at how the US manufacturing sector faired during the month of April (Chicago PMI on Thursday, final Markit PMIs + ISM Manufacturing PMI on Friday).

USDCAD DAILY

USDCAD HOURLY

JUNE CRUDE OIL DAILY

EURUSD

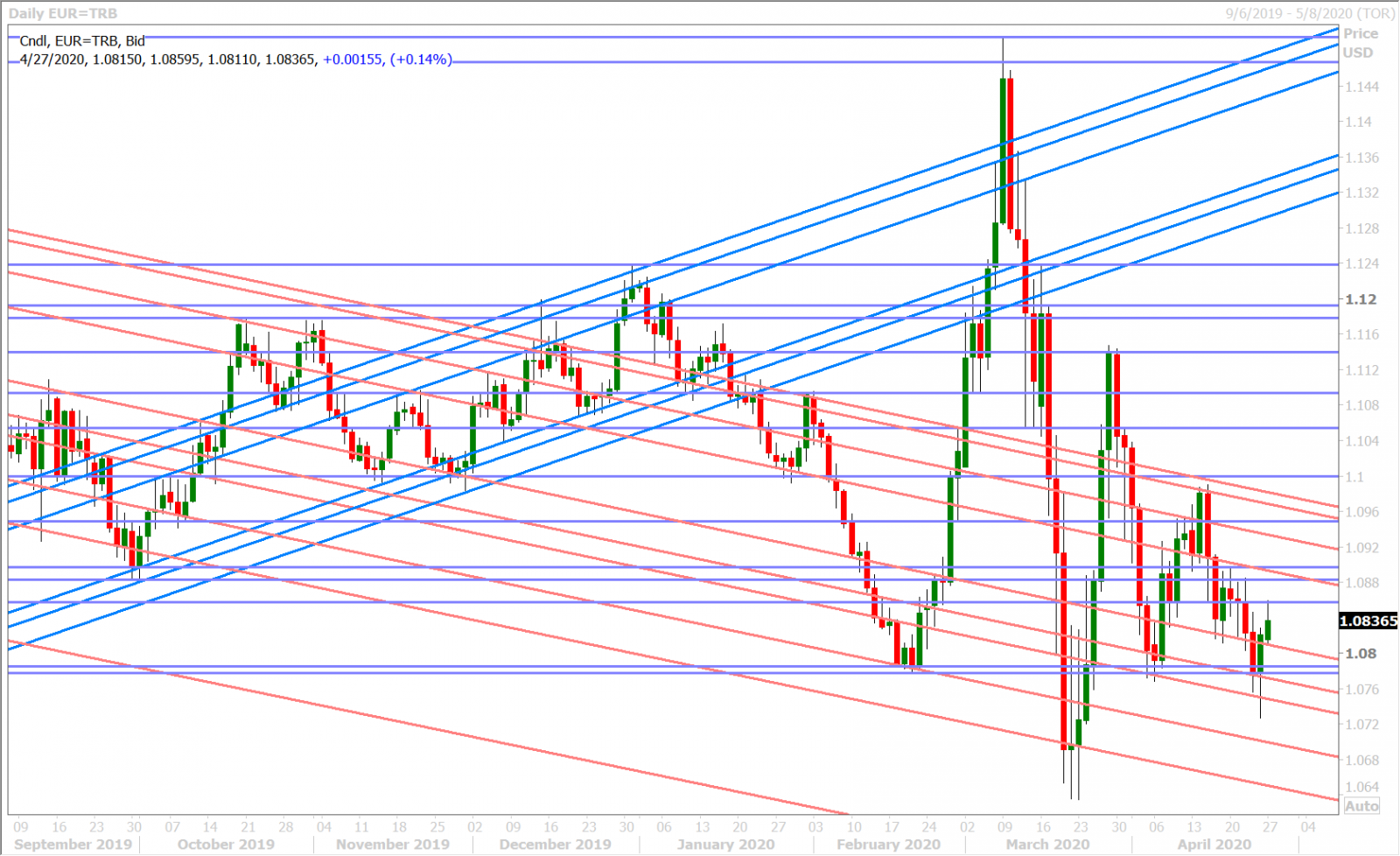

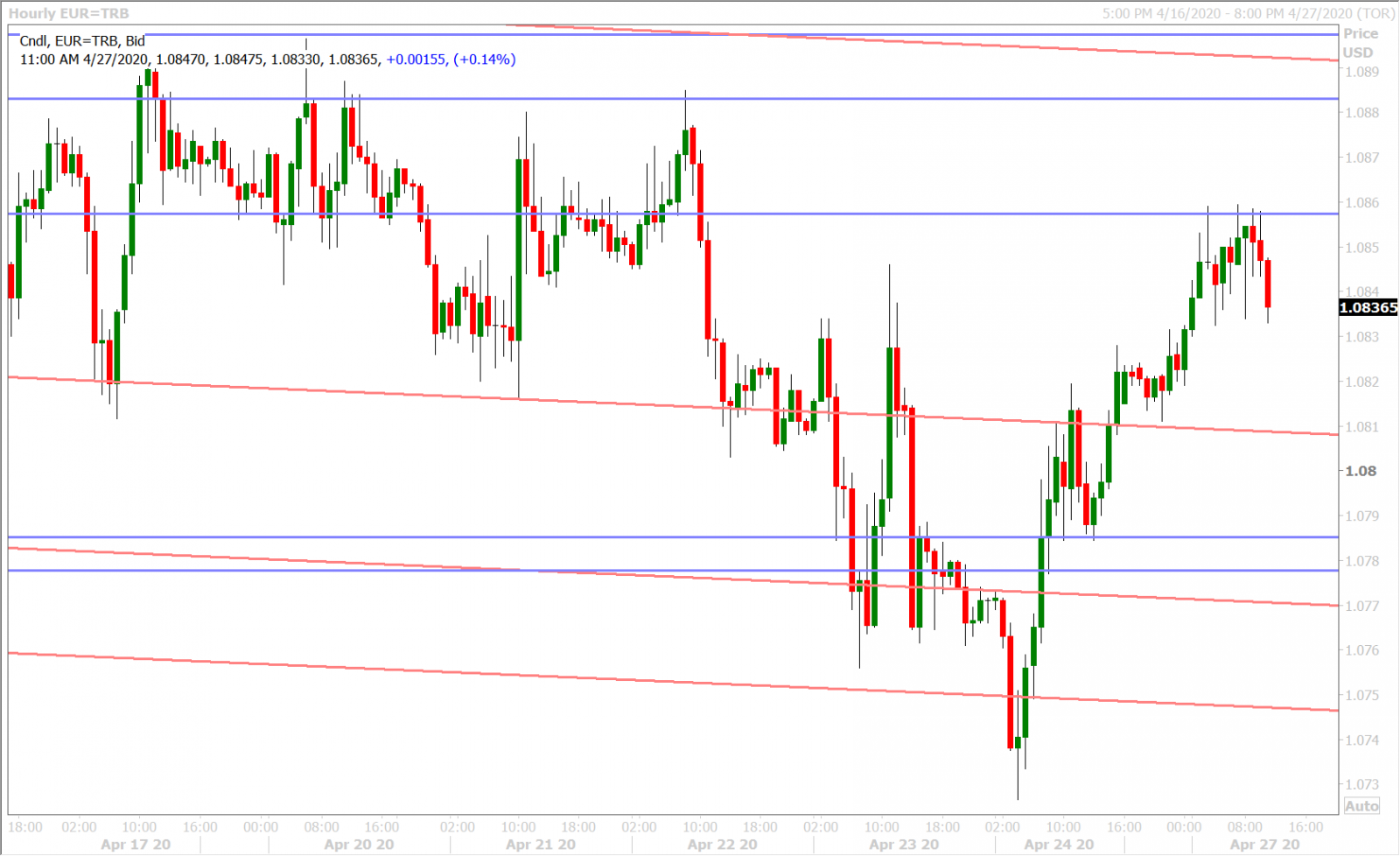

Thursday’s disappointing EU Summit is now a distant memory for the euro/dollar market, as traders have since focused on the prospects of Europe’s major economies slowing returning to normal. Italian Prime Minister Giuseppe Conte unveiled details of Italy's plans over the weekend. More here from the BBC. The Spanish and French governments are expected to outline their plans this week. Germany began reopening retail shops late last week.

All this “lockdown easing hope” seems to be doing more for European risk sentiment than the EU’s failed attempt at creating some excitement around a 500blnEUR recovery fund announcement last Thursday. The BTP/Bund yield spread is now contracting for the third day in a row (down to +219bp) and EURUSD has aggressively regained the 1.08 handle. The leveraged funds, which extended their net long EURUSD position slightly during the week ending April 21, ought to be breathing a sigh of relief here after Friday morning’s technically worrisome move below the 1.0740s.

This week’s European calendar will feature the Eurozone Q1 Flash GDP release and the ECB meeting on Thursday. We’ll also get some more dated statistics out of Germany (March Retail Sales and April Employment). European markets will be closed on Friday for the May Day holiday.

