China hopes US will meet it half way. US Retail Sales, Philly Fed and Empire Survey all beat expectations.

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

Dollar/CAD traders decided to take a breather in the overnight session today after yesterday’s recession fears spurred a strong USD rally to the upside. Some new US/China trade headlines appeared to be the features overnight, but they didn’t knock the market around all that much. First we got Trump’s peculiar new olive branch to China’s Xi in the form of a tweet where he offered a personal meeting with the Chinese President in regards to the Hong Kong situation. This, along with a positive Australian jobs report for July, gave a bid to risk assets that carried from Asia into early European trade, and saw USDCAD pull off yesterday’s trend-line resistance in the 1.3320s. Then we got what sounded like a formal response from China around the 5amET hour this morning, calling the planned tariffs on $300bln of Chinese goods a violation of accords reached between Presidents Trump and Xi, and that China would take all necessary measures to retaliate. This saw risk assets, including oil prices, go offered once again and helped USDCAD bounce off trend-line support in the 1.3280s. Then all of a sudden, we saw wire reports at the start of NY trade this morning saying “China hopes US can meet half way with it on trade issue” and with that risk went comically bid once again. Traders are now digesting an economic data dump from the 8:30amET hour, and seeing as these are all around good numbers out of the US (see below), we think this should keep USDCAD traders focused on whether or not the market can now break above trend-line chart resistance in the 1.3320s. The US 10s2s yield spread is currently trading back above zero, at +1.4bp.

US Retail Sales (July): +0.7% MoM vs +0.3% expected

US Philly Fed Survey (August): 16.8 vs 9.5 expected

US Empire Manufacturing Survey (August): 4.8 vs 2.0 expected

Canadian ADP Employment (July): +73.7k vs +30.4k expected, but with a 40k negative revision to June.

USDCAD DAILY

USDCAD HOURLY

SEP CRUDE OIL DAILY

EURUSD

Euro/dollar traders also kept the market in a side-ways pattern during the overnight session as gold prices mildly fluctuated back and forth from the contradicting US/China headlines. The three positive US economic data points that just crossed the wires have caused some mild USD buying and some moderate gold selling. The German 10yr bund traded to yet another record low yield of -0.68% a couple of hours ago. We still think Tuesday’s disappointing chart development (reject of a close above 1.1210 resistance and instead a close below 1.1190s support) and the lack of meaningful chart support until 1.1100 will weigh on the market here.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling enjoyed a nice little rally for a change during the European session today and it appears the unexpected beat on UK Retail Sales for the month of July and a break of familiar trend-line resistance in the 1.2090s were the catalysts. Retail sales grew +0.2% vs -0.2% MoM expected and +3.3% YoY vs +2.5% expected. We’re not sure we’d get too excited here considering the BOE’s hands are still tied because of Brexit, but the headline and the positive chart development does give a reason for funds to cover some short positions. GBPUSD is now fading further off trend-line resistance in the 1.2140s following the better than expected US economic data that was just released.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

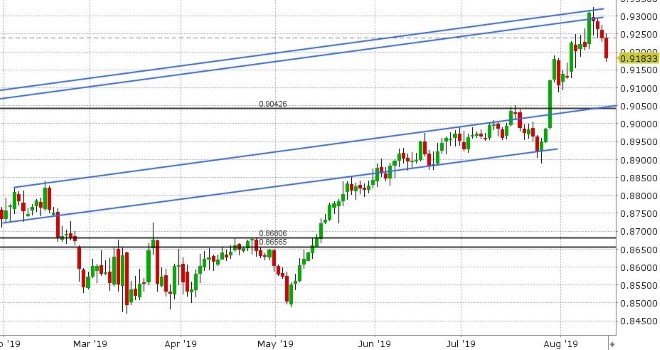

AUDUSD DAILY

AUDUSD HOURLY

SEP COPPER DAILY

USDJPY

Dollar/yen has whipped around with the US/China trade headlines of the overnight session, but it continues hold yesterday’s wide price range (105.60s-106.70s). Yesterday’s collapse in the JGB bond yield below the BOJ’s 0% +/- 0.20% yield curve control threshold continues so far today (now -0.23%) and we’re frankly surprised we haven’t heard anything from the BOJ yet. Bond and Eurodollar futures are pulling off session highs following the good US economic data dump this morning, but the S&P futures are struggling to take out their overnight highs from the latest positive US/China trade headline. We think this leaves USDJPY a bit stuck for the moment.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: TWS Workspace

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.