Broader USD looking shaky going into holidays. Massive option expiries today for AUDUSD & USDJPY. CAD traders awaiting Cdn GDP.

Summary

-

ECONOMIC DATA UPDATE: Canadian CPI came in at +2.1%, one-tenth higher than expected YoY in November. Canadian Retail Sales for October came in at +2.5% MoM, smashing expectations of just +0.3%. US GDP for Q3 was revised down one tenth to +3.2%. The US PCE Index came in +1.3%, slightly less than expectations. US Philly Fed came in at 26.2, beating expectations. The final read on UK GDP for Q3 came in at +1.7%, which is a lower revision, but it was higher than the market expected. In today’s NY session, we get Canadian Oct GDP (markets expecting +3.5% MoM) and US Durable Goods for Nov (markets expecting +2.0%).

-

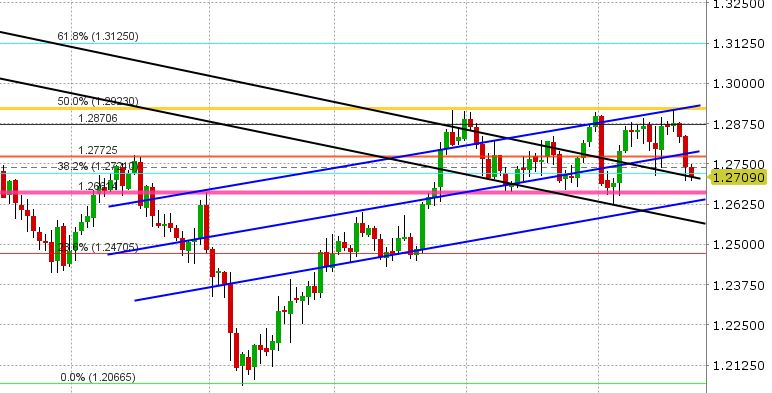

USDCAD: Yesterday’s action in USDCAD failed to disappoint as both Canadian data points (CPI and Retail Sales) came in higher than expected. Combine that with mediocre US data and the fundamental backdrop after 8:30am yesterday was bearish USDCAD. The market came into the NY session yesterday with weak technicals given Wednesday’s chart failure, and the cross selling from EURCAD and GBPCAD early yesterday certainly wasn’t helping, and then like a raindrop that catches other raindrops on its way down a wet window, the market slipped very easily lower after the bearish data points. Key support was blown through (1.2770-1.2790), and so that level is now resistence. The market found support in the low 1.27s (this coincides with the 38.2% Fibo retrace of the May to Sep downtrend and it is also trend-line extension support). USDCAD is struggling at the moment to extend a late day bounce yesterday, as traders await another key Canadian data point in Oct GDP, out at 8:30 today. A weaker than expected print would likely give us a bid, while an inline or better than expected result would make it is easy for the market to stay short and test the mid to high 1.26s. EURCAD selling continued overnight, partly on some negative European headlines (Catalonia, German politics), and it is looking for support here around 1.5050 but it’s not a strong level. GBPCAD selling continues too, with the cross now testing key support at 1.6980-1.7000. The US/CA 2yr yield spread is slightly weaker vs yesterday, now at +20bp.

-

AUDUSD: The Aussie was a star yesterday, breaking out beautifully from a few days of bullish consolidation. All it took was the mediocre US data at 8:30 and the market was able to break through trend-line resistance (black downward sloping line on our charts). The fact that copper managed to rally for a 12th consecutive day was a positive backdrop, plus the widely reported 0.7700 option expiry (Reuters reporting the notional amount for today’s expiry is now over 3bln AUD). AUDUSD has currently broken though the 0.7700 level as is testing the November highs (0.7710-0.7720). A firm close above there on a closing basis would open the door for a quick run to the 78 figure. Liquidity will be at premium after today’s option expiry as traders depart for the holidays, and so there’s a risk here of quick moves next week on not much news. We would note however that copper prices have run a fair bit already and the AU/US 2yr yield spread has not participated in this latest AUDUSD breakout (still sitting at +11bp).