EURUSD DAILY

EURUSD HOURLY

BTP/BUND SPREAD DAILY

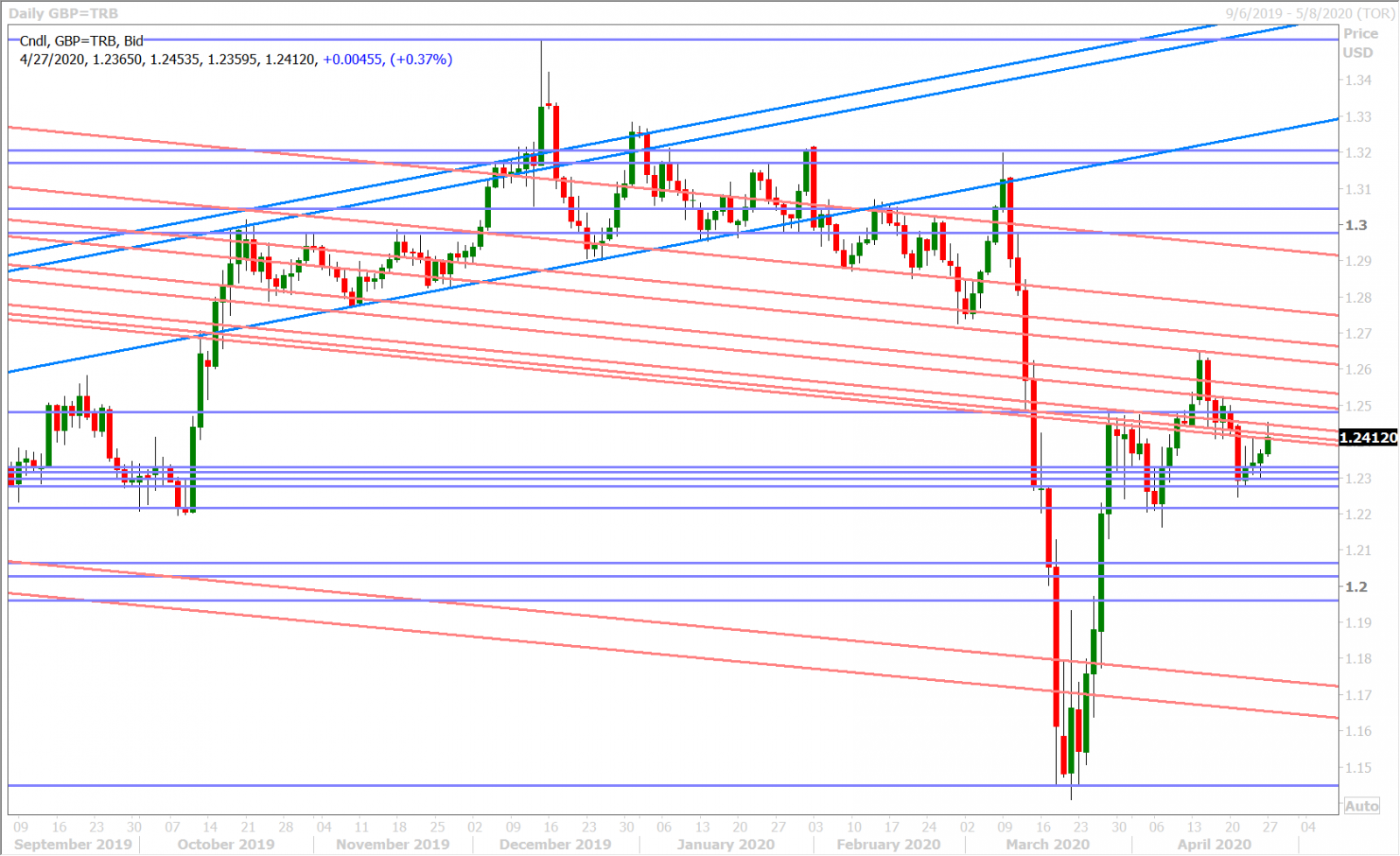

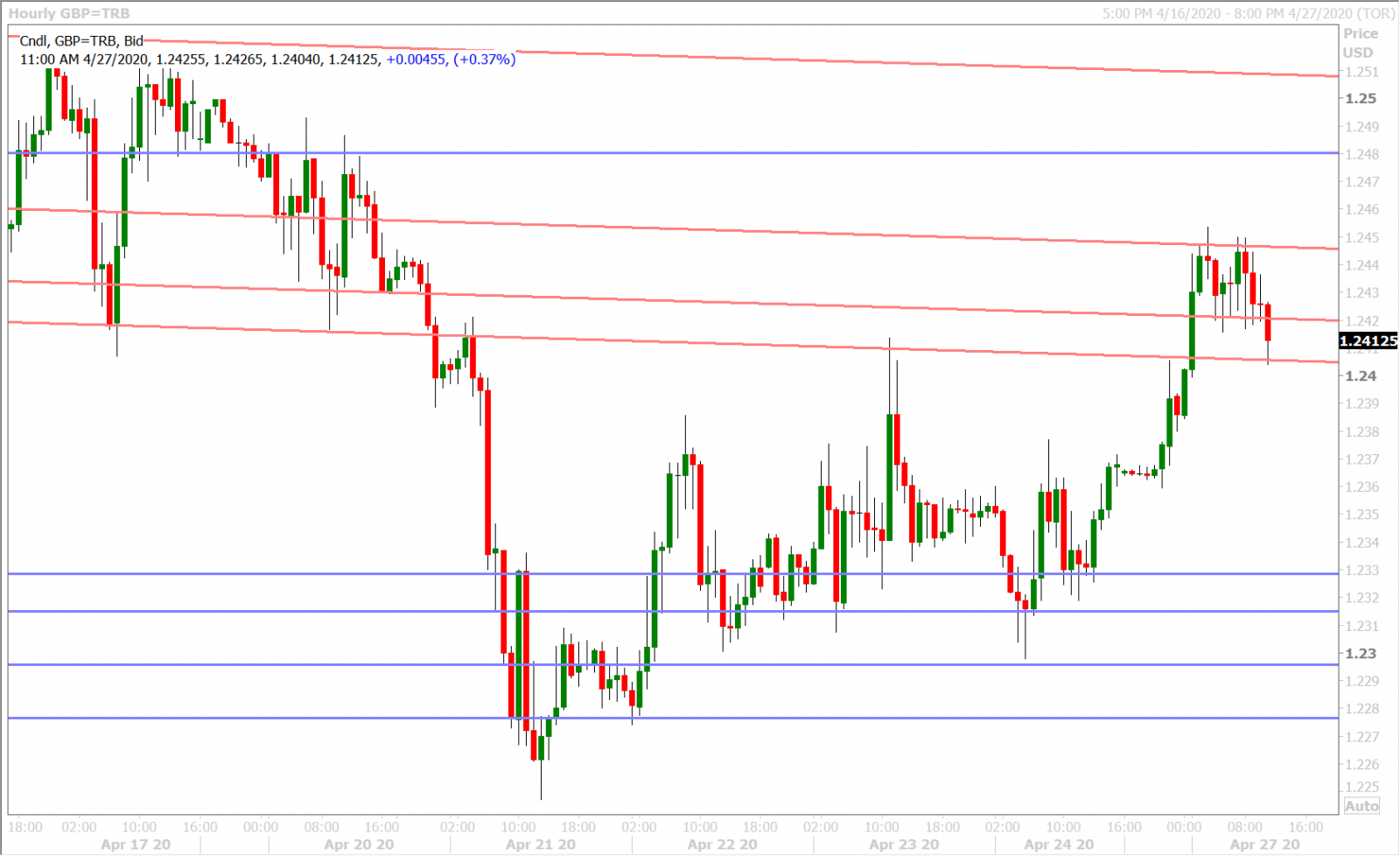

GBPUSD

Sterling is riding this morning’s “everything will get back to normal” wave as well, and we think PM Boris Johnson’s return to work helped market sentiment in the early goings as well. The UK Prime Minister is expected to unveil plans for how the lockdown could be eased as early as this week, but he has since tempered down the market’s enthusiasm a bit by saying that it’s too early to ease lockdown restrictions. GBPUSD now sits trapped within a trend-line resistance band in the 1.2420-40s as traders await the next catalyst for price action.

The latest Commitment of Traders report released by CFTC on Friday showed the leveraged funds flipping to a small net short GBPUSD position for the first time since December 2019, but we wouldn’t give this development much attention as the bulk of this change continues to come from entrenched longs that have slowly liquidated positions over the last month; which is understandable given the immense volatility they’ve endured during March. It's not like we’ve been seeing new GBPUSD short positions piling into the market.

This week’s UK calendar will be relatively uneventful as the only feature will be the final April PMIs on Friday, but UK markets will be closed for the May Day holiday as well, and so we’re not sure how much attention these figures will actually get.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

