FX markets still on EU-Summit watch

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- European leaders set to resume talks on EU recovery fund deal at 11amET.

- Frugal Four countries reportedly settled on 390blnEUR grant amount.

- EUR bid in Europe, now lower as massive downside option expiries loom.

- EURGBP imploding as Brexit negotiations resume today. GBPUSD benefits.

- AUDUSD and USDCAD remain stuck in familiar ranges since Wednesday.

- USDJPY spikes on Gotobi demand last night, now lower with broader USD.

ANALYSIS

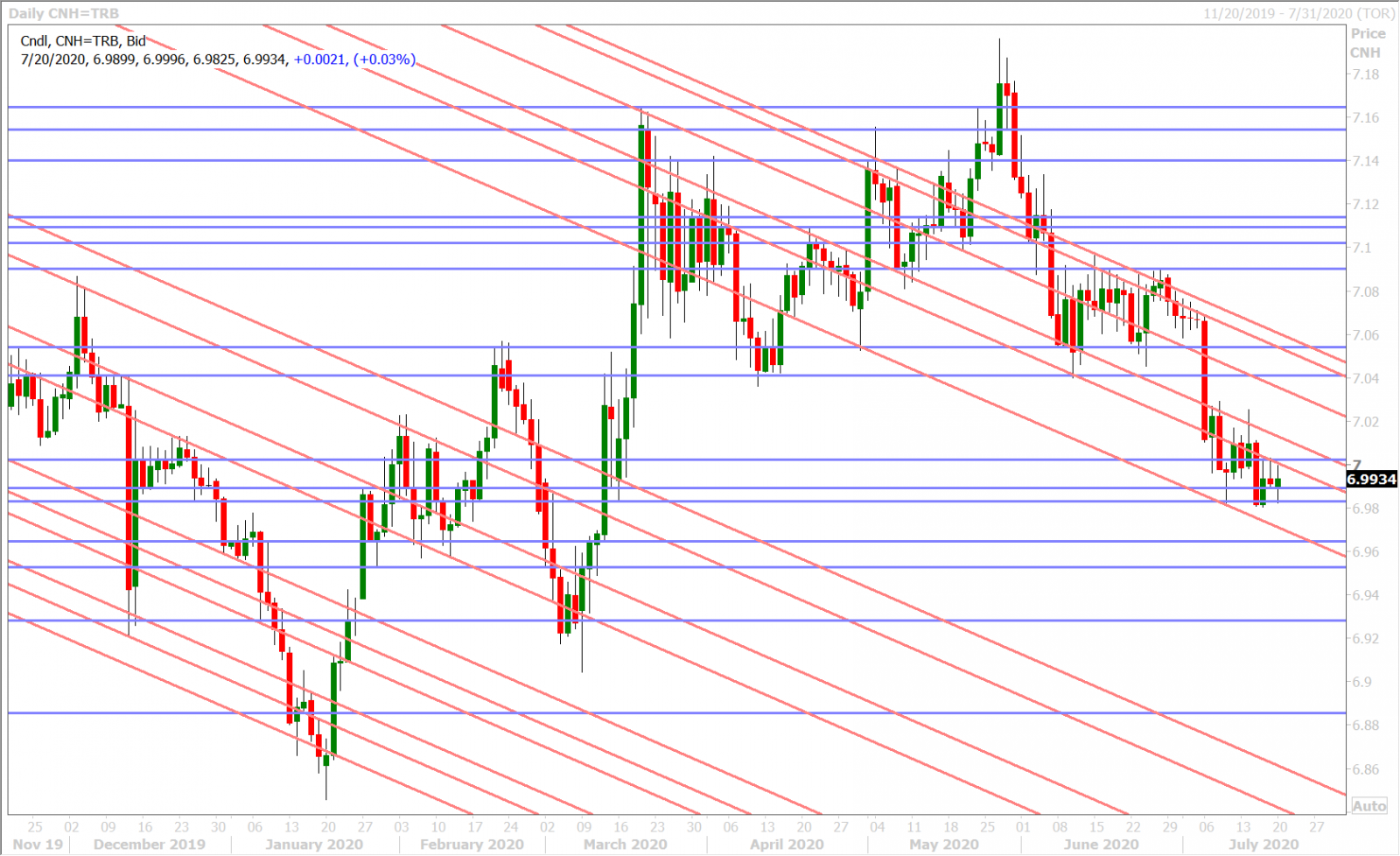

USDCAD

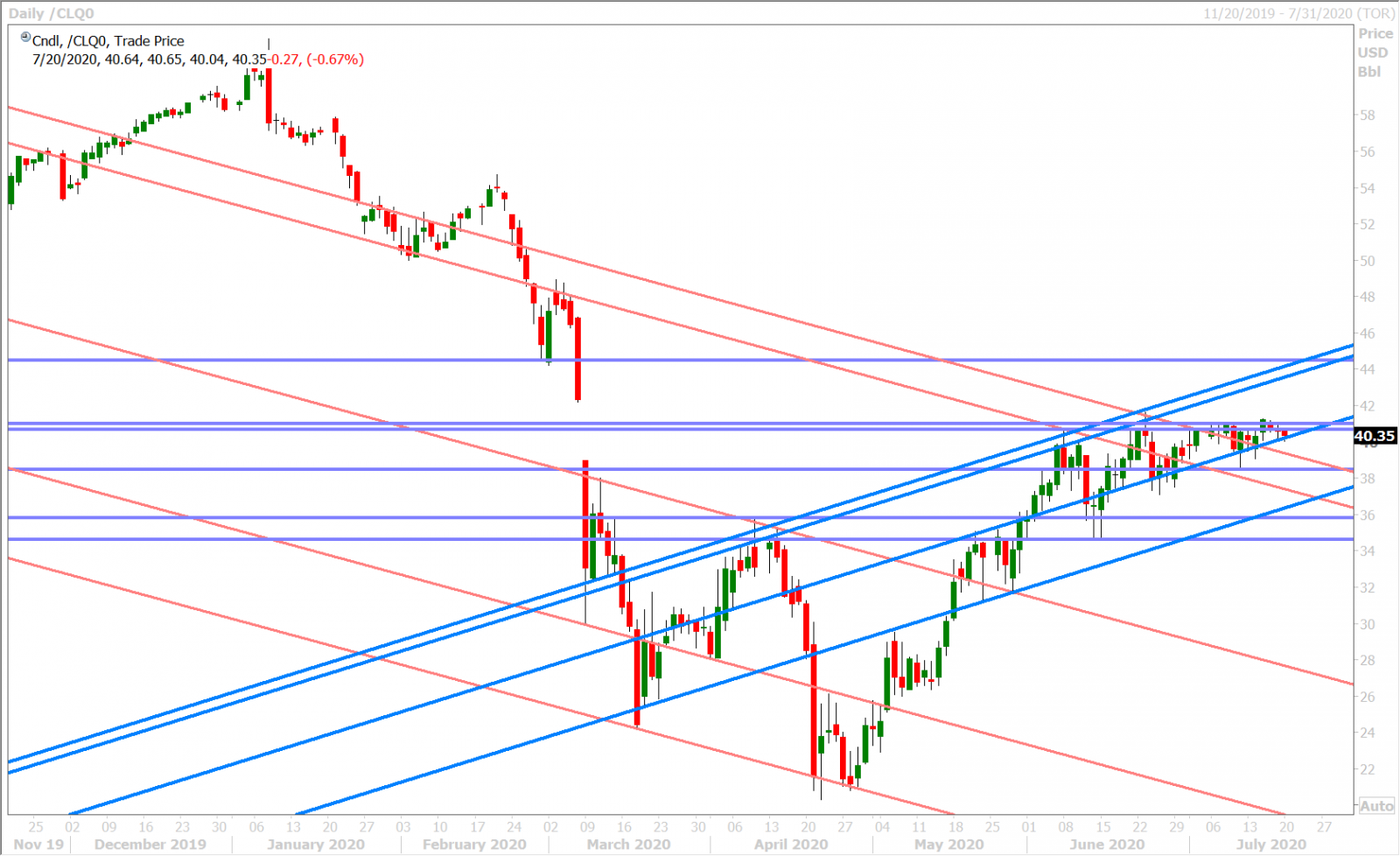

European Union leaders haven’t yet formally come to an agreement on the composition of the bloc’s 750blnEUR recovery fund, but positive chatter that the “Frugal Four” countries have settled on a figure of 390blnEUR for the grants component (vs 500blnEUR originally) seemed to drive EURUSD strength and broad USD weakness in European trade this morning. EU Summit talks are set to resume at 11amET, funnily enough right after the EURUSD market will be released from the shackles of 6.8blnEUR worth of downside option expiries between the 1.1350 and 1.1400 strikes, and so we wonder if this could sow the seeds for some EURUSD-driven USD volatility later today. Dollar/CAD is trading with a slightly offered tone this morning, but still remains stuck right in the middle of its familiar 1.3520-40 to 1.3610-20 price range.

This week’s North American economic data calendar is not going to be that eventful (see below) and so we think USDCAD traders will trade off the broader USD tone and perhaps oil prices, if they can finally break above the $41 level on the August futures contract. The latest Commitment of Traders report released by the CFTC showed the leveraged funds liquidating short USDCAD positions during the rangy week ending July 14; which had the effect of marginally increasing their net long position back to late June levels. The Federal Reserve has now entered its blackout period ahead of next Wednesday’s FOMC meeting and so that means no Fed-member speak for the next 7 days.

Tuesday: Canadian Retail Sales (May)

Wednesday: Canadian CPI (June)

Thursday: US Jobless Claims (week ending July 18)

Friday: US Flash PMIs (July)

