Sterling backs off post Brexit higher after weaker than expected wage growth. EURUSD trying to hold yesterday's breakout. USDCAD choppy ahead of Bank of Canada tomorrow.

Summary

-

USDCAD: Dollar/CAD is entering NY trading morning with a range bound to negative tone after a choppy overnight session. Asia bought USDCAD after some weaker than expected China Industrial Production data smacked AUDUSD lower. Europe then came in and sold USD broadly heading into data, which saw USDCAD probe lower to the 1.2550s. Then we got the data, which was disappointing (UK wage growth less than expected and German ZEW survey much weaker than expected). This derailed the rallies in EURUSD and GBPUSD, and took crude oil prices lower too, giving USDCAD a chance to uptick once again. However, this move is now unravelling as EURUSD and GBPUSD traders buy at familiar support levels. The 1.2560-70 support level will be key to watch today in our opinion. If USDCAD cannot regain the 1.2570s soon, we expect the market to have an offered tone as traders eye the next major support level, which is 1.2490-1.2500. The economic calendar today has some second tier items (Canadian Manufacturing Sales and US Housing Starts at 8:30amET, then US Industrial Production at 9:15amET). We also have three scheduled Fed speakers (Quarles, Harker and Evans). The main event is tomorrow, when the Bank of Canada announces its latest decision on interest rates. Markets are currently pricing just a 20% chance of a 25bp rate hike.

-

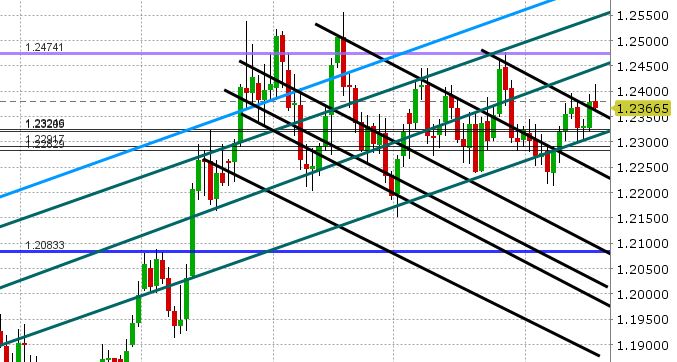

EURUSD: The Euro entered overnight trading with a bullish tone, after trend-line resistance in the 1.2360s gave way yesterday, however the rally was derailed when EURUSD traders saw sterling fall apart post the UK employment report. The market pulled swiftly back below 1.2400 and then we got the German ZEW survey, where the “Expectations” sub component printed -8.2 (lowest since 2012), and that prompted some more EURUSD selling. The market has bounced off the same trend-line support it broke out from yesterday (in the 1.2360s) which is a positive sign, however this level is under threat as we type. A break back below would render yesterday’s breakout as failed and we could very easily see a move back to the low 1.23s, while a retracement of the overnight losses will get the longs more confident about attacking the next major trend-line resistance level at 1.2450-60. Flows in EURJPY and USDCNH have been very muted today, and are therefore not yielding any clues for EURUSD.

-

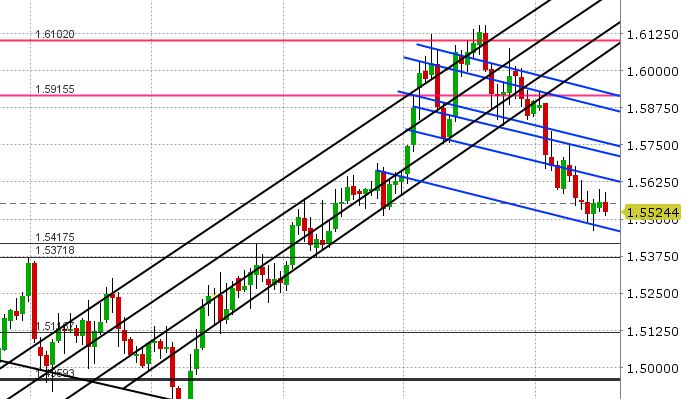

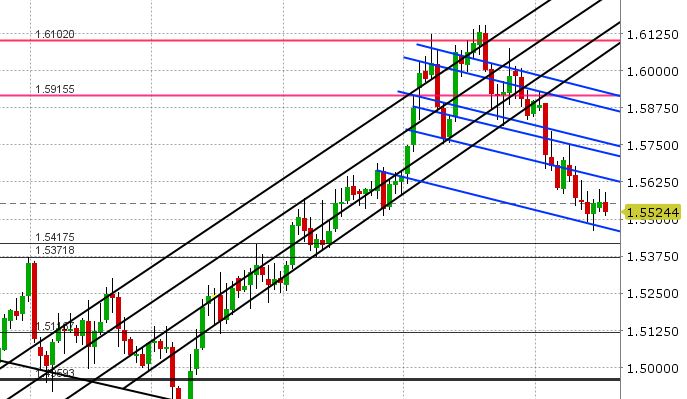

GBPUSD: Sterling was the big mover overnight in FX markets. It all started with a tremendous NY close, which completely nullified Friday’s bearish reversal pattern, and an awful close for EURGBP. Gains extended further as European trading got underway and we hit a post-Brexit high of 1.4376 before the UK reported employment numbers for March. Then we got the numbers, and while the headline job gains met expectations, the uptick in average hourly earnings came in 0.2% less than expected. Traders dumped GBPUSD on this development as it increases the likelihood of the May interest rate hike being a “one and done” scenario. However, we’ll get the more important inflation print tomorrow with UK CPI out at 4:30amET. GBPUSD has found support in the low 1.43s and has regained the 1.4325 (a key trend-line support level going into today). These levels must hold to maintain the upward momentum.

-

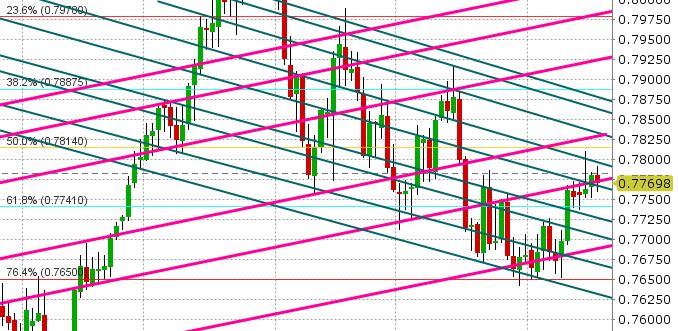

AUDUSD:The Aussie couldn’t get anything going overnight, similar to the action in USDCAD. The NY close yesterday was mildly positive in that we closed above the 0.7775 resistance level, but both the Chinese Industrial Production data and the wave of USD buying against EUR and GBP overnight have pushed the market back below it. This is causing a more negative tone as NY trading gets underway for today. Copper prices are off 0.8% today too, which isn’t helping. We think AUDUSD treads water here ahead of its main event tomorrow night, when Australia reports its employment report for March. Chart support today checks in at 0.7760-65, then 0.7740.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/CAD Daily Chart

GBP/CAD Daily Chart

EUR/USD Daily Chart

GBP/USD Daily Chart

AUD/USD Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.