Broader USD trading with weak tone ahead of US jobs report. Canada employment report also due. Markets largely shrugging off official start of US tariffs on China.

Summary

-

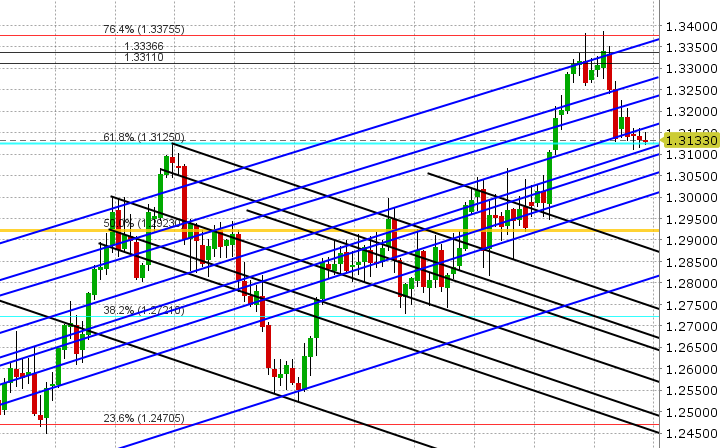

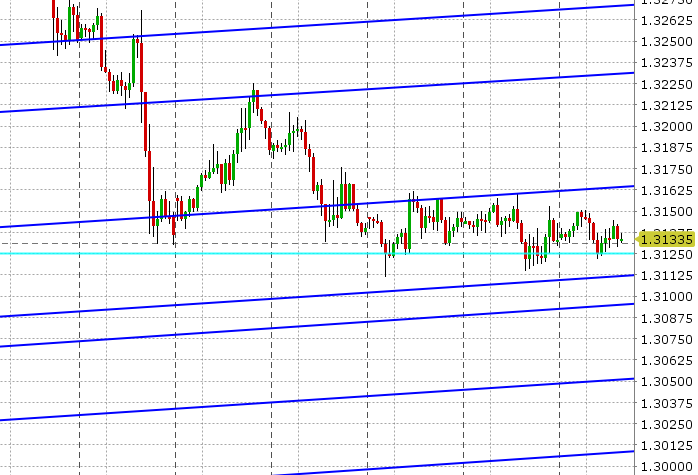

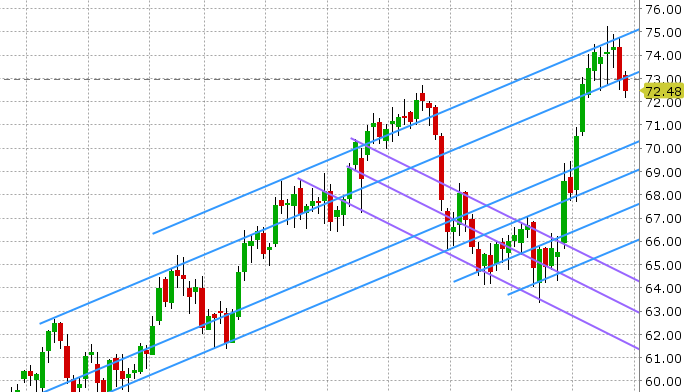

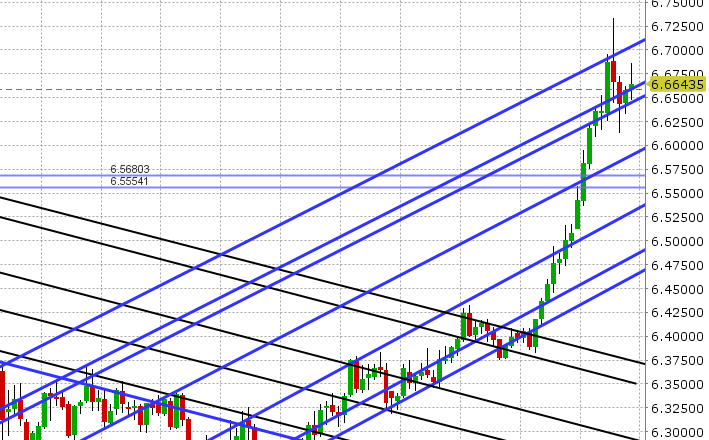

USDCAD: The downward momentum we saw in early NY trade yesterday stalled after a confluence of factors that made the market feel comfortable with the 1.3125 support level. It started with a GBP-driven rally in the broader USD after some negative Brexit news; then a bearish DOE oil inventory report which knocked oil lower; followed by a hawkish FOMC Minutes and finally a report from the WSJ saying the Saudi Aramco IPO was no longer going to happen. All this combined to give USDCAD a bid into the 1.3350s, but there’s wasn’t much momentum behind it. Overnight price action proved this point, with USDCAD testing the 1.3125 level once again ahead of the key June employment reports for the US and Canada; up next at 8:30amET. Markets are expecting +195k new US jobs, +2.8% YoY and +0.3% MoM on wages, and 3.8% on the unemployment rate. The consensus for the Canadian report is +24k jobs, +3.7% YoY on wages, and 5.8% on the unemployment rate. About 1.4blnUSD in options at the 1.3200-1.3220 strikes expire today at 10amET, which could make things interesting. Expect the 1.3050s to get attacked if we get a combination of weak US/strong Canadian data. Expect those option levels we just mentioned to be in play should we get a combination of strong US/weak Canadian data. Expect whippy price action between 1.3090 and 1.3160 should the data come in mixed. August crude oil hasn’t been able to recover from yesterday’s surprise build in DOE inventories and the WSJ headlines, and has resumed lower after a brief bounce in Asia in an attempt to regain the 73 level.

