Fed effectively goes all-in by signaling unlimited QE

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Fed to buy treasuries/MBS in “amounts needed to support smooth market functioning”.

- Fed to create two new bond/loan facilities for large corporations + main street business lending program.

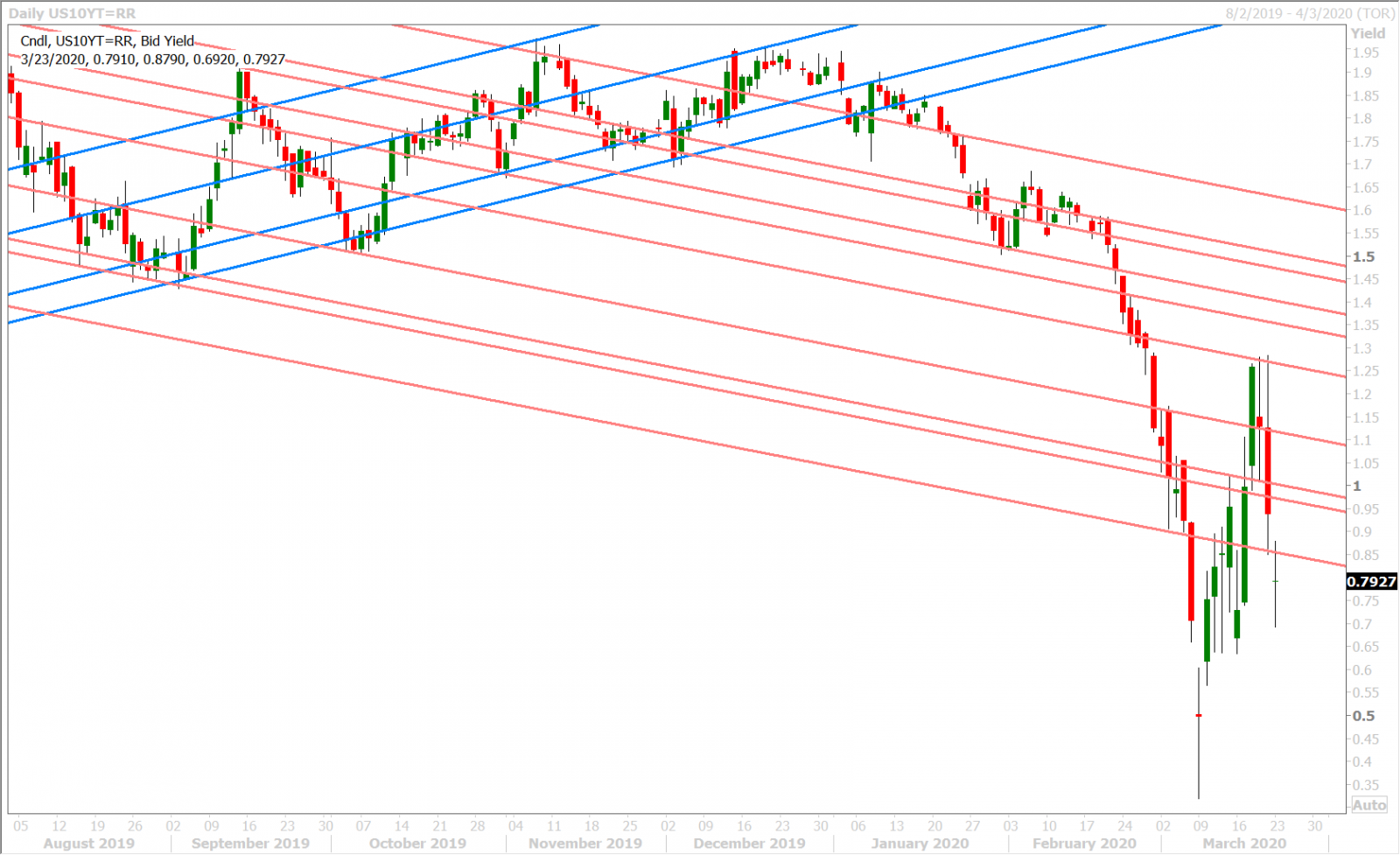

- Risk sentiment pops initially but now beginning to fade once again. US 10yr yields reverse higher.

- USDCAD holds 1.4350s resistance turned support from Friday. EURUSD still struggles with 1.08s.

- Sterling still hungover from Friday’s failed bullish outside day. Fed announcement barely helps.

- AUDUSD holding bottom of new 0.5720-0.6020 range ahead of Australian flash PMIs for March.

