Trading algos fall for positive US/China trade headlines overnight

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

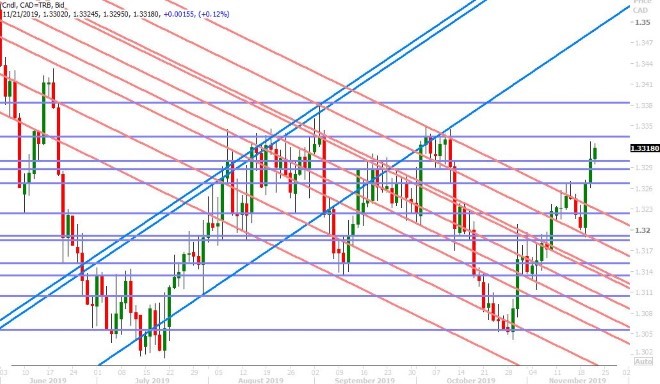

USDCAD

The bulls defended the upside breakout in USDCAD yesterday by closing the market above the 1.3300 mark. This gave the market technical strength, in our opinion, to withstand some of the “risk-on” type headlines we’ve since seen in the overnight session today.

China’s top negotiator “cautiously optimistic” about reaching a phase one trade (Bloomberg)

China Commerce Ministry says “it will strive” to reach a phase one trade deal (Reuters)

China invited US negotiators for further talks last week (WSJ)

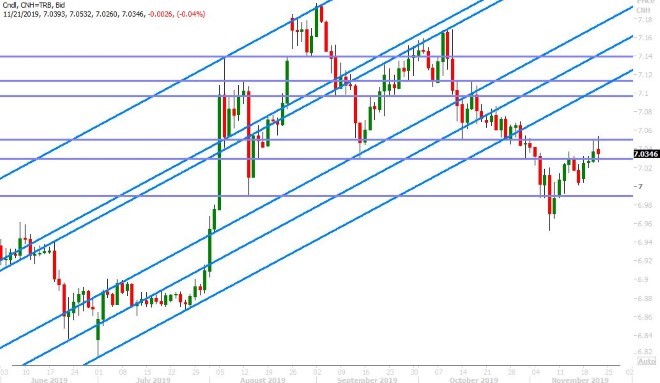

The trading algorithms are laughably falling for all of this yet again, with the S&P futures now pretty much back to break-even on the session and the US 10yr bond yield now re-challenging the 1.7550% level it broke down below yesterday. The broader USD reaction to the headlines has been mixed to weaker, depending on where you look. Off-shore dollar/yuan (USDCNH) has reversed notably lower after rejecting the 7.05 handle earlier in Asia.

The North American session has kicked off now with some rather hawkish sounding ECB Minutes in our opinion. More on this below. The US just reported its November Philly Fed survey at 10.4 vs 7.0 expected. The Fed’s Loretta Mester is now speaking in Cleveland and the Bank of Canada’s Stephen Poloz is now giving a speech in Toronto. USDCAD bulls may have some fighting to do today if broad USD sales intensify. Perhaps Poloz can keep the rally intact with some more dovish tones?

USDCAD DAILY

USDCAD HOURLY

JAN CRUDE OIL DAILY

EURUSD

We’re waking up to some hawkish headlines from the ECB this morning. The Minutes of the October 24th policy meeting were just released and we would note the following as rather EUR bullish:

ECB SAYS WIDE AGREEMENT THAT MORE INFO NEEDED TO REASSESS INFLATION OUTLOOK, IMPACT OF ECB MEASURES

ECB SAYS MEASURES SHOULD BE ALLOWED MORE TIME TO UNFOLD; EXPRESSES CONFIDENCE THEY WILL SUPPORT INFLATION

ECB SAYS PLEA WAS MADE FOR PATIENCE, "WAIT AND SEE POSTURE"

Translation? Christine Lagarde’s ECB ain’t doing anything more right now. EURUSD has extended its gold-driven bounce from yesterday to challenge trend-line chart resistance in the 1.1090s. The bounce in gold prices, the fall in US yields and the threat of more intense risk-off flows from the US/China narrative has really saved EURUSD since November 14th in our opinion, and we think any further hawkish tones out of the ECB (which we haven't heard in a long time) will continue to be celebrated by the market.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling shot higher around the 7amET hour this morning after an Ipsos Mori poll showed the Tory party regaining a 16-point lead over the Labour Party. With Tuesday’s chart resistance level around the 1.2940-50s now finally giving way (buyers failed twice earlier today), we think GBPUSD now has the upside momentum to re-challenge October’s highs in the 1.2980s.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie has benefited from the positive US/China trade headlines we’ve seen in overnight trade, but the market has yet to reclaim the 0.6815 level it fell below after yesterday’s “risk-off” move into the London close. The headline which drove that move yesterday was a Reuters piece saying the phase one China trade deal “may not be complete by year-end”. As we write, traders are now digesting an new article just released from the South China Morning Post (which sounds a little positive and negative at the same time). More here. Some broad USD buying has now emerged into NY trade.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen traders look like they don’t know what to do this morning, and for good reason in our opinion. The US/China trade headlines flow constantly now and they keep switching from positive to negative, and vice versa. We think FX dealer delta hedging around the massive slate of option expiries this morning (5blnUSD between 108.20 and 108.55) is also another reason why we’ve seen a halt to downside momentum for the moment.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.