Ten Chinese cities totaling 30 million people now on lockdown

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- More negative coronavirus headlines spurs small “risk-off” USD buying wave in London trade.

- EURUSD can’t break above 1.1060 following German flash PMI beat. Eurozone flash PMI miss doesn’t help.

- Bank of England rate cut odds for January 30th barely move (50/50) despite UK flash PMIs beating expectations.

- RBA rate cut odds for February 4th fall sharply to just 29% following Aussie jobs beat, but not helping AUDUSD.

- Canadian Retail Sales for November come in mixed. Headline +0.9% MoM vs +0.4% but core +0.2% MoM vs +0.4%.

- US flash PMIs for January up next, 52.5 expected on Manufacturing, 52.9 expected on Services.

- WHO stops short of declaring international emergency yesterday, but risk proxies showing nerves ahead of the weekend.

ANALYSIS

USDCAD

Dollar/CAD pulled back off its new 1.3070-1.3170 range highs yesterday following the WHO press conference and it’s now whipping around with a sideways tone after Canada reported an arguably mixed Retail Sales report for November. The headline figure beat expectations (+0.9% MoM vs +0.4%) but the core ex-autos measure missed (+0.2% MoM vs +0.4%). The US flash PMIs for January will likely get some play shortly, but we think broader risk sentiment surrounding the worsening coronavirus situation in China will set the tone for USDCAD going into the weekend.

USDCAD DAILY

USDCAD HOURLY

MAR CRUDE OIL DAILY

EURUSD

The German flash PMIs for January beat expectations this morning while the Eurozone PMIs came in marginally weaker on the whole. Details below. The combination of these two European data points made for a feeble attempt by traders to break EURUSD above yesterday’s NY highs at 1.1060, which we think then invited the sellers back in. Broad “risk-off” USD demand (led by USDCNH strength) also appeared to be a factor leading to the subsequent EURUSD selling we saw in early London trade today as more scary coronavirus headlines continued to circulate. Over 800 people are now infected in China; 25 people have died, and 10 cities with a combined population of 30 million (almost the size of Canada!) is effectively on lockdown.

All this being said, we’re starting to see signs of “seller failure” emerge at yesterday’s trend-line support level in the 1.1030s as NY trade gets underway. We think a bounce for EURUSD could be in order today if the US flash PMIs for January disappoint.

German Manufacturing Flash PMI: 45.2 vs 44.5 exp and 43.7 prev

German Services Flash PMI: 54.2 vs 53.0 exp and 52.9 prev

German Composite Flash PMI: 51.1 vs 50.5 exp and 50.2 prev

Eurozone Manufacturing Flash PMI: 47.8 vs 46.8 exp and 46.3 prev

Eurozone Services Flash PMI: 52.2 vs 52.8 exp and 52.8 prev

Eurozone Composite Flash PMI: 50.9 vs 51.2 exp and 50.9 prev

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

We think everybody was hoping that this morning’s UK flash PMI data for January (whether the numbers were good or bad) would resolve the coin-flip rate cut odds for next week’s Bank of England meeting. The numbers turned out to beat expectations across the board (details below) but unfortunately nothing materially changed in the OIS market for January 30th pricing, leaving the sterling traders who bought the headlines feeling a bit disappointed we feel. If we combine this subdued OIS market reaction with the “risk-off” driven demand for USD around the 4amET hour, we think this largely explains GBPUSD’s swift move lower in early London trade today.

Similar to EURUSD though, we’re now seeing “seller failure” start to emerge at chart support in the 1.3080s and we think GBPUSD could bounce here as well if the US flash PMIs for January miss expectations.

UK Manufacturing Flash PMI: 49.8 vs 48.9 exp and 47.5 prev

UK Services Flash PMI: 52.9 vs 51.0 exp and 50.0 prev

UK Composite Flash PMI: 52.4 vs 50.6 exp and 49.3 prev

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

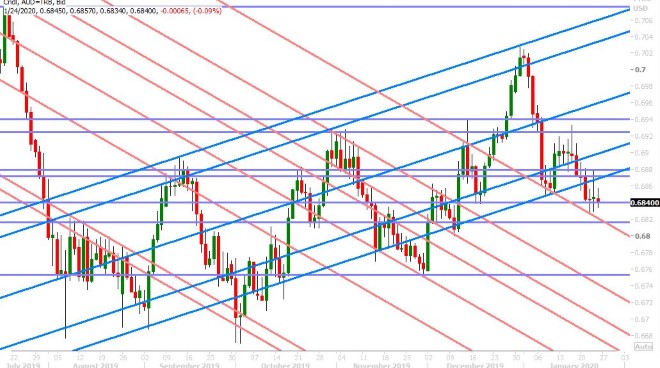

AUDUSD

Reserve Bank of Australia rate cut odds for February 4th have collapsed precipitously down to 29% in the last 24hrs, in the wake of yesterday’s sold Australia employment report for December. A number of the big Australian banks, including Westpac, have now removed their rate cut calls as well. None of this is helping the Aussie however as coronavirus fears continue to mount. We think the only thing holding up AUDUSD right now is the fact that USDCNH continues to struggle to hold gains above the 6.9310-30 resistance level. Is this technical development producing a false sense of calm for now? Perhaps. We think pre-weekend risk sentiment will be the dominant driver for AUDUSD today. Will traders want to be long risk assets, and risk-proxies like AUD, going into a weekend where the coronavirus situation could get worse?

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

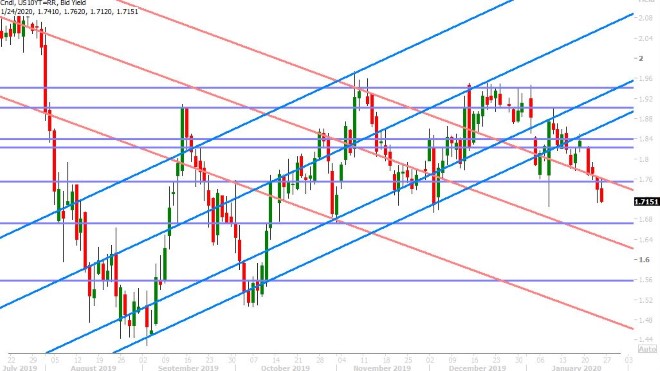

What a week it’s been for dollar/yen. Last week ended with tons of optimism for USDJPY following the US/China phase one deal signing, but there was no serious push to get the market above chart resistance in the low 110s. Recall our warning here from January 17th: “we’d make the argument that the market should be demonstrably higher than this by now, given Monday’s break above key weekly chart resistance in the 109.60s. We think the longer the market meanders just above the 110 figure without another push higher will make it vulnerable to reversing lower”. Sure enough, that’s what we’ve seen this week. While nobody could have predicted the coronavirus outbreak we’re now seeing unfold, we continue to be firm believers in the ability for chart technicals to foretell fundamentals narratives and the USDJPY structure was leaning negative coming into all this.

The World Health Organization stopped short of declaring an international emergency yesterday, leading US yields and USDJPY to bounce off their lows, but everyone knows that this assessment could change on a dime as more data gets reported from countries with reported cases of infection. We think today’s NY close for the popular risk proxies will be very important. We’re headed into the weekend portion of the Chinese New Year holiday where nothing can trade but a whole can go wrong.

USDJPY DAILY

USDJPY HOURLY

GERMAN 10YR BUND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.