Broader USD reverses lower on negative chart technicals + uptick in risk sentiment

Summary

-

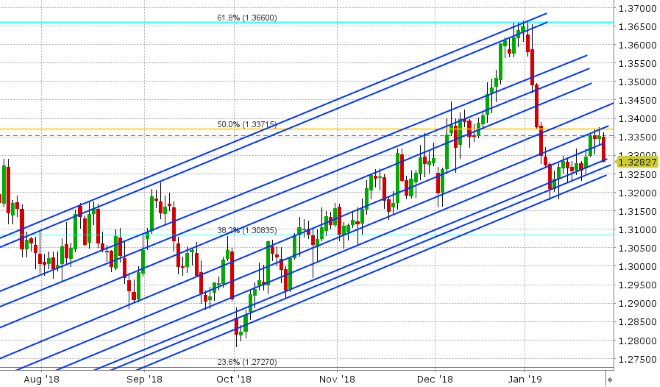

USDCAD: Dollar/CAD is slumping back this morning after buyers failed yet again to lift prices above the 1.3360-70s yesterday. We’re also seeing a bit of a “risk-on” rally across the broader markets this morning; which is lifting stocks, yields and oil prices, and hurting both the USD and the JPY. We’re hard pressed to find a reason for the general optimism this morning given the weaker than expected German IFO survey figures reported earlier, and so we’d chalk up today’s price drivers as largely technical in nature. The ongoing US government shutdown means we’re going to miss the US Durable Goods figures this morning. USDCAD is now plunging to the support zone in the 1.2280-90s as the 1.3330 level has fallen. The next support levels after reside in the 1.3270s, then 1.3245-50.

-

EURUSD: Euro/dollar fell apart yesterday, and while Mario Draghi’s press conference had plenty of dovish rhetoric in it, it was really the surprise German GDP headline out of the newspaper Handelsblatt that knocked the market lower afterwards. The report said Germany was to drop its 2019 growth forecast to 1.0% from 1.8% due to slower global economic growth and uncertainty about Brexit. More here. This saw the market crack back below the 1.1340s and make a bee line for the next support level in the 1.1280-90s. Buyers stepped up to the plate at these levels in late NY/early Asian trade yesterday however, and it’s been a slow and steady rise higher today as US stock futures trade higher and USDCNH trades lower. The negative January German IFO print was brushed off by traders earlier this morning (99.1 vs 100.6 expected), and so we may very well have an inflection point on our hands now considering the market is shaking off bad news. A regain of the 1.1340s opens up an extension of the rally into the 1.1370-80s in our opinion. A quick rally back above the 1.1410 level would be quite bullish for near term price action.

-

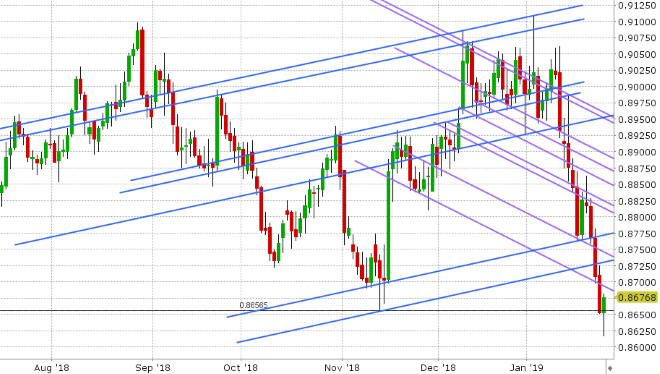

GBPUSD: Sterling is struggling a bit this morning after traders succumbed to a “fake-out” break out in Asian trade last night. Headlines from the UK’s Sun crossed about the DUP party (Northern Irish) deciding to privately support Theresa May’s Brexit deal when the UK parliament reconvenes debate on the matter next week. This saw the trading algorithms burst GBPUSD past the 1.3100 level as this was good Brexit news on the surface, but the optimism waned when traders actually read the report and noticed that the DUP support is conditional on there being a clear time limit for the Irish backstop. GBPUSD has since fallen back below the 1.3100 level, and is now struggling because of the negative chart pattern this move has created. The EURGBP cross is also trying to bottom this morning after being absolutely pummeled this week. We think GBPUSD might finally cool off here for bit.

-

AUDUSD: The Aussie is recovering handsomely this morning after yesterday’s price action produced a bearish outside day. We said yesterday that any hopes of a reversal higher would need to occur quickly, and it appears we’re getting that today with the market regaining the 0.7110s with swift upside momentum. Chalk this up to EURUSD strength, today’s broad risk-on sentiment, and copper prices (which have just popped 1% higher as we write). We think AUDUSD has legs to extend to yesterday’s trend-line resistance level in the 0.7150s. Australian markets were closed today for the Australia Day holiday.

-

USDJPY: Dollar/yen continues with its attempt to drift higher, but the price action has been choppy. A new trend-line support level zone (109.50-80) continues to hold and the S&Ps are maintaining their bid above chart resistance at 2650 at this hour. We think the market will inch ever close to the 110.00 level today, where over 1.2blnUSD in options expire.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

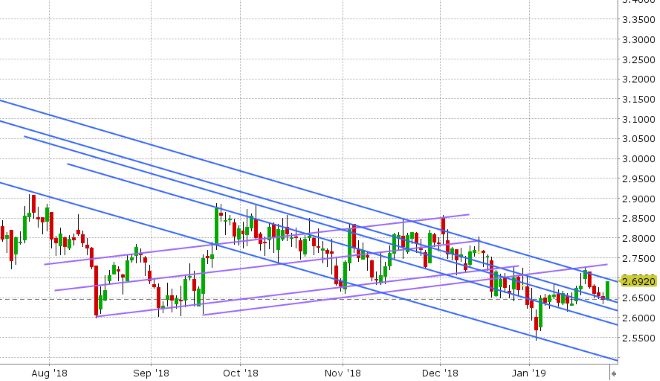

March Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.