$USD broadly weaker in news heavy overnight session. US stocks, $JPY in focus. $EUR bid.

Summary

-

News heavy Asian and European sessions give traders multiple themes to trade on. USD now broadly weaker into NY trading.

-

AUD higher on stronger than expected Australian employment figures.

-

NZD crashes lower (-1.8%) as new coalition government is finally announced and it’s not what traders expected (NZ First Choice will team up with Labor and Green parties). National Party out after 9 years in power. Jacinda Ardern to become New Zealand prime minister.

-

EUR sees some volatility as Spain announces it will proceed with Article 155 of constitution (which will suspend Catalonia’s autonomy) but is now trading higher. Puigdemont fails to clarify position on independence.

-

GBP sees some selling on much weaker than expected UK Retail Sales.

-

JPY rallies strongly as the Nikkei makes a blow off top, S&Ps down 11, US yields retracing much of yesterday’s progress, precious metals higher too (now above yesterday’s NY range). Eerily, it’s also the 30th anniversary of Black Monday today.

-

Nothing earth shattering coming out of the 19th National Congress in China so far. PBOC’s Zhou says expansion of the Yuan trading band is not a focus right now. China’s GDP print comes in as expected (+6.8%). USDCNH has almost fully retraced last week’s selloff, but is running into resistance in the 6.63s.

-

Quiet trading for CAD again overnight as the action is elsewhere. Broader USD selling and cross flows are the drivers at this moment. Technicals still weighing on USDCAD. More CAD specific headline risk tomorrow with Cdn CPI and Retail Sales. Another option expiry being talked about again for today ($900mln at 1.2500). TD still likes short positions into the BOC policy announcement for next week.

-

US Phily Fed survey comes in at +27.9, slightly better than expected. Market yawns.

-

CME open interest changes 10/18: AUD -378, GBP -3285, CAD +2149, EUR -2115, JPY +9251

Currency Calendar

| Date | Releases / Holiday | Entity |

|---|---|---|

| October 19, 2017 | Employment Change s.a. (Sept) | AUD |

| October 19, 2017 | Unemployment Rate s.a. (Sept) | AUD |

| October 19, 2017 | GBP (YoY) (Q3) | CNY |

| October 19, 2017 | GBP (QoQ) (Q3) | CNY |

| October 19, 2017 | Retail Sales (MoM) (Sep) | GBP |

Bank holidays and impactful report releases for select countries.

By The Numbers: Daily FX Snapshot

USD/CAD - Canadian Dollar

Dollar/CAD continues to trade with a soft tone as the market breaks the 1.2490 level we mentioned yesterday. A second straight day of decent position accumulation in CAD futures is interesting to note. Resistance 1.2490-1.2510. Not much support at all underneath the 1.2450s, perhaps some at 1.2410 (the 38.2% Fibo at the Sep low to Oct high). The 1.2500 option expiry could be a bit of a magnet into 10am, but the hourly trend is now lower here. EURCAD is holding the 1.47s again today but GBPCAD sales continue for a third day now.

