US/China trade sentiment deteriorates further. BOC's Wilkins shocks market.

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

The upside break-out in dollar/CAD has been back on since mid-day yesterday. It all started with seller failure at chart support in the 1.3180-90s despite some better than expected Canadian Manufacturing Sales data. A weak corporate earnings report from Home Depot then knocked equity futures lower, and the crude oil selling that correlated with that “risk-off” move saw USDCAD regain 1.3200. Tough talk from Trump on US/China and banter that the Russians have no serious intentions of cutting oil production further right now then saw oil prices fall precipitously down 3% to the $55 mark, and before we knew it USDCAD traded back to familiar trend-line resistance in the 1.3220-30s. A shockingly dovish speech from Bank of Canada deputy governor Wilkins around the 1pmET hour then lit a fire under the market. The key headlines were the following:

WHILE THE POLICY RATE MAY BE LOW AT 1.75%, THERE IS STILL ROOM TO MANEUVER; BANK ALSO HAS OTHER OPTIONS SUCH AS EXTRAORDINARY FORWARD GUIDANCE AND LARGE-SCALE ASSET PURCHASES TO HELP ECONOMY WEATHER POTENTIAL STORMS

"THE GLOBAL CONTEXT HAS WORSENED, INCREASING RISK TO GLOBAL EXPANSION AND CHANCES OF FINANCIAL STRESS THAT COULD SPILL OVER INTO CANADA."

Boy...are they getting cautious at the Bank of Canada! This is not what the USDCAD fund short position wanted to hear in our opinion, and so we’d posit some of the screeching rally up to the 1.3260s yesterday was this crowd “throwing in the towel”. Yesterday’s NY close was very bullish, technically speaking, and has allowed the market to benefit very easily from another broad wave of “risk-off” during the overnight session. The mood soured in Asia after the Chinese threatened “forceful measures” in retaliation for the US Senate voting unanimously in favor of the House of Representative’s Hong Kong Human Rights Bill. Chinese Global Times editor Hu Xijin didn’t help matters with this tweet at the start of European trade:

“Few Chinese believe that China and the US can reach a deal soon. Given current poor China policy of the US, people tend to believe the significance of a trade deal, if reached, will be limited. China wants a deal but is prepared for the worst-case scenario, a prolonged trade war”.

The broad USD buying continued and allowed USDCAD to then quickly blow past the 1.3300 chart resistance level, and we saw December Bank of Canada rate cut odds trade back up to 26% at one point. We’ve since seen some selling come in this morning however as traders lightened up ahead of the Canadian CPI report for October, and we’re now seeing them sell a little bit more following the report (which met expectations on both the headline and core measures). We think USDCAD buyers need to confidently show up now on any dips down to the 1.3270s if they are to respect yesterday’s bullish upside breakout. A NY close below this level would be hugely disappointing.

USDCAD DAILY

USDCAD HOURLY

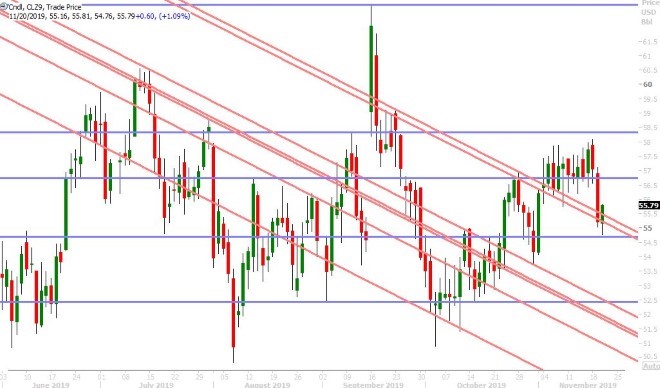

DEC CRUDE OIL DAILY

EURUSD

Euro/dollar is slipping back to chart support in the 1.1050s this morning after the overnight “risk-off” mood saw US 10yr yields fall further, this time below the 1.75% level. We would say today’s risk-off mood is “mild”, because it hasn’t hurt equity futures all that much, and gold prices are actually trading well off their session highs. Had the headlines hurt stocks significantly and spurred gold prices higher, we might have been talking about a higher EURUSD this morning. We think the market will tread water here ahead of the FOMC Minutes later today at 2pmET.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

We grabbed our popcorn yesterday to watch Boris Johnson and Jeremy Corbyn go at it in the first televised debate of the 2019 UK election campaign, and while we felt the PM performed much better than the Labour leader, a YouGov poll released right afterwards said otherwise (showing it was a draw, according to 1,646 viewers). More here. If we combine this slight disappointment with some other polls showing the Tories now just 12pts ahead of the Labour Party (vs 14pts earlier this week), it’s not surprising to see GBPUSD a little weaker again today. Chart support today resides in the 1.2870s while resistance is 1.2910-20.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie has been following the broader “risk-off” theme in the overnight session. Off-shore dollar/yuan’s breakout above the 7.0300 level led broad USD strength in Asia and the quick pop above 7.0400 in London trade provided the negative catalyst for AUDUSD's fall back below 0.6815. The chart technicals have become a tad mixed here and so we think the market will be content to wait for the release of the FOMC Minutes later this afternoon.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen has been hanging in there over the last 24hrs, despite an even lower US 10yr bond yield and a US/China trade narrative that is now obviously getting worse. Over 1lbnUSD in option expiries this morning, between the 108.50-65 strikes, appear to be stemming the selling for now. We wonder how this all changes after 2pmET today. The FOMC Minutes are expected to show a Fed reinforcing its “on-hold” policy, but you never know how the wire headlines will be written for the algos. Tomorrow morning could be interesting, if USDJPY closes NY today below back below 108.50, because a boat load of options (5blnUSD) will be expiring between 108.20 and 108.50.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.