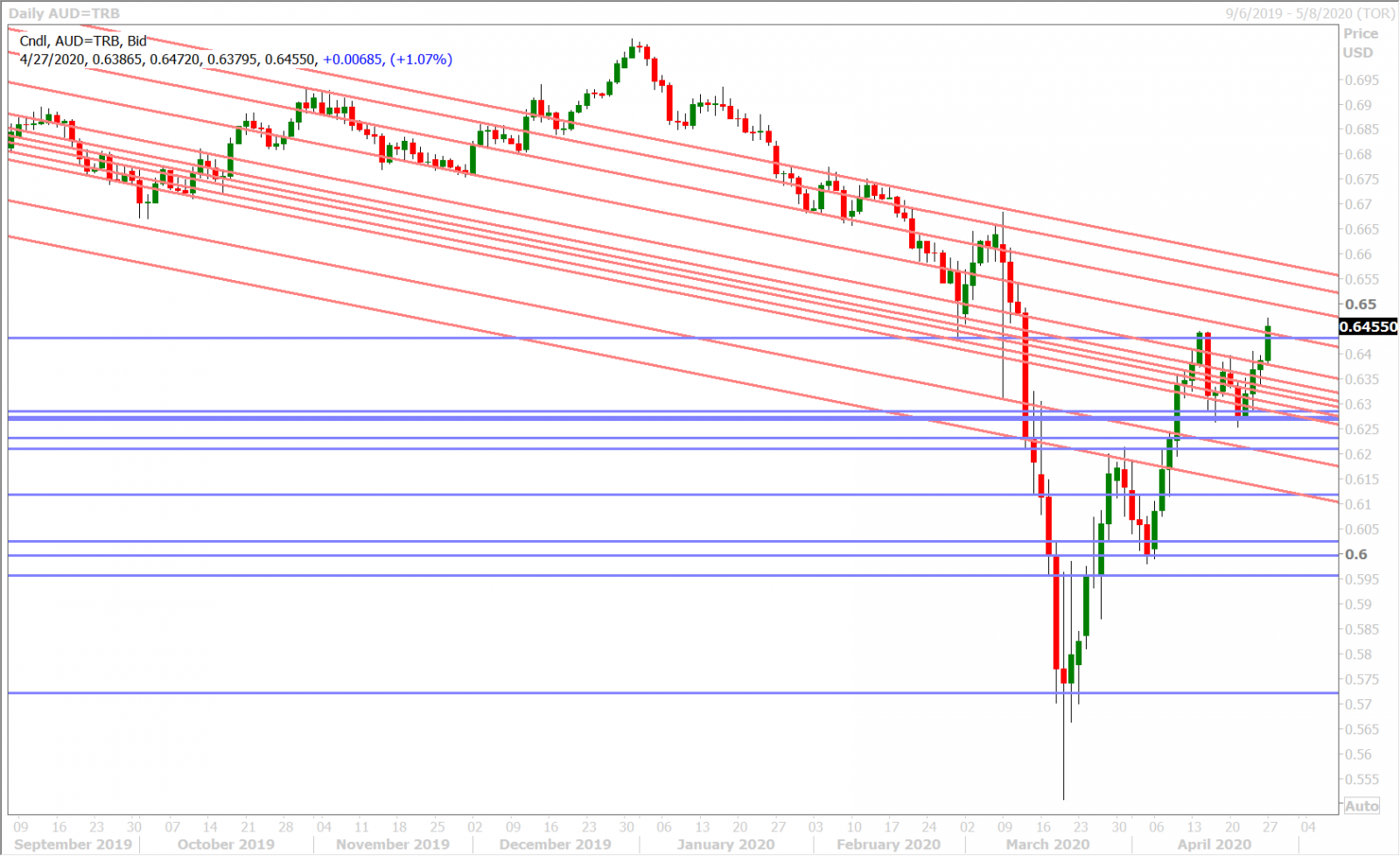

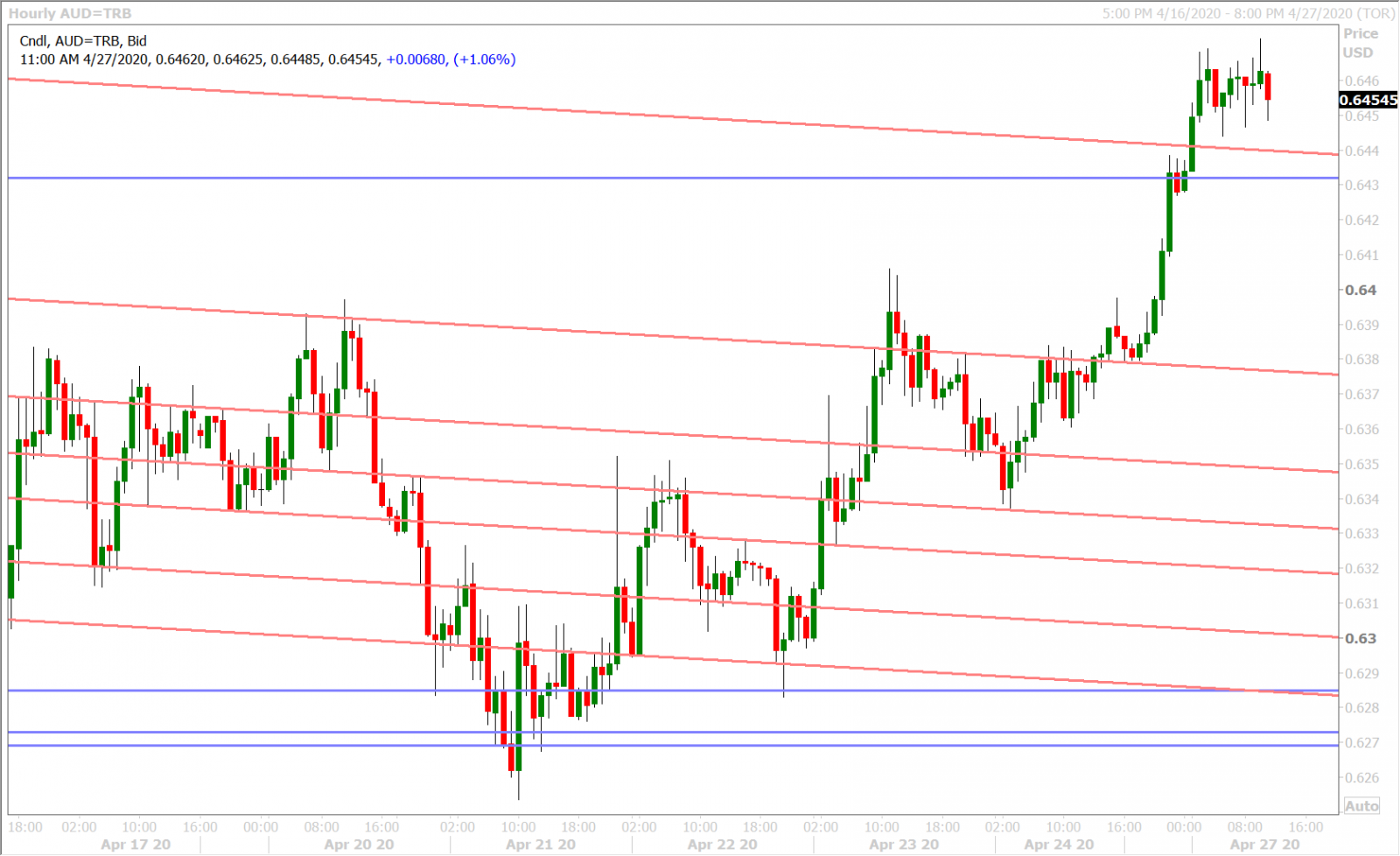

AUDUSD

The Aussie is surging higher this morning as traders bet that Australia will be one of the first G7 countries to reopen its economy from the coronavirus driven lockdowns instituted last month. Australia is being widely praised for its efforts to contain the spread of the virus; recording just 6,700 cases and 83 deaths since the outbreak started. The states of Queensland and Western Australia said they would ease some restrictions this week as well. PM Scott Morrison’s approval rating has skyrocketed to 68% following his 130blnAUD wage subsidy program to help workers stay employed. What is more, Health Minister Greg Hunt has said 1.13mln Australians (4.5% of the population) have downloaded a new COVID-19 tracing app over the weekend, which is designed to help state governments track close contacts of infected patients. It certainly appears as though the Aussie’s are doing something right and are willing to go a step further now to ensure they conquer the coronavirus sooner rather than later.

Traders definitely appear to be willing to give the Australian dollar the benefit of the doubt today. We also think Friday’s bullish NY close above the 0.6370s helped set the market up for today’s gains. The latest Commitment of Traders report released by CFTC on Friday showed the leveraged funds not doing much to reduce their net short AUDUSD position during the week ending April 21, despite a 200pt move against them during the month of April so far. This helps the bull thesis for AUDUSD in our opinion and we believe a NY close above the 0.6550 could finally force these shorts to cover.

The 0.6430-40s should be the market’s near term pivot though to start the week. Australia will report its Q3 CPI figures tomorrow night. China’s official Manufacturing PMI for April (to be released on Wednesday night) should also get some attention, as China is Australia’s largest trading partner and any further signs of normalization there are likely to boost Australian export sentiment.

