US yields, USDJPY breakout on House/Senate passage of US tax reform. USDCAD stalls on charts ahead of key Cdn data points. EUR, AUD and GBP holding gains in quiet trade.

Summary

-

ECONOMIC DATA UPDATE: US Housing Starts beat expectations yesterday, coming in at +1297k for November or +3.3% MoM. Today’s North American calendar is quiet, with US Existing Home Sales and Cdn Wholesale Trade data on tap, but these are not traditionally market movers.

-

UPCOMING CENTRAL BANK SPEAK: The BOE’s Governor Mark Carney will be speaking in UK parliament shortly, around 9amET. The Bank of Japan announces its monetary policy update early tomorrow morning and governor Kuroda will speak at a press conference at 1:30amET. The market is not expected any surprises here. The Bank of Japan is still uber dovish on monetary policy.

-

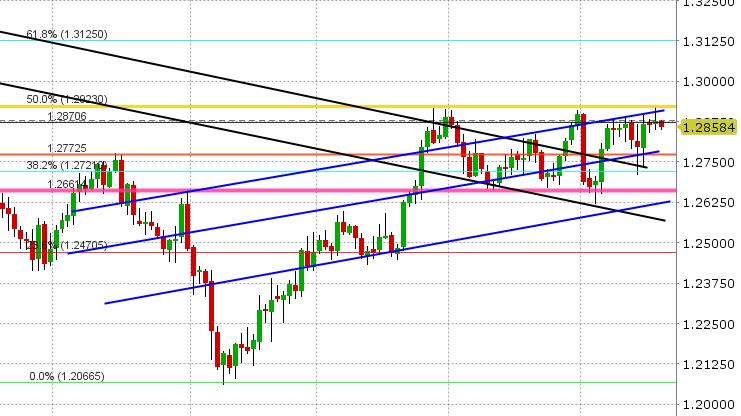

USDCAD: It was another quiet day for USDCAD yesterday, but we did get a technical development which was a bit negative. The market probed higher into the low 1.29s, but failed three to four times at key trend-line/Fibo chart resistance in the 1.2910-1.2920 region. The end result was a daily doji-candle, which means “indecision” according to market technicians. The good news is there hasn’t been much follow-through lower in overnight trade. EURCAD continues to hold gains very well, now sitting on top of recent trend-line resistance, and GBPCAD has regained the 1.72s again...which is positive backdrop for USDCAD so far today. The US/CA 2yr yield is a bit softer again today, now sitting at +25bp. Odds are USDCAD will be a mixed bag today given the slightly negative development on chart technicals when combined with supportive cross flows. We get two big Canadian data points tomorrow: CPI and Retail Sales.

-

AUDUSD: The Aussie continues to perform well, supported by improved chart technicals, rising base metal prices, widening short term interest rate differentials, and a massive option expiry widely reported at 0.7700 on Friday. The market is testing the same trend-line resistance that has been capping prices all week (the slope now comes in at the 0.7670-80s). Support comes in at 0.7655-0.7665, with even better support at 0.7640-0.7650 (weeklies). Reuters is reporting that Friday’s 0.7700 option expiry has grown to $2.5bln AUD notional.

-

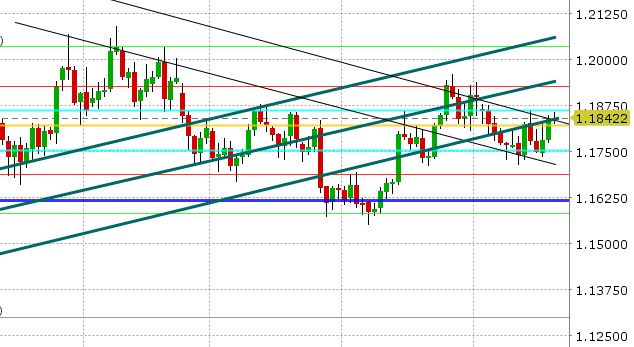

EURUSD: The Euro staged an impressive rally yesterday, despite better than expected US Housing Starts and a breakout higher in US yields. We continue to believe excessive bearishness to start the week and cross buying in EURGBP and EURJPY has played a part too in supporting EURUSD so far this week. Yesterday’s close was positive technically, but the market is now dealing with thicker chart resistance now (1.1830-1.1860, where two trend-line resistance levels converge with a Fibo level). See chart. Support today lies at 1.1810-1.1820. The US/GE 10yr yield spread is steady at +207bp (as Bund yields surged yesterday too). EURJPY has broken out of its recent trend-line channel to the upside, and now looks poised to make new swing highs. EURGBP punched above 0.8850 yesterday. All in all, it’s been a very positive 48hrs for EURUSD on the charts, which is leading us to call the market range-bound to higher now. The Dec 4th Sunday opening gap remains unfilled at 1.1880-1.1900.

-

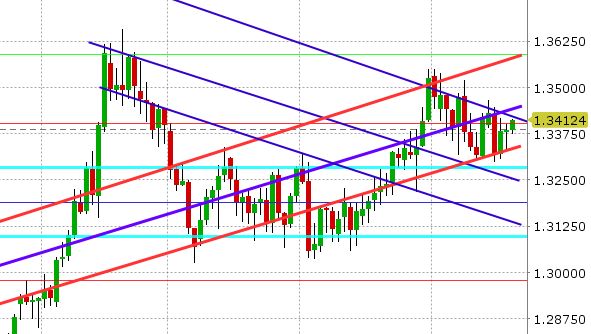

GBPUSD: It was a bit of a shaky day for sterling traders yesterday, as GBPUSD traded down to trend-line support yesterday (1.3330s) on some broad based USD buying post US Housing Starts, but the market bounced confidently off of it yet again. There’s not much market chatter behind the move, but we cannot ignore the market’s ability to find buyers twice so far this week at key support. The chart technicals have improved yet again as we enter NY trade above the 1.34 handle. Resistance today comes in at 1.3420-1.3430. Support 1.3360-1.3370.

-

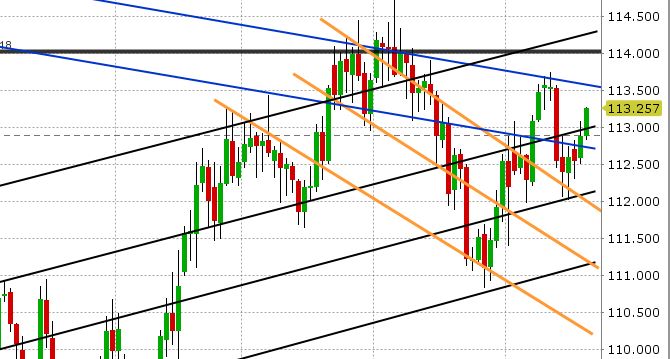

USDJPY: Dollar/yen has been a big winner in the last 24hrs, as US yields surged back into the 2.40s yesterday. The passage of US tax reform yesterday in the US House of Representatives was a key driver of US yields, and rates continue higher this morning as the US Senate passed the tax bill overnight as well. All of this is bullish USDJPY and so the market has surpassed resistance in the 112.80-113 quite easily. Next resistance is 113.40-50. Support today lies at 113.10. The BOJ meets tonight/early tomorrow morning.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.