OPEC+ agrees to historic production cut, but oil traders not impressed

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- OPEC+ to cut 9.7mln bpd through May/June, then 7.7mln to Dec, then 5.8mln to April 2022.

- Saudi Arabia & Russia to cut from 11mln bpd April baselines. Mexico allowed to cut by just 6%.

- Oil markets unimpressed as news largely priced in + falls way short of demand drop from COVID-19.

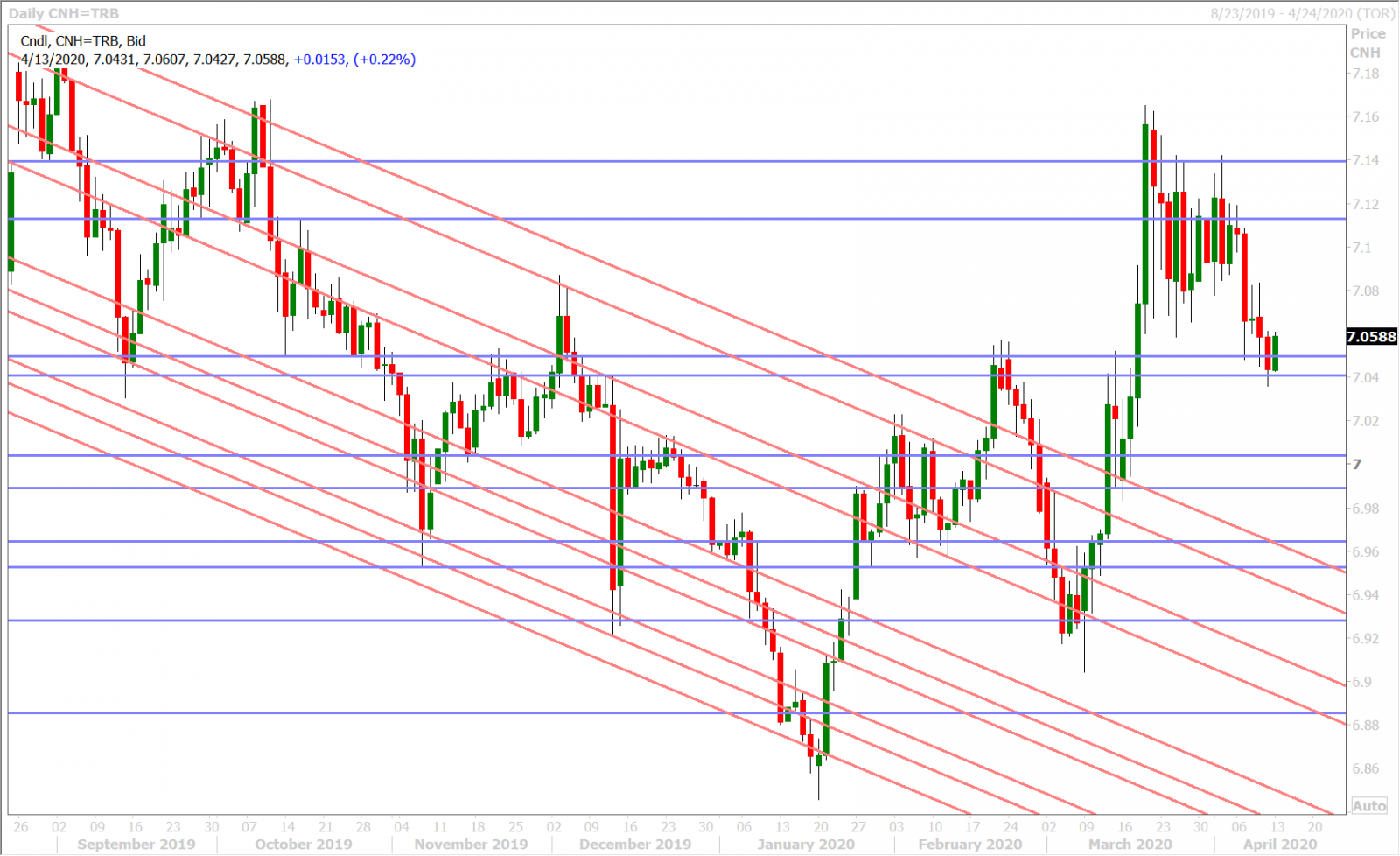