- Global flash PMIs out tomorrow. US Senate vote expected today. G20 emergency meeting underway.

ANALYSIS

USDCAD

There was an uneasiness to global markets in the overnight session as traders digested more negative coronavirus news over the weekend, a scheduled vote before the US Senate on the US coronavirus relief package this morning, and possible news from an emergency G20 meeting now underway; but the US central bank is attempting to come to the rescue yet again now by effectively announcing that it has gone "all in". The Fed has just announced open-ended treasury/MBS purchases, a term asset-backed loan facility (TALF), two new bond/loan facilities for large corporations, and a “main street business lending program” to support eligible SMEs. Full press release here.

The surprise news worked for a little bit. The US 10yr yield dropped 12bp initially, the S&P futures traded +3% after being locked limit -5% last night, and the USD was sold across the board. USDCAD re-tested the 1.4350 resistance level it broke above on Friday and the May oil futures bounced 4% higher. However, all this excitement is now fading.

This week’s economic calendar will be focused on the flash global PMI reports, which will be freshest look at how business sentiment is faring so far in the month of March. The Australian and Japanese numbers come out tonight; and the European and US figures come out tomorrow. Canada just reported its January Wholesale Trade numbers at +1.8% MoM vs -0.2% expected and +0.9% previously, but again we think traders are ignoring this because it’s all pre-coronavirus. On the coronavirus front, anxiety continues to grow as the death count in Italy surpassed China’s on the weekend and as lockdowns went into effect for New York and California. Ordered lockdowns for the UK, Australia and New Zealand are rumored to be next. The IOC is finally considering postponing the 2020 Toyko Olympic Games.

The latest Commitment of Traders (COT) report from the CFTC showed the leveraged funds flipping from a net short to a net long USDCAD position during the week ending March 17, which is not shocking considering the market’s move to the 1.42s during that window of time, but we’re a bit surprised that they were not long more as of last Tuesday. We’ll probably see this reflected in Friday’s COT update.