USDCAD DAILY

USDCAD HOURLY

AUGUST CRUDE OIL DAILY

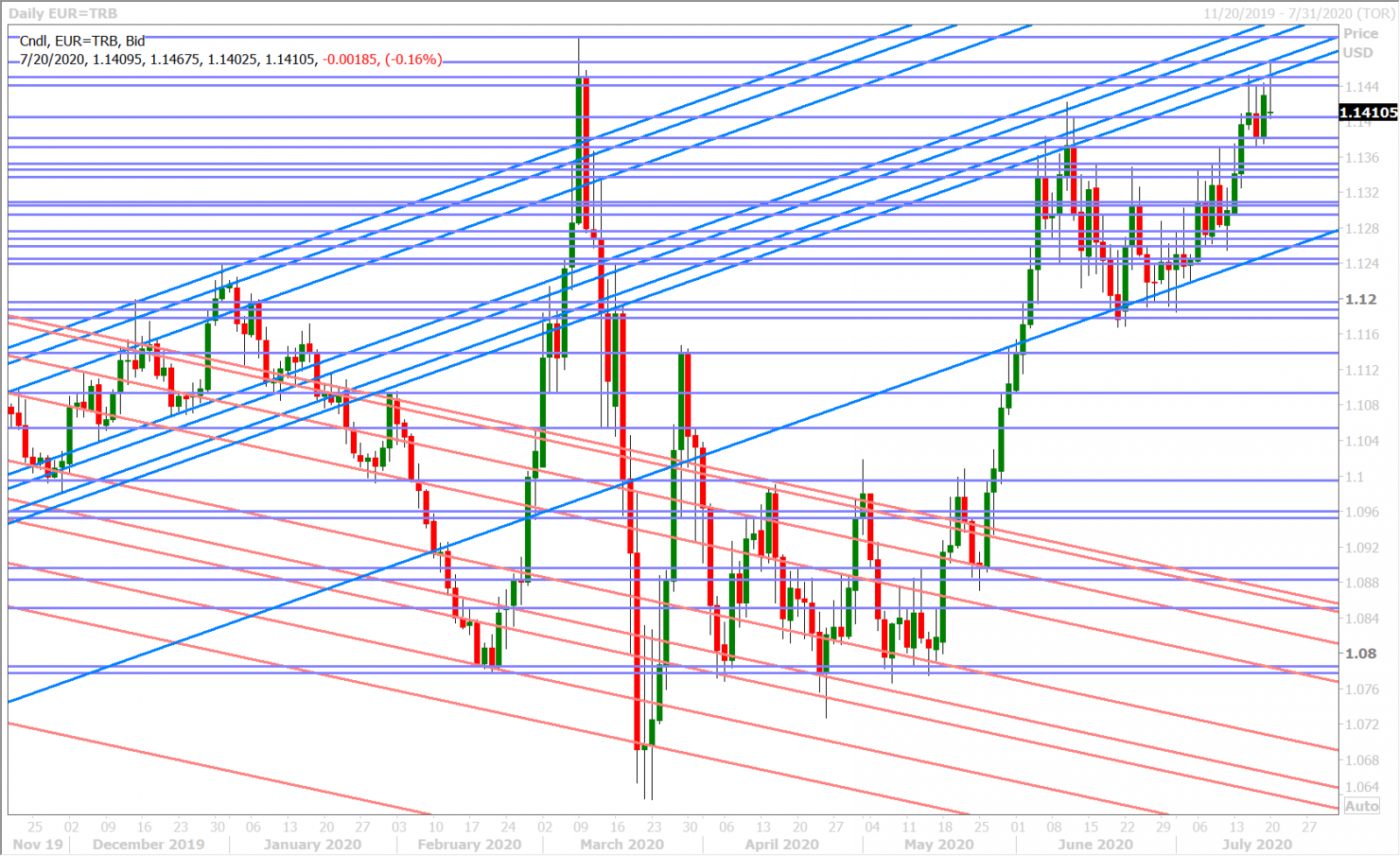

EURUSD

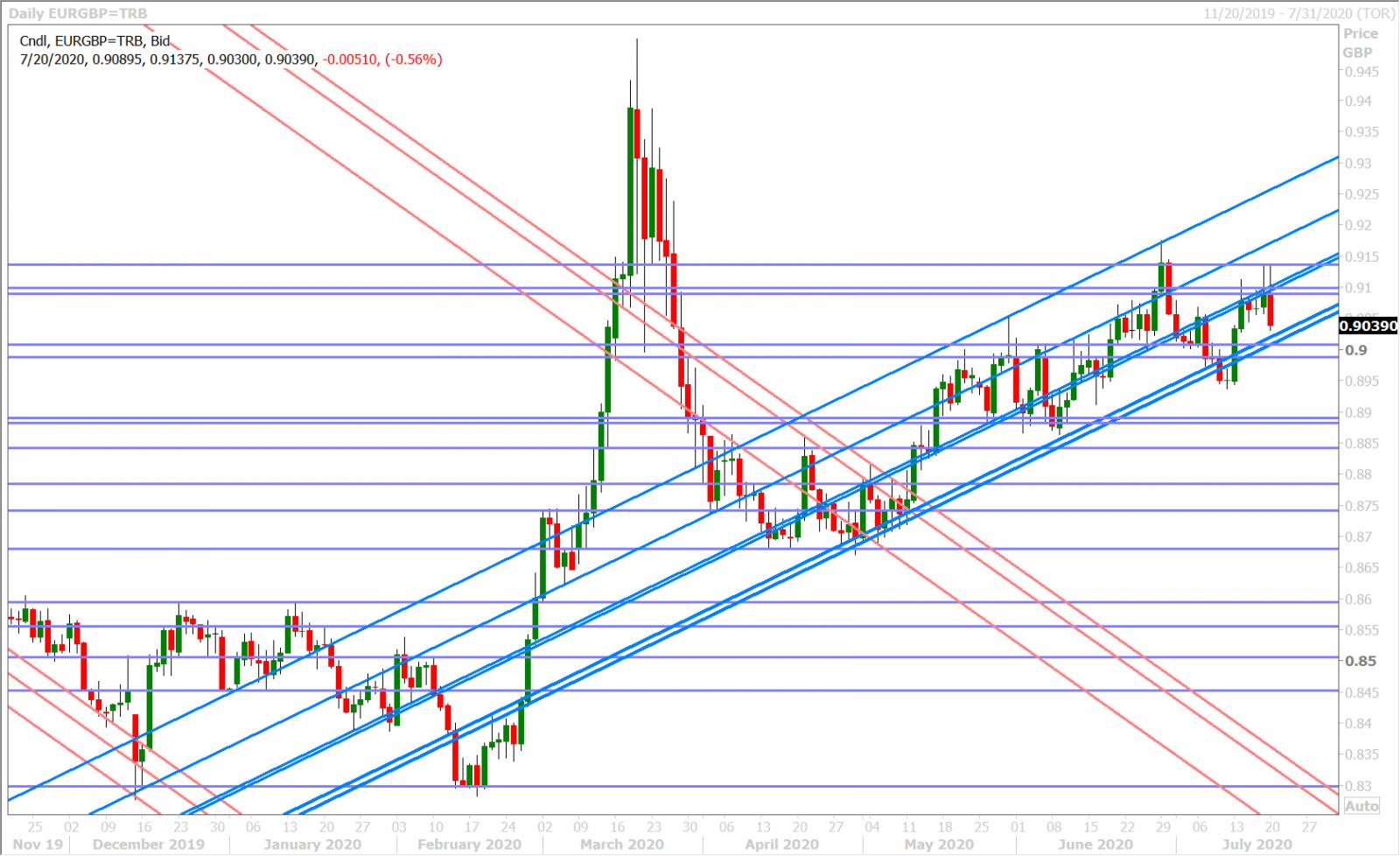

Everybody’s on “EU Summit watch” this morning as recovery fund discussions are set to resume at 11amET. A deal wasn’t reached over the weekend, but the markets are trading as if EU leaders are very close to reaching one. We still can’t help but notice how bullish the street is when it comes to EURUSD forecasts, and so we have to wonder if the eventual confirmed deal headlines prompt a “buy the rumor/sell the fact” type of market reaction. The leveraged funds added to their net long position for the second week in a row during the week ending July 14. This week’s European economic calendar features the flash PMIs for July on Friday.