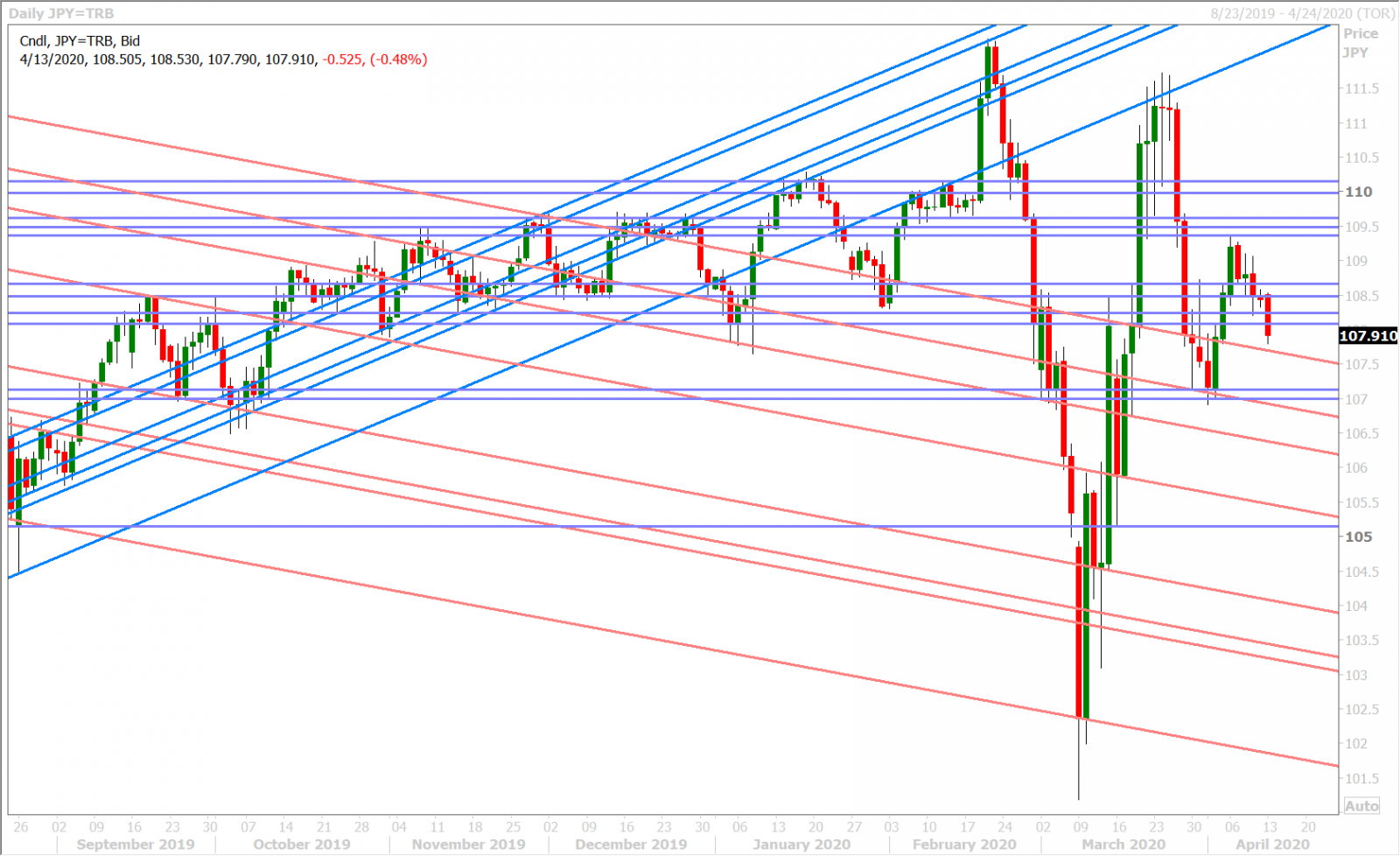

- Nikkei fell 2.3% today. USDJPY losses 108.50s support. Broader USD finding support into NY trade.

- EURUSD and GBPUSD appear to trigger buy stop orders during Easter Monday holiday trade in Europe.

- AUDUSD outperforming on lack of upside chart resistance. USDCAD trying to regain 1.3970s.

- Bank of Canada rate decision + key US and Australian economic data on deck for Wed/Thurs sessions.