AUDUSD DAILY

AUDUSD HOURLY

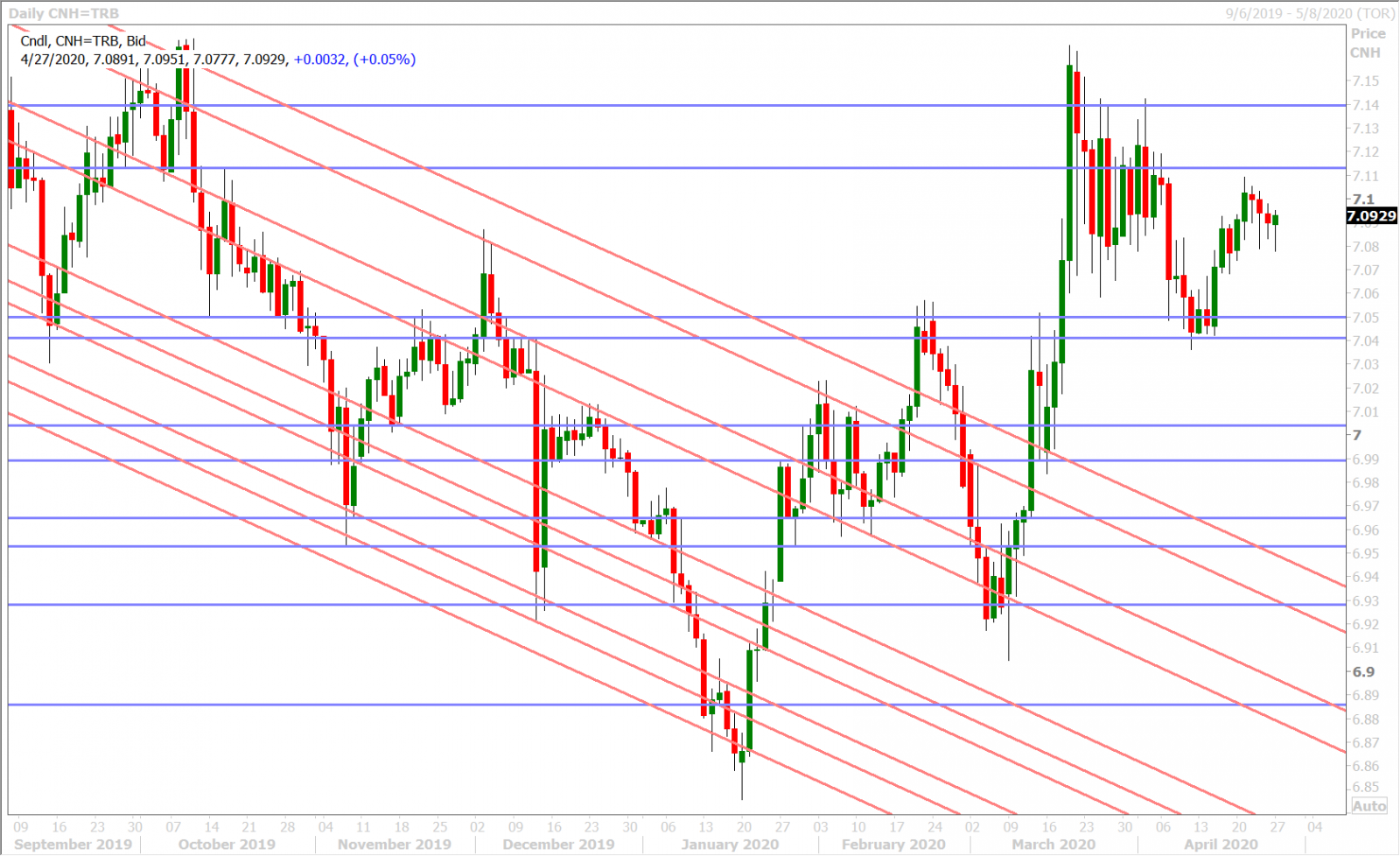

USDCNH DAILY

USDJPY

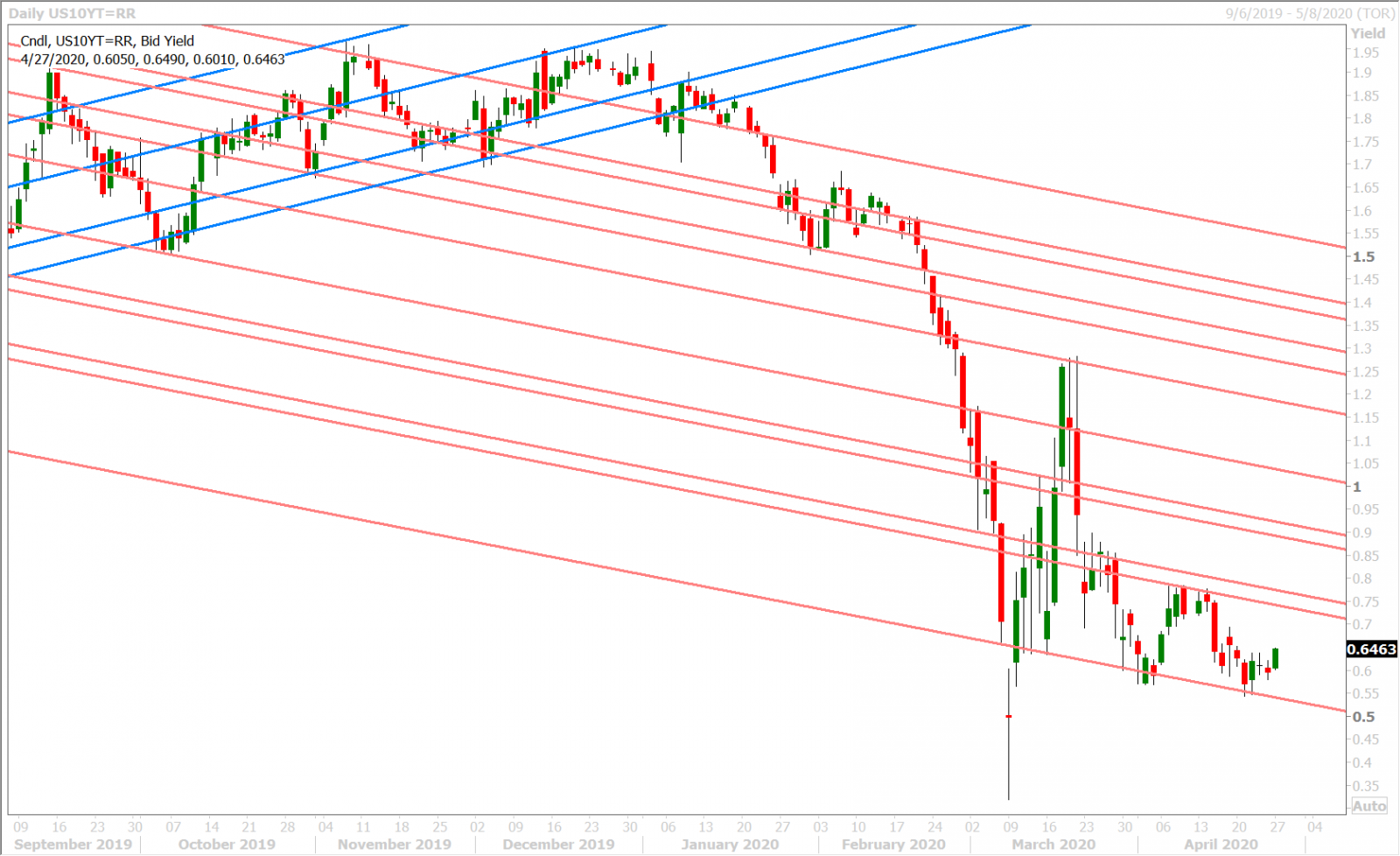

The Bank of Japan announced new monetary policy measures to try and help the Japanese economy last night. Warning that Japan was in an “increasingly severe situation”, the BOJ said it would buy an unlimited amount of JGBs going forward versus its current annual pace of 80trillion JPY. It will quadruple the amount of corporate bonds it buys, extend the duration of those buys to 5 years, and relax the rules around the commercial paper purchases that it makes. It removed “price momentum” from its forward guidance, suggesting that its near term focus will be to battle the coronavirus instead. Finally Governor Kuroda said "we won't hesitate to take additional monetary easing steps if needed," adding that interest rate cuts would be among options if the BOJ were to ease again.