-

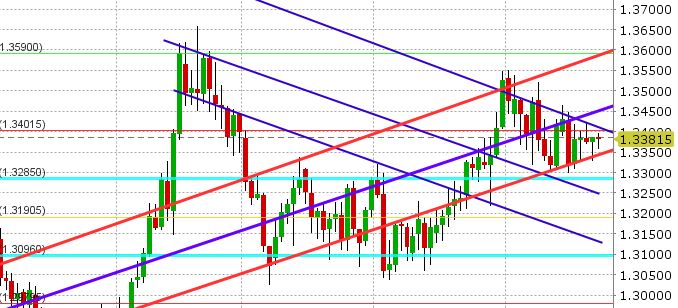

EURUSD: The Euro had a very range bound session yesterday as CAD and AUD took centre stage for change. We saw some swift selling in Asia overnight on a double-whammy of negative headlines (Catalonia separatists win in regional Catalonia election and German politicians muttering the possibility of a minority government being formed, meaning no coalition), but EURUSD has recovered smartly as NY traders role in. The recovery is positive, from a technical perspective, because it keeps the market above the 50% Fibo of the Sep-Nov down move, and above two key trend-line support levels. A full retrace of last night’s selling would be even better, but the 1.1860s are capping for now (61.8% Fibo). Reuters is reporting two decent sized option expiries today, 1bln EUR at 1.1800 and 1bln EUR at 1.1900. The US/GE 10yr yield spread continues to trade steady, now +206bp. We feel EURUSD continues to have legs here, given improving technicals, given support on crosses (EURJPY and EURGBP finding support on dips today). We’re also hearing more and more market chatter about other central banks potentially further diversifying their FX reserves into EUR next year (this would be very bullish EURUSD if this pans out). Should EURUSD break higher during the holidays amidst thin trading conditions, the next resistance points would be 1.1930, 1.1970, 1.2000 and then 1.2030.

-

GBPUSD: Sterling wobbled a little bit after the final read on UK Q3 GDP overnight, but GBPUSD is still very much stuck in a range. That range is getting ever so tighter though, and this week’s consolidation is starting to form a triangular pattern, which is potentially bullish (because a rally...the November rally...preceded the triangle). It’s hard to say what will happen next week in holiday trade where liquidity will be at a premium and headlines likely to minimum, but given weak technical developments for USD against CAD, AUD and EUR, we would not be surprised to see something that gives GBP traders an excuse to break this pattern out to the upside.

-

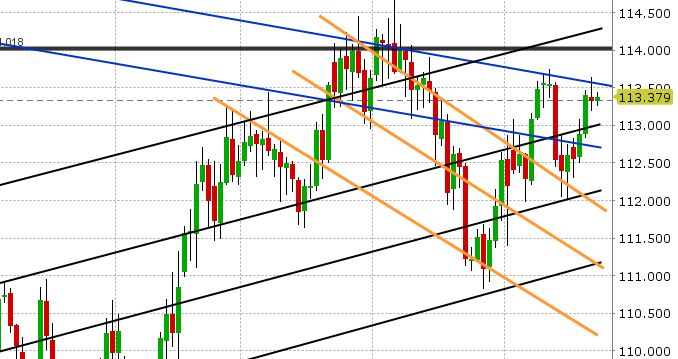

USDJPY: There’s very little going on in USDJPY as the holidays approach. The market has literally done nothing since bumping up against the trend-line resistance we noted yesterday (113.50s). US bond yields are very quiet, as are global stock markets. Reuters is reporting over $6bln USD in options rolling off today between 113 and 113.50, which is just massive. This means the market probably does nothing again today. As for next week, the only things to note are Japanese CPI (out on Christmas Day) and a speech from governor Kuroda very early on Boxing Day. Market techincals continue to be supportive USDJPY and US yields. Support in USDJPY lies at 112.90-113.00, the 112.70. If resistance in the 113.50s is taken out, we would expect to see a rally all the way back to the 114 handle.

THANK YOU TO ALL OUR READERS THIS YEAR. THE EBC DAILY MORNING MARKET COMMENTARY WILL BE BACK ON JANUARY 2, 2018. MERRY CHRISTMAS, HAPPY HOLIDAYS AND HAPPY NEW YEAR!

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.