Research team at Zhejiang University has “found an effective drug” for coronavirus

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Chinese state TV releases headline during 3amET hour, leads to another broad “risk-on” move.

- Sky News reporting UK scientists have made “significant breakthrough” in race to create vaccine.

- US yields break through 1.61% resistance. USDJPY gallops over 109.50s. CNH rallies again.

- EURUSD succumbs to US yield rise despite decent German/Eurozone Services & Composite PMIs for January.

- GBPUSD back below 1.3030-40s as “EU TAKES AIM AT CITY OF LONDON WITH POST-BREXIT MIFID REWRITE”.

- US ADP Employment Report for January BEATS expectations, +291k vs +156k.

- US Non-Manufacturing ISM report for January BEATS expectations, 55.5 vs 55.0.

ANALYSIS

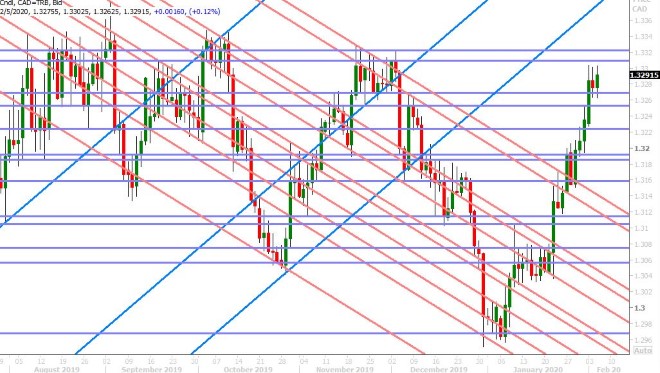

USDCAD

So apparently there’s a cure in the making? Global risk-on sentiment shot higher during the 3amET hour this morning following unconfirmed reports out of China that a research team at Zhejiang University has “found an effective drug” to treat people with the new coronavirus. This follows a separate report from Sky News saying UK scientists have made a “significant breakthrough” in the race to create a vaccine. More here.

This saw the S&P futures, the yuan and commodity currencies jump higher while bonds, gold, and the yen took another leg lower…leading USDCAD right back down to chart support in the 1.3270s in early European trade. Some of this risk-on move has since been dialed back as the WHO reiterated that there is “no known effective” treatments for the conoravirus, and with that USDCAD has bounced modestly.

The US reported a much better than expected ADP Employment Report for January this morning (+291k vs 156k), which is re-adding a little fuel to the risk-on fire. The US Non-Manufacturing ISM report for January also beat expectations (55.5 vs 55.0). The EIA will be reporting its weekly oil inventory report at 10:30amET, and the expectation here is for +2.831M barrels. Last night’s API report showed an unexpected build in inventories (+4.18M vs +2.8M), but oil traders have quickly forgot about this given this morning’s more positive coronavirus headlines. We’re having a hard time believing today’s “viral optimism” but we still don’t think it’s wise to over-analyze this and try to become wannabe epidemiologists. The response we’re seeing from Chinese authorities is not surprising. They’re doing everything they can to shore up investor confidence and frankly we expect more of this kind of reporting.

Senior deputy governor Carolyn Wilkins will be speaking at 12:30pmET today before the Economic Club of Canada (text of speech to be released at 12:15pmET).

USDCAD DAILY

USDCAD HOURLY

MAR CRUDE OIL DAILY

EURUSD

The final January Services and Composite PMIs for Germany and the Eurozone were reported moderately better than expectations this morning (see below), but none of this was a match for this morning’s coronavirus optimism. The headlines out of China and Sky News saw US yields immediately spike higher and gold prices fall lower, which in turn gave EURUSD another sucker punch. We’re now seeing the market re-test the 1.1010-20 support zone we talked about yesterday. We think a NY close below the psychological 1.1000 level would confirm the start of another downward wave in EURUSD.