EURUSD DAILY

EURUSD HOURLY

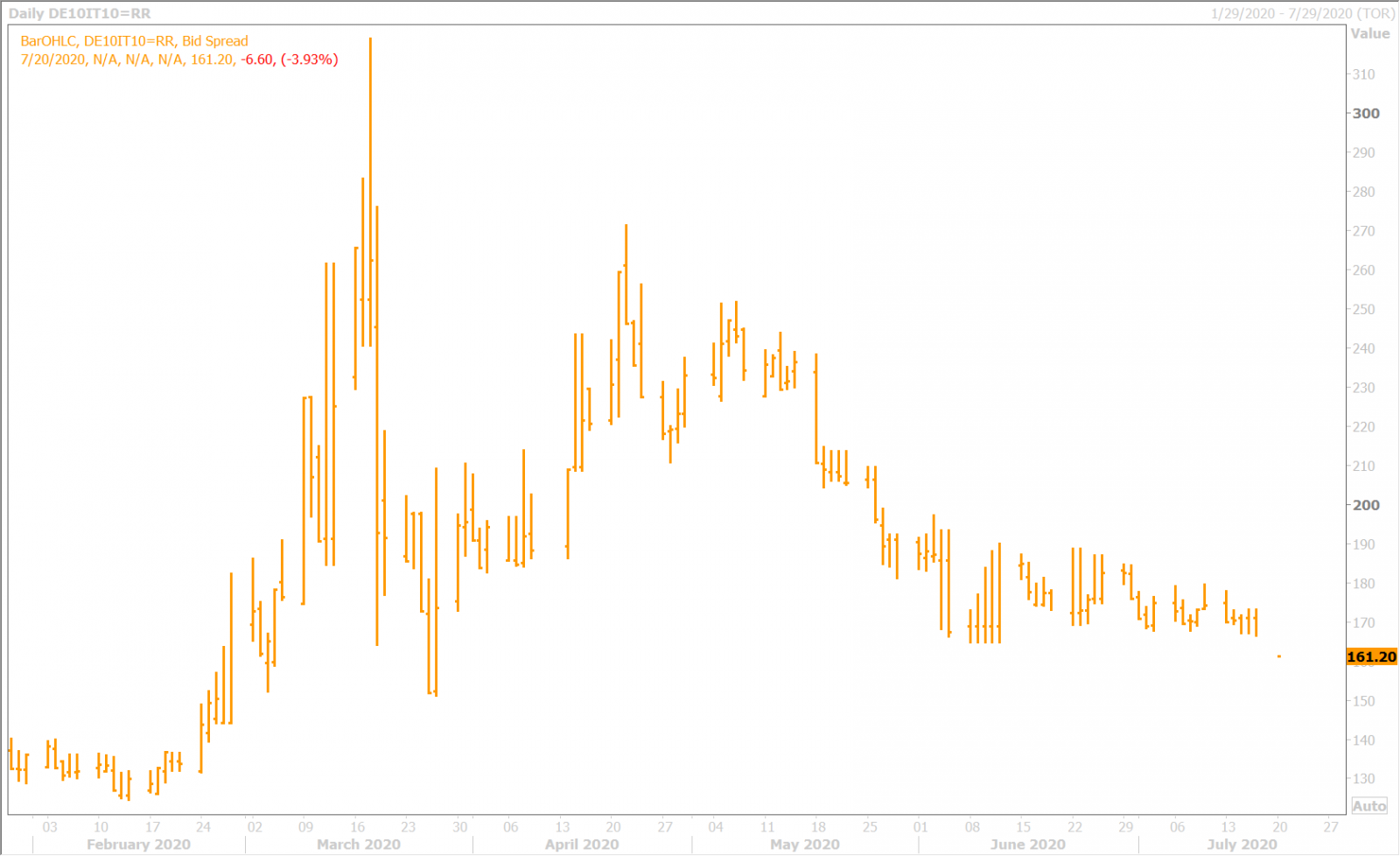

BTP/BUND YIELD SPREAD DAILY

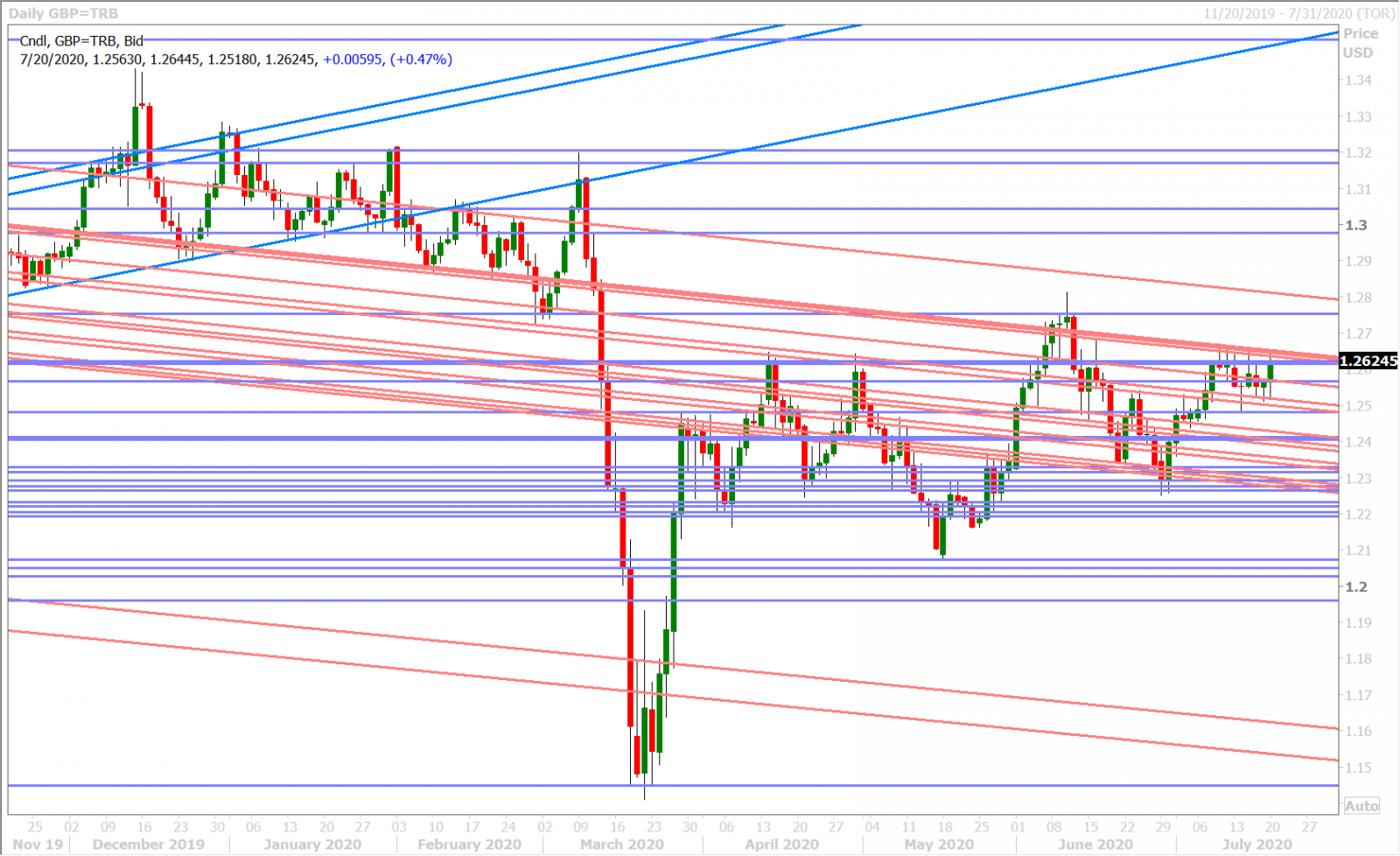

GBPUSD

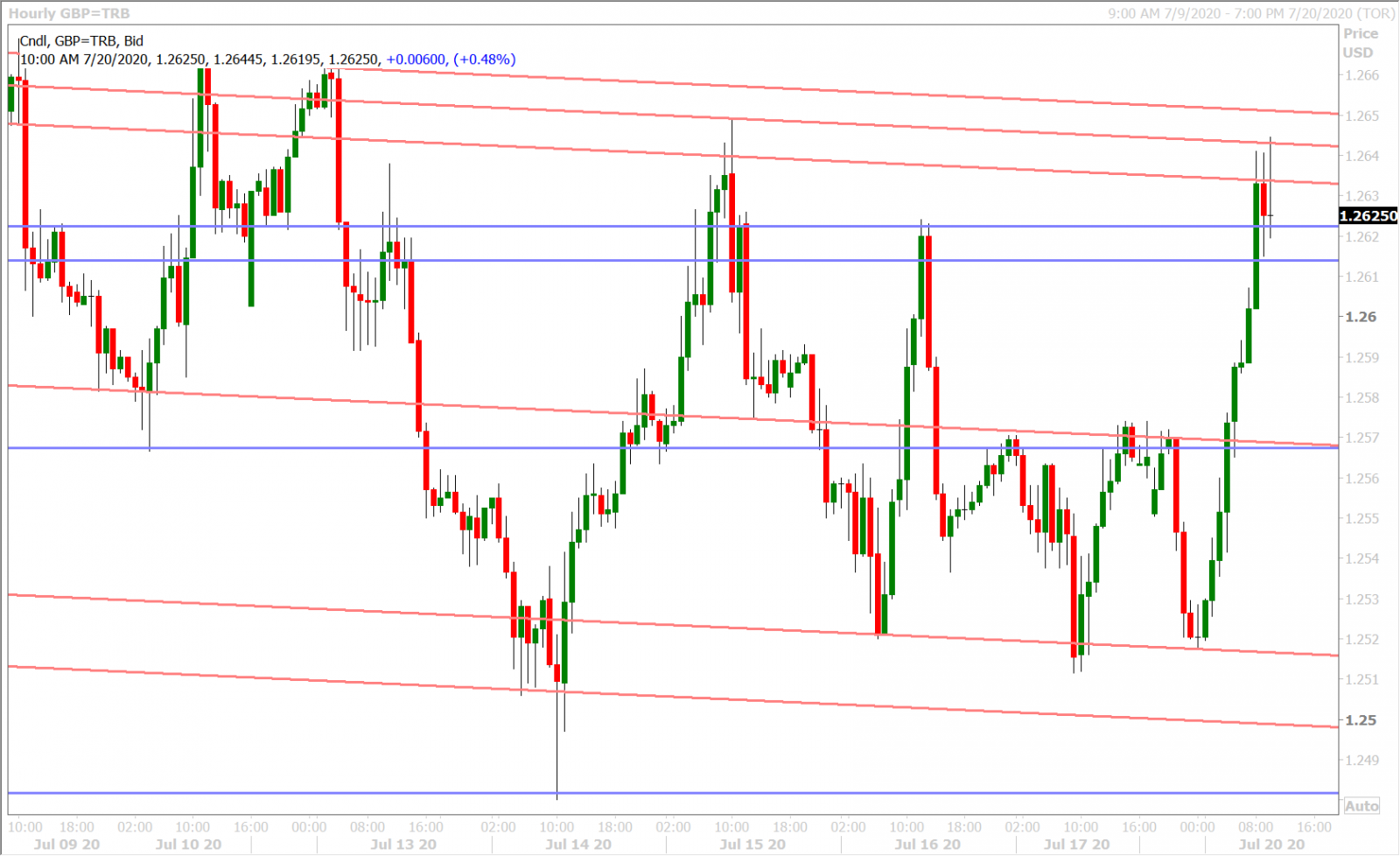

Sterling is staging an impressive rally this morning, but this honestly feels like repositioning ahead of something positive on the Brexit front this week, as opposed to strength on broad USD weakness. We haven’t come across a positive headline per se, but it’s hard not to notice the complete implosion for EURGBP back down into the mid 0.90 handle. GBPUSD has vaulted up 100pts this morning as result and we think the more times it keeps knocking on the door of downward sloping trend-line resistance in the 1.2630-50s, the greater the likelihood that the market breaks above it.