USDCAD DAILY

USDCAD HOURLY

3-MONTH EURUSD CROSS CURRENCY BASIS SWAP HOURLY

EURUSD

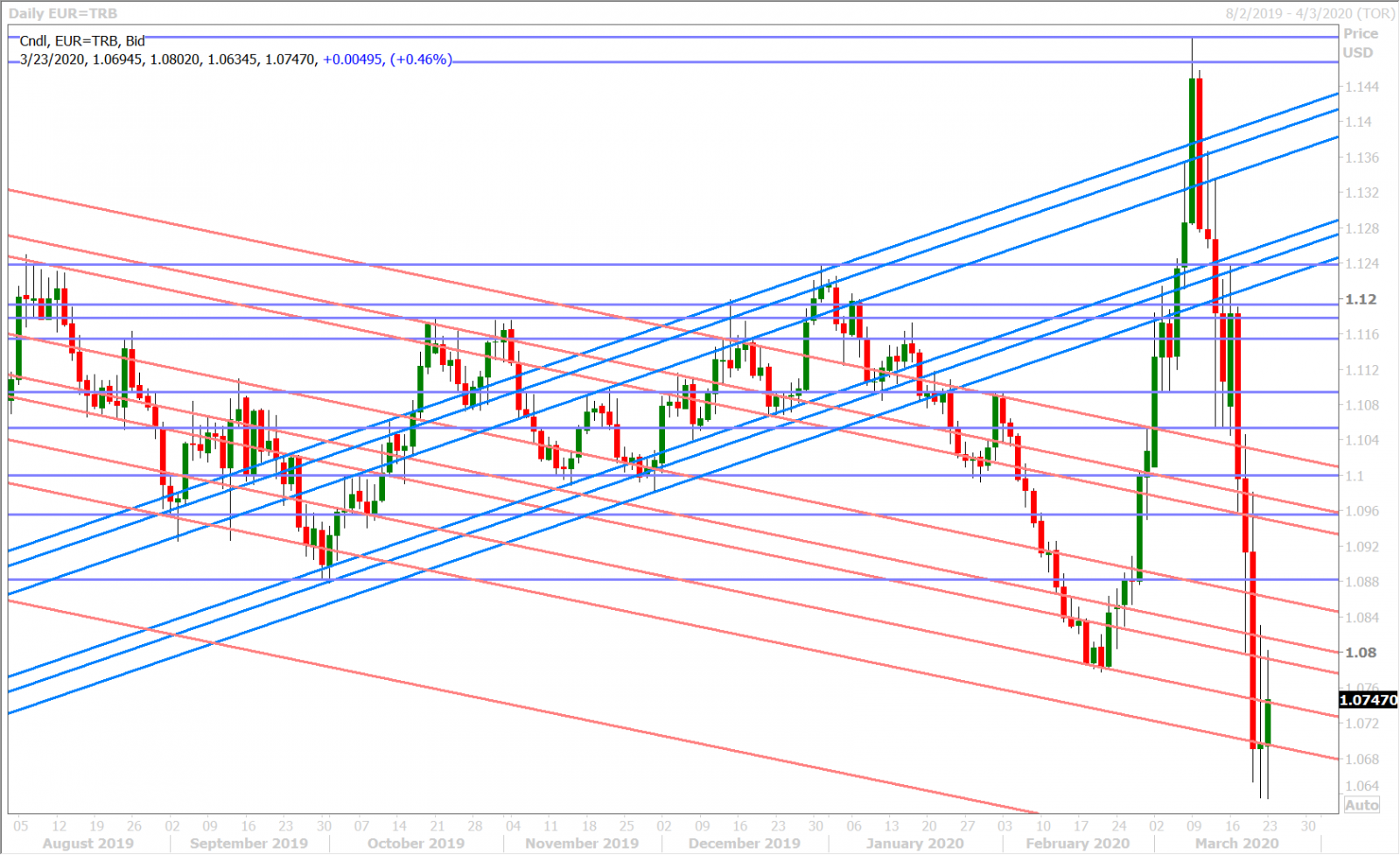

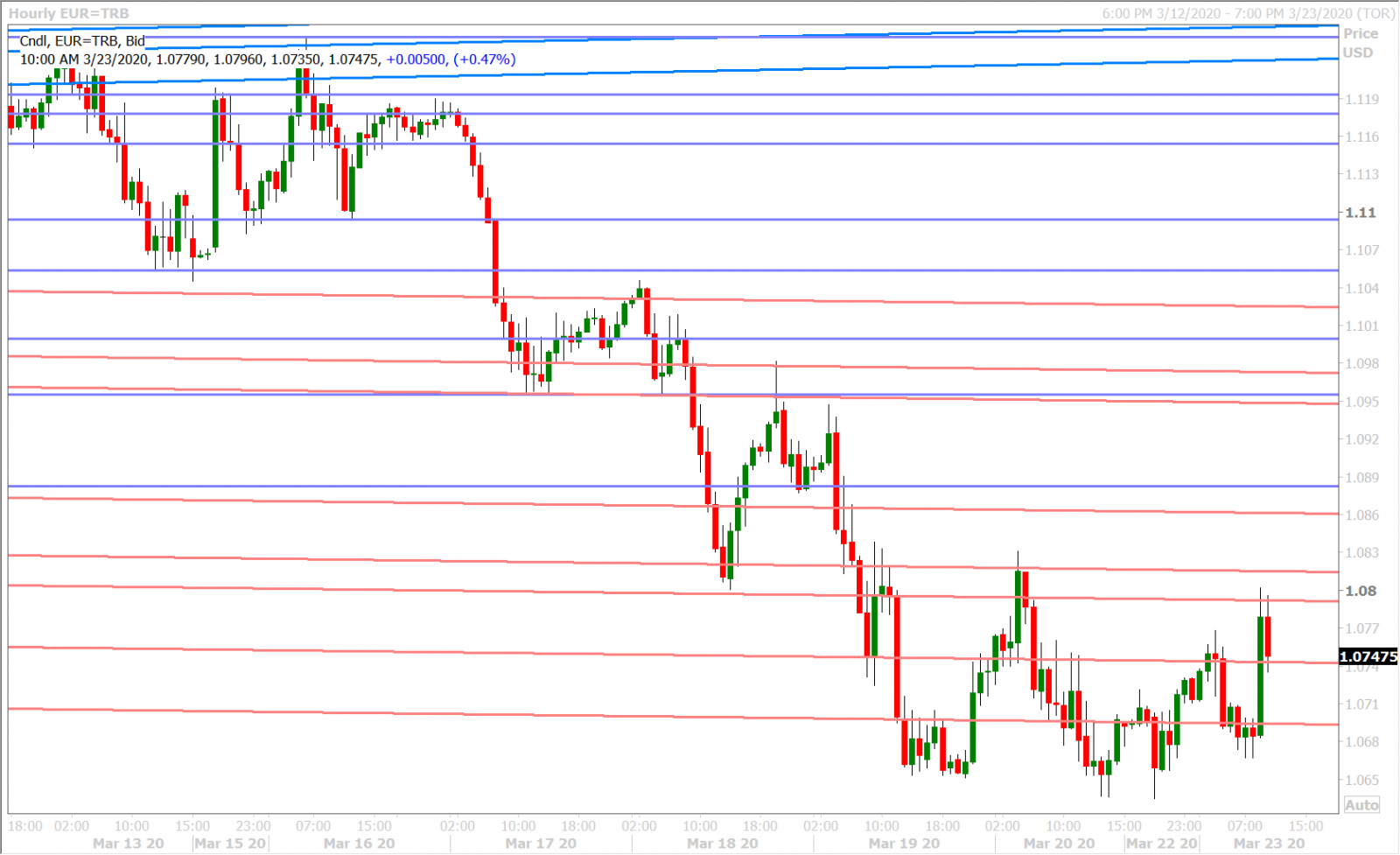

Euro/dollar quickly popped back towards the 1.08 handle on the back of the Fed’s surprise open-ended QE announcement this morning, but it’s now falling back. The German government just signed off on a 750blnEUR economic package to battle the economic fallout expected from the coronavirus outbreak as well, but we think this news got lost in the Fed headlines. We’re truly seeing unprecedented stimulus measures being taken this morning, but it still remains to be seen if this can help EURUSD arrest its downward trajectory. We think the market’s momentum is still down so long it stays below the 1.0820s.

