Markets rangebound ahead of holidays and option expiries. US tax bill update, BOJ, Cdn data expected later this week

Summary

-

ECONOMIC DATA UPDATE: The RBA minutes were a non-event last night as the bank board members maintained a very neutral tone (as expected) in their outlook for Australian growth and inflation. The German IFO came in at 117.2, slightly weaker than expectations. Todays’ NY session sees US Housing Starts for Nov, expected +1249k.

-

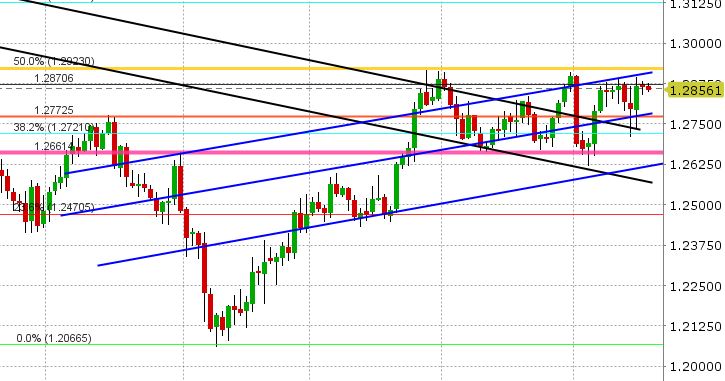

USDCAD: There’s a whole lot of nothing going on in USDCAD right now. Yesterday’s range was just 35pts, leaving the same support and resistance levels at play for today. EURCAD is finding dip buyers again after pulling back from trend-line channel highs yesterday, while GBPCAD is struggling a bit now as it losses the 1.72 handle once again. See charts. The US/CAD 2yr yield spread is a touch softer this morning at +26bp. The next big event risks for USDCAD are Canadian CPI and Retail Sales on Thursday, then Canadian Oct GDP on Friday. Until then, expected quiet pre-holiday trade unless there a broad USD move surrounding US tax reform this week.

-

AUDUSD: The Aussie continues to be bought on dips, bouncing confidently off weekly support in the 0.7640s yesterday. The market is now testing resistance in the 0.7670-0.7690 level, and is stalling a bit now as copper prices stall. Next resistance is 0.7700-0.7710. Reuters is still reporting an massive option expiry (2bln+ AUD) at 0.7700 on Friday, which could have a magnetic on prices leading up to it. We expect range-bound to higher trade in AUDUSD given improved technicals and the option expiry into week’s end. The AU/US 2yr yield spread is firm at +11bp.

-

EURUSD: The Euro caught a bid yesterday, as the bearish trader talk from yesterday as a bit overblown if you ask us. EURUSD bounced off Fibo support in the 1.1750s very well, and the market even went so high as to test Fibo and trend-line resistance in the low 1.18s. The market has since backed off, but has is finding buyers again as we write. Option expiries continue to be a dominant theme in EURUSD of late, which is helping to keep the market contained. Today sees 1.5bln EUR of expiries between 1.1770-1.1825, another 1bln tomorrow at 1.18 and another 1bln at 1.18 on Friday. The US/GE 10yr yield spread is steady at +207bp. EURGBP continues to find buyers on dips after last week’s important technical bottom. EURJPY also looks poised to test the upper bounds of its new trading channel. We continue to expect EURUSD to range-trade here ahead of the holidays.

-

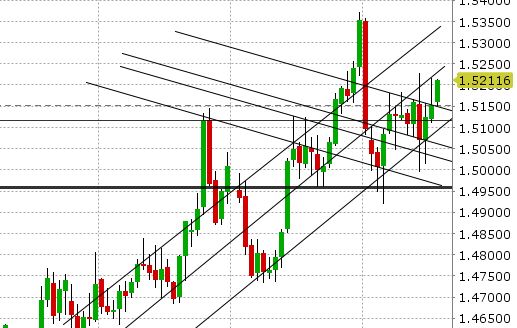

GBPUSD: Traders rescued sterling yesterday, with most of the market chatter citing positive Brexit talk from Theresa May in UK parliament yesterday. Technically speaking, the strong bounce of channel support in the 1.3325 was positive, but the market stalled easily when testing resistance again at 1.34 yesterday. The market has failed at 1.34 again during early European trade, giving traders an excuse to sell GBPUSD once again and buy EURGBP. A technical break above 1.3460 would ignite more positive momentum, while a breakdown below 1.3310-1.3325 would invite more selling. Combing through Brexit headlines is still the theme for GBP traders.

-

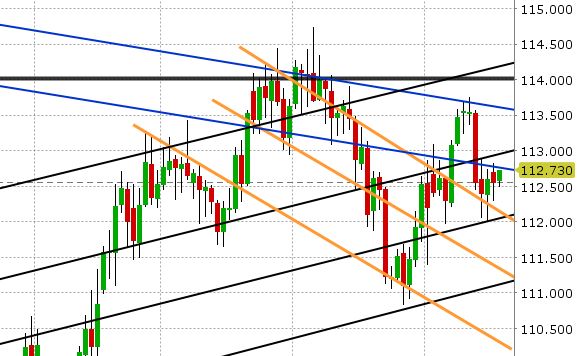

USDJPY: There’s not much going in dollar/yen either as traders here await US tax reform updates, expected later this week. The market also has the Bank of Japan monetary policy meeting to hunker down for on Thursday. While no surprises are expected there, the meeting will come at a time when market liquidity starts to thin out ahead of the holidays, which could make the market reaction larger than usual. Technicals are saying the market is stuck right now, with the 112.30s supporting and the 112.80-113 area resisting. US yields are knocking on the door at 2.40 again, which is positive for USDJPY, considering last week’s post Fed plunge. The never-ending rally in global equities also continues to underpin (from a psychological “risk-on” perspective). Reuters is reporting massive option expiries in USDJPY around current levels all the way to the end of the week.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

EUR/CAD Chart

GBP/USD Chart

GBP/CAD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.