This week’s UK economic calendar features Retail Sales for June and the flash PMIs for July; both on Friday. The leveraged funds added new GBPUSD long positions for the third week in a row during the week ending July 14; which had the effect of reducing their overall net short position back down to early June levels.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

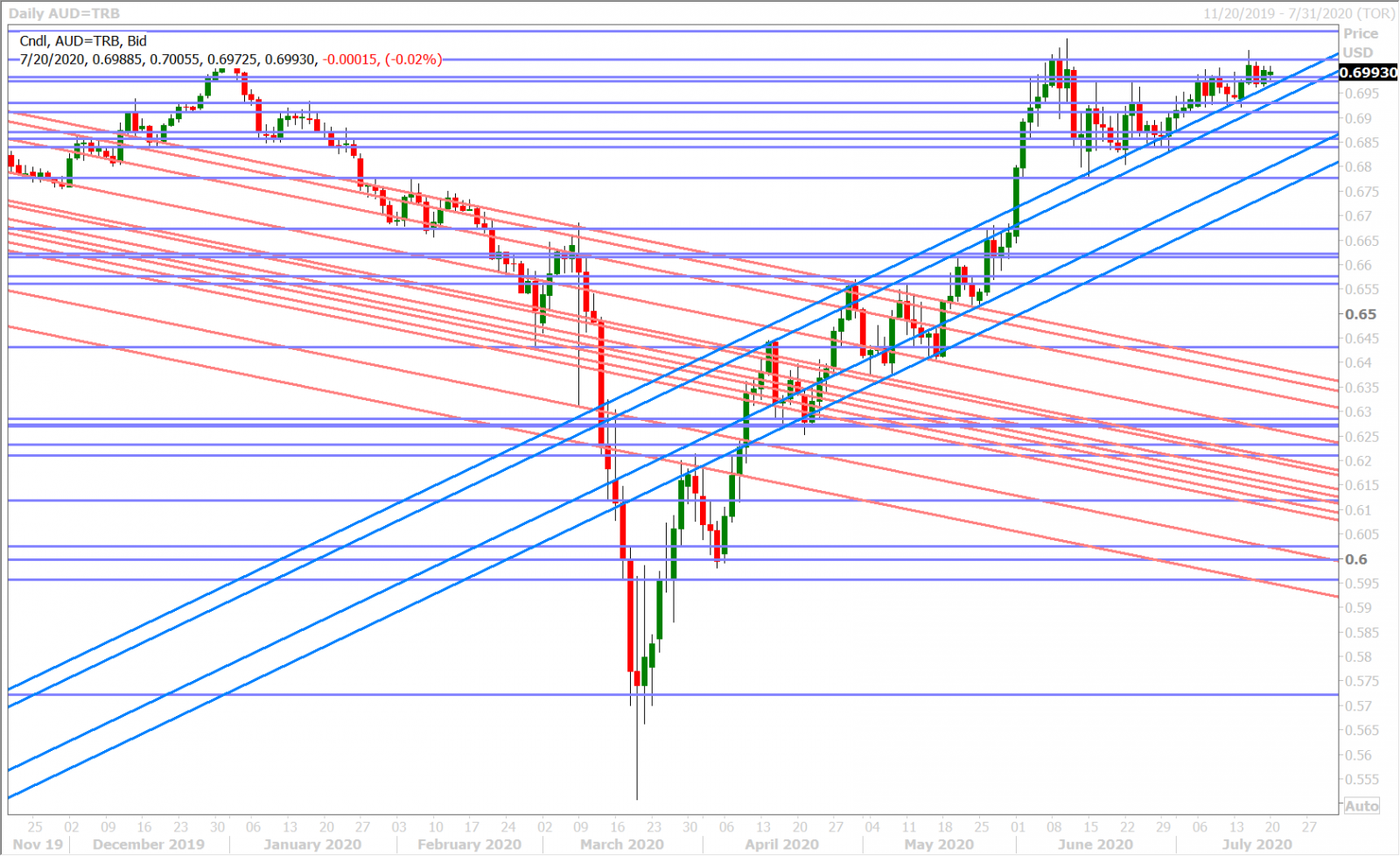

AUDUSD

Broad USD sales are helping to keep the Aussie bid above chart support in the 0.6970-80s this morning but, similar to the Canadian dollar, it has remained technically stalled since late Wednesday last week. The next 24hrs could shake things up as we’ll likely get EURUSD’s reaction to some sort of EU recovery fund deal, the RBA Minutes (9:30pmET), and a speech from RBA Governor Lowe (10:30pmET).

The latest COT report showed the leveraged funds flipping to a net long AUDUSD position, for the first time since March 2018, during the week ending July 14; which is a tad concerning considering spot prices have yet to take out their June highs.