EURUSD DAILY

EURUSD HOURLY

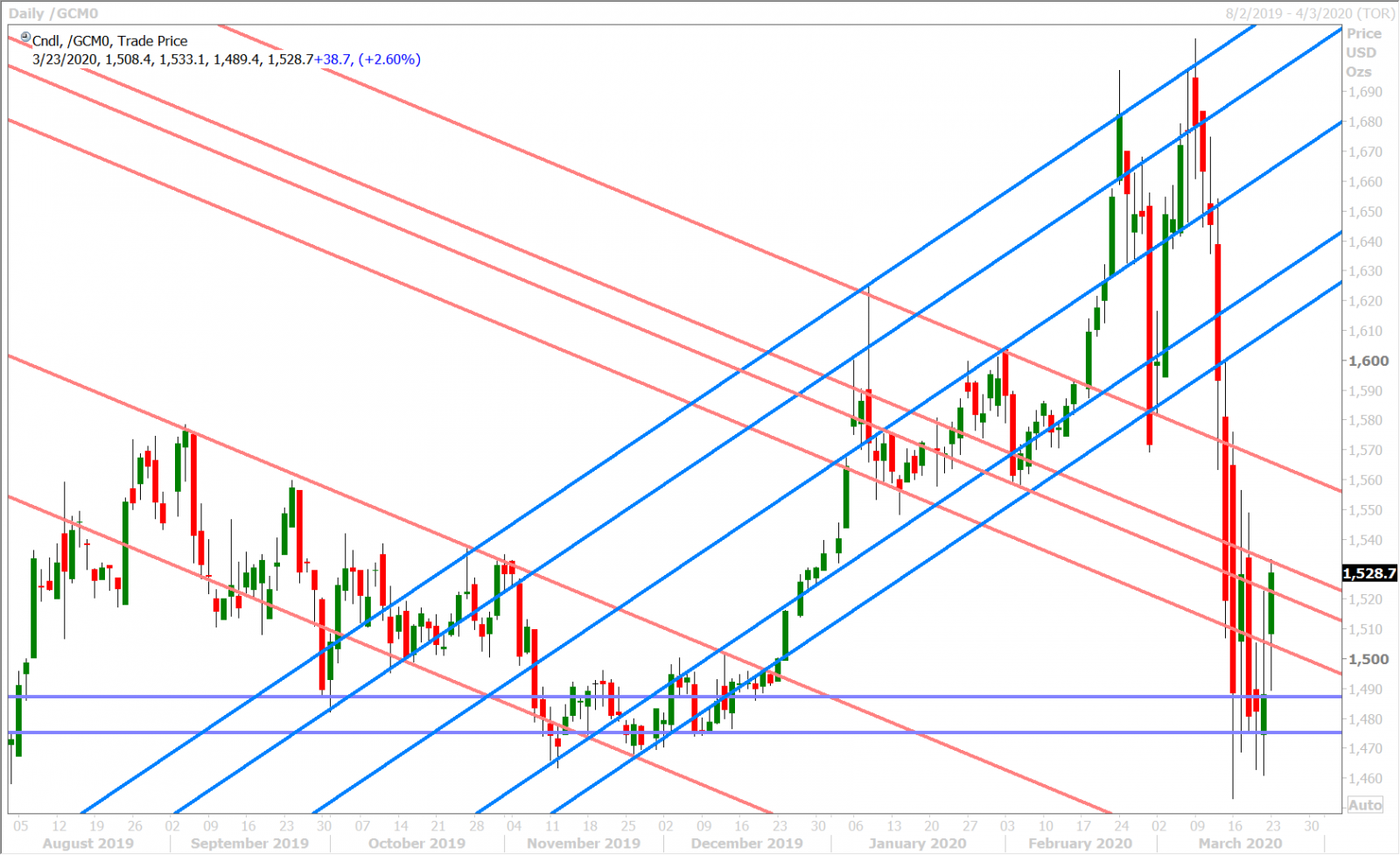

APRIL GOLD DAILY

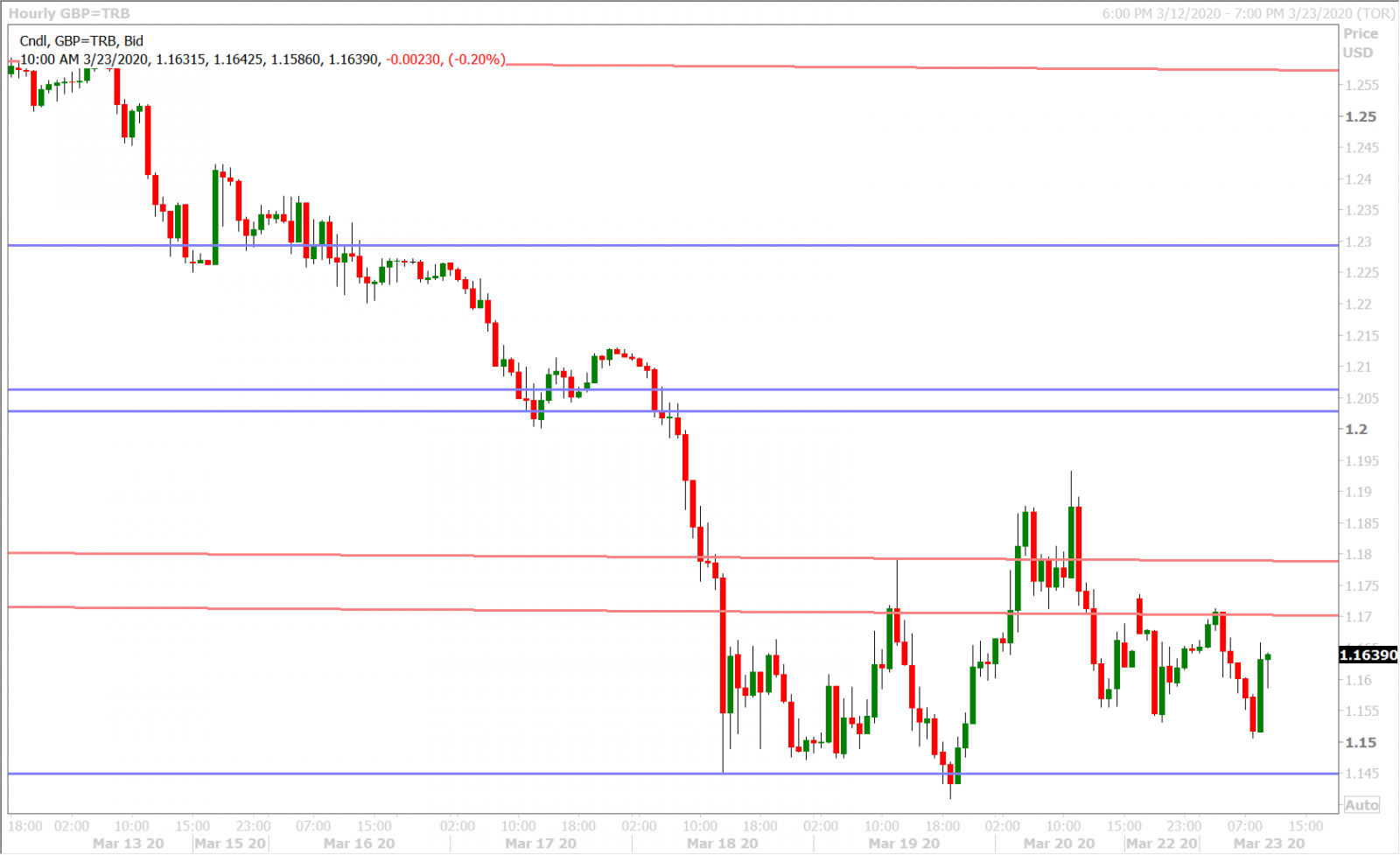

GBPUSD

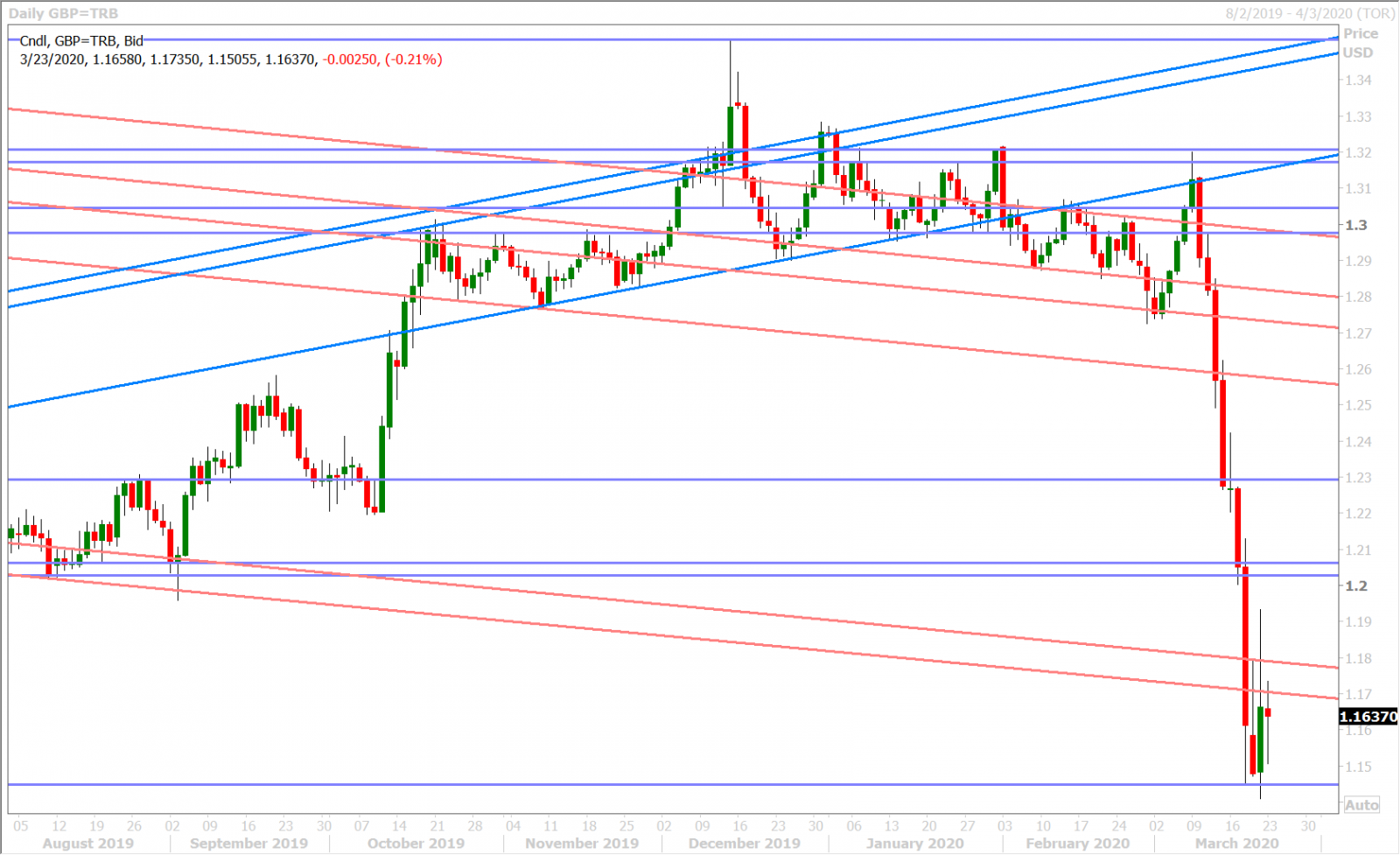

Sterling bounced 150pts on the Fed’s 8am announcement this morning, but it remains well below the 1.1700 mark which it lost in NY trade on Friday and it seems to still be hungover from Friday’s failed attempt to confirm a bullish outside day above 1.1790. Rumors are circulating the UK will be the next nation to force new lock-down laws upon its citizens. More here from Sky News.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