ANALYSIS

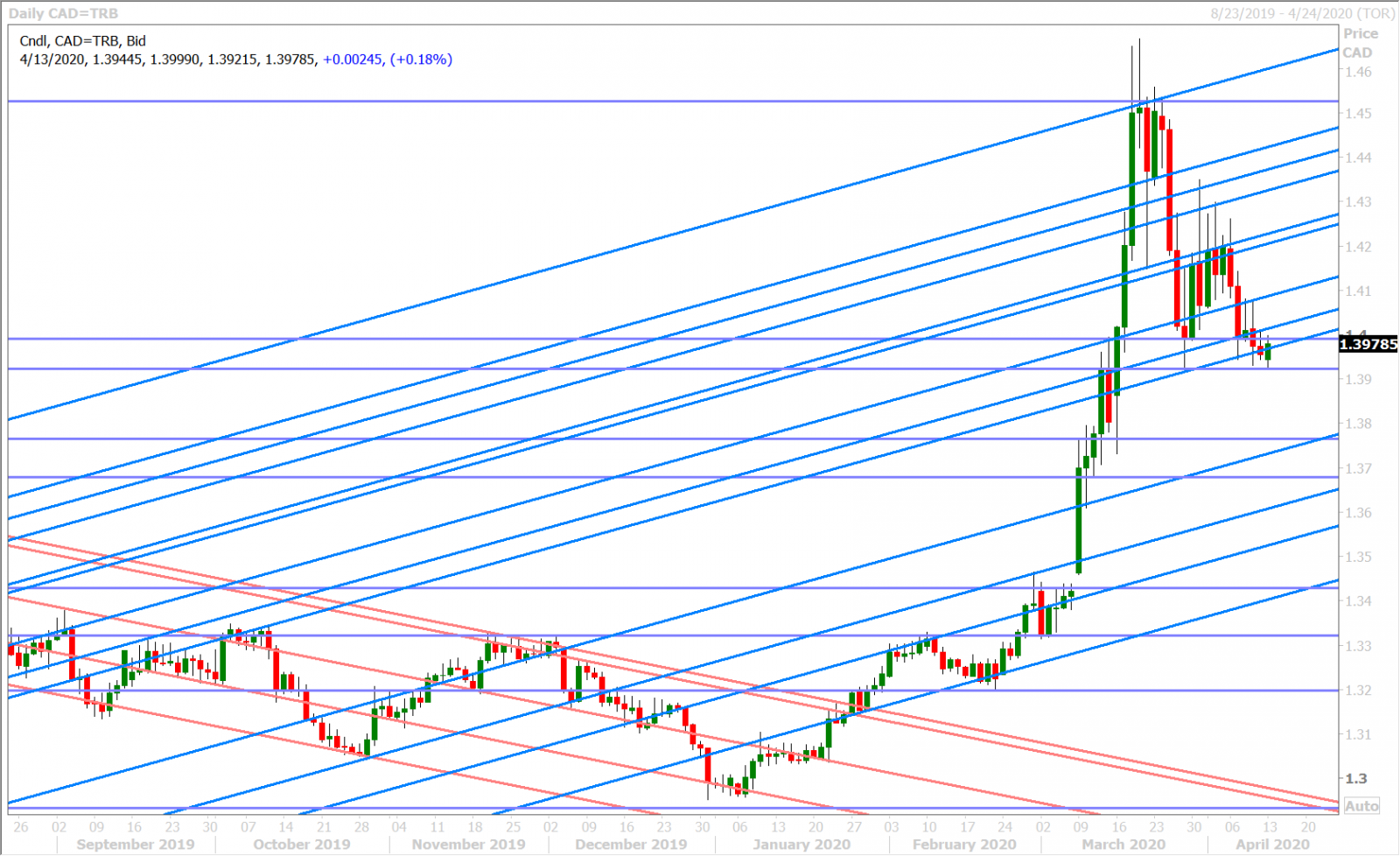

USDCAD

The broader USD is trading with a quiet bid tone this morning but the move is really just a retracement of some modest losses that occurred when EURUSD and GBPUSD appeared to trip some buy stop orders earlier today. European markets remain closed for Easter Monday and while its hard to deduce much from market moves on holidays, we’re noting signs of USD seller fatigue on the charts this morning.

We think this past weekend’s OPEC+ deal, to cut production by a historic 9.7mln bpd over the next two months, is contributing to the USD seller fatigue because the coordinated action was too little/too late to address what is now expected to be a 30mln+ bpd fall-off in Q2 oil demand due to the coronavirus. What is more, Saudi Arabia and Russia will be cutting from already inflated April baseline production levels and Mexico has been given the lone exception to cut just 100k bpd (6% reduction vs the 23% agreed to by the other nations). It really makes us wonder how serious the world's major oil producers really are about this oil deal. The optics of it may sound good on the surface, but oil traders certainly don’t look convinced this morning with May WTI prices trading flat versus their NY closing levels from Thursday.

