SD safe-haven bid fades as stocks recover. Technical reversals in AUD,EUR and GBP fizzle out however. USD now broadly bid again with USDCNY leading.

Summary

-

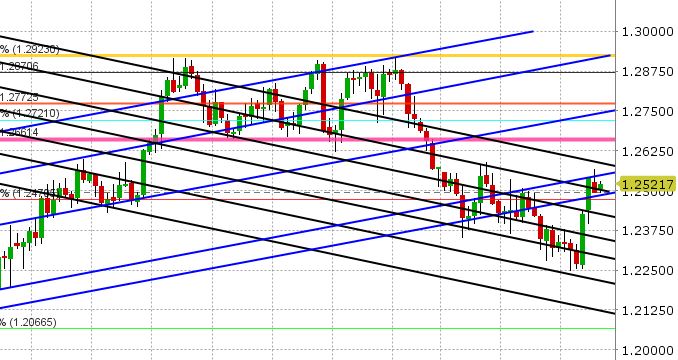

USDCAD: So the world didn’t fall apart yesterday like some had feared, following Monday’s stock market plunge and record volatility spike. The S&Ps clawed back from the October 2017 lows and rallied all the way back to 2700. It was a choppy day, but equities and US yields closed on their highs, the VIX closed on its lows (back down to 30), the broader USD gave up its safe haven bid. USDCAD failed at chart resistance in the 1.2540-60 area and traded back down to trend-line support at 1.2510, and the market has been hugging that level in overnight trade. The broader USD is trading higher overnight as reversal patterns going into the NY close for EURUSD, GBPUSD and AUDUSD have failed. While this is helping USDCAD here, we would note EURCAD and GBPCAD as notable drivers today too, with EURCAD putting in a bearish outside day on the charts yesterday. We feel USDCAD range trades today as a result, with 1.2475-80 supporting and 1.2540-60 resisting. Today’s session sees the release of December Building Permits for Canada (markets expecting +2.0% MoM). We have Fed speak from Dudley, Evans and Williams today as well. Deputy Bank of Canada Governor Wilkins makes a speech at 2:45pm. The big event for CAD traders comes on Friday when we get the January employment report for Canada.

-

AUDUSD: The Aussie held the line at 0.7840-0.7850 yesterday and rallied strongly into the NY close along with the recovery in the S&Ps. While the daily AUDUSD chart scored a positive reversal yesterday (by closing back above 0.7890-95), Asian traders failed to follow this through overnight. The market failed at trend-line resistance around 0.7910 and has since drifted lower with broad USD strength in Europe. Copper prices seem to be having more of an influence today as well, as the base metal tests trend-line support at 3.17 for the third time in as many days. We feel AUDUSD needs to regain 0.7890-95 in short order for any hopes of a near term continuation of the reversal higher, otherwise we see the market settling into a range of 0.7840 to 0.7890. Reuters is reporting two massive option expiries on Friday, (2.6bln AUD at 0.7800 and 2.3bln AUD at 0.7900), which may very likely keep the market range bound for the rest of the week.