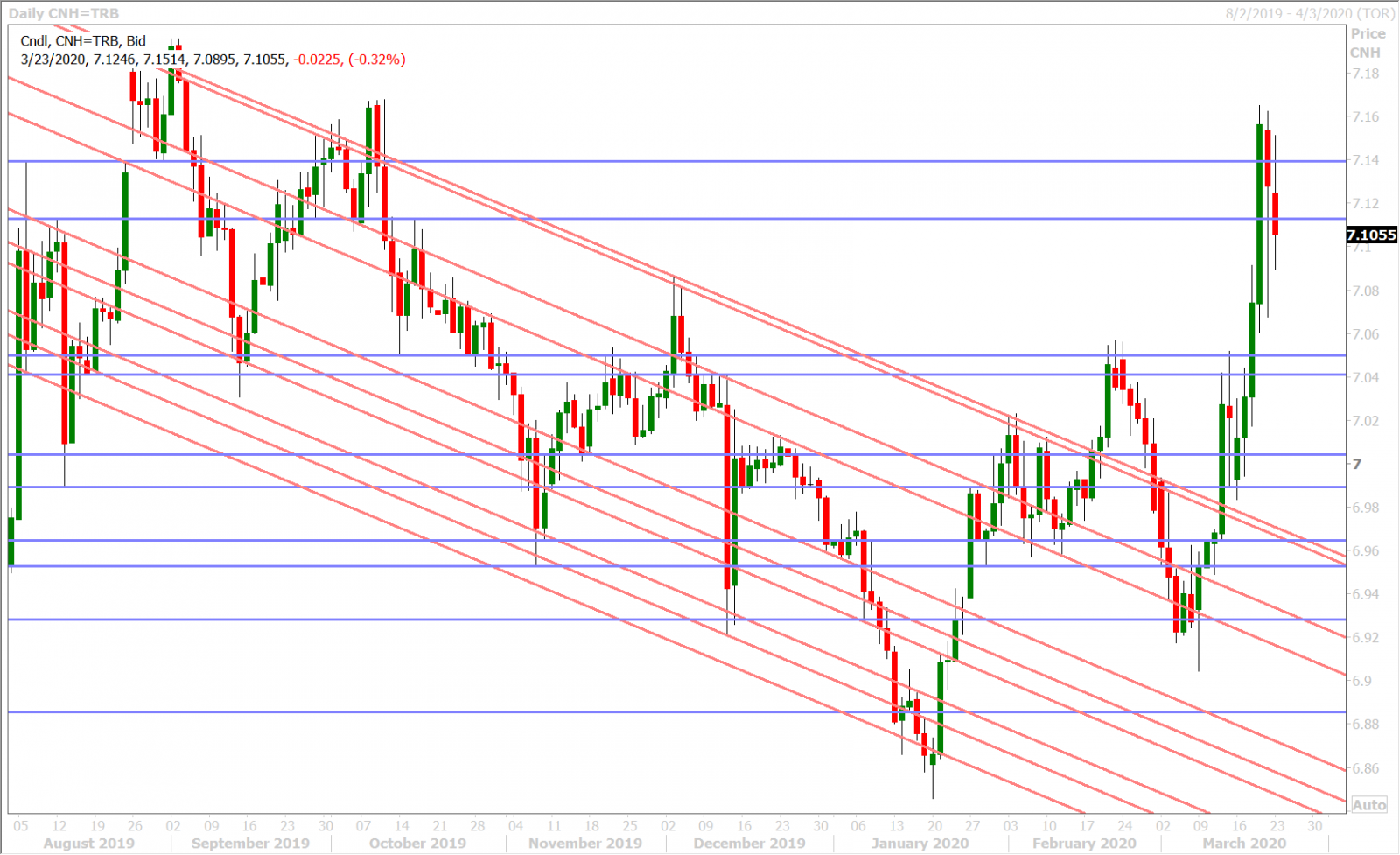

AUDUSD

The Australian dollar remains volatile. It traded weaker again overnight on the back of the limit down move in US stock futures and it’s gotten a boost back into the green this morning following the Fed's "QE-forever" announcement. We think the 0.5720s to the 0.6020s will be the pivotal price range for AUDUSD to start the week, and we believe tonight’s flash Australian PMIs for March (to be released at 6pmET) may get more attention than usual.