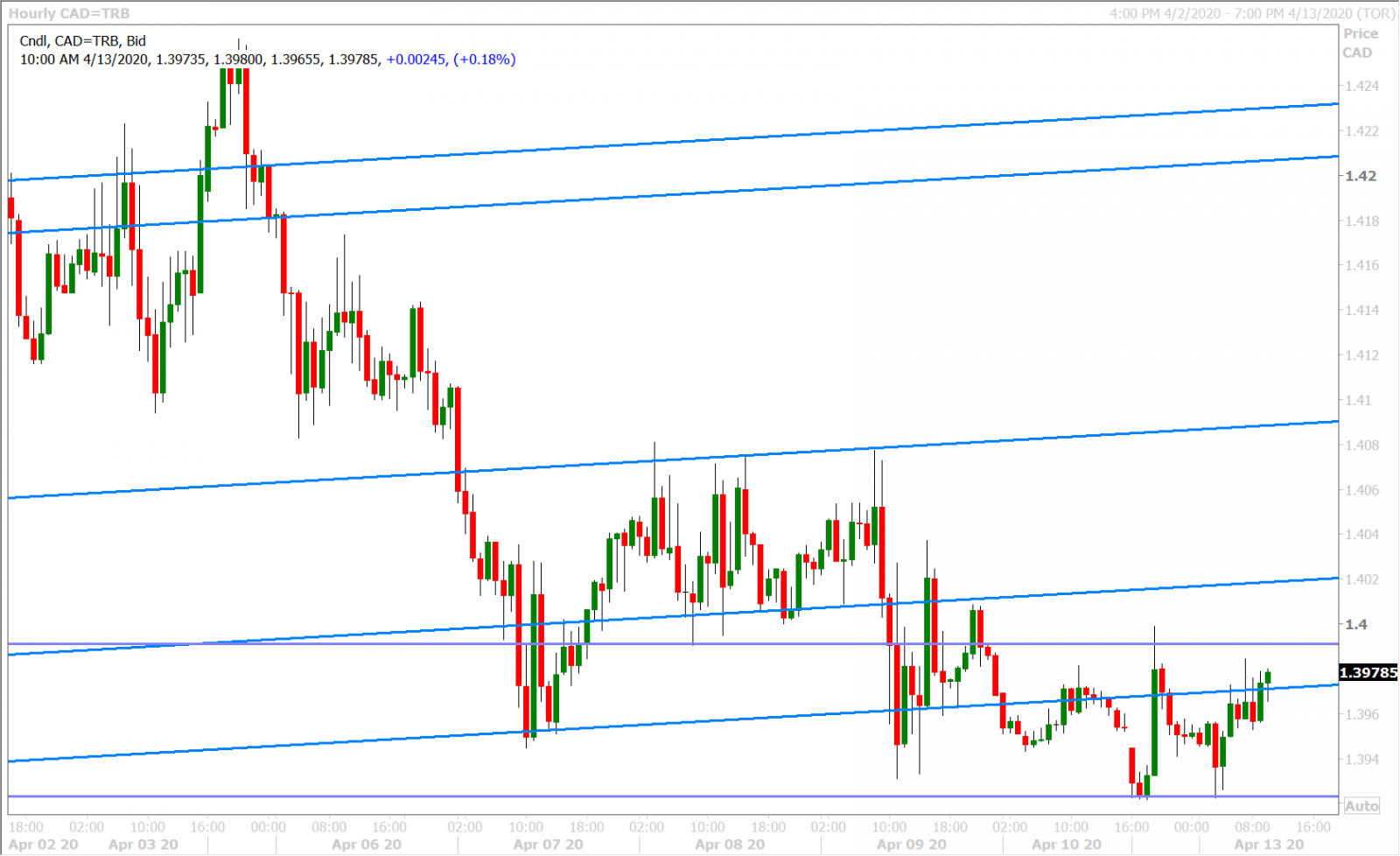

One could make the argument that the oil market’s lackluster start to the week is contributing to a mild risk-off tone here. The Nikkei fell 2.3% today, USDJPY has given up the 108 handle, and US bond yields are trading modestly lower as well. Dollar/CAD is now trying to regain Thursday’s upward sloping trend-line support level (now in the 1.3970s).

The latest Commitment of Traders Report released by the CFTC on Friday showed the leveraged funds reducing both long and short USDCAD positions during the week ending April 7th, which is fitting given the market’s switch to a more neutral chart structure in late March. We think USDCAD continues to conform to its 1.3900-1.4200 price range this week, but given how close we’re trading to the bottom end of it, we wouldn’t be surprised to see it briefly dip below it. Potential catalysts this week could from the economic and monetary policy calendar for Wednesday/Thursday (see below)

Tuesday: Speeches from the Fed’s Bullard, Evans and Bostic

Wednesday, US Retail Sales & Industrial Production (March) + Bank of Canada interest rate decision

Thursday: US Jobless Claims (week ending April 11) + US Philly Fed Survey (April)