Wednesday’s session could be interesting this week as it features a massive 1.8blnAUD option expiry around the 0.6915 strike and Australia’s Fiscal and Economic Statement.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

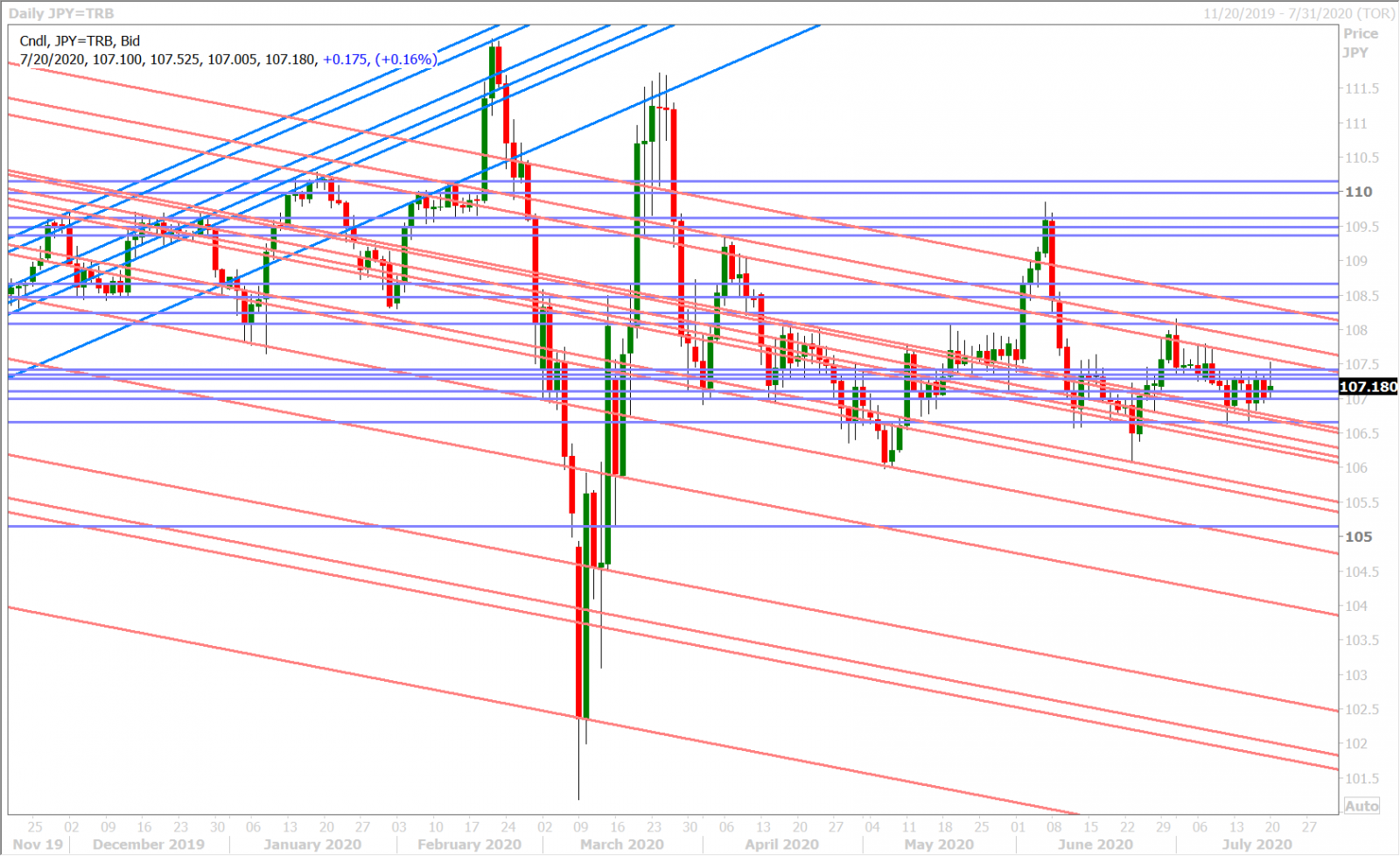

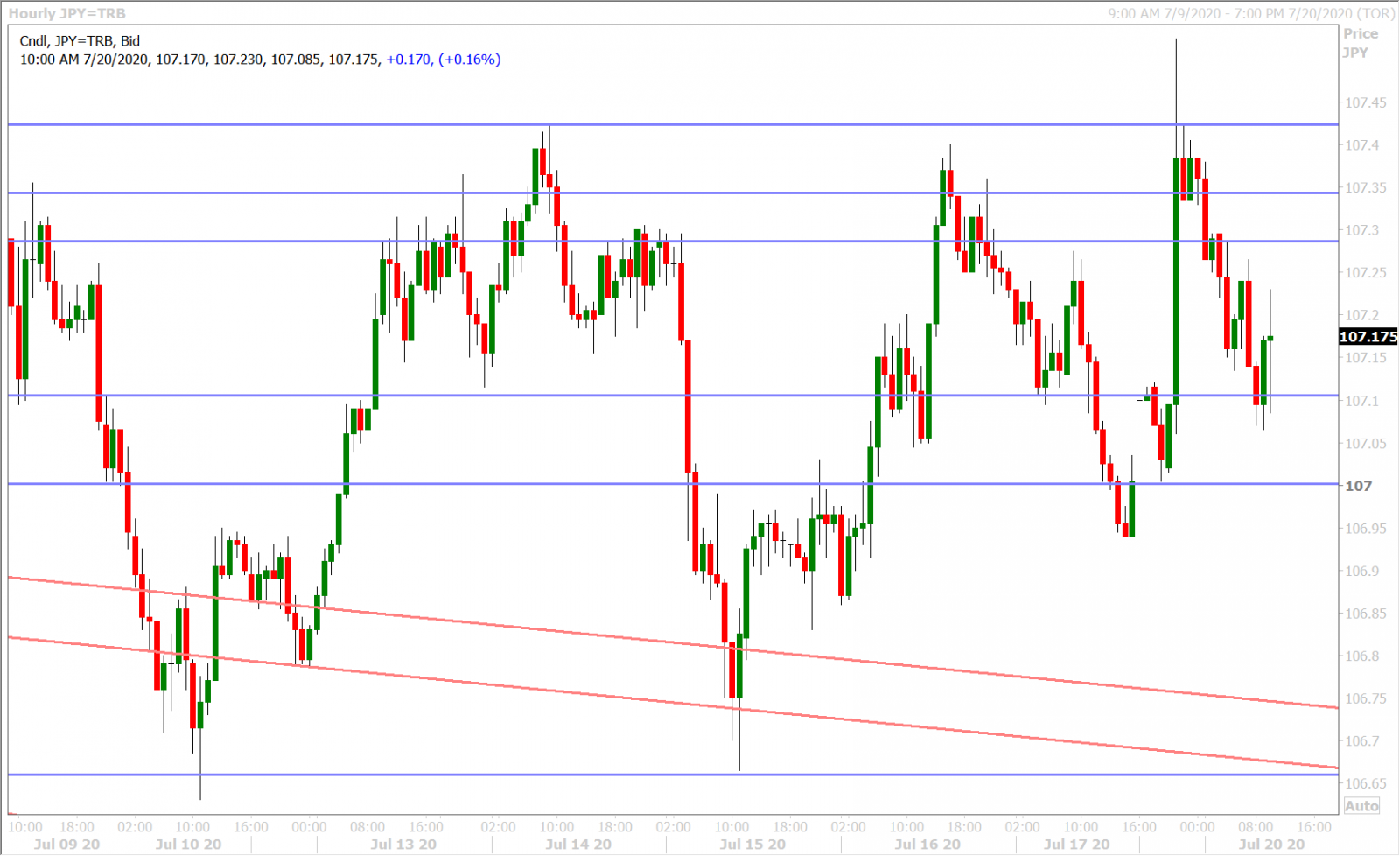

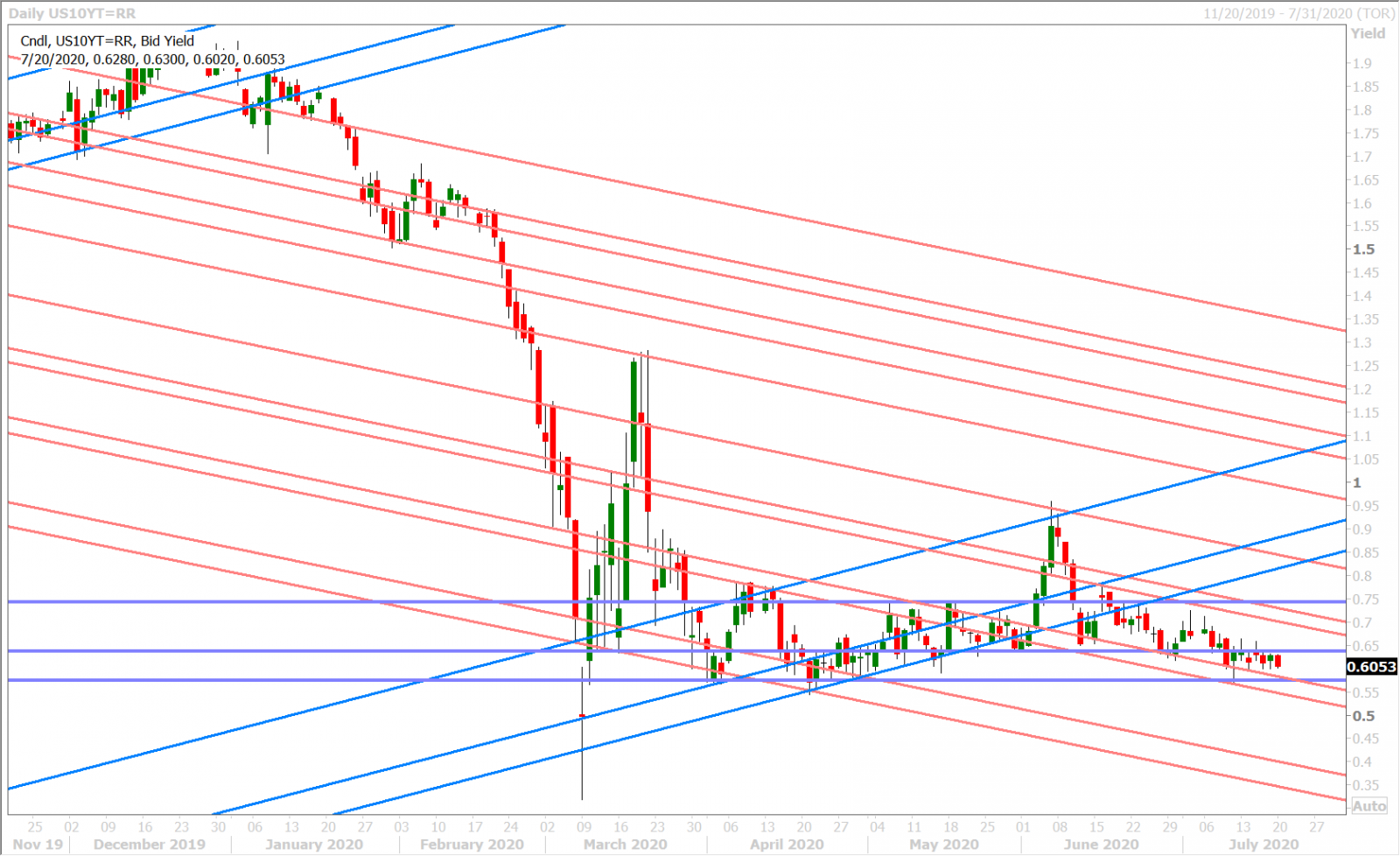

Market chatter suggested that massive Gotobi (Japanese importer) demand was behind the 50pt surge in USDJPY at the Tokyo fix last night. Chart resistance in the 107.40s gave way briefly but the buyers ultimately failed when this event passed, and we now have a market that is following the broader USD lower into NY trade. The leveraged funds trimmed longs and added to shorts during the week ending July 14, which made sense given the market’s continued struggle with chart resistance in the high 107s from the week prior. Japanese markets will be closed on Thursday and Friday for the Marine Day and Health & Sports Day holidays.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.