Dovish FOMC minutes changes the tide for the broader $USD. $AUD, $CAD, $EUR, $GBP, $JPY all now looking technically stronger. Liquidity still at a premium in holiday trade.

Summary

-

ECONOMIC DATA HIGHLIGHTS OVER THE LAST 48HRS: US Durable Goods on Wed came in -1.2%, much worse than expected. The FOMC Minutes (from Nov 1st Fed meeting) were clearly dovish. A few members opposed a Dec rate hike because of weak inflation, and a number of members expressed concerns about the buildup of financial imbalances and the damaging effects that a sharp market selloff would have on the economy. UK Q3 GDP came in as expected yesterday (+1.5%). The ECB minutes had nothing noteworthy. Canadian Sep Retail Sales came in at just +0.1% (much weaker than expected for the 2nd month in a row). The German IFO survey came in overnight at a new record 117.5, which was higher than expectations and the previous read. There are no major economic headlines on deck for the holiday shortened US session today.

-

AUDUSD: The dovish tilt to the FOMC minutes reported Wednesday afternoon really clobbered the USD across the board, and one of the biggest beneficiaries has been the Aussie. The market has steadily moved higher, taking out resistance at 0.7590 and then 0.7600. We now sit at the important near-term resistance level we mentioned earlier this week, 0.7625. Given the bullish engulfing daily candle from Tuesday and Wednesday’s follow through higher, we feel the path of least resistance near-term is higher. A break above current levels invites a rally to the 0.7660-70s.

-

USDCAD: Wednesday afternoon’s broad USD selloff took a dent out of the USDCAD chart as well. While we weren’t surprised at the market’s offered tone given the technical failure above 1.2830 and the weight from cross sales earlier this week, the intensity of the move lower was a little more than most traders were expecting (given US holidays were upon us). The move took out support in the 1.2720s and we traded back down to November’s low in the 1.2670s at its worst. The weak Cdn retail sales figure yesterday repaired the chart a bit. Overnight trade took us back above the 1.2720s again but as we type we’re now back below it. Another new swing high for crude oil (up another 1.3% today), while not directly correlating, is not a positive backdrop for USDCAD. EURCAD and GBPCAD are the drivers yet again today. Given’s Wednesday’s action and yesterday’s inability to correct, we’re now calling USDCAD range-bound to lower near term.

-

EURUSD: Everything is going right for the committed EUR longs. After the technical break higher last week, and a brief dip due to the German political drama, EUR buyers were right back at it on Wednesday. The rally started after the horrible US durable goods print. Then we got the dovish FOMC minutes, and that was the icing on the cake. Now we he rumors the leader of Germany’s SPD party might step down, paving the way for new collation talks. Option traders continue to report interest in upside strikes, 1.19+. Futures open interest was up over 7k contracts on Wednesday (suggesting new longs). This market clearly wants higher and it’s hard to formulate arguments against at this point. Technically speaking, we’re trading right at the 61.8% Fibo retrace of the Sep-Nov down move. We’re also at some trend-line extension resistance going back to the summer (now plotted on our charts). A break above here would invite a rally to the mid 1.19s and even 1.20 in short order. With liquidity being lighter than normal today, we wouldn’t be surprised to see this scenario play out.

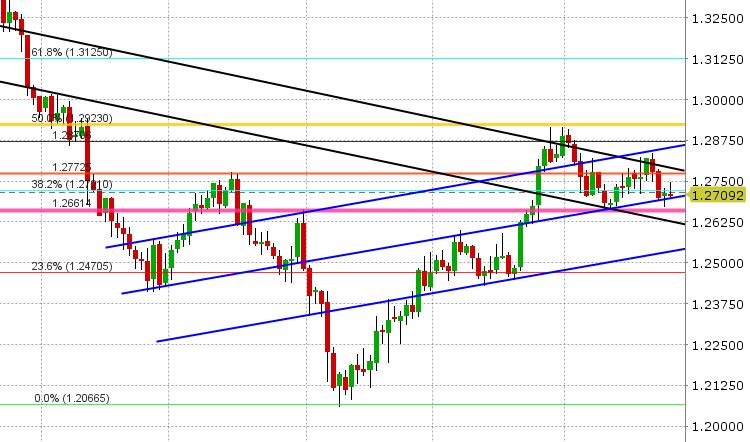

GBPUSD: Confidence is returning for sterling traders as well. GBPUSD benefited from the USD rout on Wednesday as well. We now sit above the Oct/Nov range highs, and we’ve tested the upper bound of it earlier today and bounced (all this is positive technically). We’re running into some trend-line extension resistance now (call it 1.3330-1.3350). See purple lines on chart. Negative Brexit headlines have few and far between this week (so that’s sort of good). Traders are now talking about two big event risks coming up in December. The first: A meeting between the UK’s Theresa May and the EU’s Juncker on Dec 4th re: Brexit. The second: the EU summit, which will be on Dec 14 and 15th. We expect further chop in GBPUSD, but with an upward bias here as the USD continues to feel the heat more broadly.

-

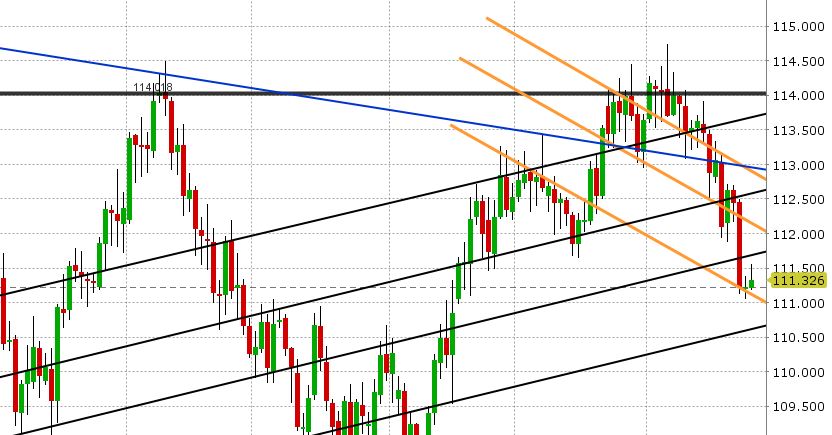

USDJPY: The dovish FOMC minutes was the last thing USDJPY traders wanted to hear on Wednesday, and given so many traders are still long, we seemed to finally see the market’s “puke” moment. USDJPY has now plunged down through support in the 111.60s-70s (this area is now resistance). Futures traders liquidated another 3143 contracts. US bond yields are playing catch-up now too, and are trading with an offered tone again. Technically speaking, the market is still looking weak. We’ve stalled a little bit here at 111.10-25, which is trend-line extension support. We’re also seeing EURJPY and GBPJPY cross buying today, which has helped to stem USDJPY selling for the time being.

Market Analysis Charts

AUD/USD Chart

USD/CAD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.