-

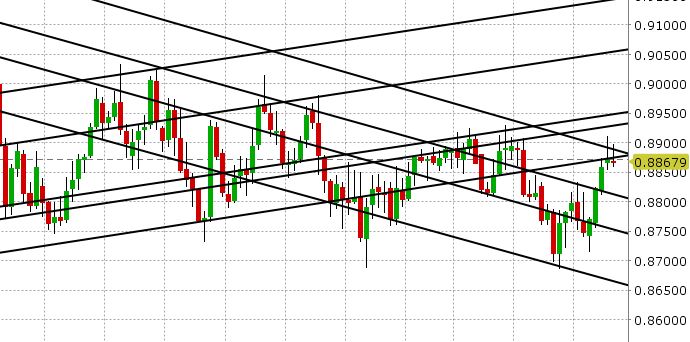

EURUSD: The Euro staged a decent comeback yesterday as well, but the NY close lacked enthusiasm. EURUSD also became sandwiched between some support and resistance levels on the daily chart (1.2370-1.2400), which curtailed activity as Asian trading got underway. USDCNH broke down decisively below 6.2850 in Asia (something that should have helped EURUSD), but EURUSD couldn’t find much of a bid at all. Then when USDCNH started its recovery back towards breakeven, we saw EURUSD selling re-emerge (almost as if sellers were waiting for a catalyst). The release of weaker than expected German Industrial Production for Dec (+6.5% YoY vs. +6.8% expected) didn’t help. Plus we got headlines about German SPD leader Schultz reportedly stepping down (just as his party has agreed to a coalition with Merkel). EURJPY has been a volatile mess; helping EURUSD yesterday but not today. EURGBP has failed twice now at the 0.8895-0.8900 level in the last 24hrs, which is a bit disconcerting for longs in the cross. All this is keeping pressure on EURUSD as NY trading gets underway. We feel EURUSD will range and possibly drift lower today, with 1.2320-1.2325 supporting and 1.2370-1.2400 resisting.

-

GBPUSD: Sterling is having another miserable start to NY trading for the second day in a row. Yesterday’s positive NY close fizzled out in Asia as traders showed no enthusiasm to follow the move through, and a brief attempt to break above 1.3970 in the 2am hour failed as EURUSD backed off and USDCNH recovered. Some buyers have stepped in here at 1.3890-1.3900, but we now have some intra-day overhead resistance coming at 1.3940-50 today that could make the recovery difficult. EURGBP looks like it will be supportive factor for GBPUSD today. All eyes will be on the Bank of England tomorrow as it announces it monetary policy decision at 7amET. Markets are not expected any changes to interest rates or the asset purchase program, but as always, traders will be paying close attention to Governor Carney’s tone (especially his comments on inflation, growth, Brexit and the GBPUSD exchange rate). We think GBPUSD will drift today ahead of this event risk, and perhaps inch higher with EURGBP sales.

-

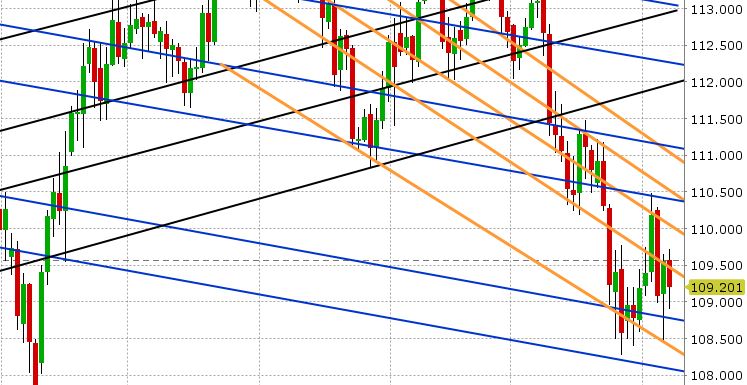

USDJPY: Dollar/yen staged an impressive NY close yesterday, following the S&Ps higher in lockstep, and the market closed at trend-line resistance in the 109.50s. While we said yesterday that this could mark a short-term double-bottom on the daily chart, we’re not seeing the follow through in overnight action that we want to see in order to confirm the pattern. The 109.50 level gave way almost too easily as Asia got underway and the selling has intensified as EURJPY and GBPJPY sales pick up in Europe. There’s definitely steady demand for JPY today across the board, but it doesn’t seem to be safe-haven related, as the S&Ps were only down 20-25 pts at their worst overnight. Reuters is reporting over $1.4bln in expiries between 109.25 and 109.60 going into the NY cut today (this can explain some of the overnight action). We feel JPY cross sales are the larger influence right now, as weak longs probably used yesterday’s rally to get out. Support in USDJPY today is 108.90-109.00. Resistance is once again 109.50-60.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

USD/CNH Chart

EUR/CAD Chart

EUR/GBP Chart

March Copper

March S&P500

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.