US Q3 Advance GDP beats expectations. BOC, FED and BOJ meetings loom.

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- US Q3 Advance GDP +1.9% vs +1.6% expected. USD bid broadly into NY open.

- Bank of Canada interest rate decision at 10amET. Press conference at 11:15amET.

- Fed interest rate decision at 2pmET. Press conference at 2:30pmET.

- Traders expect no change from BOC, 25bp cut from the Fed, optimistic tones from each.

- UK elections now confirmed for Dec 12. Sterling traders finding comfort with Tory lead in polls.

- Australia reports in-line CPI for Q3. RBA still expected to stand pat on Nov 5.

- Bank of Japan meets tonight. More dovish tones expected, but no change to monetary policy.

ANALYSIS

USDCAD

Dollar/CAD gave back a third of yesterday’s US/China headline-driven gains in London trade this morning as FX traders refocus on some positives out the UK, namely the fact that Boris Johnson finally got his Dec 12th election date with none of the caveats that Jeremy Corbyn proposed. That being said, market participants are now digesting some better than expected US economic data at the start of NY trade:

US ADP Employment (Oct): +125k vs +120k expected

US Advance GDP (Q3): +1.9% vs +1.6% expected

Next up is the Bank of Canada’s interest rate decision and Monetary Policy Report at 10amET, followed by a press conference from Stephen Poloz at 11:15amET. Markets are expecting no change to interest rates and an upbeat tone on the state of the Canadian economy and global trade conditions. After this we’ll get the FOMC meeting at 2pmET, followed by a press conference from Jerome Powell at 2pmET. Markets are expecting a 25bp cut to interest rates and a hawkish tone on the state of the US economy given slight improvements to the US/China trade war, the Brexit situation, and the US yield curve. We still do wonder however how the Fed is going to explain their now constant intervention in US money markets via repo and T-bill operations; what the street is jokingly calling “Not-QE”.

The overnight options straddle is pricing in a 65pt range for USDCAD in today’s trade, which doesn’t seem like a whole lot of price volatility. The key levels to watch today are the 1.3050s to the downside, the 1.3100-1.3115 zone to the upside, and the 1.3130-50s should we break above that. Yesterday’s daily candle close for USDCAD was a bullish outside day, which rests in the back of our minds as well, but we’re a little apprehensive to give this much credence ahead of today's event risks.

USDCAD DAILY

USDCAD HOURLY

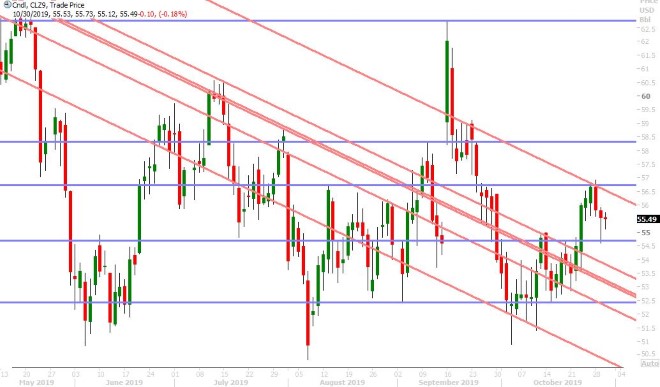

DEC CRUDE OIL DAILY

EURUSD

Euro/dollar scaled trend-line chart resistance in the 1.1120s during overnight trade and it’s pulling back a tad now as traders digest the better than expected ADP Employment and Advance Q3 GDP numbers out of the US. The focus will now turn to today’s FOMC meeting, where they Fed is expected to cut interest rates again but deliver a hawkish tone on the outlook.

The overnight options straddle is pricing in just a 45pt range for EURUSD today, which feels a bit anti-climactic. We think Jerome Powell may have a little bit of a “see…I told you so” tone today if he chooses to reference today’s GDP number, the Phase 1 US/China trade deal, the removal of no-deal Brexit risk, and the steepening of the US yield curve with his “the economy is in a good place” tagline. The key levels to watch today are the 1.1070s to the downside, and then the 1.1145-60 zone to the upside (above which there is not much chart resistance). We don’t think the market is positioned whatsoever for some sort of dovish or cautious surprise. We think EURUSD would surge higher in such a scenario.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

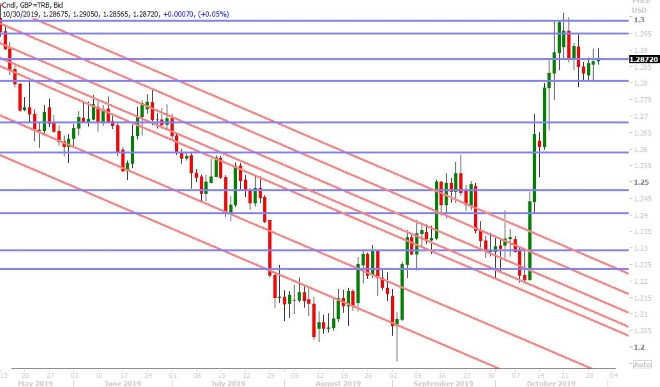

GBPUSD

Boris Johnson has finally secured approval of his election bill, which means the Brits will now go to the polls on December 12th. This came after Jeremy Corbyn’s amendments to allow a lower voting age and EU “settled status” citizens to vote were voted down. Sterling traders appear to be liking the news for now because Johnson’s Tory party is leading in the polls and should they win more seats on Dec 12th, it will be easier for the government to finally pass the Brexit Withdrawal Agreement Bill. Reuters is reporting a huge 1.2900 option expiry for GBPUSD on Friday, which is something to take note of given its proximity to spot prices right now.

The key levels to watch in GBPUSD ahead of the FOMC meeting are the 1.2810s to the downside and the 1.2950s/1.2980s to the upside. We think sterling will trade off the broader USD tone following the meeting. The EURGBP continues to hold the 0.8600 handle despite the approval of the election bill.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar is pulling back from its overnight highs as traders bid up USD across the board following the better than expected US data out this morning. The beat on US advance GDP for Q3 was the real feature, with personal consumption growing +2.9% vs +2.6% and accounting for 100% of growth for the quarter (+0.35% growth in government spending offset declines from trade, fixed investment and inventories). Last night’s Q3 CPI data out of Australia was reported in-line with expectations (+0.5% QoQ and +1.7% YoY). The OIS market is not pricing any additional rate cuts from the RBA, when it meets again to decide monetary policy next week on Nov 5th. The key levels to watch for AUDUSD ahead of the Fed are the 0.6830s to the downside and the 0.6870-90s to the upside.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Traders continue to toy with the upside breakout we talked about in USDJPY earlier this week, but it appears they want hawkish confirmation from the Federal Reserve first. We think a more positive than expected tone from the FOMC meeting today could do the trick and we think a more dovish than expected Bank of Japan (which meets tonight) could add fuel to the fire. The fund community is very much re-positioned for more upside here in USDJPY.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.