German Final Services PMI (Jan): 54.2 vs 54.2 exp

German Final Composite PMI (Jan): 51.2 vs 51.1 exp

Eurozone Final Services PMI (Jan): 52.5 vs 52.2 exp

Eurozone Final Composite PMI (Jan): 51.3 vs 50.9 exp

EURUSD HOURLY

APRIL GOLD DAILY

GBPUSD

Sterling avoided a very bearish NY close yesterday with its Construction PMI-driven bounce back above the 1.2960-80 support zone. Today’s better than expected final January Services and Composite PMIs helped GBPUSD break through chart resistance in the 1.3030-40s earlier but the following headline regarding financial market regulation is now seeing the market move swiftly back lower:

EU TAKES AIM AT CITY OF LONDON WITH POST-BREXIT MIFID REWRITE

It’s hard to say what this means at this point because the story is still fresh, but it’s a negative headline that has effectively produced “buyer failure” above the 1.3030-40s in GBPUSD. This now gives the sellers the edge to re-threaten the 1.2960s again in our opinion.

UK Final Services PMI (Jan): 53.9 vs 52.9 exp

UK Final Composite PMI (Jan): 53.3 vs 52.4 exp

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

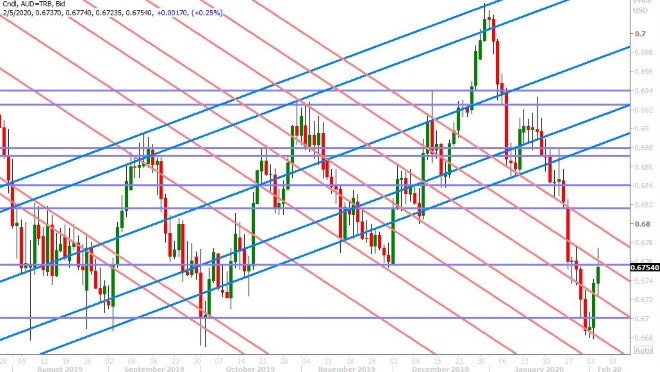

AUDUSD

The Aussie is getting a triple boost today. It all started with yesterday’s rampant risk-on optimism that saw AUDUSD close firmly above the 0.6720s. We then heard rather upbeat comments from RBA Governor Lowe last night. See here for a summary from Reuters and here for the full text of his speech. Finally, we got the positive coronavirus headlines.

All this saw AUDUSD bust through chart resistance in the 0.6750s in London trade, and this level is now acting as support heading into NY trade. Rate cut odds in the OIS market for March 3rd have dropped to just 9% vs 23% post-RBA meeting earlier this week.

We think the 0.6750s will be pivotal for AUDUSD price action heading into tonight’s Australian Retail Sales report at 7:30pmET. Traders are expecting a read of -0.2% MoM for December

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

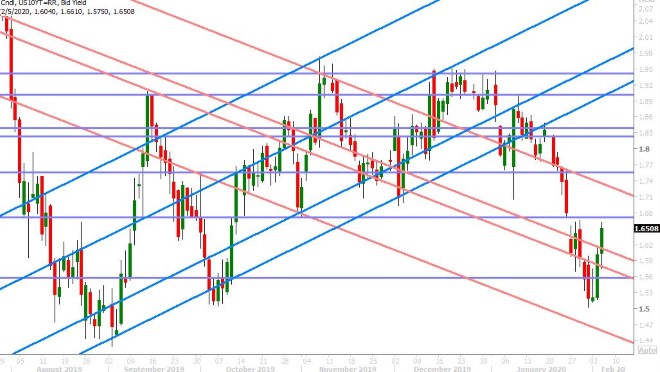

USDJPY

Dollar/yen recorded an absolutely stellar session yesterday; smashing through the 109.00 resistance level and closing right up at its next chart resistance level in the 109.50s. While the PBOC refrained from intervening in money markets today (which we think explained the market’s modest pullback in Asian trade), Chinese TV outlets are effectively doing the same by pushing the “new drug” headlines.

The US 10yr yield has now broken through resistance at 1.61%. USDJPY has broken above the 109.50s and it has survived a downside test of this level following the WHO “no known” treatment headlines. The better than expected US ADP and Non-Manufacturing ISM reports have now added a little more fuel to the fire, and we think traders now need to be prepared for an attack of the low 110 level once again.

USDJPY DAILY

USDJPY HOURLY

GERMAN 10YR BUND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.