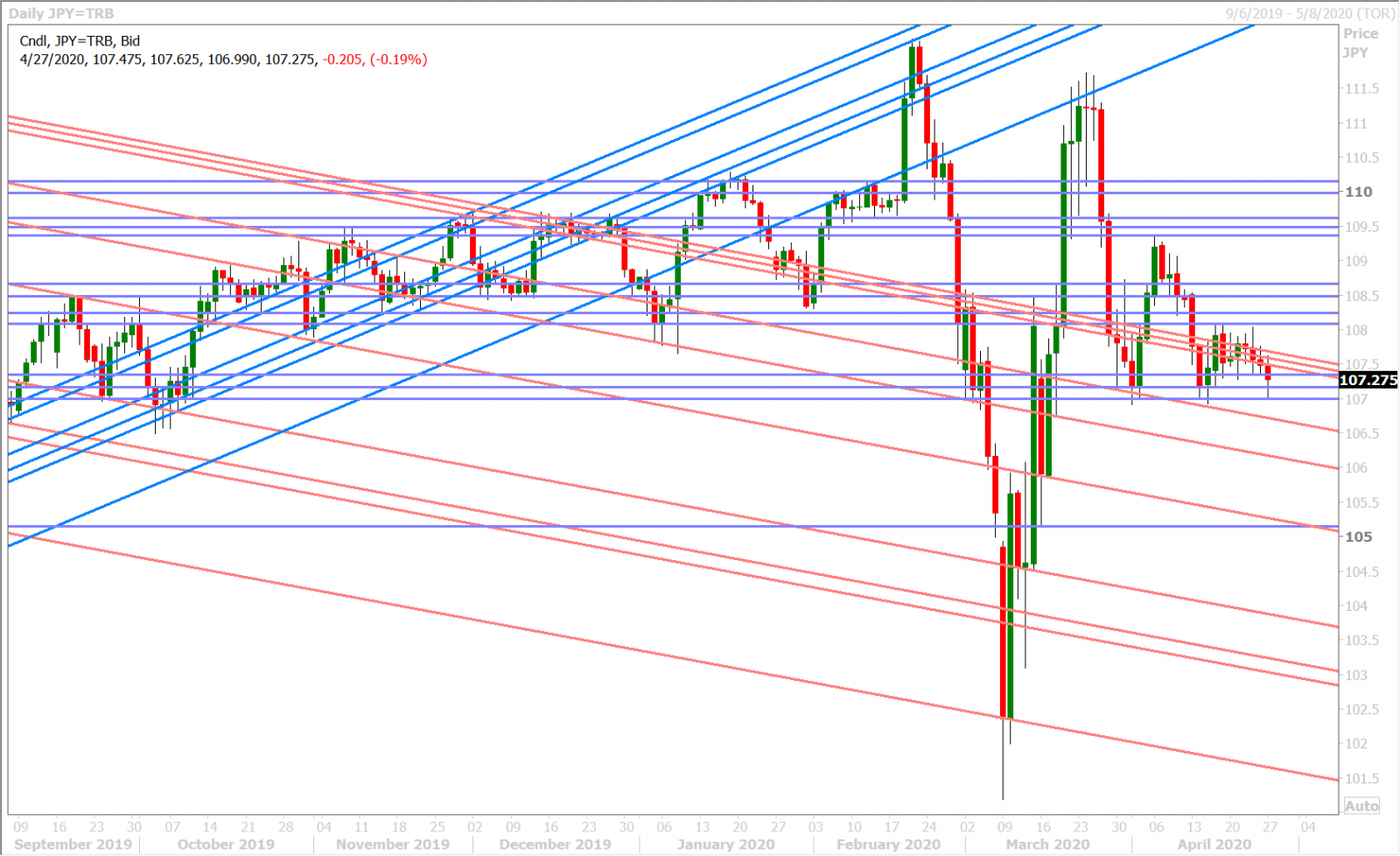

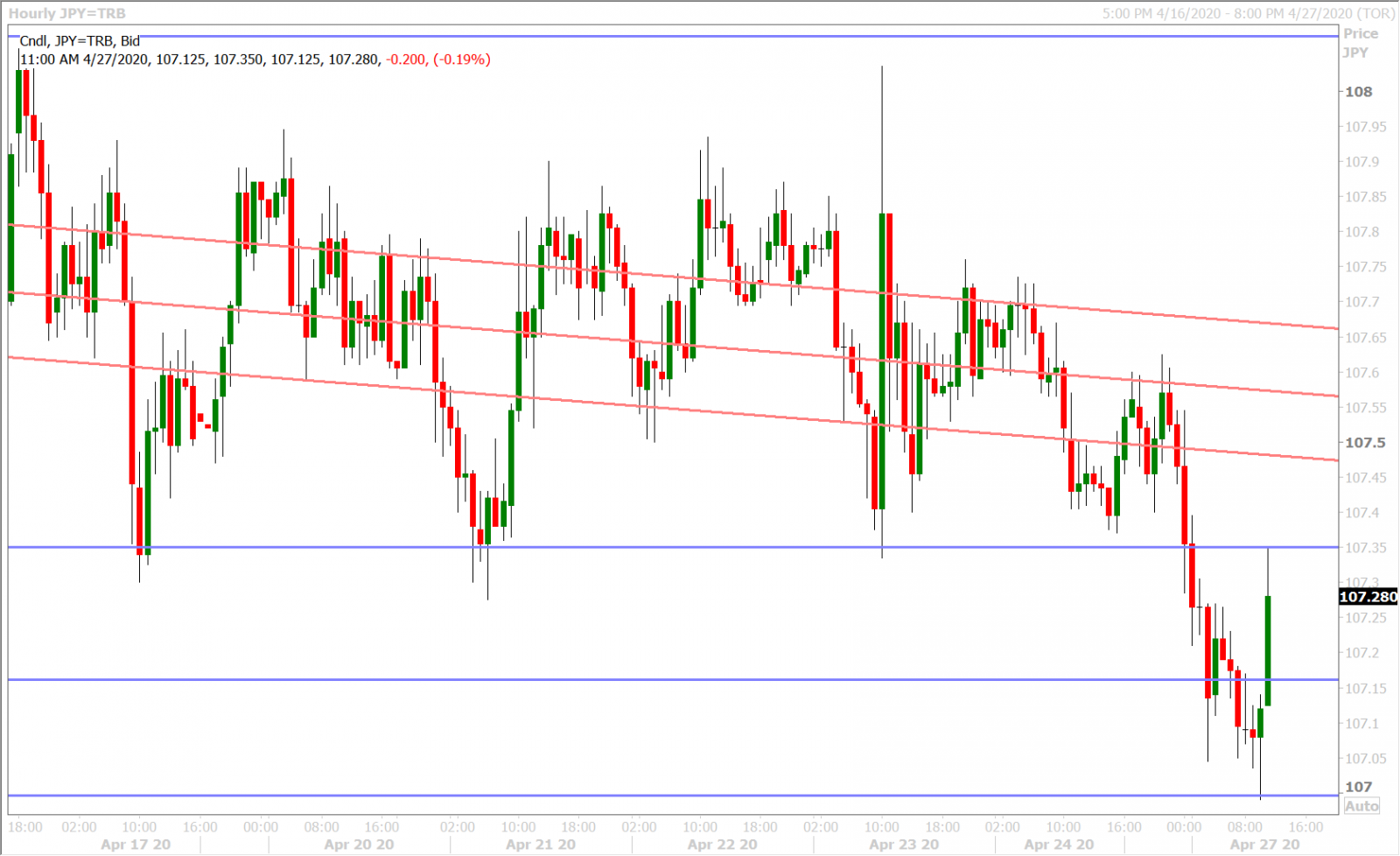

None of this monetary policy heroism has hurt the yen today though, which is probably driving the BOJ crazy. Dollar/yen broke chart support in the 107.30s last night when the news broke, which then allowed traders to make a bee line for some large option bets at the 107.00 level, which just expired at 10amET. We think it has also been hard for USDJPY traders to fight the broad, risk-on, USD sales we’ve witnessed overnight due to “lockdown easing hopes”.

Traders are now trying to buy and hold the 107.00 lows in USDJPY as the broader USD catches a bid into the release of the daily coronavirus statistics out of New York State.

USDJPY DAILY

USDJPY HOURLY

US 10 YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.