-

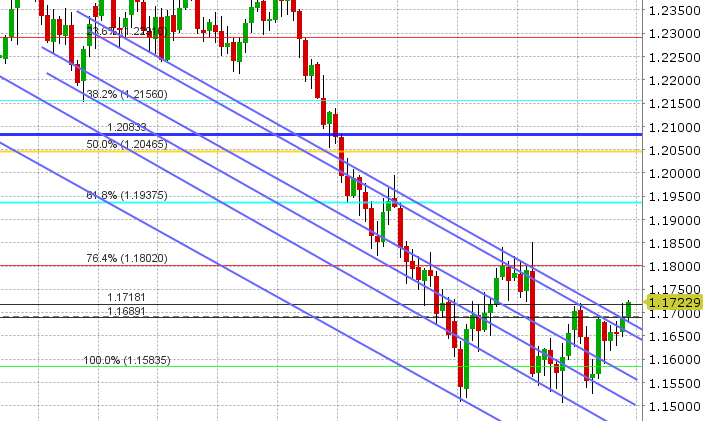

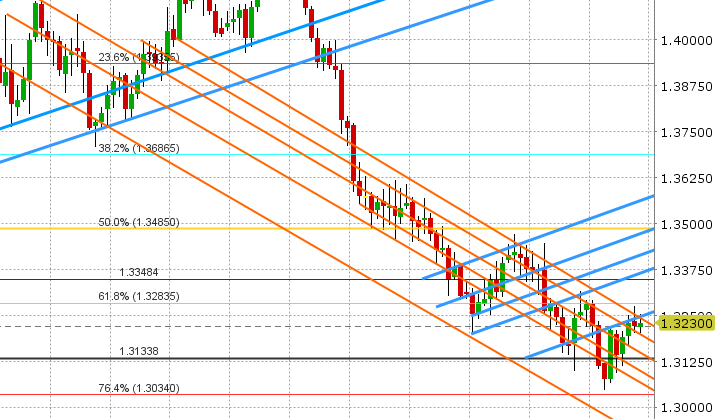

EURUSD: Euro/dollar is bid once again this morning, after a rocky session yesterday that was largely influenced by broader USD flows. Key chart support in the 1.1670s held despite a hawkish FOMC Minutes release (one could argue it wasn’t new news), and with that EURUSD has resumed higher in the European AM and is once again testing key near term resistance in the 1.1720s. Strong German Industrial Production data was a factor overnight as well (coming in +2.6% MoM in May vs. +0.3% expected). We saw a rally in USDCNH into midnight as the US tariffs on $34bln of Chinese goods officially took effect, but we’ve since backed off as China announced retaliatory measures (without much detail mind you), and this is helping EURUSD as well. EURJPY, a key influence in overnight trade yesterday, looks poised to resume its upward path towards the 130 handle. Given the lack of technical meaningful technical resistance on the EURUSD chart until 1.18 in our opinion, we think any disappointment in the US employment report today could see EURUSD quickly shoot higher. Another large 2blnEUR+ option expiry looms at the 1.1700 strike again today however, so the post-report kneejerk reaction could be choppy.

-

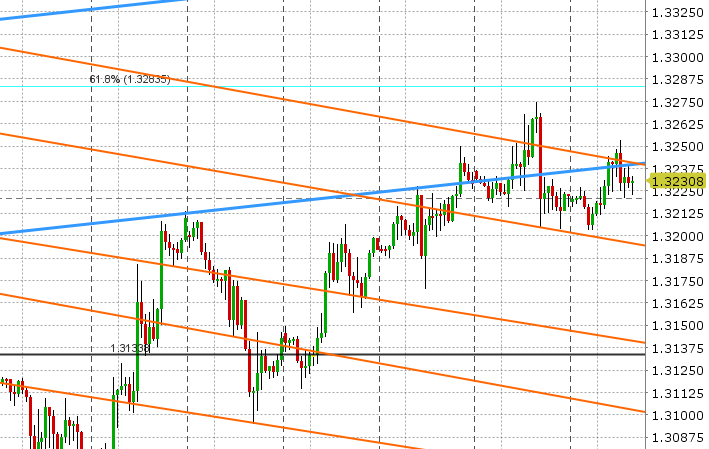

GBPUSD: Sterling’s rally was dismantled yesterday after German sources (according to Bloomberg) saw Theresa May’s Brexit customs plan as “unworkable”. This smashed GBPUSD down through the 1.3250s and into support at 1.3200, and has traders a little skittish ahead of a key day for Theresa May today, where the UK PM will be presenting her blueprint for the UK’s future relationship with the EU. More here: https://www.bbc.com/news/uk-politics-44733802. Up next is US payrolls at 8:30amET. GBPUSD sits just shy of the 1.3250s. Expect a move back down to the 1.3200 level or even below should the data surprise to the upside. Conversely, expect a rally into resistance at 1.3280 should the jobs number disappoint.

