Main stumbling block to a Brexit deal has been removed, according to RTE.

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- RTE News quoting two EU sources, claiming DUP acceptance of latest proposal. GBP pops.

- US reports weaker than expected Retail Sales for September. Some EUR and AUD buyers return.

- Canada reports weaker than expected CPI data for September. USDCAD inches higher, eyeing option expiry.

- China reacts angrily to US House passage of Hong Kong Human Rights and Democracy Act. AUD falls.

- USDJPY breaks out on Brexit optimism. Weak US data now testing buyer resolve.

- ECB’s Lane speaking at 10amET. Fed’s Evans at 10:45amET. BOE’s Carney at 1pmET. Fed Beige Book at 2pmET.

- Australia reports its September employment report tonight at 8:30pmET.

ANALYSIS

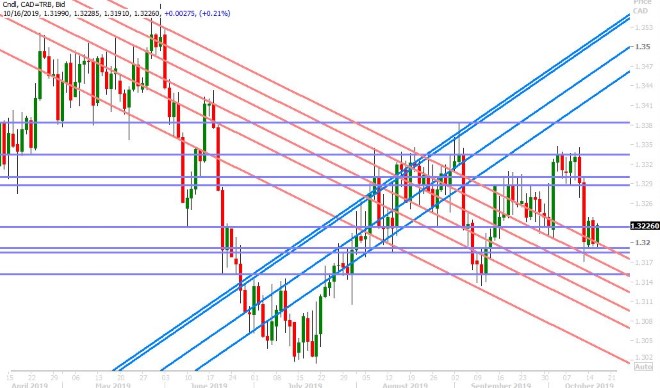

USDCAD

Dollar/CAD was quiet in the overnight session as a barrage of conflicting Brexit headlines kept GBPUSD and the broader USD in a choppy range. Some buyers were found at chart support in the 1.3190s while some sellers stepped in at the 1.3220s (the support level below which prices fell yesterday). Traders are now digesting some worse than expected September economic data out of both the US and Canada, which seems to be netting itself out in terms of its effect on USDCAD.

US Retail Sales: -0.3% MoM vs +0.3%, -0.1% MoM vs +0.2% ex-Autos

Canadian CPI: -0.4% MoM vs -0.2%, +1.9% YoY vs +2.1%

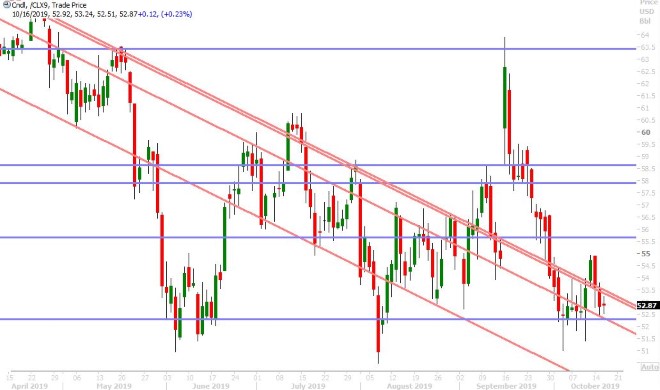

Over 1blnUSD in options expire between the 1.3235 and 1.3255 strikes at 10amET this morning and so we think this could play more of a factor on buyer minds. The weekly release of oil inventory data from the API and EIA has been delayed one day due to the Columbus Day holiday on Monday, and so watch out for these oil market headlines today at 4:30pmET and tomorrow morning at 11amET. November crude oil prices look stuck for the moment between 52.20 and 53.20.

USDCAD DAILY

USDCAD HOURLY

NOV CRUDE OIL DAILY

EURUSD

Euro/dollar was very choppy in overnight trading today as traders followed GBPUSD amid a lack of other European economic headlines. The market made two attempts to rally and stay above the 1.1030s, but these forays to the upside ultimately failed. The weaker than expected US Retail Sales figure just released is now trying to cancel out this negative technical development, and so we are watching closely. Sizable option expiries are plentiful in EURUSD for 10amET this morning, with 1.1blnEUR rolling off at 1.1025 and another 1.2blnEUR coming off the board at 1.1050-60.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling has been all over the map this morning as a barrage of conflicting Brexit headlines floods the wires. Much of the talk today has centered around the DUP party from Northern Ireland and whether or not they’ll support Boris Johnson’s new plan. The market dipped on headlines about talks potentially collapsing on DUP resistance, but it has since rebounded on reports that the Northern Irish have privately accepted the PM’s proposals. The EU’s chief Brexit negotiator Michel Barnier is adding to the positive mood over the last couple hours by saying he's optimistic for getting a deal done today. The UK reported slightly weaker than expected CPI figures for the month of September this morning (+0.1% MoM vs +0.2% and +1.7% YoY vs +1.8%), but traders are not really paying attention. RTE News is now reporting that “two senior EU sources say the main stumbling block to a deal has been removed with the DUP accepting the latest proposals on consent” and with that GBPUSD has seen a brief pop above the 1.2800 level. The two-day EU summit begins tomorrow and if a deal cannot be formally struck by the end of it, the UK’s new Benn Act requires Boris Johnson to write a letter to the EU by Saturday requesting a 3 month Brexit extension.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar is under pressure again this morning, but this time on the back of a “risk-off” headline from China last night. The US House of Representatives unanimously passed a bill in support of Hong Kong protestors called the Hong Kong Human Rights and Democracy Act, to which China then threatened retaliation. More here from the Washington Post”. This sent the Chinese yuan and the China-sensitive AUD lower around the 9pmET hour, and we also saw US yields and USDJPY back up. AUDUSD fell below the 0.6750 level that held up prices in NY trade yesterday as a result, and while the weak US Retail Sales report just released has stemmed the selling for now, we think the AUD sellers are back in charge here. Australia reports its September employment report tonight at 8:30pmET, with traders expecting +15k jobs created and 5.3% on the unemployment rate.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Yesterday’s big headline about EU/UK negotiators “closing in” on a draft Brexit deal was enough to see dollar/yen surge above the 108.40s, and with that we now have a confirmed upside breakout on the daily chart. The overnight headlines from China regarding Hong Kong brought about some selling in Asian trade, and traders are now wrestling RTE's positive Brexit headline against some weak US economic data as NY trade gets underway. We think another NY close above the 108.40s is very important in order to sustain the market’s upward momentum.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.