BOC leaves rates on hold with dovish tone. $CAD sells off again. ECB policy meeting up next.

Summary

-

Bank of Canada leaves rates unchanged and adopts a more dovish tone into year end. USDCAD, EURCAD and GBPCAD surge higher. Technicals still supporting.

-

ECB policy meeting in focus for today. Headlines at 7:45amET. Press conference at 8:30am. Markets expecting a reduction in bond purchases to $25-30bln per month and a 9 month extension of the QE program. Market sentiment a little too aligned going into this event. Be on guard for a surprise.

-

JPY traders watching key technical level in EURJPY. USDJPY quiet. Japanese CPI late tonight.

-

GBP backing off a bit on some soft retail sales data. Bank of England meets next Thursday.

-

Open interest changes 10/25: AUD +3318, GBP -1726, CAD +2160, EUR -111, JPY -1261.

Currency Calendar

| Date | Releases / Holiday | Entity |

|---|---|---|

| October 26, 2017 | ECB Deposit Rate Decision | EUR |

| October 26, 2017 | ECB Interest Rate Decision | EUR |

| October 26, 2017 | ECB Monetary Policy Statement and Press Conference | EUR |

| October 26, 2017 | Catalan Parliament Session | EUR |

Bank holidays and impactful report releases for select countries.

By The Numbers: Daily FX Snapshot

USD/CAD - Canadian Dollar

The Bank of Canada left rates unchanged yesterday and while they raised GDP forecasts for 2018, they lowered the forecast for Q3 growth, said inflation would take longer to pick up now due to the higher Canadian dollar, and mentioned NAFTA talks as a substantial uncertainty to the bank’s outlook. All this was super dovish news and so USDCAD surged higher yet again. From our viewpoint, the move higher was not surprising. We’ve been mentioning the overextended USD short position for weeks now and we’ve been citing technical strength on the charts for USDCAD, EURCAD and GBPCAD ever since the awful Cdn Retail Sales print on 10/19. So now what? Technically speaking, we’ve hit the underside of the upward sloping trend line we’ve been drawing on the daily chart for over a week now, and this is capping things for now. We would not be surprised to see a small retracement back into the mid to high 1.27s (now support), and then a resumption of the rally with a 1.2850-70 area as the next target for traders who are long (resistance starts to get a little thicker up there). The next resistance level after that is the 1.2920s (50% Fibo retrace of the May high to the September low). EURCAD has now undeniably broken out of its bullish triangular consolidation on the weekly chart. Rumored EURUSD short covering yesterday, in the wake of a pullback in US yields, added fuel to the fire for the cross. GBPCAD surged higher too, touching the 1.70 level in a move we said could happen very easily given strengthening technical patterns. The crosses are now taking a breather as EUR traders wait for the ECB policy decision and GBP traders decide how to position themselves for next week’s BOE meeting after some soggy retail sales data released earlier this morning. The next major Cdn data points are Aug GDP on Wednesday next week (bit of a lagging indicator) and the Cdn jobs report next Friday.

EUR/USD - European Central Bank Euro

Euro/dollar traders got a little more than they expected during yesterday’s NY session. What was supposed to be a quiet, pre-ECB session marred by option expiries turned into a healthy bid for EUR. US stocks sold off hard into mid-day, causing US yields to back off from recent highs, which in turn caused broad USD sales against JPY and CNH. This wasn’t a great reason to buy EURs, and so some traders chalked up yesterday’s move to frustrated shorts covering ahead of an ECB meeting where almost everyone is expecting a “dovish taper”. What if we don’t get that? EUR traders are very much on pins and needles this morning as today’s announcement will likely set the trend for the next month. Expect significant volatility as the headlines first cross at 7:45am, then there’s a 45 minute gap until the press conference. Mario Draghi is also notorious for sounding dovish and hawkish at the same time and so expect whipsaws in price as high frequency trading algorithms comb through and react to headlines. Technically speaking, we still have that H&S topping pattern in play, but the more the market talks about it and the longer we go we without getting follow through, the more likely the pattern will fail. With the market clearing the 1.1790s in yesterday’s trade, we would not be surprised to see a knee jerk reaction higher putting the EUR short narrative to the test in the 1.1870-1.1900 area (this is where the 50% Fibo of the Sep high to the Oct low coincides with the top of the right shoulder for the H&S topping pattern). We continue to watch the Chinese Yuan (CNH) and its inflection points, which of late, have correlated well with inflection points in EUR. Yesterday, USDCNH made a bearish reversal lower after trying to rally above 6.65 and it is now trading back into the 6.63s, which would imply strength for EUR into today if we follow the correlation. Also, with China’s week long National Congress now over, does CNH volatility return? From a positioning standpoint, the EURUSD market is still held net long and we haven’t observed any meaningful shift in open interest since the last Tuesday (the day of the week CFTC collects positioning data for its weekly COT Positioning Report issued on Fridays).

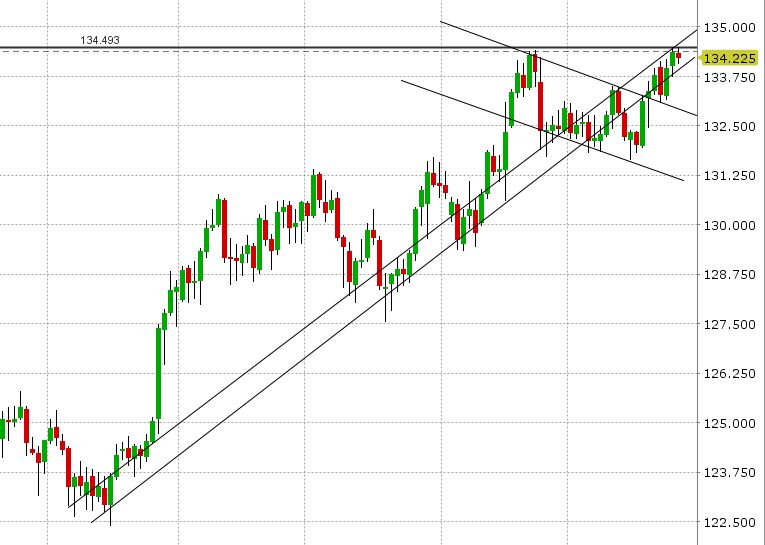

EUR/JPY - Japanese Yen

With USDJPY likely to be contained today because of lower US yields and option expiries (over $3bln USD rolling off between 113.50-114), JPY traders will focus on the ECB meeting and the EURJPY cross. Technically speaking, the market is flirting with a new 2yr high as we speak (134.50) and so today’s reaction to the ECB headlines is important. If the market pushes higher to the 135 level and holds, this invites another 200pt rally into the 137s. If the market spikes higher and reverses lower (back into the high 133s), today’s activity could mark a short term top in the tremendous 1900pt rally we’ve witnessed since April, which in turn code bode negatively for EURUSD.

Market Analysis Charts

USD/CAD Chart

EUR/USD Chart

EUR/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.