AUDUSD HOURLY

USDCNH DAILY

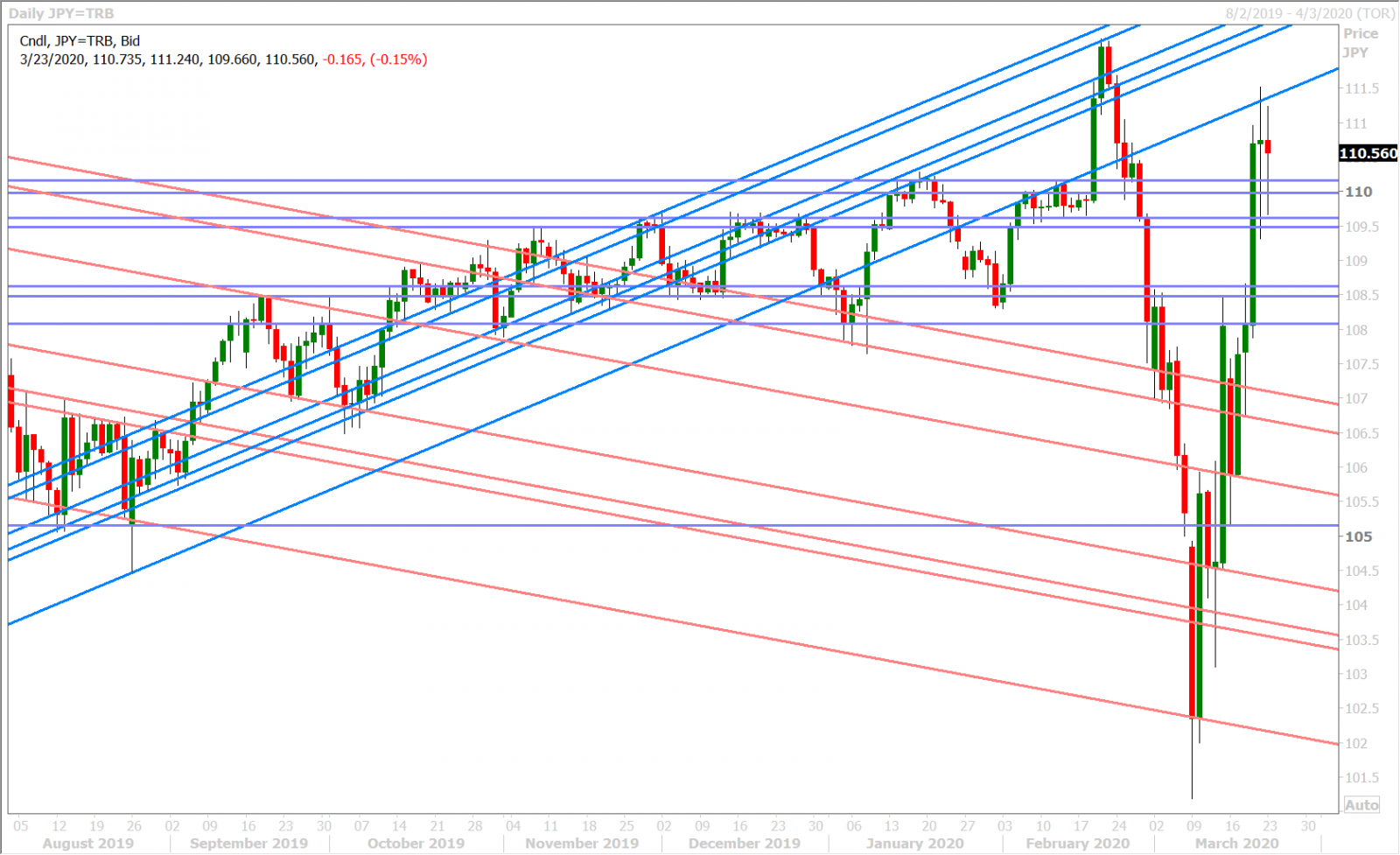

USDJPY

Dollar/yen is pulling back from its overnight highs as the Fed tries to prop up everything for as long as necessary now, but we’re still seeing buyers on dips below 110.00. The 3-month USDJPY cross currency basis swap has narrowed to -82 bp and the EURUSD version has narrowed to -8 bp, but again…we’re seeing a market that appears to be once again resisting whatever monetary authorities through at it. The US 10yr yield has now completely reversed its 12bp dip on the Fed announcement, which is not good news at all for global bond markets.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.