Markets in "risk-off" mode following Chinese response to US proposed 25% tariff on $200bln of Chinese goods. BoE hikes 25bps, but dovish Carney slams GBP. Traders eyeing US non-farm payrolls tomorrow.

Summary

-

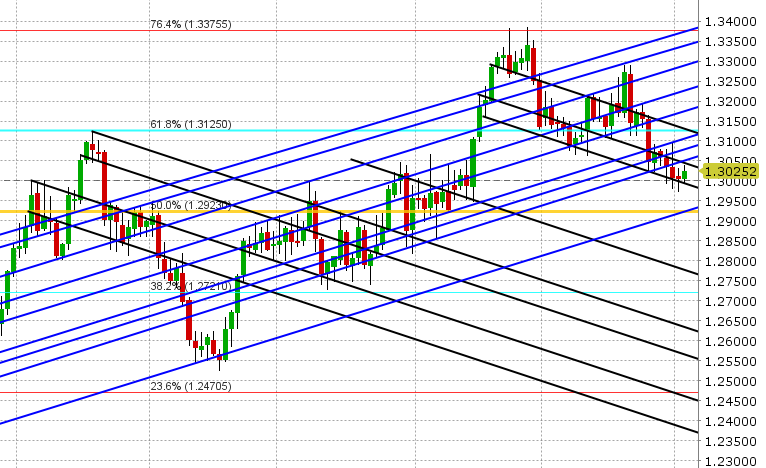

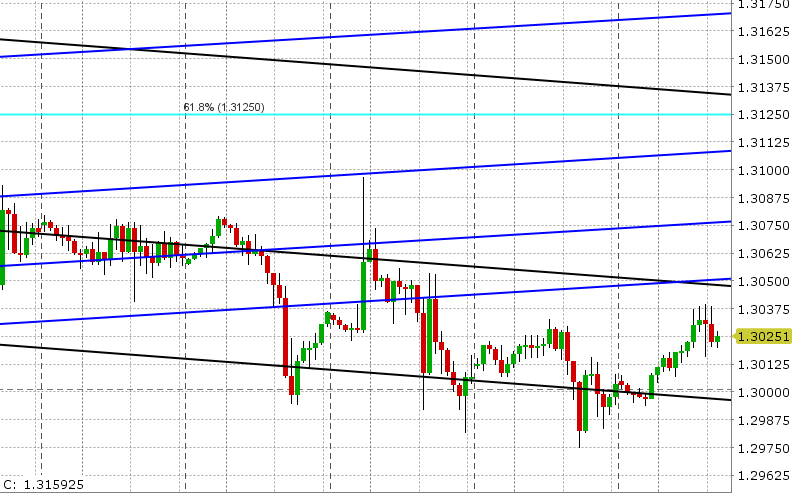

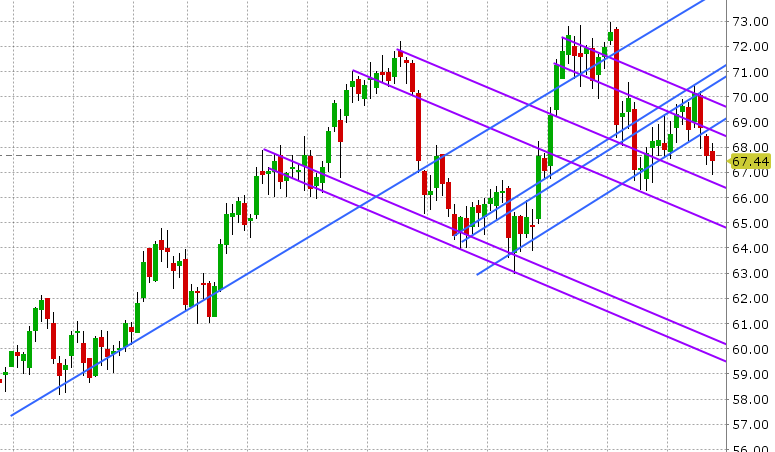

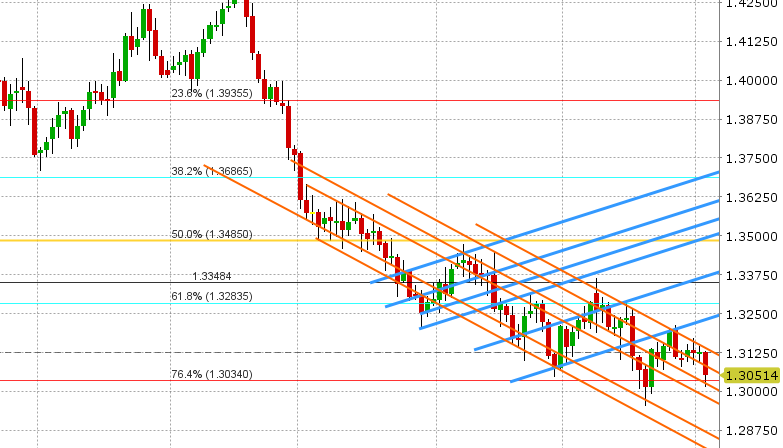

USDCAD: Dollar/CAD is bid this morning as traders held the market above the 1.3000 level yet again going into the NY close yesterday. There were some precarious moments sub 1.3000 yesterday when crude oil bounced off its lows in the aftermath of the EIA oil inventory report, but selling in the energy complex ultimately resumed and allowed for USDCAD to recover. The FOMC’s expected hold on interest rates was a non-event for markets. Overnight action has been largely “risk-off” in tone and supportive of USDCAD, with Chinese stocks and global equities broadly weaker, USDCNH at new highs, the JPY and the USD broadly stronger, and EM currencies lower following another plunge in the Turkish lira. The key driver today is China’s retaliatory response to Trump’s proposed tariff increase on $200bln worth of Chinese goods (which made headlines yesterday). More here: https://mobile.reuters.com/article/amp/idUSKBN1KN1BP. Today’s North American calendar is light, with just US Factory Orders at 10amET. The week’s main event comes tomorrow, when the US reports non-farm payrolls for July. We’ll also get the US and Canadian trade balance figures for June and the US Services ISM. With September crude oil and “risk” assets bouncing broadly here into the NY open, we think USDCAD continues to drift. However, an upward test of chart resistance in the 1.3050s would not be surprising.

