Sterling sales leading USD bid to start week. Big night for AUD traders ahead. USDCAD traders eyeing chart resistance.

Summary

-

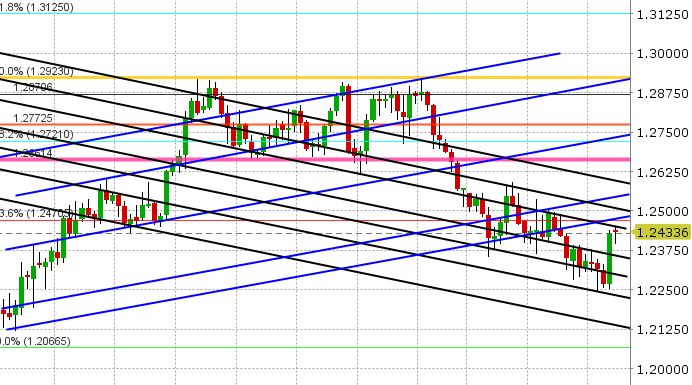

USDCAD: Dollar/CAD continues to consolidate Friday’s NFP and Trudeau driven rally. We saw some buying re-emerge at the 1.24 level in early European trading and that’s stemming mostly from some GBP led, USD buying after the release of a weaker than expected UK Composite PMI number for January. The key today is how USDCAD responds to overhead chart resistance between 1.2450 and 1.2475. While Friday’s rally was a relief for USDCAD bulls, the market is still in a pronounced downward trend and these resistance levels need to give way to start deterring sellers in our opinion. We may get a catalyst today with Jan US Services ISM at 10amET. GBPCAD is looking a little heavy this morning after the UK numbers, and EURCAD looks capped at trend-line resistance for the moment. We’ll get some Canadian data this week as well, with Dec Building Permits on Wed, Dec Housing Starts on Thurs, and the Dec Employment Report on Friday. We feel USDCAD will drift range-bound to higher for the moment, driven by Friday’s momentum shift higher. Support today checks in 1.2390, then 1.2360.

-

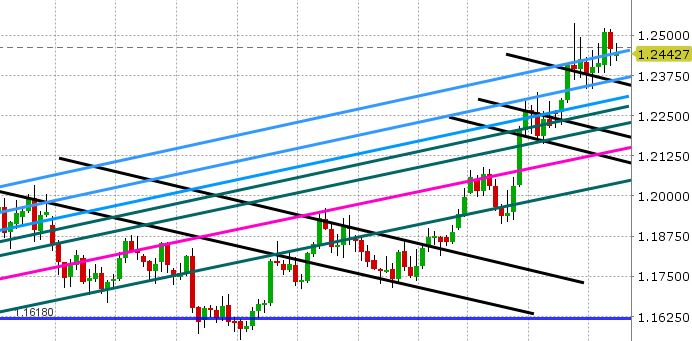

AUDUSD: The Aussie came off around the same time as GBPUSD did in early European trading as there hasn’t been much to trade off of so far today. While the early Asian bounce off trend-line support at 0.7890 and the recovery back above 0.7910 is mildly positive, there’s been much damage to the chart after Friday’s NFP plunge lower, and so we see AUDUSD in a bit of a range bound here, with 0.7960 resisting. Up next is US Services ISM and then a very important overnight session ahead where we’ll get the Aussie trade balance, retail sales and of course the RBA rate announcement at 10pmET. Markets are not expecting a change to interest rates, but traders will be focused on Governor Lowe’s inflation outlook, especially given the weaker than expected CPI that was reported last week. Copper is surprisingly steady today (up +0.4% actually), despite the global equity sell off. Reuters is reporting a large option expiry at 0.8000 for tomorrow’s NY cut (1.1bln AUD rolling off), would could attract price in our opinion if 0.7960 is taken out.

-

EURUSD: The Euro continues to hug trend-line support at 1.2430-1.2440 in the aftermath of the impressive US jobs numbers on Friday. Eurozone Retail Sales was reported in-line with consensus earlier (+1.9% YoY in Dec). Next up is US ISM at 10amET, then Mario Draghi presents the ECB annual report before the EU Parliament at 11amET. We feel EURUSD could be a mixed bag today with the broad USD bid underway and EURJPY sales as drags, while USDCNH sales and EURGBP purchases support. Should the current EURUSD support level give way, we see further support at 1.2410-1.2420, then 1.2370. We expect to see a resumption of the rally should resistance in the 1.2475-80 give way.

