Global markets trying to shrug off virus fears again

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- S&P futures and US yields bounce, despite more coronavirus cases in South Korea and Italy.

- China reports just 5 new cases outside Hubei province. USDCNH traders sidelined.

- USDCAD continues to struggle with 1.3300 resistance level. AUDUSD extends to new lows.

- EURUSD sees volatility around Zeit headline: GERMANY'S SCHOLZ PLANS TEMPORARY DEBT BRAKE SUSPENSION.

- Sterling gives up yesterday’s gains as traders await UK negotiating mandate for 2020 trade talks with EU.

- Traditional USDJPY risk-on/risk-off correlation re-establishes itself as Japanese cases increase by just 12 today.

- Weekly EIA oil inventory report at 10:30amET, ++2.005M barrels expected.

ANALYSIS

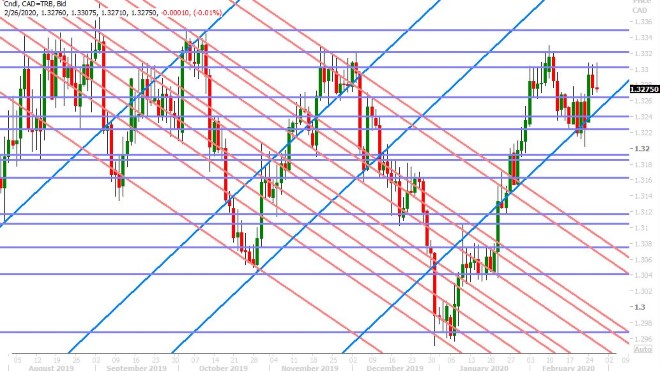

USDCAD

Dollar/CAD traders couldn’t muster any sort of challenge on the 1.3300 level yesterday despite the continued coronavirus fear-driven selloff in the equity and oil markets. This had us pondering increasing downside vulnerability for USDCAD, especially if the virus news flow were to turn more positive. This hasn’t really happened in overnight trade today as the coronavirus case count increased to 1,261 in South Korea, 374 in Italy and 139 in Iran. The S&P futures and US yields are oddly taking this news in stride recouping most of their early European losses, but the oil market is still not in a good mood. The April contract lost chart support in the 49.60s earlier today and the market now looks poised for further losses as traders now appear doubtful that OPEC will announce a deepening of production cuts next week. The Reuters poll consensus expectation for this morning’s weekly EIA inventory report is +2.005M barrels.

We feel today’s relative under-performance for the crude oil market is behind USDCAD’s overnight bid, but we’d note how the market continues to struggle with chart resistance at the 1.3300 level. We strongly feel the bulls need to make a move above 1.3300 quickly or we’re going to have a bunch of disappointed longs who may want to bail.

USDCAD DAILY

USDCAD HOURLY

APR CRUDE OIL DAILY

EURUSD

Traders are debating a headline from German news outlet Zeit this morning titled: GERMANY'S SCHOLZ PLANS TEMPORARY DEBT BRAKE SUSPENSION. More here from Bloomberg. This seemed to be the catalyst behind EURUSD’s early NY session run-up above chart resistance in the 1.0890s, but the move proved to be very short lived after market chatter largely concluded that these headlines about helping out local German municipalities were largely anticipated and were not a knee jerk reaction to the coronavirus outbreak.

The market has given up its gains and then some, which is creating some negative reversal momentum on the charts. There are a ton of options expiring this morning but it appears traders will now be focused on the 3blnEUR worth rolling off between the 1.0850 and 1.0870 strikes.

EURUSD HOURLY

APRIL GOLD DAILY

GBPUSD

Sterling is giving back all of yesterday’s gains this morning, in lockstep with the choppy tone we expected for the week back on Friday. Reuters is running with the pound being down today because of coronavirus fears, but we don’t buy that. We think what we’re seeing is a little bit of anxiety ahead of the release of the UK’s negotiating mandate for trade talks with the EU (tomorrow) + a little bit of GBPUSD traders following EURUSD after the latter showed buyer failure in the 1.0890s. We’d argue that sterling has been rather immune (pun intended) from the ebbs and flows of the coronavirus fear trade so far, as the UK has reported only 13 cases so far and no deaths.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

We’re seeing a similar pattern in the Australian dollar again this morning where traders want to keep selling it despite a mild bounce in broader risk sentiment. We think repeated buyer failure at the 0.6605 level over the last 24hrs has been part of the problem, and we think last night’s much weaker than expected Australian Construction Work figures for Q4 2019 are adding to negative Aussie sentiment. The report is not normally market moving but the fact that it missed expectations big time (-3.0% QoQ vs -1.0%) is leading some traders to believe next week’s Q4 GDP numbers out of Australia will be weak. AUDUSD has extended to yet another 11 year low this morning and we think focus will be on whether or not trend-line extension support in the 0.6560s can hold.

China’s National Health Commission reported just 5 new coronavirus cases outside Hubei province for February 25 – an unbelievable number when you consider we’re talking about the rest of China’s population (1.3bln people) and how they're nowhere near returning to normal. It’s almost as if Chinese yuan traders don’t know what to do with themselves here. Problem solved?

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen is catching a bid today as traders reestablish the market’s traditional correlation to risk-on/risk-off flows. This was evident in NY trade yesterday and it continues today, and we think this is because the daily growth rate of new conoravirus infections in Japan was low once again today (just 12 new cases) and there have still only been 2 deaths since the country first started reporting cases. We think the market will pivot around the 110.50 chart resistance level today, where it just so happens over 1.3blnUSD in options will also be expiring.

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.

Side bar content: or Cancel