-

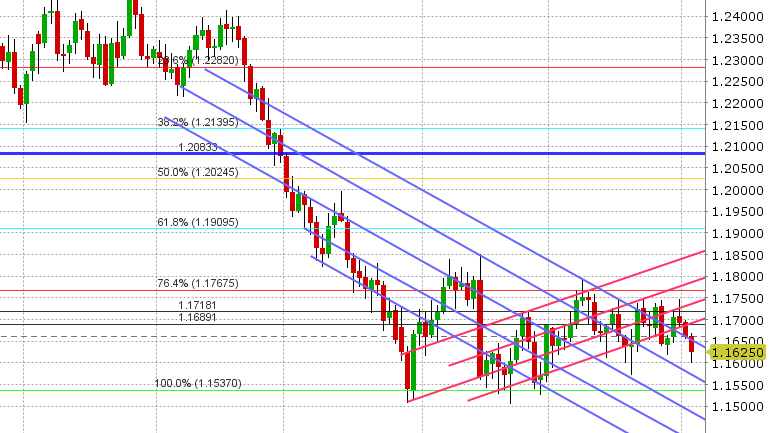

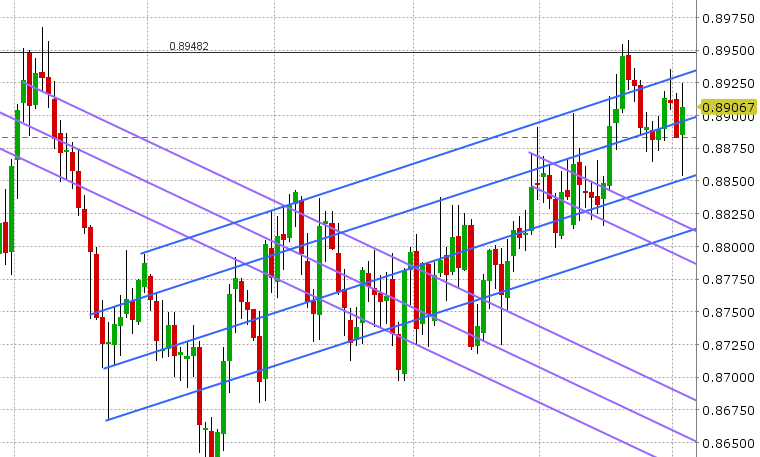

EURUSD: Euro/dollar is trading lower this morning as yesterday’s weak NY close below support in the 1.1670s, today’s broad “risk off” tone to markets, and a slew of option expiries around 1.1600-1.1635 strikes (~2blnEUR+) combine to entice short sellers back in. We’re seeing some GBPUSD driven EURUSD volatility in the last hour as Governor Carney’s post rate hike press conference turns initial GBP gains into steep losses. With USDCNH looking poised to attack the 6.87s, we would not be surprised to see EURUSD weaken further into the 1.1580s (next trend-line support level), but we think we’ll see a little short covering first ahead of the NFP numbers tomorrow.

-

GBPUSD: Sterling is the feature this morning as the Bank of England hiked interest rates by 25bp to 0.75% in a 9-0 unanimous vote. This, along with the BoE’s 7am press release headlines suggesting “more rate hikes will needed” saw GBPUSD spike above trend-line resistance in the 1.3100, but all this has reversed and then some as Governor Carney’s tone went a tad dovish during the post meeting press conference: BoE Gov Carney: Some Signs Business Investment Is Softening Due To Brexit Risk Premia On Sterling Assets Have Increased Somewhat In Recent Weeks. Says Policy Needs To Walk, Not Run, To Stand Still As Equilibrium Interest Rate Rises Gradually. BOE'S CARNEY SAYS IF THERE IS A MAJOR SHIFT DUE TO BREXIT TALKS THAT IS DISINFLATIONARY OR CREATES EXTREME TRADE-OFF, THAT COULD HAVE CONSEQUENCES FOR MONETARY POLICY. With GBPUSD now plunging through chart support in the 1.3030s and subsequently reversing back above it post press conference, we think GBPUSD consolidates its losses today in a choppy 1.3030-1.3060s range.

-

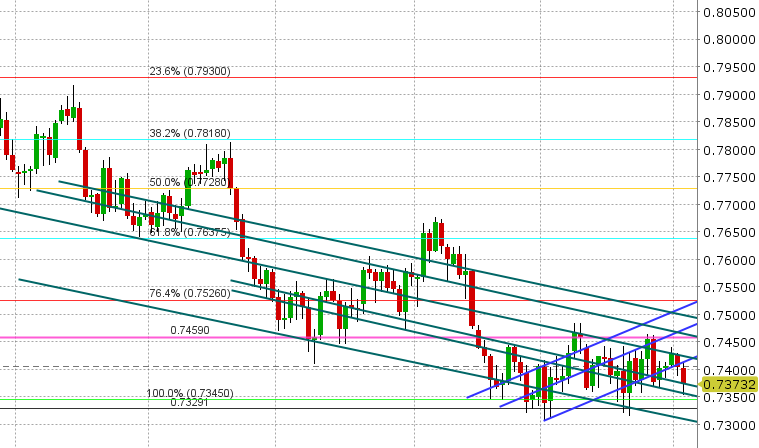

AUDUSD: The Aussie is trading lower this morning as well, as yesterday’s break below 0.7400-0.7405 chart support and today’s escalation in the US/China trade war rhetoric combines to set a negative tone. Some buyers have stepped in as trendline support in the 0.7350s holds and EURUSD, copper, gold, and stocks all bounce into the NY open. A $1blnAUD option expiry today at the 0.7350 strike may weigh into 10amET, but we think AUDUSD consolidates it losses today ahead of the US NFP numbers tomorrow. A close back above the 0.7370s would be mildly positive.