-

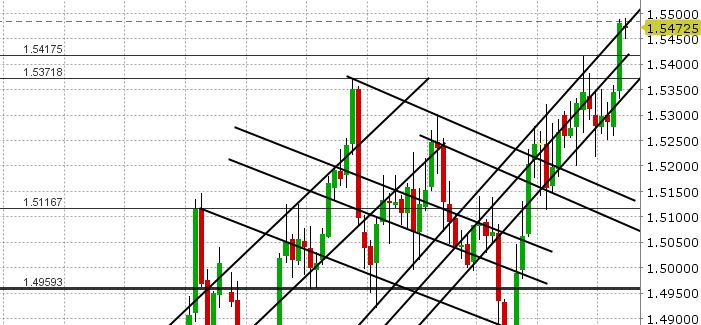

GBPUSD: Sterling is the biggest mover during European trading, as it tried to regain the 1.4120-30s after Friday’s rout, but failed miserably when the UK Composite PMI was released at 4:30amET. The January figure was reported at 53.5 vs. expectations of 54.6. With that, selling ensued and we traded straight down into the next trend-line support area (1.4030-40). Should this level give way, we see further support at 1.4010, then the 1.3970s. Selling seems to be taking a pause for the time being though as traders await US Services ISM at 10amET (56.6 expected). Watch out for Brexit headlines this week as well as negotiations resume. The BOE meets Thursday.

-

USDJPY: Dollar/yen benefited handsomely from the stellar US jobs report on Friday, and while we’ve pulled back a bit here to start the week, we’re still trading above the 109.60-70 resistance level that the market broke out from (which is positive technically speaking). Some are attributing today’s JPY bid to the global equity sell-off (that looks like it might continue today). Resistance today checks in at 110.25-110.40. The latest read on futures positioning from the CFTC shows the net USD long (JPY short) position reducing slightly in the week ending Jan 30th, but this was largely on the back of new USD shorts (JPY longs), not USD long liquidation (JPY short covering). This tells us that the market amazingly still wants to be long USDJPY and that even a move down to the low 108s doesn’t scare these traders. Odds are these traders are feeling emboldened now as USDJPY is back at 110.

The EBC Trading Desk is now on Twitter @EBCTradeDesk. Stay tuned for real-time news, commentary and analysis throughout the trading day!

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

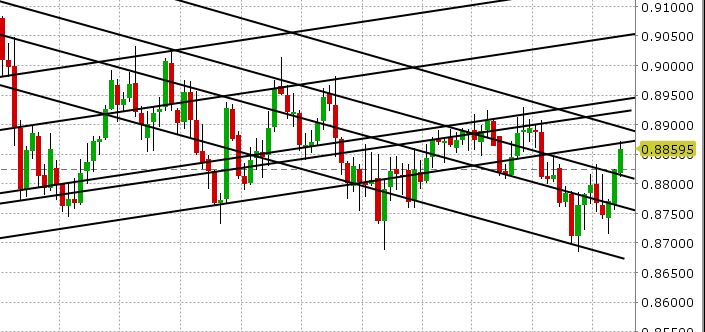

EUR/USD Chart

GBP/USD Chart

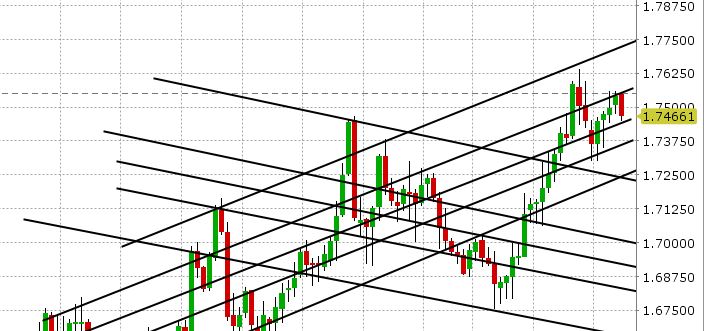

USD/JPY Chart

EUR/GBP Chart

USD/CNH Chart

GBP/CAD Chart

EUR/CAD Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.