USDCAD DAILY

USDCAD HOURLY

MAY CRUDE OIL DAILY

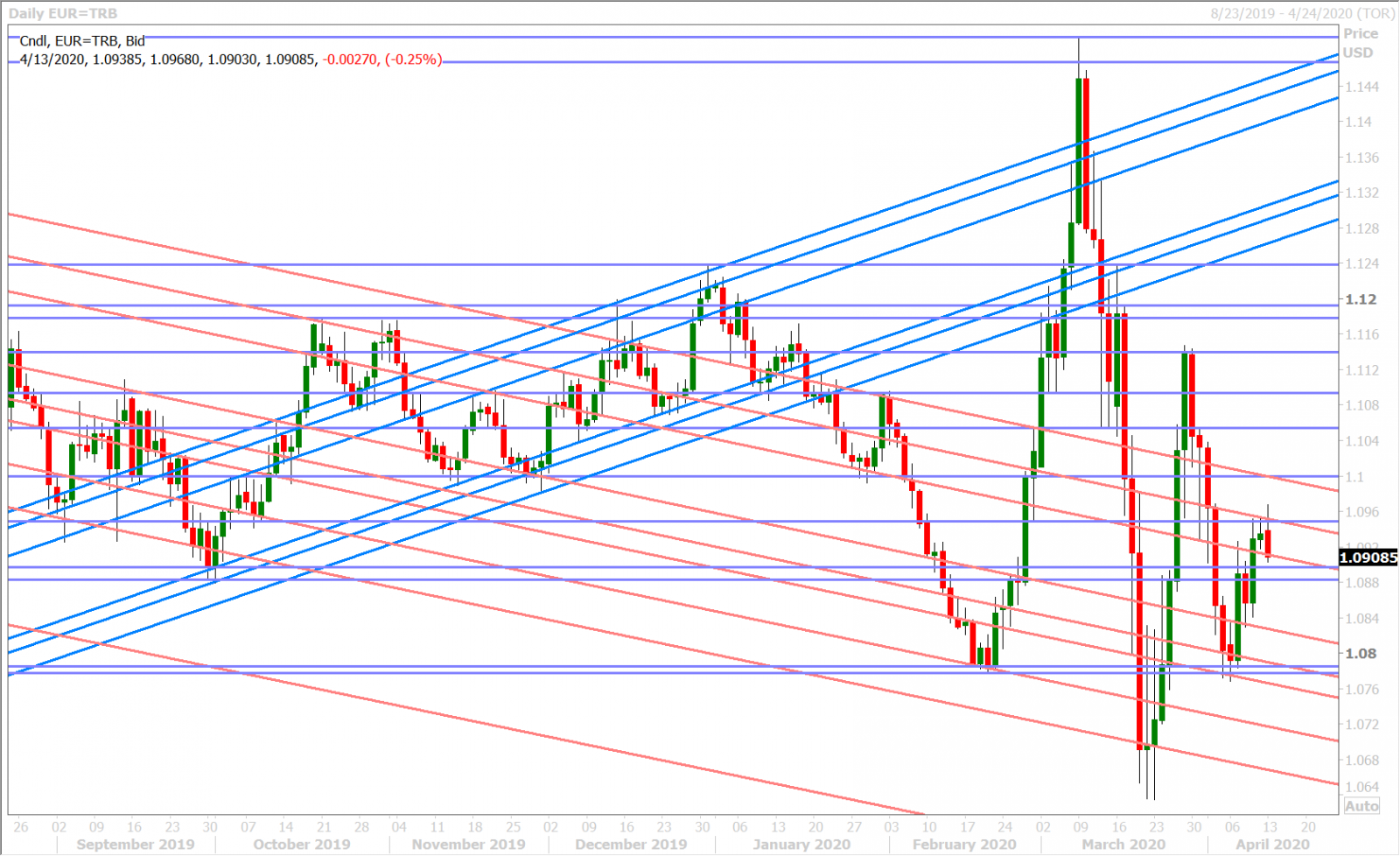

EURUSD

The Fed’s unprecedented action last Thursday morning, to provide up to $2.3trillion in additional loans, really stole the limelight and allowed EURUSD to finally break above the 1.0870 level late last week, but the market has been stuck in a higher range ever since (1.0910-1.0950). The four-day Easter long weekend in Europe is contributing to the malaise for the most part, but we’d have to admit that we’re a little concerned about this morning buyer failure above the 1.0950s. The swiftness of the spike higher/fall back lower suggests that the move was flow driven (ie. buy stops triggered), but it’s hard to ignore the mild damage this has now been done to the market’s upside momentum from last week.

The latest Commitment of Traders Report released by the CFTC on Friday showed the leveraged funds adding fresh long EUR positions during the week ending April 7th, which doesn’t help the bull thesis here in our opinion because the net long EURUSD position is now starting to look overextended.

