Bullish USDCNH reversal leads USD strength overnight. BOE delivers hawkish hold on monetary policy. GBP surges while EUR, AUD, CAD work on reversals higher

Summary

-

USDCAD: The big theme overnight in FX markets was the bullish turn-around in USDCNH (Dollar/Yuan). After a drop to new lows during Asian trading yesterday, USDCNH staged a bullish outside side day on the charts to close the NY session. The market also regained key trend-line support at 6.2850 and closed firmly above the psychological 6.30 level. The move extended further in Asia after the release of a weaker than expected Chinese trade surplus figure for January (imports surged 30% YoY vs. +10.6% expected). With that, USDCNH blasted through 6.3330 (next trend-line resistance) and has rallied all the way up to the 6.37s, where it’s now testing another trend-line resistance level. All this has ignited a broad USD bid in the overnight session, and after USDCAD put in an impressive NY close (above 1.2540-60), it was easy for USDCAD to benefit further. The move higher in USDCAD overnight has been moderate however because the market is running into some downward sloping, trend-line resistance in the 1.2580-90s (this also coincides with the January highs). If the market stalls here, and the broader USD backs off a bit, we could see USDCAD pull back into the 1.2540-60s. If it breaks through the 1.2580-90s to the upside, we could see a meaningful rally as the next resistance level is 1.2660. The CAD crosses have been a mixed influence today. EURCAD is extended losses for a third day after Tuesday’s bearish reversal, yet GBPCAD is surging after the BOE announcement just now. Canadian Housing Starts for December were just reported at +216k, beating estimates of +210k. Deputy Governor Wilkins will also be making a speech at 2:45pmET. PM Trudeau was on the wires saying “no NAFTA deal might be better for us than a bad one”.

-

AUDUSD: The Aussie put in rough NY close yesterday, with a broad USD rally and a plunge in copper prices as the main culprits. The 0.7840 support level was taken out easily, and while some buyers stepped up to the plate around 0.7815-0.7825 in late NY/early Asian trade (where two trend-line support levels are + the 50% Fibo of Dec/Jan rally), this all gave way in Europe when EURUSD traders caught on to the rally in USDCNH. EURUSD resumed its selloff, and so did AUDUSD. Technically speaking, the market is not looking too hot as support after support level keeps getting taken out, and we don’t have much support at this point on the charts now until the 0.7750s. While AUDUSD is currently below 0.7815-0.7825, we’d be on the lookout for a possible reversal higher today as EURUSD is currently bouncing off support. If AUDUSD were to continue its bounce and close back into 0.7815-0.7825 or higher, that would arrest some of this recent downward momentum. A bounce in copper prices would help too.

-

EURUSD: Everything went wrong for the Euro yesterday. The EURUSD downdraft started with technical chart failure in Asia, then picked up with USDCNH strength, got compounded by weak German data, EUR cross sales, and the selling intensified even further as USDCNH staged a bullish turn-around into the NY close. With EURUSD closing NY trading below 1.2275 (trend-line support), it opened the door for further selling to the 1.2220s (the next trend-line support level), which we saw in early European trade this morning. As we write, however, EURUSD is bouncing off the 1.2220s in style and looks poised to test 1.2275 again. USDCNH is backing off the 1.37 level after another intra-day test higher over the last hour, so this supports EURUSD here a little bit. EURJPY is recovering too today, but it faces some stiff resistance at 134.75-135.00. EURGBP is getting crushed on the BOE rate announcement this morning, but it’s not having much effect at all as it’s a GBP story this morning. Like AUDUSD, we’d be on the look out for a possible reversal higher today in EURUSD. A close back above 1.2280-90 would do much to stop the downward momentum here as well.

-

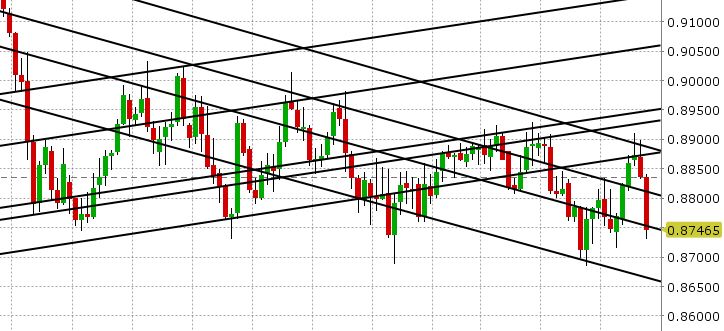

GBPUSD: Sterling is front and centre this morning as the Bank of England just announced it left interest rates and QE unchanged, but said “were the economy to evolve broadly in line with the February Inflation Report projections, monetary policy would need to be tightened somewhat earlier and by a somewhat greater extent over the forecast period than anticipated at the time of the November Report, in order to return inflation sustainably to the target”. Traders immediately bid up GBP across the board on this rather hawkish rhetoric. GBPUSD shot up to 1.4000 and EURGBP plunged back down to the 0.8750s. Governor Carney just finished his press conference where he commented about strong global growth, UK CPI rising above 3% in the short term, and how rate rises will be gradual. He talked about Brexit uncertainty and recent volatility in markets, but didn’t seem too phased by it from a policy perspective. This comment was interesting: If you stay still in environment of rising global rates, then other things being equal, your monetary policy becomes more accommodative. According to an analyst at ForexLive, this pretty much says “that if everyone else is raising rates, the BOE pretty much has to too”. With the press conference now over and GBP now significantly higher across the board, we will likely see traders focused on the 1.4130s in GBPUSD (trend-line resistance) and the 0.8740-50s in EURGBP (trend-line support). Breaks of both levels would invite significant further gains for the pound, as the next significant resistance level for GBPUSD is not until 1.4150 and the next significant support for EURGBP is not until 0.8700-0.7815.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

EUR/GBP Chart

USD/CNH Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.