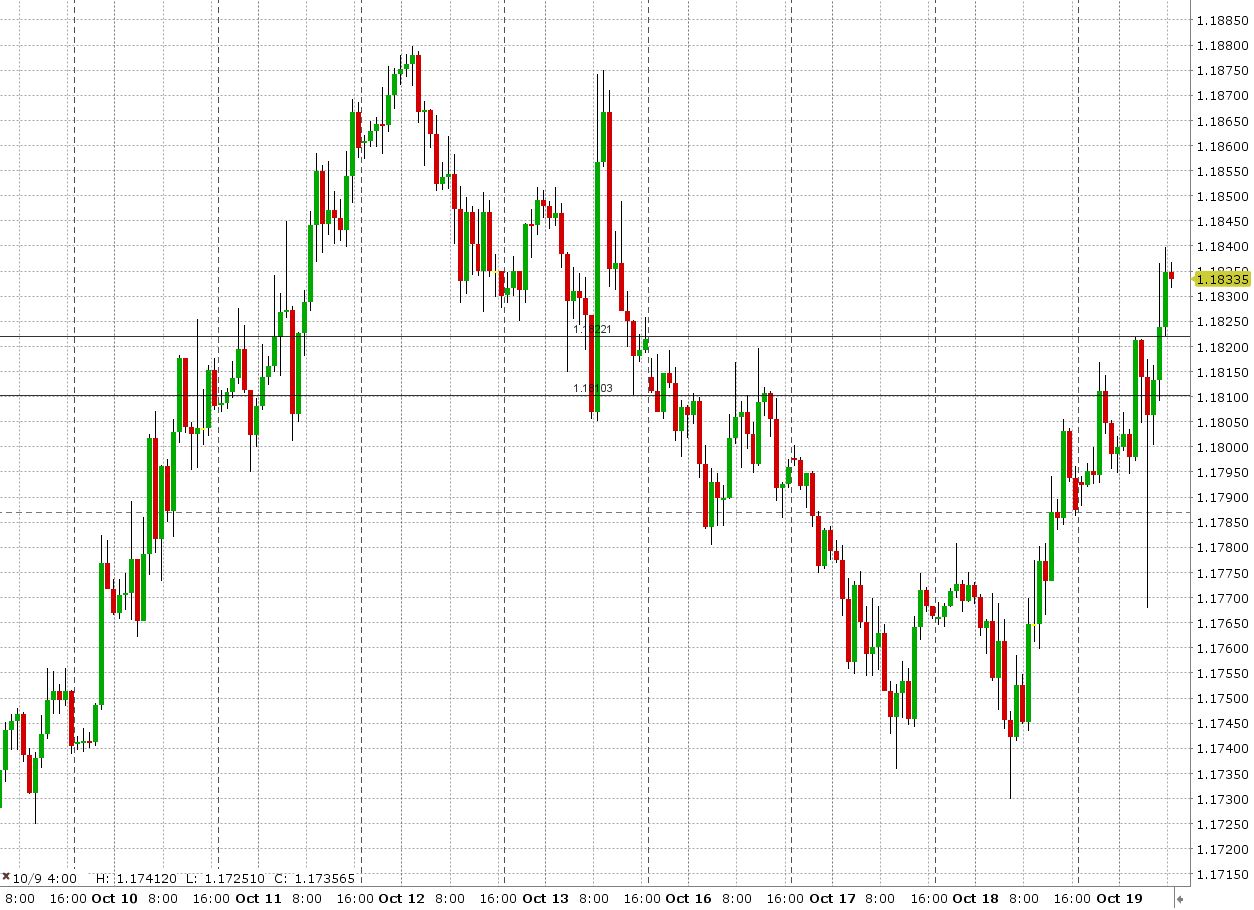

EUR/USD - European Central Bank Euro

The Euro’s ability to make a strong recovery on the Catalonia headlines early today is technically positive. Longs continue to hang in there. The bearish head & shoulder topping pattern erases itself if we rally back above 1.19. We’re calling it range-bound to higher today so long as the 1.1810-20 level holds. EURGBP flows supportive (Oct 12th’s bearish reversal getting cancelled). EURJPY technicals hanging in there despite the JPY rally.

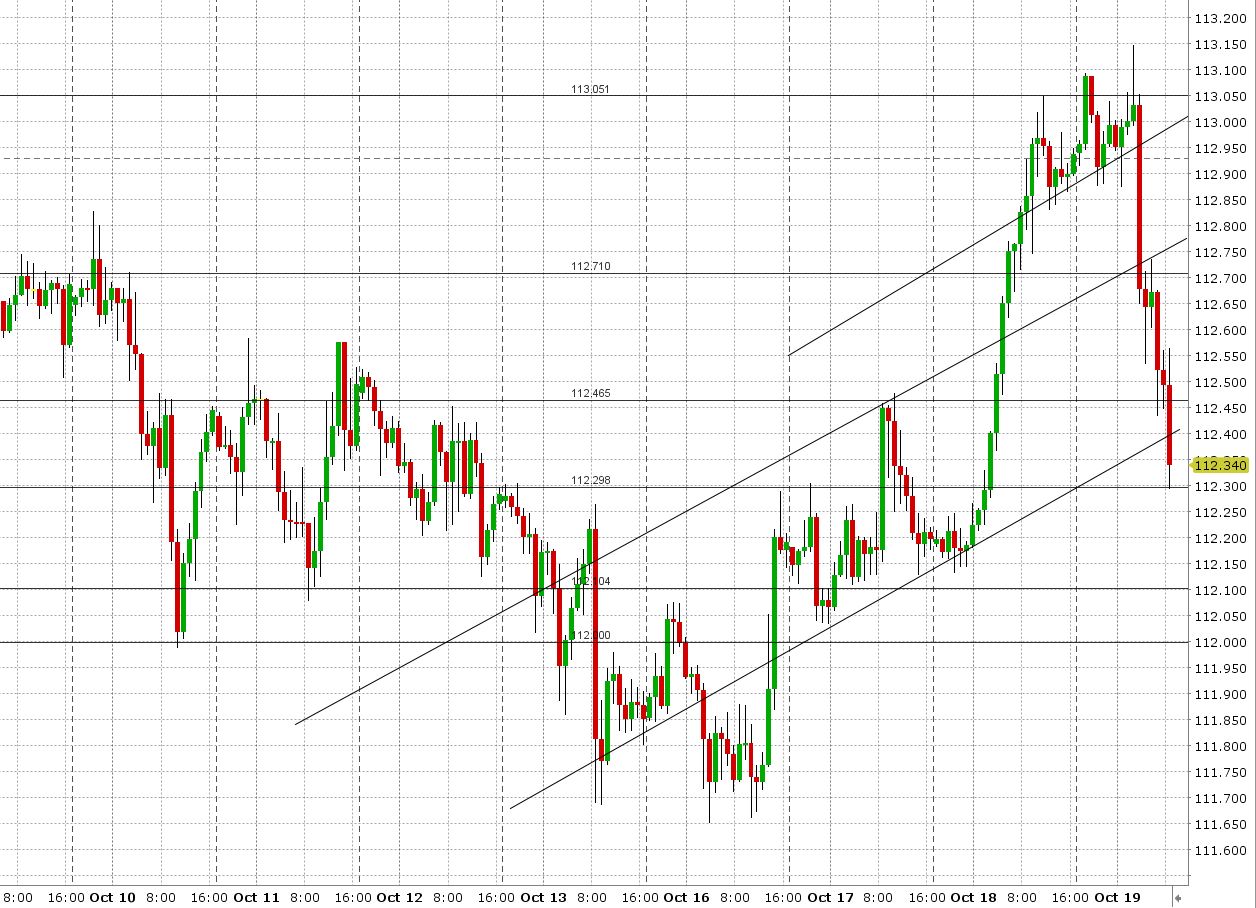

USD/JPY - Japanese Yen

Watch US stocks today as the JPY displays its safe-haven status yet again overnight. USDJPY is in the process of completely erasing yesterday’s gains (which is not great technically). Market toying with the 112.30-50 area (the level it broke out from yesterday). Next support 112-112.10. Recent longs could be bailing (over 9k contracts in positions added at CME yesterday (likely USD longs). Market needs to regain the 112.70s for bullish momentum to return.

Market Analysis Charts

USD/CAD Chart

EUR/USD Chart

USD/JPY Chart

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.