EURUSD DAILY

EURUSD HOURLY

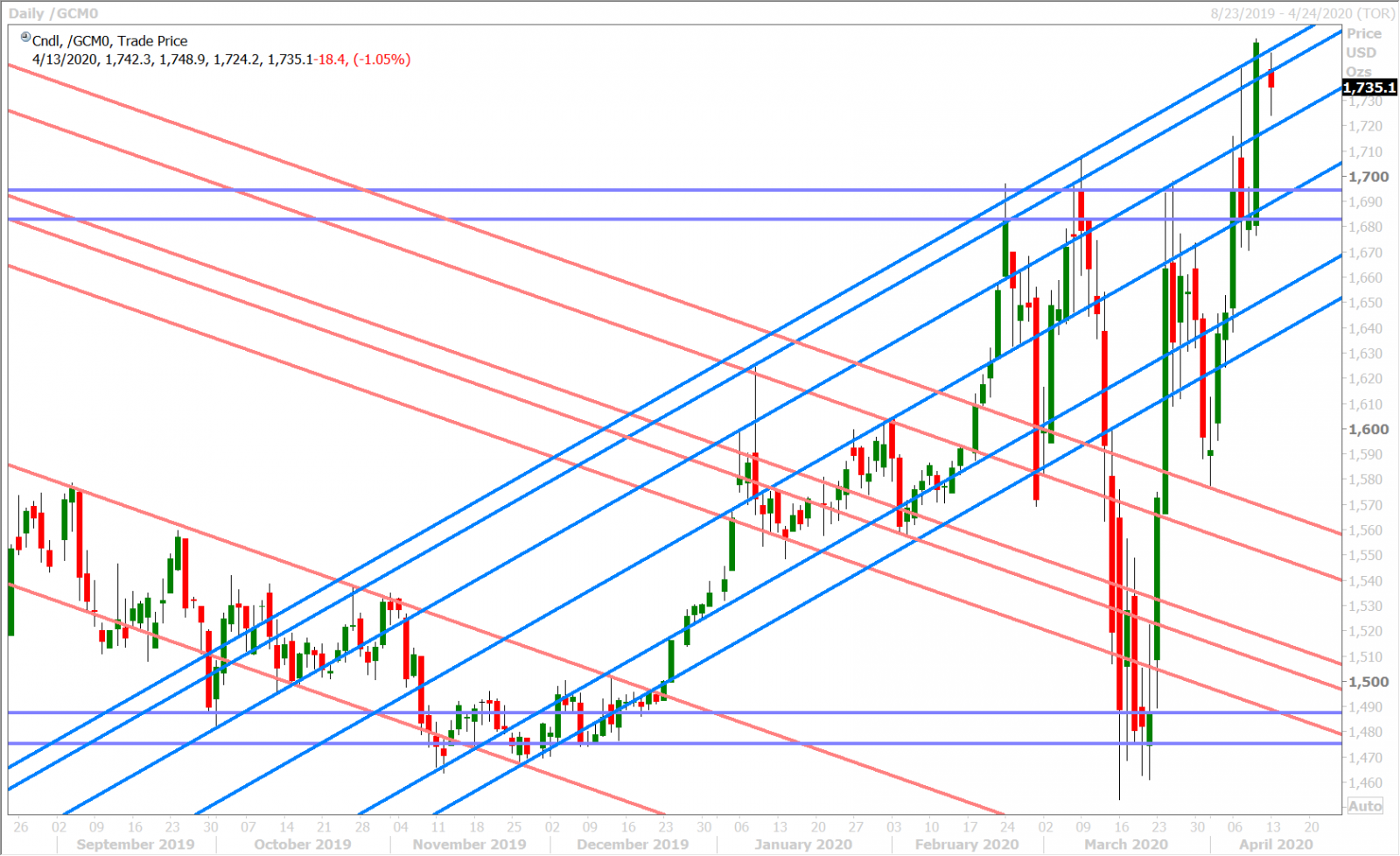

JUNE GOLD DAILY

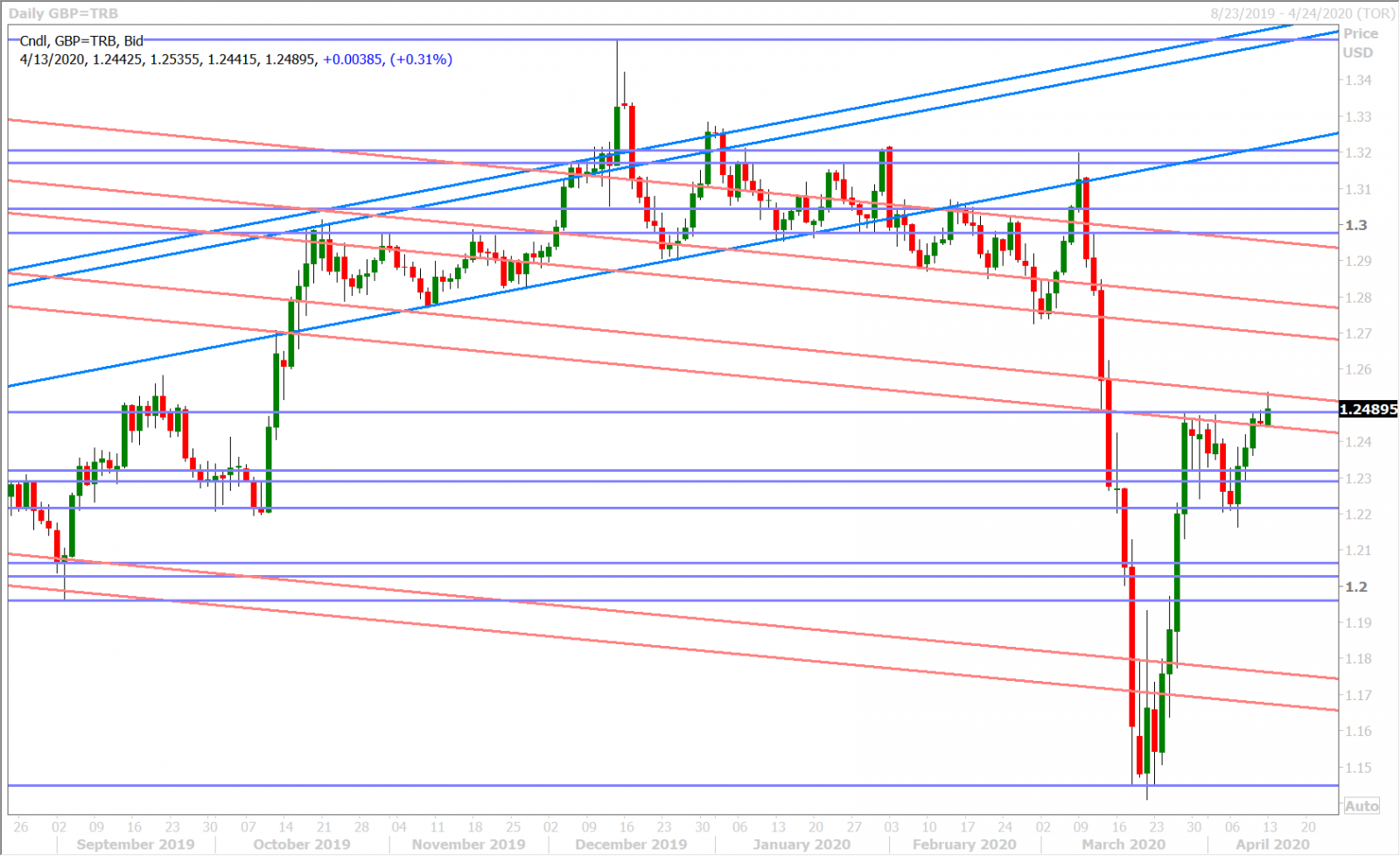

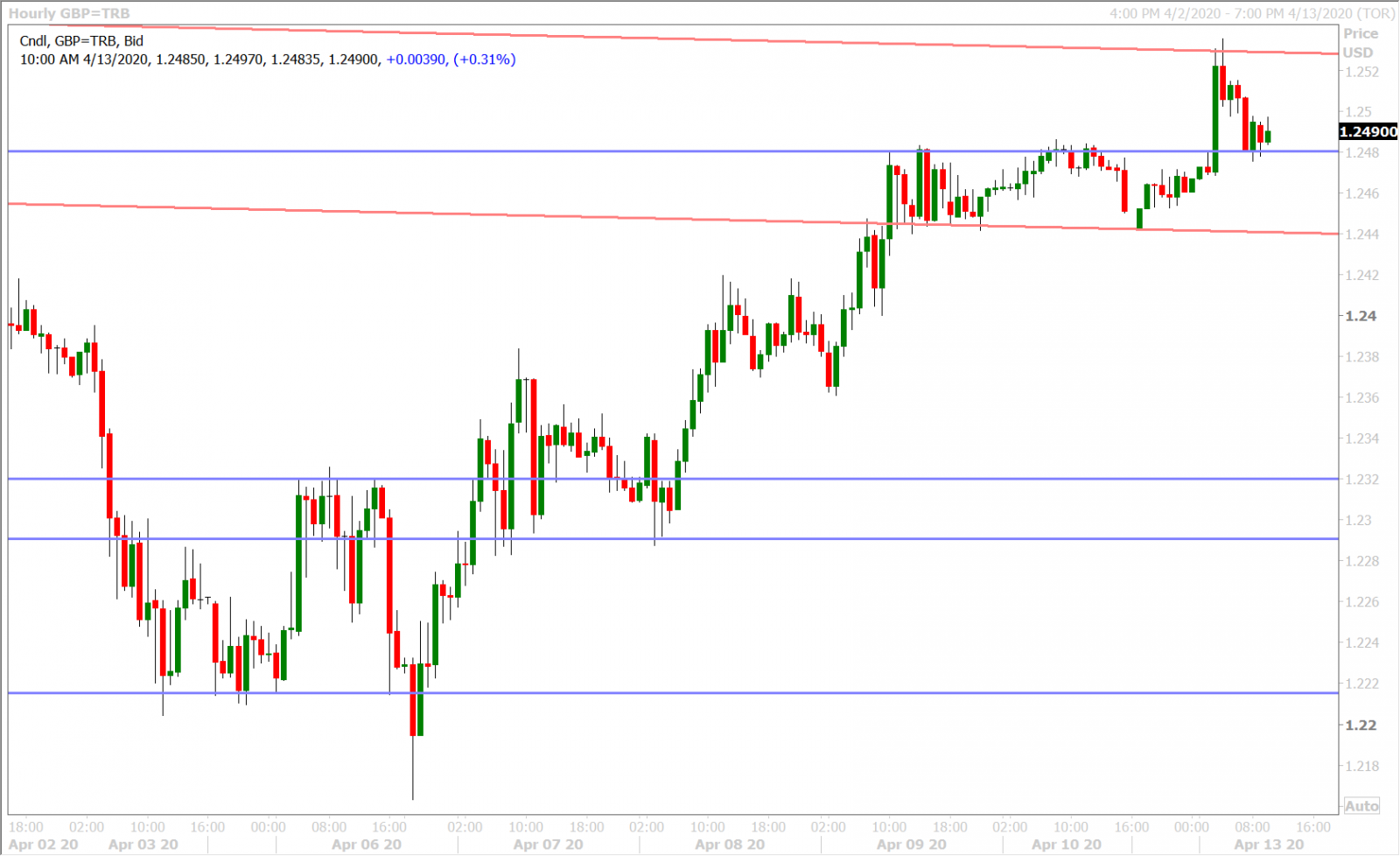

GBPUSD

Boris Johnson was released from hospital over the weekend, and while this was definitely a “feel-good” headline for markets, we don’t traders were ever too concerned about the UK political situation and Boris Johnson’s ability to recover from COVID-19 when he first got admitted. Thursday morning’s Fed move pushed GBPUSD above the 1.2440s and dip buyers have been present in Easter holiday trade ever since. Today’s spike above the 1.2480s felt order driven though, just like the EURUSD move earlier, and we think that a NY close back below it would stall the market’s upward momentum in the short term.

The latest Commitment of Traders Report released by the CFTC on Friday showed the leveraged funds liquidating both long and short GBPUSD positions for the third week in a row during the week ending April 7th. We think this helps to explain the lack of volatility we’ve seen in the market since late March, but this unwinding has produced a very neutral net position for the funds…which unfortunately offers no clues for fast money directional bias heading into the rest of April.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