-

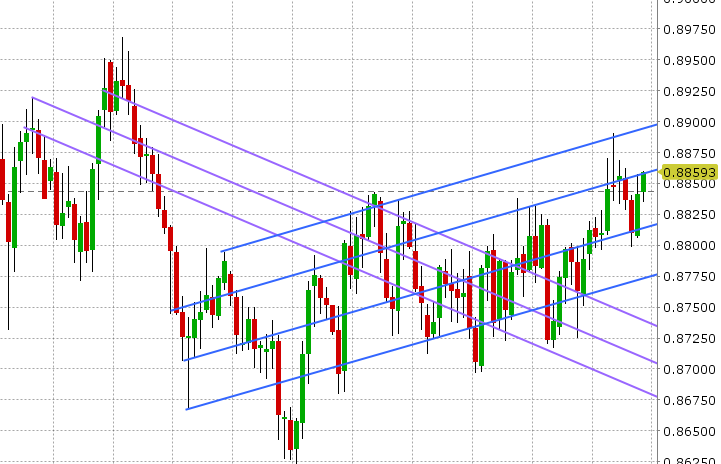

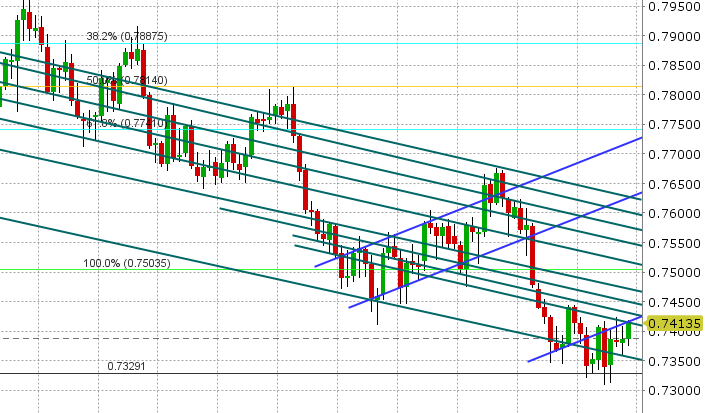

AUDUSD: The Aussie continues to hang in there, despite today being the official start to the US/China trade war. AUDUSD actually popped higher at midnight funny enough, when the US tariffs took effect. This is another positive development for AUDUSD, along with the EURUSD correlation and CME short positioning we mentioned yesterday, which will have traders once again glued on key resistance in the 0.7420s. Should this level give way today and hold (post US jobs report), we see scope for a rally to the high 0.74s or even the 0.7500 level. Complicating matters early potentially, like EURUSD, are some option expiries at the 0.7400 level (650mlnAUD+).

-

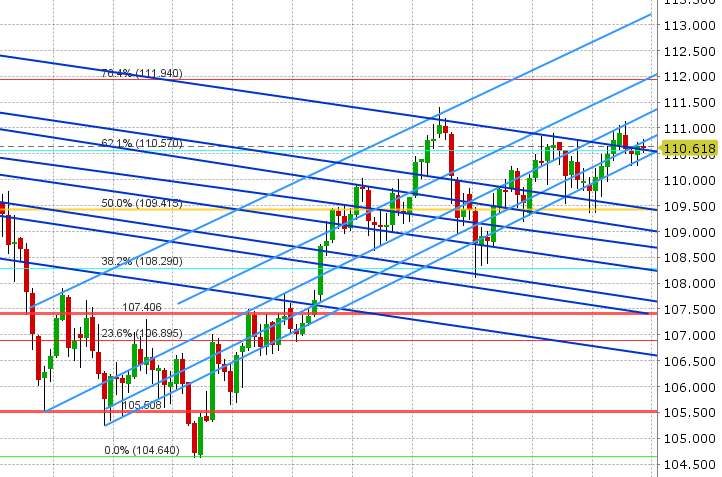

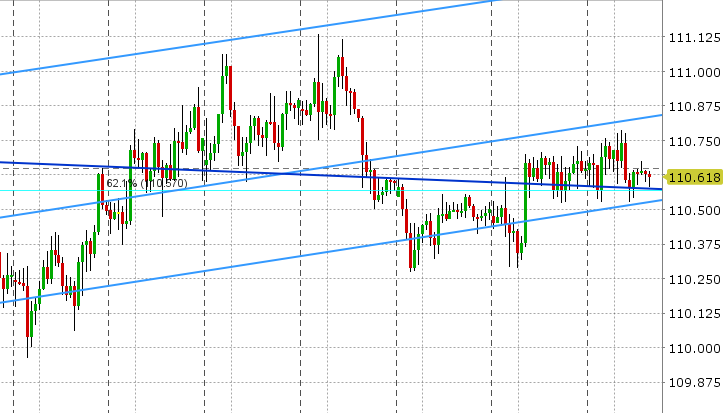

USDJPY:Dollar/yen continues to coil in a tight range as a three month, symmetrical, triangular consolidation reaches its apex on the daily chart. This is typically a bullish pattern if it is preceded by a rally in price (which was the case for USDJPY from March to May this year). Support ahead of the US jobs report is still 110.50, where we also have around $500mlnUSD in options rolling off again today. Resistance is 110.80-90, then not much else until the 111.40-50 level. The broader “risk off” tone that one might expect given the official start of the US/China trade war has been relatively absent so far (S&Ps down 6pts). One could argue we knew this was coming and all market participants (including those directly affected) have been given some time to adjust. All eyes will now be on China to see what sectors of the US economy they formally retaliate against. Watch soybean futures.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

August Crude Oil

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.