-

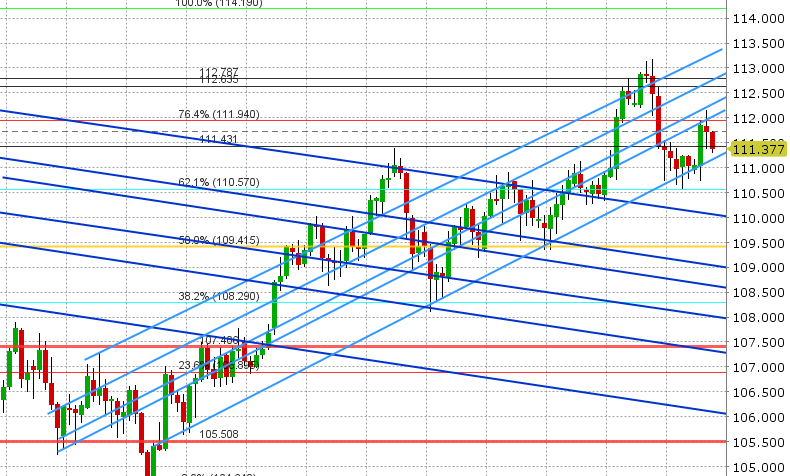

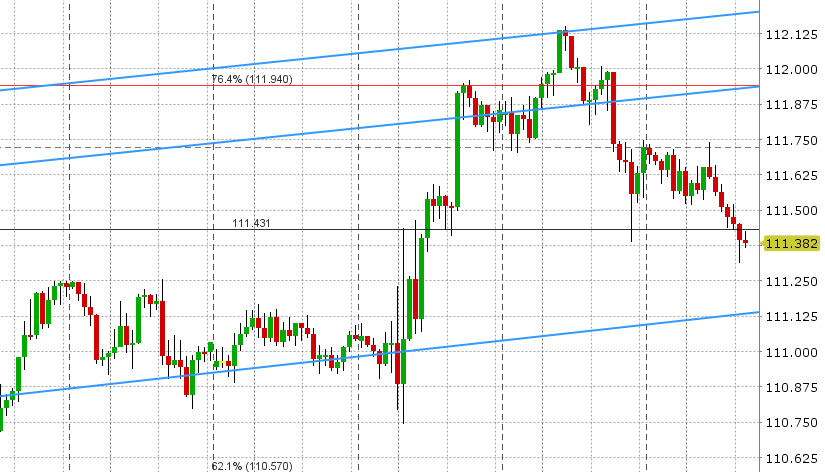

USDJPY: Dollar/yen is testing the post-Fed, NY lows this morning as the “risk off” tone to markets sees broad demand for JPY. The BOJ surprised markets overnight by intervening yet again to weaken JGBs yields, after a poor 10yr JGB auction saw yields spike to 0.13%. While the move was unscheduled and done via their open market operation, it wasn’t a fixed-rate operation (like the “line in the sand” move we saw last week) and so it still technically allows JGBs to reach Kuroda’s new 0.2% upside limit in yields (which is USDJPY negative). We think USDJPY remains on the defensive here, so long as the market remains below the 111.40s.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

September Crude Oil Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily

USD/JPY Daily Chart

USD/JPY Hourly Chart

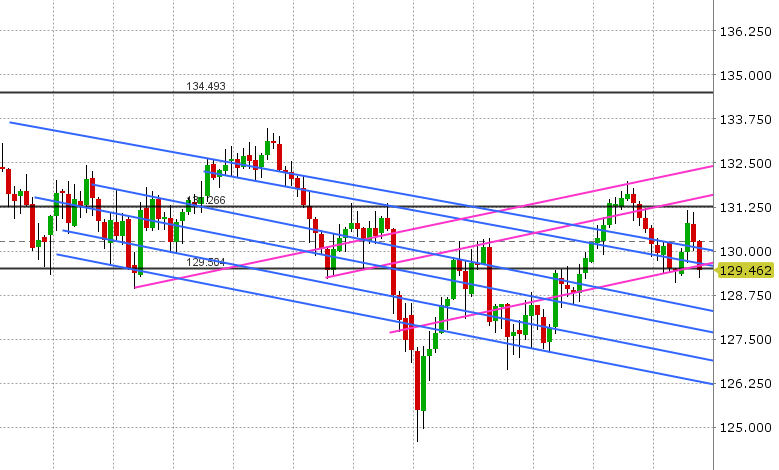

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.