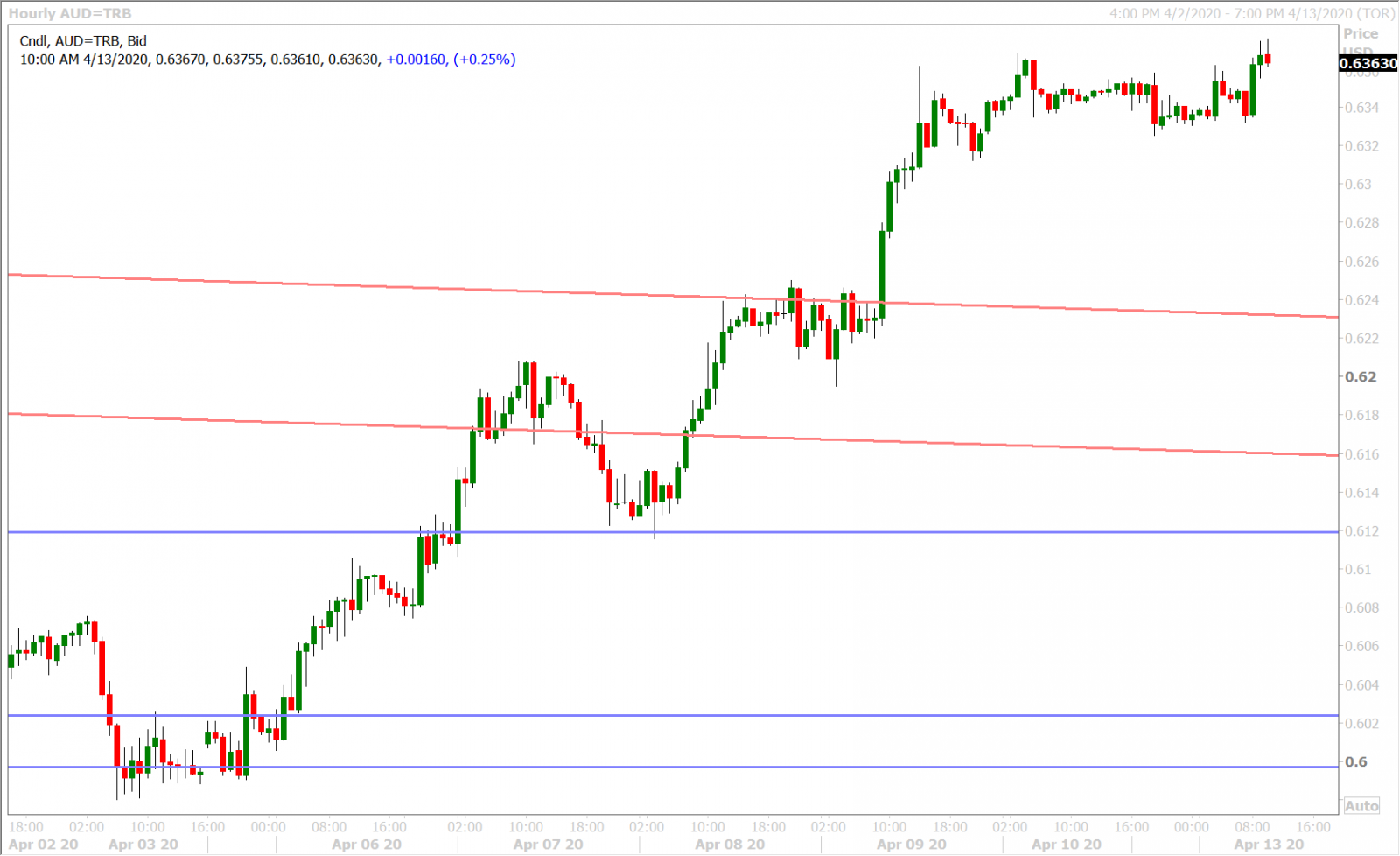

AUDUSD

The Australian dollar is well on track to achieving the 0.64 mark this week after the Fed said on Thursday that it would backstop an additional $2.3 trillion dollar in loans. This announcement saw AUDUSD shoot past the 0.6240s trend-line resistance level and, while the four-day Easter long weekend in Australia led to some flat price action, we think the lack of overhead chart resistance until the 0.6430-50s could allow the AUD to outperform its G7 peers today.

The latest Commitment of Traders Report released by the CFTC on Friday showed the leveraged funds adding to their net short AUDUSD position for the first time in three weeks during the week ending April 7th. Unfortunately, this was the wrong move given last week’s break above the 0.6160s, and we think this helps the AUD bull thesis here.

Australia’s key economic update this week will come from its March Employment Report on Wednesday night. Traders are expecting that 40k jobs were lost down under last month and that the unemployment rate moved higher to 5.5% (versus 5.1% in February).

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

The Australian dollar is well on track to achieving the 0.64 mark this week after the Fed said on Thursday that it would backstop an additional $2.3 trillion dollar in loans. This announcement saw AUDUSD shoot past the 0.6240s trend-line resistance level and, while the four-day Easter long weekend in Australia led to some flat price action, we think the lack of overhead chart resistance until the 0.6430-50s could allow the AUD to outperform its G7 peers today.

The latest Commitment of Traders Report released by the CFTC on Friday showed the leveraged funds adding to their net short AUDUSD position for the first time in three weeks during the week ending April 7th. Unfortunately, this was the wrong move given last week’s break above the 0.6160s, and we think this helps the AUD bull thesis here.

Australia’s key economic update this week will come from its March Employment Report on Wednesday night. Traders are expecting that 40k jobs were lost down under last month and that the unemployment rate moved higher to 5.5% (versus 5.1% in February).

USDJPY DAILY

USDJPY HOURLY

JUNE S&P 500 DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.